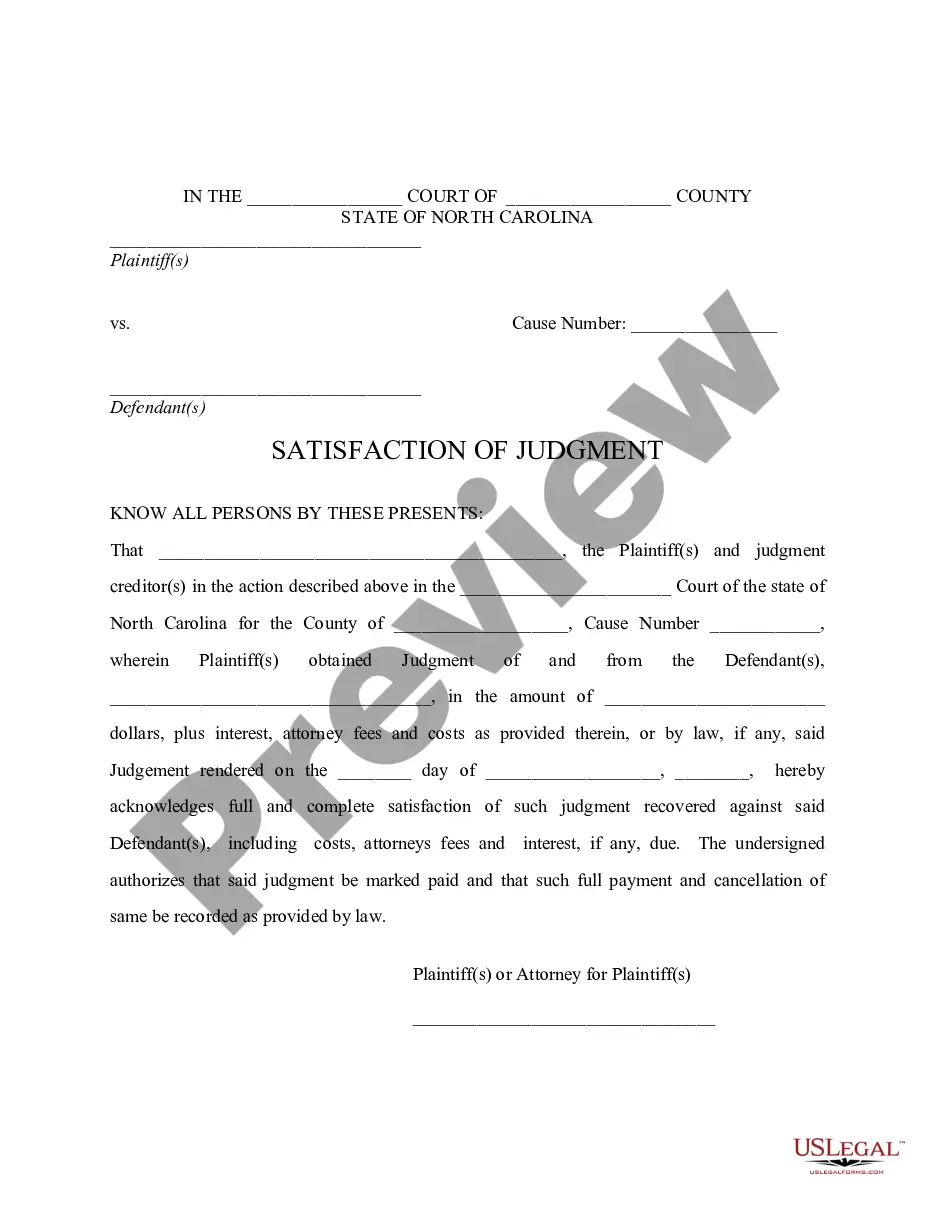

High Point North Carolina Satisfaction of Judgment

Description

How to fill out North Carolina Satisfaction Of Judgment?

If you have previously employed our service, Log In to your account and download the High Point North Carolina Satisfaction of Judgment to your device by selecting the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

In case this is your initial interaction with our service, follow these straightforward instructions to acquire your document.

You have uninterrupted access to all documents you have acquired: you can find them in your profile under the My documents section whenever you need to use them again. Utilize the US Legal Forms service to quickly discover and save any template for your individual or business requirements!

