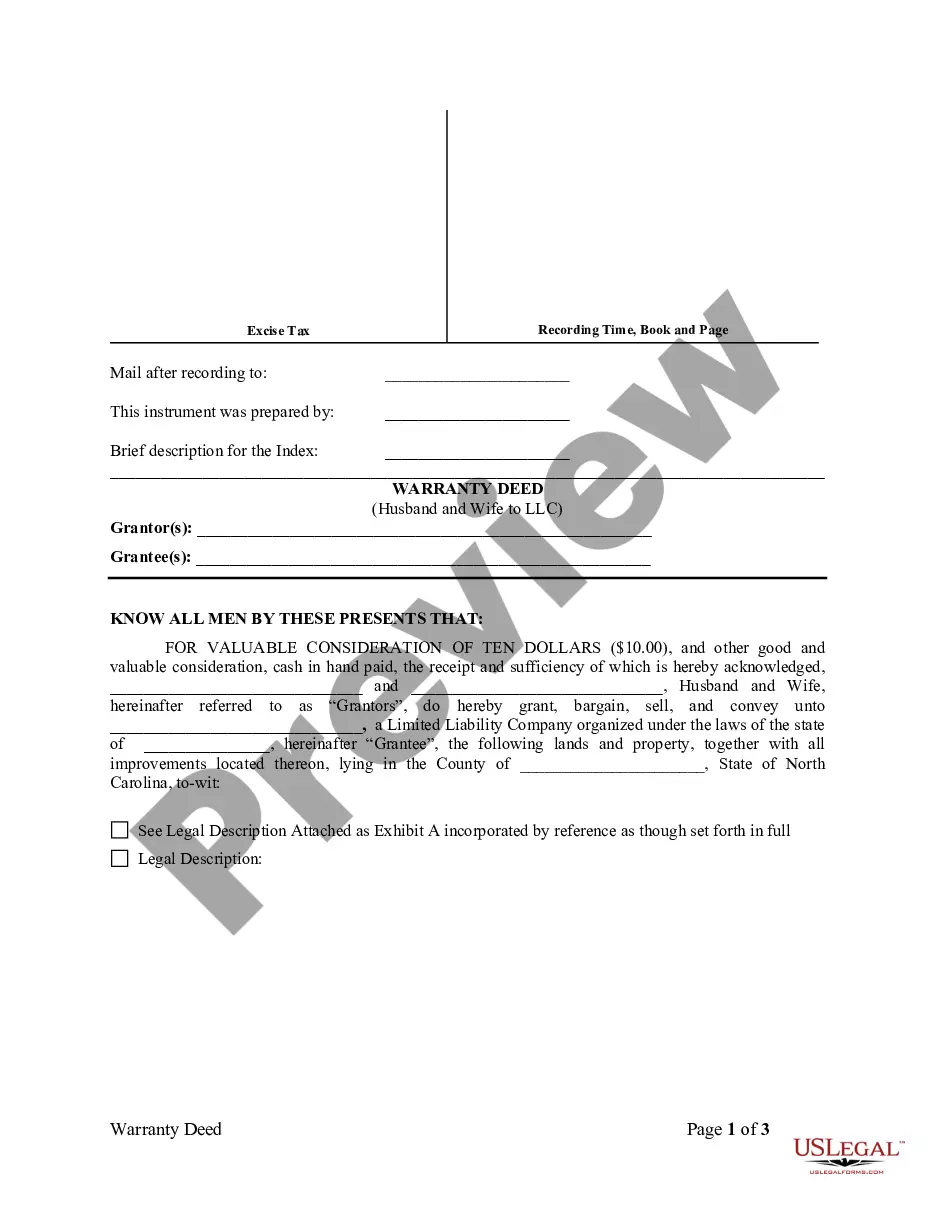

Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC

Description

How to fill out North Carolina General Warranty Deed From Husband And Wife To LLC?

Finding validated forms tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library. This is an online repository containing over 85,000 legal documents for personal and professional requirements as well as various real-world situations.

All the files are appropriately categorized by area of application and jurisdiction, making it as easy as pie to find the Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC.

For those who are already familiar with our library and have used it previously, obtaining the Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC takes only a few clicks. Simply Log In to your account, select the document, and click Download to store it on your device. The procedure will require just a few additional steps for new users.

Maintaining documentation organized and in accordance with legal requirements is of great significance. Take advantage of the US Legal Forms library to always have necessary document templates for any needs right at your fingertips!

- Check the Preview mode and document description. Ensure you’ve picked the right one that fulfills your requirements and aligns with your local jurisdiction standards.

- Search for another template if necessary. If you encounter any discrepancies, use the Search tab above to locate the correct one. If it fits your needs, proceed to the next step.

