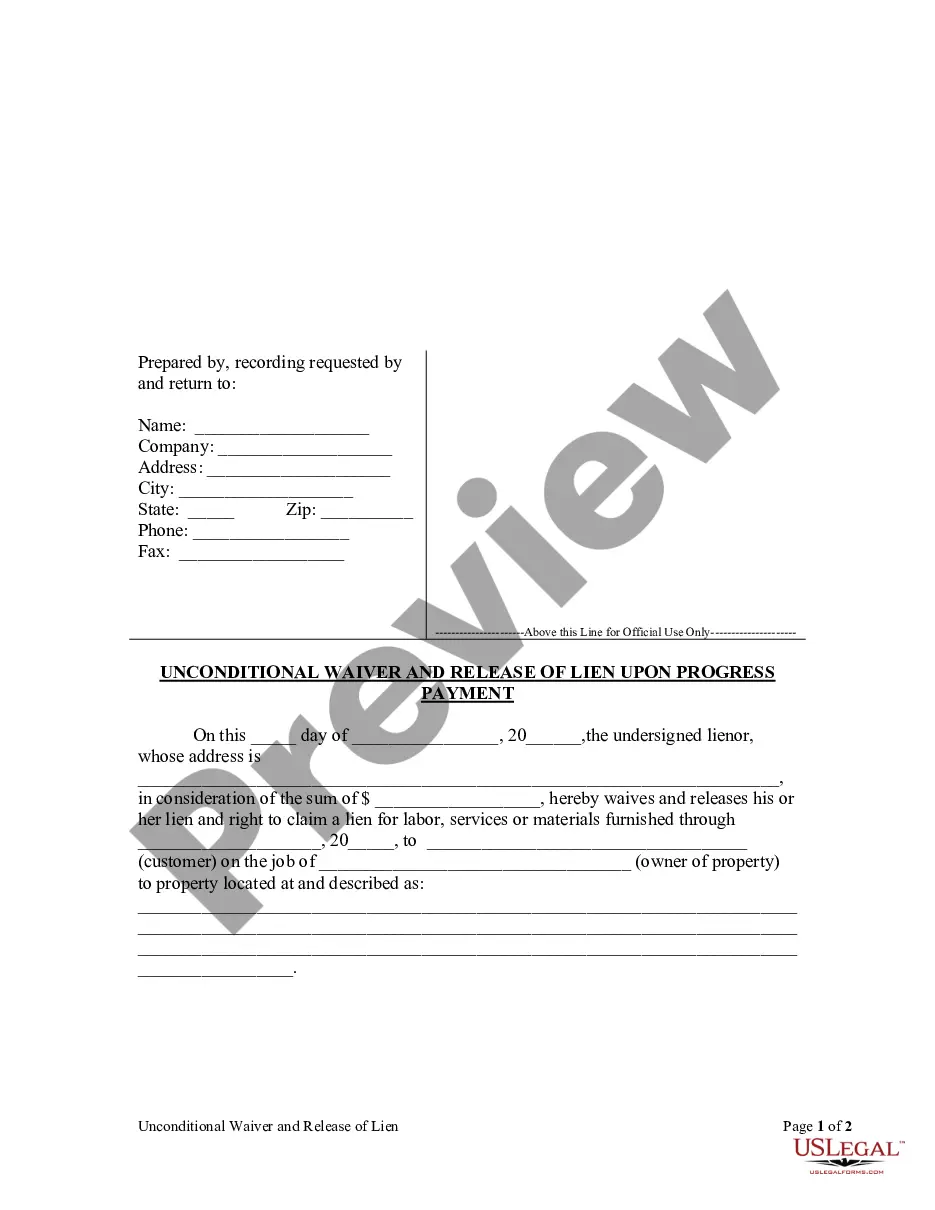

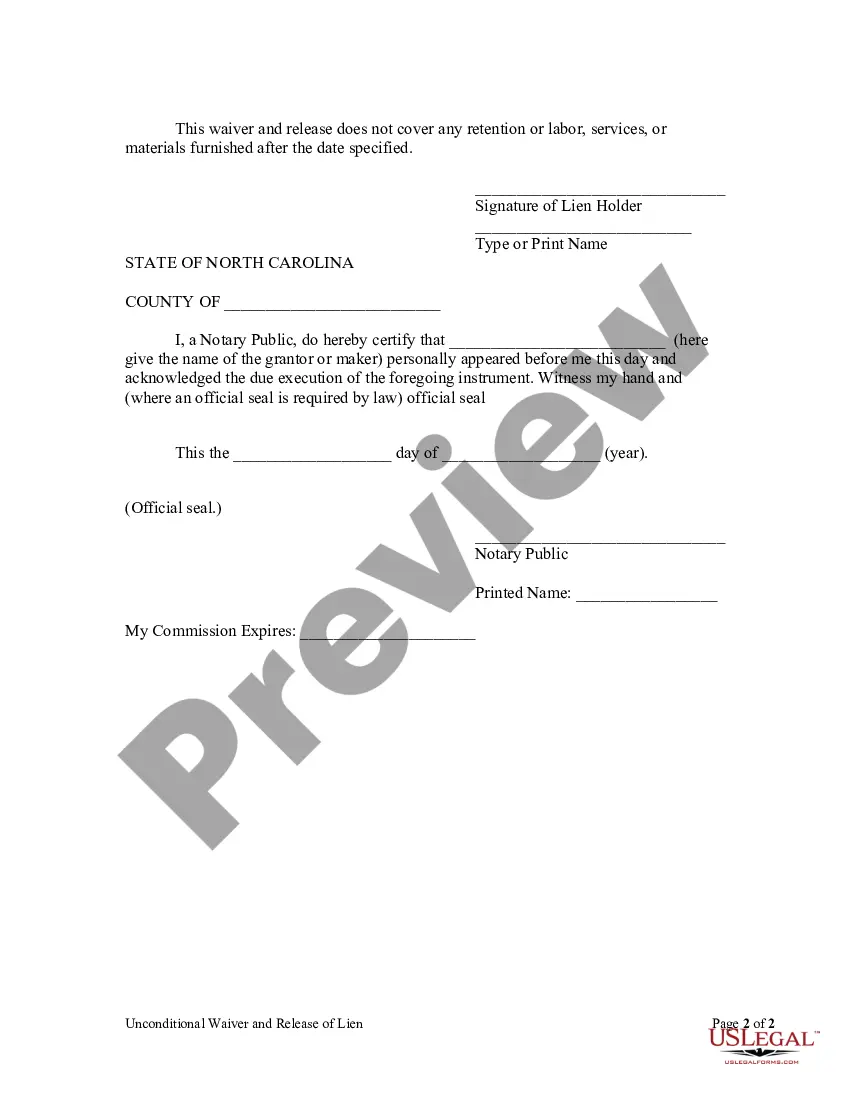

This Unconditional Waiver and Release of Lien Upon Progress Payment form is for use by a lienor, in consideration of a certain sum of money to waive and release his or her lien and right to claim a lien for labor, services or materials furnished through a specific date to a customer on the job of an owner of property.

Greensboro North Carolina Unconditional Waiver and Release of Lien Upon Progress Payment

Description

How to fill out Greensboro North Carolina Unconditional Waiver And Release Of Lien Upon Progress Payment?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal solutions that, as a rule, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of a lawyer. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Greensboro North Carolina Unconditional Waiver and Release of Lien Upon Progress Payment or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Greensboro North Carolina Unconditional Waiver and Release of Lien Upon Progress Payment adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Greensboro North Carolina Unconditional Waiver and Release of Lien Upon Progress Payment is suitable for your case, you can select the subscription plan and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!