A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

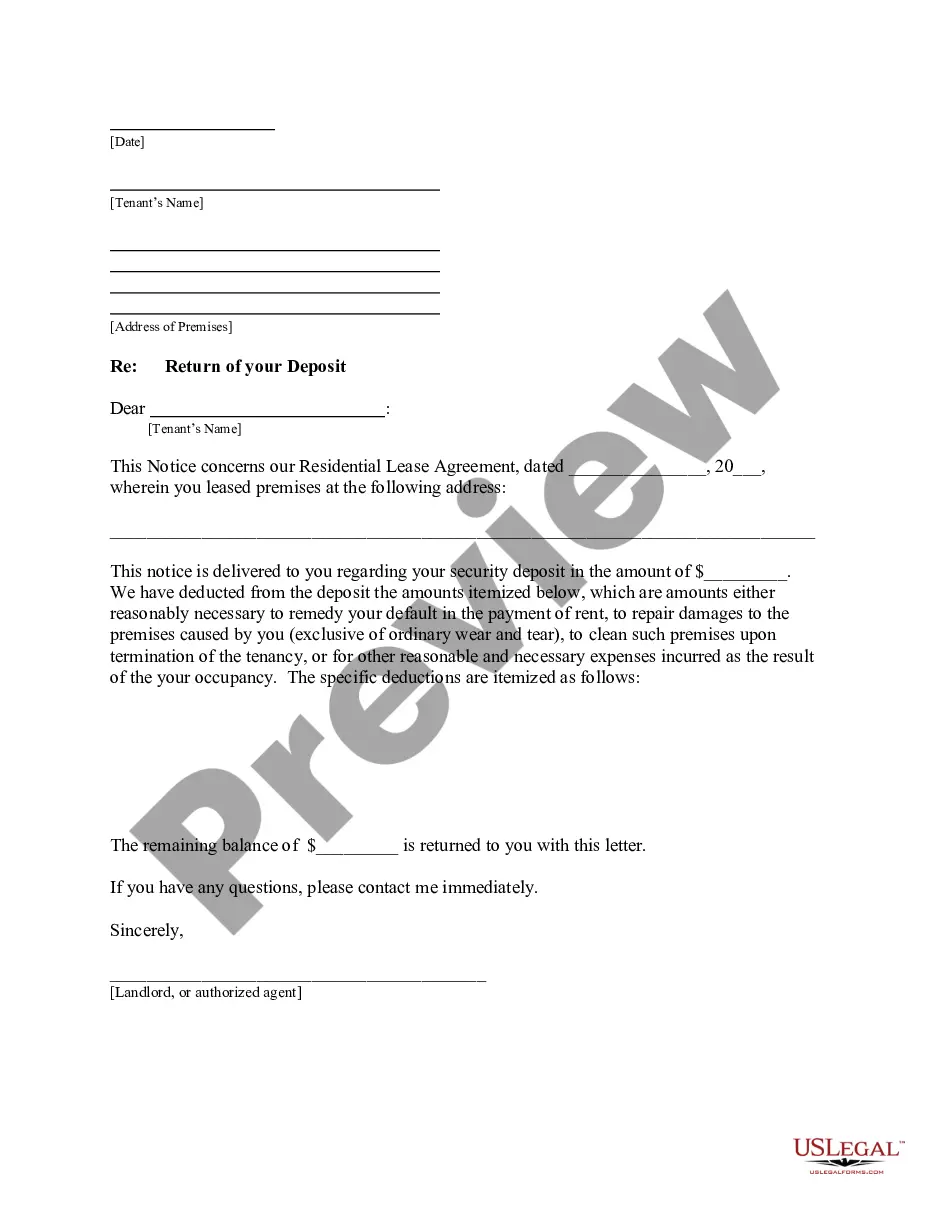

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. Title: High Point North Carolina Letter from Landlord to Tenant Returning Security Deposit with Deductions Keywords: High Point North Carolina, letter, landlord, tenant, returning security deposit, deductions Introduction: In High Point, North Carolina, it is essential for landlords to comply with the state's laws when returning a tenant's security deposit. This detailed description will guide landlords in writing a letter to their tenants, specifying the return of the security deposit after making necessary deductions. Different types of deductions, such as cleaning fees, repairs, and unpaid rent, may vary for each case. 1. Landlord's contact information: Begin the letter by providing your name, address, phone number, and email, ensuring tenants can easily reach out for any clarifications or questions regarding the security deposit return. 2. Tenant's contact information: Include the tenant's name, current address, and any other relevant contact details to personalize the letter and ensure it reaches the intended recipient. 3. Security deposit details: Specify the original security deposit amount and the date it was received. Mention any interest earned on the deposit, if applicable, based on state regulations. 4. Deductions made: Clearly explain each deduction made from the security deposit, providing a breakdown of the charges. Common deductions may include: a. Unpaid rent: State the unpaid rental amount and any associated late fees or penalties. Attach supporting documents, such as monthly rent statements or notices of late payment, if required. b. Repairs and damages: Highlight any damages beyond normal wear and tear, such as broken appliances, holes in walls, or damaged flooring. Include repair invoices, contractors' estimates, or photographs to substantiate the deductions. c. Cleaning fees: If the tenant left the property excessively dirty or failed to return it in the same condition as when they moved in, specify the cleaning charges incurred. Attach cleaning service invoices or receipts to justify the deduction. d. Other deductions: If any additional charges need to be deducted, such as unpaid utilities or outstanding fees as stated in the lease agreement, clearly outline these in the letter. 5. Final calculation: Sum up the deductions made from the original security deposit and provide a detailed breakdown of the remaining refundable amount. If any funds have been deducted but not exhausted, specify the purpose of these remaining funds (e.g., future repairs, unpaid fees). 6. Timeline for refund: Clearly mention the date by which tenants can expect to receive the refund. Ensure you adhere to North Carolina laws, which typically state that landlords have 30 days from the lease termination to return the security deposit or provide an itemized statement of deductions. Conclusion: By crafting a detailed High Point North Carolina letter from landlord to tenant returning a security deposit with deductions, landlords can maintain transparency and avoid potential disputes or misunderstandings. Adhere to the state's regulations and act in accordance with the lease agreement while providing necessary documentation to support deductions, ensuring a smooth and fair return of the security deposit.