- Purchase the document. Hit the Buy Now button and select the subscription plan you prefer. You will need to create an account to access the library’s resources.

- Complete your purchase. Enter your credit card information or use your PayPal account to pay for the subscription.

- Download the Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC. Store the template on your device for completion and access it in the My documents section of your profile whenever you need it again.

Form popularity

FAQ

The primary disadvantage of a special warranty deed is the limited protection it offers to the buyer. It does not cover any issues that arose before the seller acquired the property, potentially exposing the buyer to unforeseen risks. Buyers should consider these risks carefully when engaging with the Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC, and consult platforms like uslegalforms for clarity.

The difference between a special and general warranty deed in North Carolina is the scope of the warranties provided. A general warranty deed offers comprehensive protection against any title defects that may exist. On the other hand, a special warranty deed limits protection to events that happened during the seller's ownership, making it crucial for buyers to understand these distinctions, especially when transitioning ownership through the Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC.

In North Carolina, the main difference lies in the level of protection offered. A general warranty deed guarantees ownership against all claims, even those arising before the seller’s ownership. In contrast, a special warranty deed only protects against claims that occurred during the seller's tenure, making it essential to choose wisely for the Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC.

The two primary types of warranty deeds are the general warranty deed and the special warranty deed. A general warranty deed provides the broadest protection, ensuring the buyer against any title defects, while the special warranty deed limits this protection to the time the seller owned the property. Understanding these options is crucial when dealing with the Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC.

The buyer generally benefits the most from a warranty deed, as it provides a strong guarantee of the property's title. A warranty deed, especially the Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC, assures the buyer they will receive clear ownership with no undisclosed claims. This assurance can increase the property's value and appeal in a competitive market.

A seller might choose a special warranty deed when they want to limit their liability for any issues that arose before they owned the property. This type of deed protects the seller from claims associated with the previous owner. It is particularly useful in transactions involving properties that may have complex histories, ensuring a smoother process for the Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC.

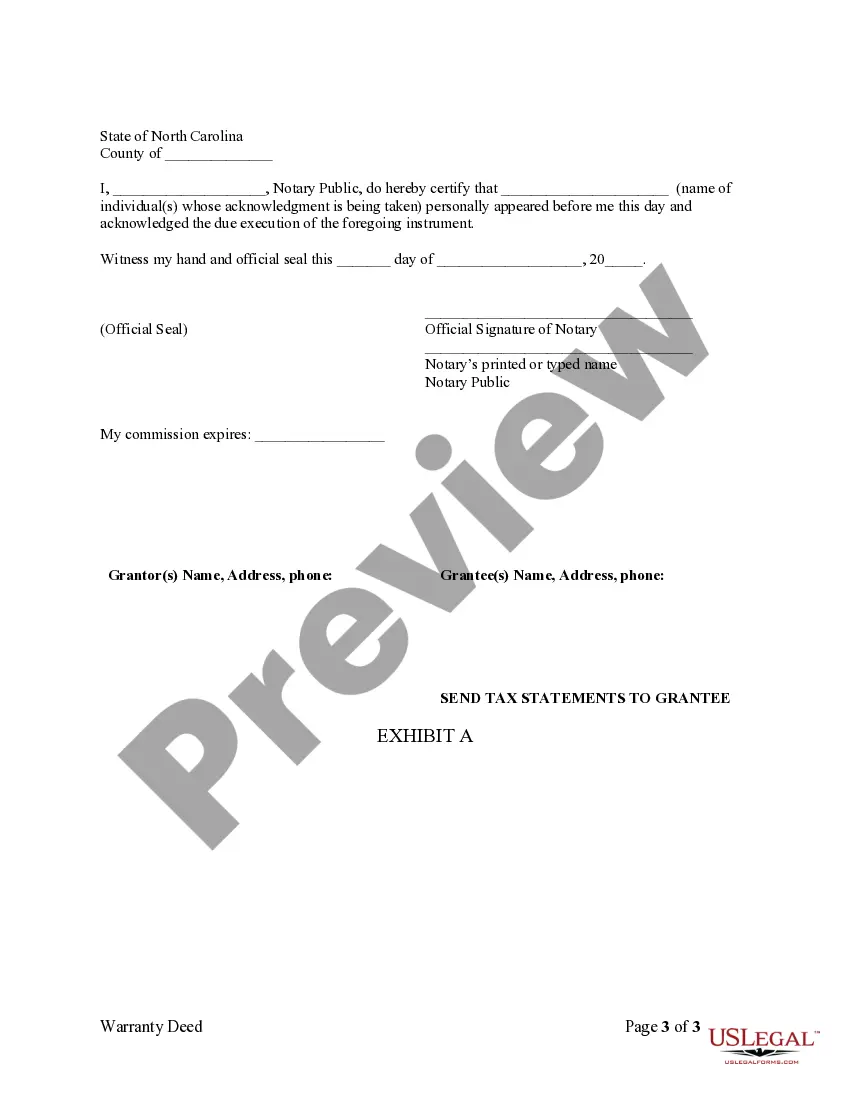

You can obtain a Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC through various outlets. Many legal websites, including US Legal Forms, provide downloadable templates that are easy to fill out. Additionally, local attorneys can prepare a customized deed for your specific transaction. Choose the option that best aligns with your needs and legal requirements.

