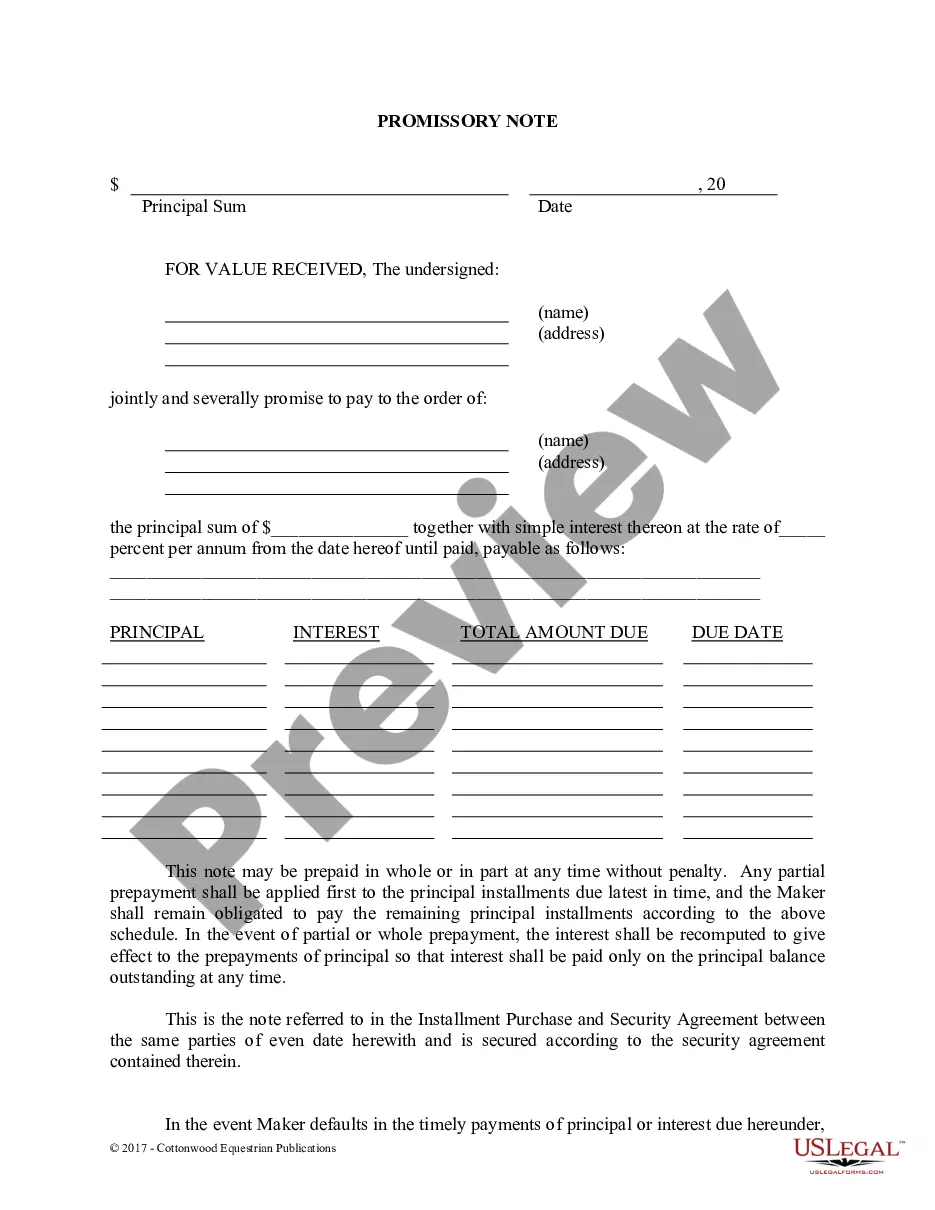

Cary North Carolina Promissory Note — Horse Equine Forms are legal documents that outline a loan agreement between two parties, specifically in the context of owning, selling, or financing a horse or equine-related transaction. These forms serve as a written contract, establishing the terms and conditions under which the borrower agrees to repay the lender a specific amount of money. Promissory notes are essential in the horse industry to protect both the borrower and the lender. They help ensure that all parties involved are clear about the loan agreement details to prevent potential disputes or misunderstandings. Whether you're a buyer seeking financial assistance for purchasing a horse or a seller looking for a secured loan, having a promissory note in place is crucial. Cary, North Carolina, offers various types of promissory notes tailored specifically for horse and equine transactions. Some prominent types include: 1. Purchase Promissory Note: This type of promissory note is used when the borrower is seeking financial assistance to buy a horse. It outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and consequences for defaulting on payments. 2. Boarding Promissory Note: When a horse owner needs to board their horse at a facility but can't afford the fees upfront, they may enter into a boarding promissory note. The document specifies the boarding-related expenses, payment dates, and any additional terms agreed upon by the parties involved. 3. Training Promissory Note: In cases where an owner wants to send their horse for professional training but requires financial assistance, a training promissory note is used. It states the training costs, duration, payment structure, and conditions if the horse fails to meet the desired training outcomes. 4. Breeding Promissory Note: Breeders often use this type of promissory note when allowing someone to breed their horse in exchange for a monetary fee. The document outlines the breeding terms, stud fees, and any specific conditions related to the breeding process, such as live foal guarantees or return breeding rights. 5. Co-ownership Promissory Note: In joint ownership scenarios, where two or more individuals purchase a horse together, a co-ownership promissory note is used. This note includes details about each party's financial obligations, ownership percentages, and procedures for resolving disputes or dissolving the co-ownership agreement. It is crucial to consult with a local attorney or legal professional in Cary, North Carolina, to ensure the promissory note accurately reflects the specific terms and regulations in effect to protect the interests of all parties involved.

Cary North Carolina Promissory Note - Horse Equine Forms

Description

How to fill out Cary North Carolina Promissory Note - Horse Equine Forms?

If you have previously made use of our service, sign in to your account and retrieve the Cary North Carolina Promissory Note - Horse Equine Forms on your device by selecting the Download button. Ensure your subscription is current. If not, renew it based on your payment plan.

If this is your initial engagement with our service, adhere to these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to reuse it. Take advantage of the US Legal Forms service to swiftly locate and save any template for your personal or professional requirements!

- Confirm that you’ve found a suitable document. Browse the description and use the Preview option, if accessible, to verify if it aligns with your requirements. If it does not fit your needs, utilize the Search tab above to locate the correct one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Provide your credit card information or opt for the PayPal method to finalize the purchase.

- Acquire your Cary North Carolina Promissory Note - Horse Equine Forms. Select the file format for your document and store it on your device.

- Complete your template. Print it out or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Absolutely, a promissory note can indeed be secured through collateral. This means that if the borrower fails to repay, the lender has a claim on the collateral specified. When using a Cary North Carolina Promissory Note - Horse Equine Forms, you can specify the equine asset as collateral to provide additional assurance.

Yes, a promissory note can be transferred to another party. This transfer often occurs through an endorsement and requires the consent of both parties involved. In the context of a Cary North Carolina Promissory Note - Horse Equine Forms, it is essential to ensure proper documentation to maintain its enforceability.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame.

Only the borrower signs the promissory note, whereas both the lender and the borrower sign a loan agreement. The signed document means that the borrower agrees to pay back the loan.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

Does a promissory note have to be notarized? A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Dated Signature: In North Carolina, both unsecured and secured promissory notes should be signed and dated by the borrower and any co-signer; the lender need not sign. There is no legal requirement for most promissory notes to be witnessed or notarized in North Carolina.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.