- Confirm that you’ve located a suitable document. Review the description and utilize the Preview feature, if available, to verify if it satisfies your requirements. If it does not, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and process a payment. Enter your credit card information or select the PayPal option to finalize the purchase.

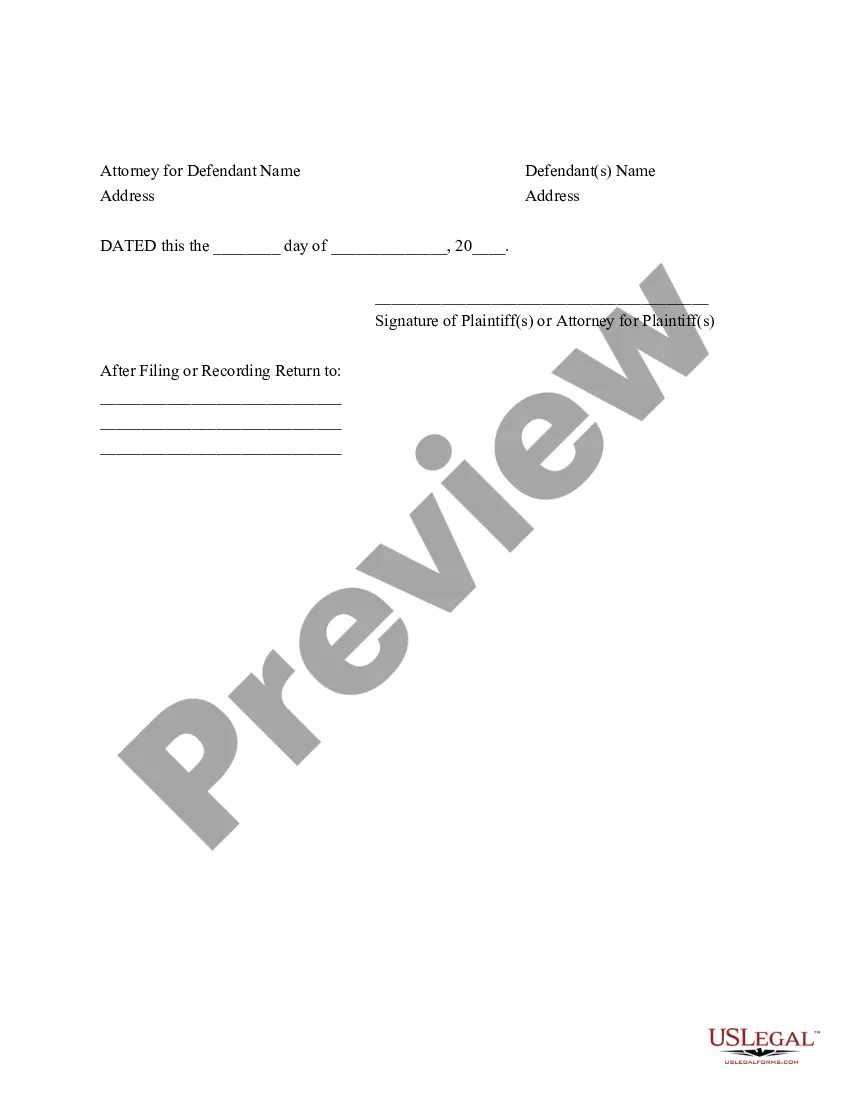

- Obtain your High Point North Carolina Satisfaction of Judgment. Choose the file format for your document and store it on your device.