To get a Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC, you will need to draft the deed according to state laws. You can create one using templates or forms available online, such as those offered by US Legal Forms. Alternatively, hiring an attorney can simplify the process, ensuring all necessary information is accurately included. By following these steps, you can successfully obtain your deed.

The time it takes to obtain a Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC can vary based on several factors. Generally, if you work with a knowledgeable professional, the preparation can take a few days to a week. After that, recording the deed with the county can add additional time, depending on the local office's workload. Therefore, it is best to start the process early to meet any deadlines.

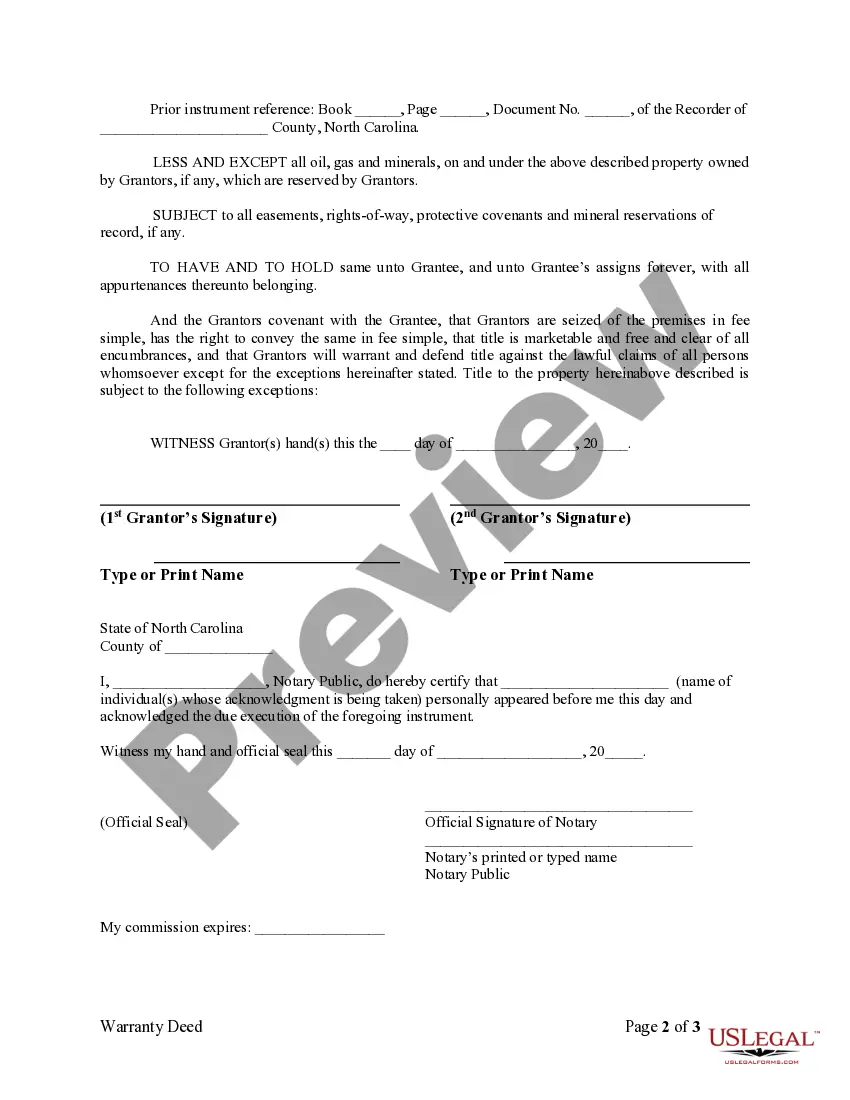

Typically, a general warranty deed is prepared by an attorney or a qualified legal professional. In the case of a Wilmington North Carolina General Warranty Deed from Husband and Wife to LLC, it's advisable to consult with an attorney to ensure all legal requirements are met. This professional can help in drafting the document accurately and ensure proper execution. By doing so, you protect both your interests and the interests of the LLC.