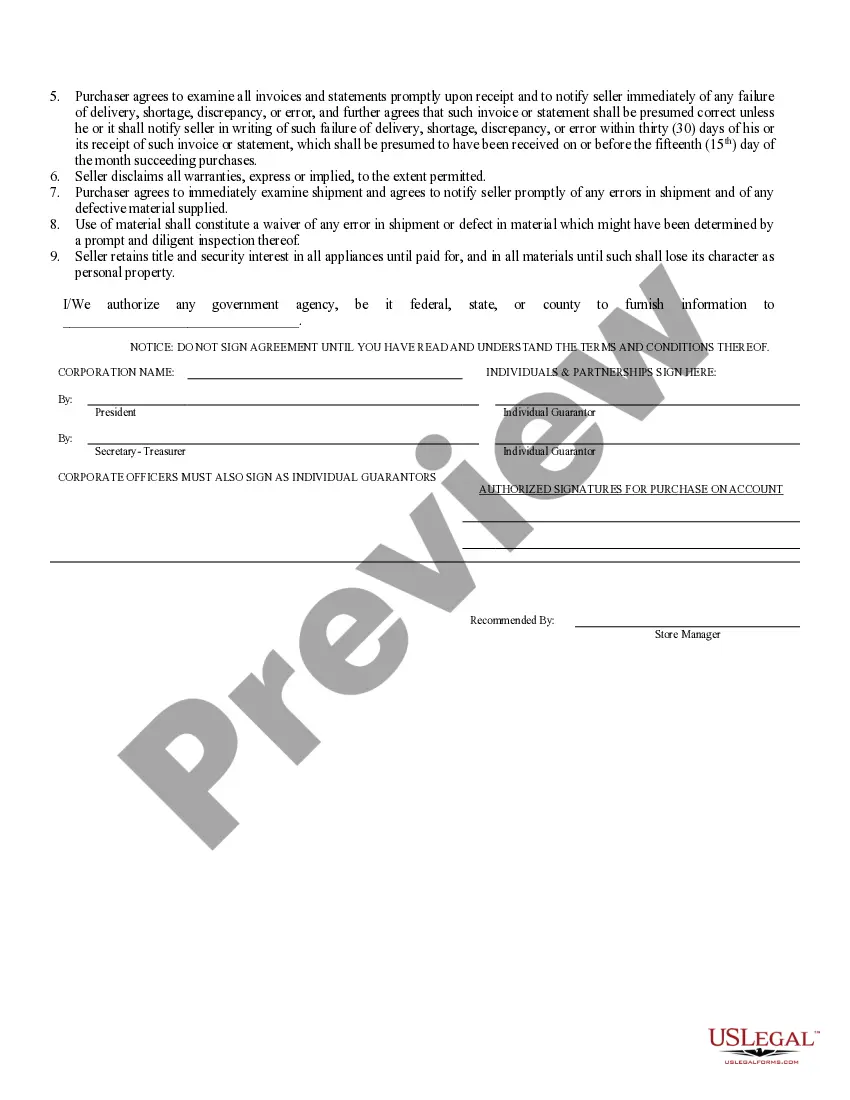

Mecklenburg North Carolina Business Credit Application serves as the key document required by business owners or entities seeking credit facilities or financing solutions from financial institutions in Mecklenburg County, North Carolina. This comprehensive application gathers relevant information about the business, its financial standing, and the credit requirements. It allows lenders or creditors to assess the creditworthiness of the business and make informed decisions regarding loan approval. The Mecklenburg North Carolina Business Credit Application typically includes the following sections: 1. Business Information: This section requires detailed information about the business, such as legal name, address, contact details, and years in operation. It may also outline the business structure (sole proprietorship, partnership, corporation, etc.) and provide links to the business's website or online presence. 2. Financial Information: Here, the application collects crucial financial data about the business, including its annual revenue, profit/loss statements, balance sheets, cash flow statements, and tax identification numbers. This section enables lenders to assess the business's financial stability and ascertain its ability to repay the credit. 3. Ownership and Management: This section highlights the management team and ownership structure of the business. It requires personal information about the owners, partners, or executives, including their names, social security numbers, contact information, and percentage of ownership. Lenders often scrutinize this information to evaluate the management's experience and expertise. 4. Credit Requirements: In this part, applicants specify their credit requirements, outlining the purpose of the credit, the desired loan amount, and the preferred terms and conditions. Mecklenburg North Carolina Business Credit Applications acknowledge that different businesses may have varying credit needs, such as working capital loans, equipment financing, trade credit, or lines of credit. 5. Collateral and Guarantees: Some applications may request details about any collateral or guarantees that the business is willing to provide as security for the credit facility. This information helps lenders assess the risk associated with the loan and determine the appropriate terms. While there may not be multiple types of Mecklenburg North Carolina Business Credit Applications, variations may occur based on the specific lender or financial institution. Each institution may have its unique application form or requirements, although the core information such as business details, financial information, ownership, and credit requirements remain consistent. Overall, Mecklenburg North Carolina Business Credit Applications are essential tools for businesses seeking financing solutions within the county. By providing a comprehensive overview of the business's financial health, ownership, and credit requirements, these applications facilitate effective communication between businesses and lenders, enabling successful credit evaluations and facilitating growth and development.

Mecklenburg North Carolina Business Credit Application

Description

How to fill out Mecklenburg North Carolina Business Credit Application?

Benefit from the US Legal Forms and get immediate access to any form you require. Our useful website with a large number of templates makes it simple to find and get almost any document sample you require. It is possible to export, complete, and certify the Mecklenburg North Carolina Business Credit Application in just a matter of minutes instead of browsing the web for hours attempting to find a proper template.

Using our catalog is a wonderful way to improve the safety of your document filing. Our experienced legal professionals regularly check all the records to make certain that the forms are relevant for a particular region and compliant with new acts and polices.

How do you get the Mecklenburg North Carolina Business Credit Application? If you have a subscription, just log in to the account. The Download option will appear on all the documents you view. Moreover, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instructions listed below:

- Open the page with the template you require. Ensure that it is the template you were hoping to find: check its name and description, and take take advantage of the Preview feature if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the saving process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the document. Pick the format to obtain the Mecklenburg North Carolina Business Credit Application and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable form libraries on the web. We are always ready to assist you in virtually any legal process, even if it is just downloading the Mecklenburg North Carolina Business Credit Application.

Feel free to make the most of our service and make your document experience as convenient as possible!