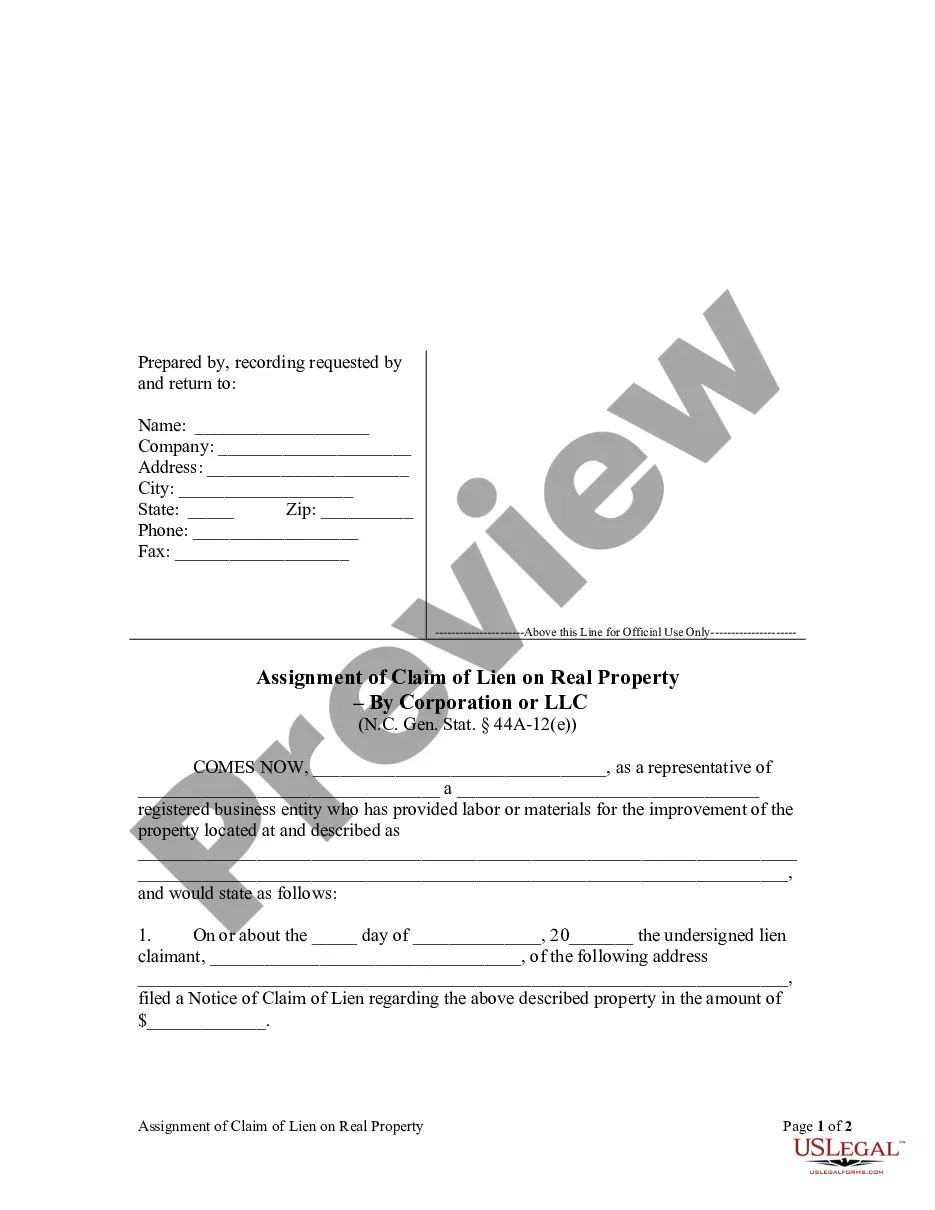

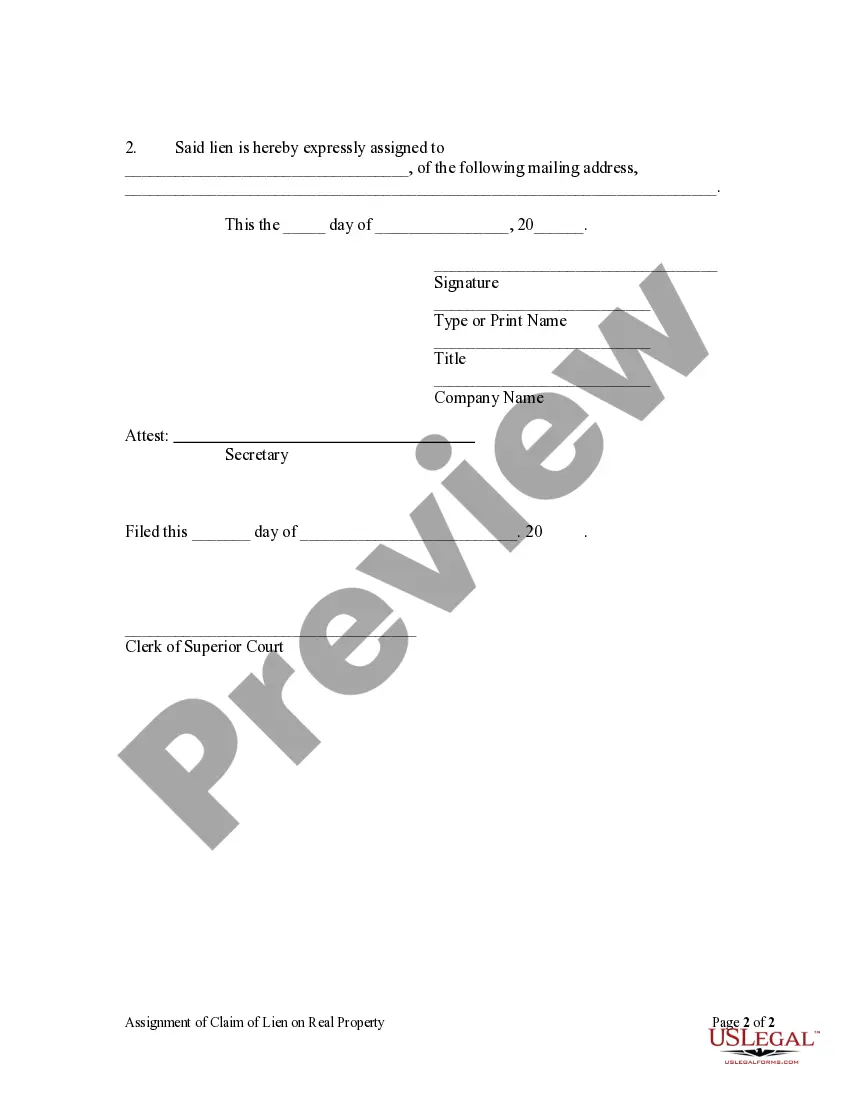

This Assignment of Claim of Lien on Real Property form is for use by a corporate party who has provided labor or materials for the improvement of property to assign its lien and to provide the date the lien claimant filed a Notice of Claim of Lien regarding the property and the amount of the lien.

In Wilmington, North Carolina, the Assignment of Claim of Lien on Real Property for Corporations or LCS is a legal document that facilitates the transfer of a claim of lien from one party to another. This assignment is commonly used when a corporation or limited liability company (LLC) needs to transfer or assign its right to collect a debt secured by a lien on real property. There may be different types or scenarios in which the Assignment of Claim of Lien on Real Property for Corporations or LCS becomes relevant. Let's explore some of these scenarios: 1. Assignment of Claim of Lien on Real Property — Corporation or LLC Due to Business Sale: When a corporation or LLC sells its business which holds a claim of lien on real property, this assignment document allows for the transfer of the claim to the new owner. This ensures that the new owner assumes the responsibility and right to collect the debt secured by the lien. 2. Assignment of Claim of Lien on Real Property — Corporation or LLC in Debt Settlement: In some cases, a corporation or LLC may hold a claim of lien on a property for unpaid debts. This assignment is utilized when the original debtor and lien holder reach a settlement agreement, allowing for the transfer of the claim and its subsequent collection by a different party. 3. Assignment of Claim of Lien on Real Property — Corporation or LLC for Financial Transactions: Corporations or LCS may use their claims of lien on real property as collateral in financial transactions, such as obtaining loans or lines of credit. In such cases, an assignment may be made to transfer the claim temporarily as security for the financial arrangement. When drafting the Assignment of Claim of Lien on Real Property for Corporations or LCS in Wilmington, North Carolina, it is crucial to include the following essential details: — Names and addresses of the assignor (the corporation or LLC transferring the claim) and the assignee (the party taking ownership of the claim). — Description of the real property on which the lien is held, including its address and legal description. — Detailed information regarding the claim, such as the amount owed, the date the lien was recorded, and any other relevant information pertaining to the debt or agreement. — An acknowledgment section for both the assignor and assignee's signatures, as well as the date of execution. It is recommended to consult with a qualified