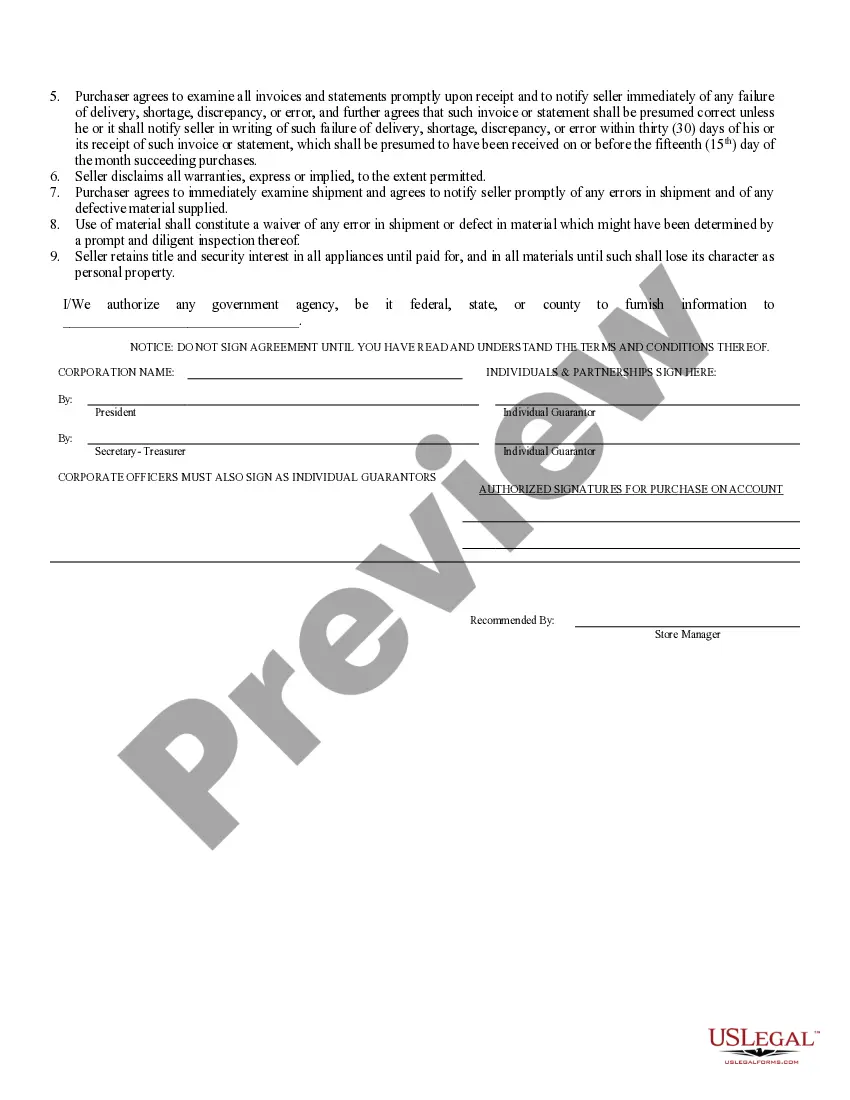

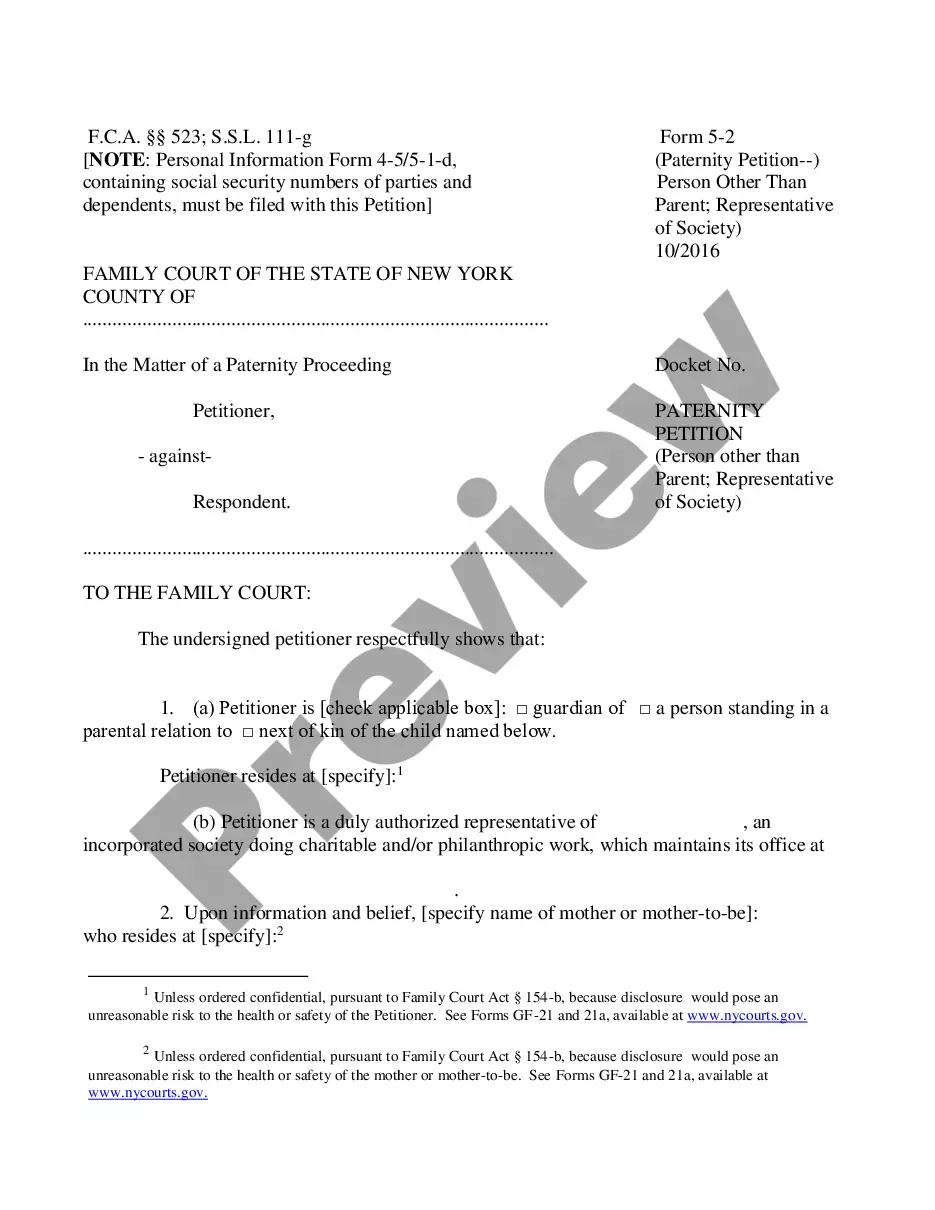

High Point North Carolina Business Credit Application is a comprehensive form used by businesses in High Point, North Carolina, to apply for credit with financial institutions or suppliers. This application assists them in securing necessary funds, extending payment terms, or obtaining goods and services on credit. The High Point North Carolina Business Credit Application enables businesses to provide detailed information about their financial stability, creditworthiness, and ability to manage credit responsibly. This information helps lenders or suppliers assess the risk involved in extending credit and determine suitable credit terms. The application may differ slightly depending on the specific lender or supplier requirements, but its overall purpose remains consistent. Keywords: High Point North Carolina, business credit application, financial institutions, suppliers, funds, payment terms, creditworthiness, credit management, lenders, goods and services, credit terms. Types of High Point North Carolina Business Credit Application: 1. General Business Credit Application: This type of application is used by businesses in various industries seeking credit from financial institutions or suppliers. It covers a wide range of businesses, including retail, manufacturing, services, and more. 2. Small Business Credit Application: Designed specifically for small businesses operating in High Point, North Carolina, this application focuses on the unique credit needs and financial situations of small enterprises. It may have streamlined sections and requirements tailored for small-scale operations. 3. Manufacturer Credit Application: This application is specific to manufacturers based in High Point, North Carolina. It includes additional fields and information relevant to the manufacturing industry, such as production capabilities, inventory management, and supply chain relationships. 4. Supplier Credit Application: Suppliers in High Point, North Carolina, often require businesses to complete this application to establish credit accounts. It gathers essential information about the company's purchasing needs, order volumes, and payment history, allowing suppliers to determine credit limits and terms. 