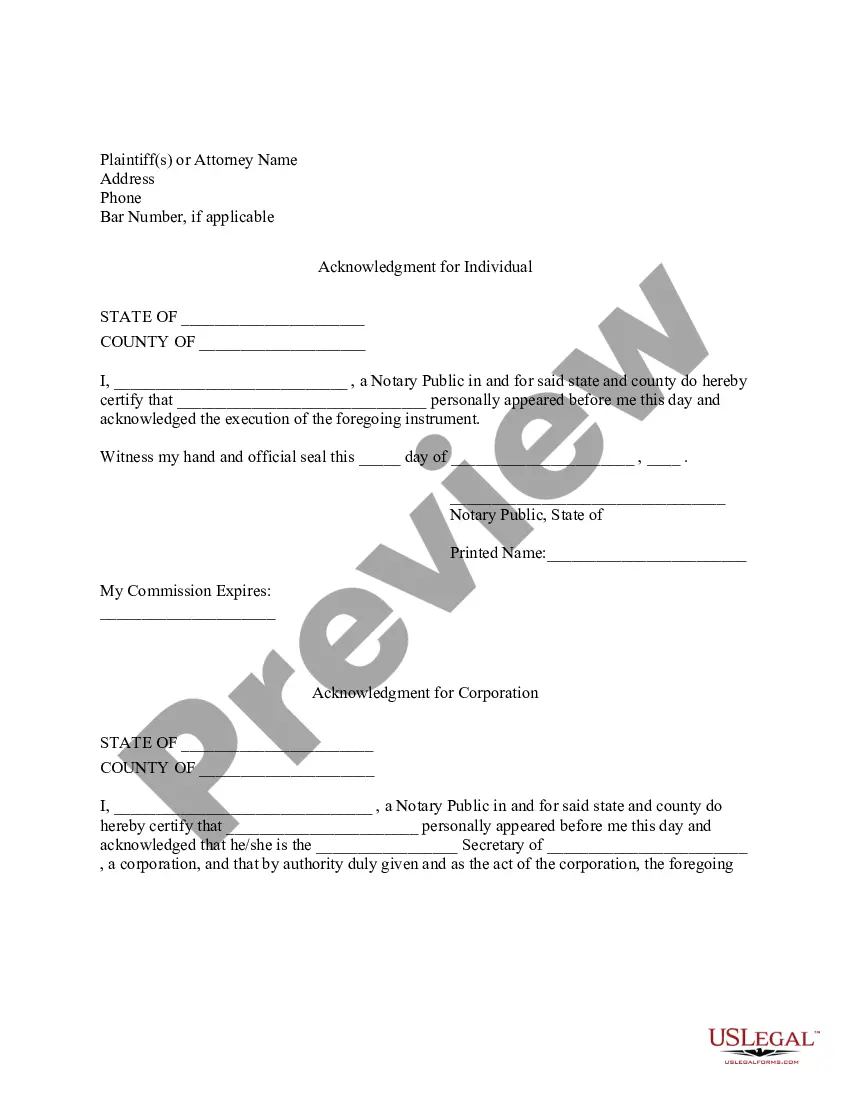

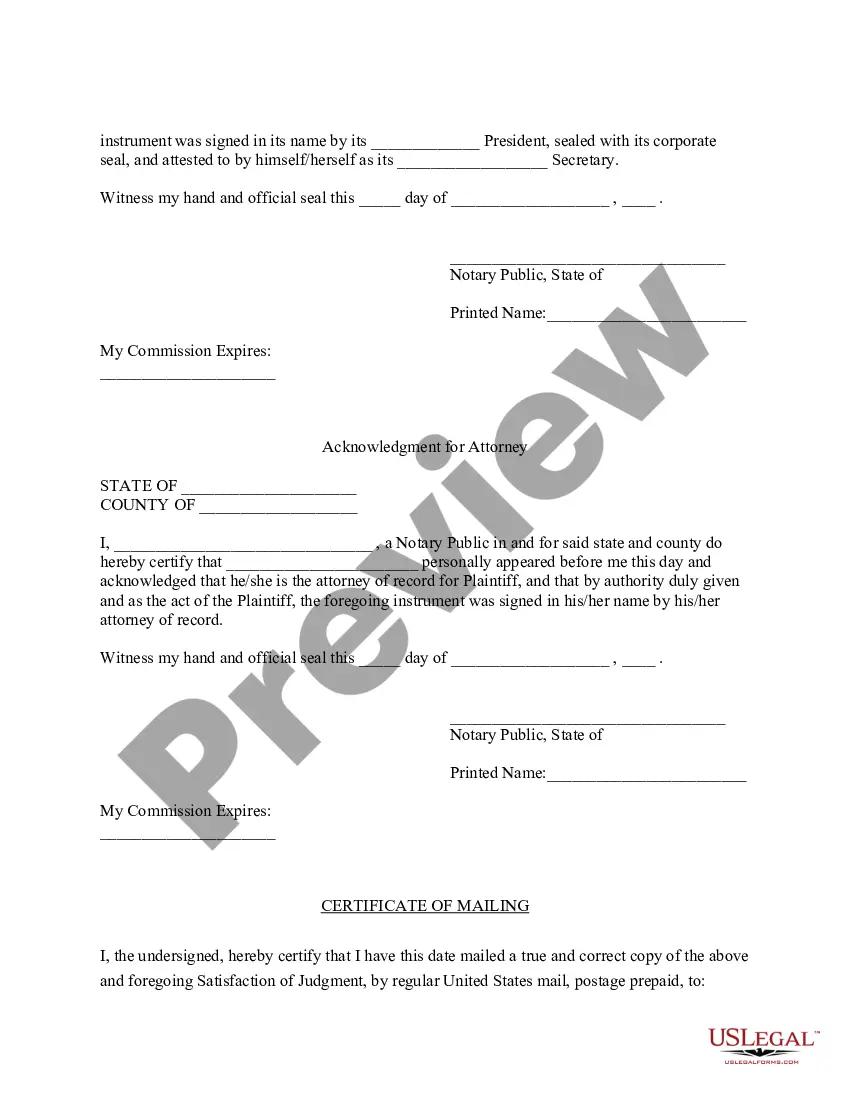

- Complete your template. Print it or utilize professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

To satisfy a judgment in High Point, North Carolina, you must fulfill the amount ordered by the court. Start by paying the outstanding amount to the creditor or the court. After making your payment, get a satisfaction of judgment form, which you can easily find on the US Legal Forms website. Once completed, file this form with the court to officially record the High Point North Carolina Satisfaction of Judgment and clear your financial record.

Yes, a satisfied judgment can still affect your credit score, but its impact may lessen over time. Although a satisfied judgment shows that you have fulfilled your obligation, the record of the judgment might still appear on your credit report for several years. Understanding the implications of High Point North Carolina Satisfaction of Judgment can guide you on how to manage your credit report effectively, ensuring potential lenders understand your commitment to resolving past debts.

A satisfaction of judgment filed indicates that the legal obligation imposed by a court has been fulfilled. This can occur when the debtor pays the amount owed or otherwise complies with the court's order. Once this is filed, it can help clear your name and restore your creditworthiness. For residents in High Point, North Carolina, learning about Satisfaction of Judgment can be crucial for establishing financial stability.

In North Carolina, certain properties are exempt from judgment liens. These typically include your primary residence, necessary household goods, and certain amounts in wages. Additionally, specific assets like retirement accounts and life insurance policies may also be protected. Understanding these exemptions can help you navigate the High Point North Carolina Satisfaction of Judgment effectively.