attorney or legal professional when preparing or executing the Assignment of Claim of Lien on Real Property for Corporations or LCS to ensure compliance with all relevant laws and regulations.In Wilmington, North Carolina, the Assignment of Claim of Lien on Real Property for Corporations or LCS is a legal document that facilitates the transfer of a claim of lien from one party to another. This assignment is commonly used when a corporation or limited liability company (LLC) needs to transfer or assign its right to collect a debt secured by a lien on real property. There may be different types or scenarios in which the Assignment of Claim of Lien on Real Property for Corporations or LCS becomes relevant. Let's explore some of these scenarios: 1. Assignment of Claim of Lien on Real Property — Corporation or LLC Due to Business Sale: When a corporation or LLC sells its business which holds a claim of lien on real property, this assignment document allows for the transfer of the claim to the new owner. This ensures that the new owner assumes the responsibility and right to collect the debt secured by the lien. 2. Assignment of Claim of Lien on Real Property — Corporation or LLC in Debt Settlement: In some cases, a corporation or LLC may hold a claim of lien on a property for unpaid debts. This assignment is utilized when the original debtor and lien holder reach a settlement agreement, allowing for the transfer of the claim and its subsequent collection by a different party. 3. Assignment of Claim of Lien on Real Property — Corporation or LLC for Financial Transactions: Corporations or LCS may use their claims of lien on real property as collateral in financial transactions, such as obtaining loans or lines of credit. In such cases, an assignment may be made to transfer the claim temporarily as security for the financial arrangement. When drafting the Assignment of Claim of Lien on Real Property for Corporations or LCS in Wilmington, North Carolina, it is crucial to include the following essential details: — Names and addresses of the assignor (the corporation or LLC transferring the claim) and the assignee (the party taking ownership of the claim). — Description of the real property on which the lien is held, including its address and legal description. — Detailed information regarding the claim, such as the amount owed, the date the lien was recorded, and any other relevant information pertaining to the debt or agreement. — An acknowledgment section for both the assignor and assignee's signatures, as well as the date of execution. It is recommended to consult with a qualified attorney or legal professional when preparing or executing the Assignment of Claim of Lien on Real Property for Corporations or LCS to ensure compliance with all relevant laws and regulations.