5. Professional Service Credit Application: Professionals like lawyers, accountants, consultants, or marketing agencies based in High Point, North Carolina, may use this specialized credit application. It emphasizes the unique aspects of service-based businesses, such as billable hours, retainer agreements, or project-based invoicing. Keywords: High Point North Carolina, business credit application, general business, small business, manufacturer, supplier, professional service, credit accounts, credit limits, financial situations, industry-specific fields.

High Point North Carolina Business Credit Application

Description

How to fill out High Point North Carolina Business Credit Application?

Benefit from the US Legal Forms and get instant access to any form template you need. Our helpful platform with a large number of document templates simplifies the way to find and get virtually any document sample you will need. You are able to export, complete, and sign the High Point North Carolina Business Credit Application in a matter of minutes instead of surfing the Net for hours attempting to find an appropriate template.

Using our library is an excellent way to raise the safety of your document filing. Our experienced lawyers on a regular basis check all the documents to ensure that the templates are appropriate for a particular region and compliant with new laws and regulations.

How can you obtain the High Point North Carolina Business Credit Application? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. Moreover, you can find all the earlier saved files in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Find the form you need. Make sure that it is the form you were looking for: check its headline and description, and use the Preview feature if it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the saving procedure. Select Buy Now and select the pricing plan you like. Then, sign up for an account and process your order with a credit card or PayPal.

- Export the file. Pick the format to obtain the High Point North Carolina Business Credit Application and modify and complete, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable template libraries on the web. Our company is always ready to help you in any legal procedure, even if it is just downloading the High Point North Carolina Business Credit Application.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!