To remove a satisfied judgment from your credit report in High Point, North Carolina, you should first obtain a copy of your credit report. After confirming the judgment's status as satisfied, you must notify the credit bureaus. They will require documentation showing the judgment has been resolved through the High Point North Carolina Satisfaction of Judgment process. In some cases, using professional services can expedite this process.

In High Point, North Carolina, a judgment typically remains on your record for ten years. This period starts from the date of the judgment. After ten years, the judgment may automatically become unenforceable, but it still might appear on your credit report. It's essential to stay informed about your rights regarding the High Point North Carolina Satisfaction of Judgment to understand how it affects your financial future.

You can confirm if a judgment has been satisfied by checking court records or obtaining a copy of the satisfaction of judgment document. In High Point North Carolina, it is essential to ensure that the court's records reflect the status accurately. Services like USLegalForms can assist you in tracking and documenting this information.

A judgment can significantly impact your credit score and remain on your credit report for up to seven years. This negative mark can hinder your ability to secure loans or credit in High Point. However, satisfying a judgment can help improve your credit standing over time.

Negotiating a settlement after judgment involves reaching out to the creditor to discuss a potential payment plan or reduced amount. It is important to express your willingness to resolve the outstanding debt while being clear about your financial limitations. Legal platforms, such as USLegalForms, can provide resources to assist in this process effectively.

You can satisfy a judgment by paying the amount owed, settling the debt with the creditor, or through specific legal procedures in High Point. Once the judgment is satisfied, you need to ensure that the court records are updated to reflect this change. Consulting with professionals can streamline your process.