Title: High Point North Carolina Letter from Landlord to Tenant Returning Security Deposit with Deductions Keywords: High Point North Carolina, letter, landlord, tenant, returning security deposit, deductions Introduction: In High Point, North Carolina, it is essential for landlords to comply with the state's laws when returning a tenant's security deposit. This detailed description will guide landlords in writing a letter to their tenants, specifying the return of the security deposit after making necessary deductions. Different types of deductions, such as cleaning fees, repairs, and unpaid rent, may vary for each case. 1. Landlord's contact information: Begin the letter by providing your name, address, phone number, and email, ensuring tenants can easily reach out for any clarifications or questions regarding the security deposit return. 2. Tenant's contact information: Include the tenant's name, current address, and any other relevant contact details to personalize the letter and ensure it reaches the intended recipient. 3. Security deposit details: Specify the original security deposit amount and the date it was received. Mention any interest earned on the deposit, if applicable, based on state regulations. 4. Deductions made: Clearly explain each deduction made from the security deposit, providing a breakdown of the charges. Common deductions may include: a. Unpaid rent: State the unpaid rental amount and any associated late fees or penalties. Attach supporting documents, such as monthly rent statements or notices of late payment, if required. b. Repairs and damages: Highlight any damages beyond normal wear and tear, such as broken appliances, holes in walls, or damaged flooring. Include repair invoices, contractors' estimates, or photographs to substantiate the deductions. c. Cleaning fees: If the tenant left the property excessively dirty or failed to return it in the same condition as when they moved in, specify the cleaning charges incurred. Attach cleaning service invoices or receipts to justify the deduction. d. Other deductions: If any additional charges need to be deducted, such as unpaid utilities or outstanding fees as stated in the lease agreement, clearly outline these in the letter. 5. Final calculation: Sum up the deductions made from the original security deposit and provide a detailed breakdown of the remaining refundable amount. If any funds have been deducted but not exhausted, specify the purpose of these remaining funds (e.g., future repairs, unpaid fees). 6. Timeline for refund: Clearly mention the date by which tenants can expect to receive the refund. Ensure you adhere to North Carolina laws, which typically state that landlords have 30 days from the lease termination to return the security deposit or provide an itemized statement of deductions. Conclusion: By crafting a detailed High Point North Carolina letter from landlord to tenant returning a security deposit with deductions, landlords can maintain transparency and avoid potential disputes or misunderstandings. Adhere to the state's regulations and act in accordance with the lease agreement while providing necessary documentation to support deductions, ensuring a smooth and fair return of the security deposit.