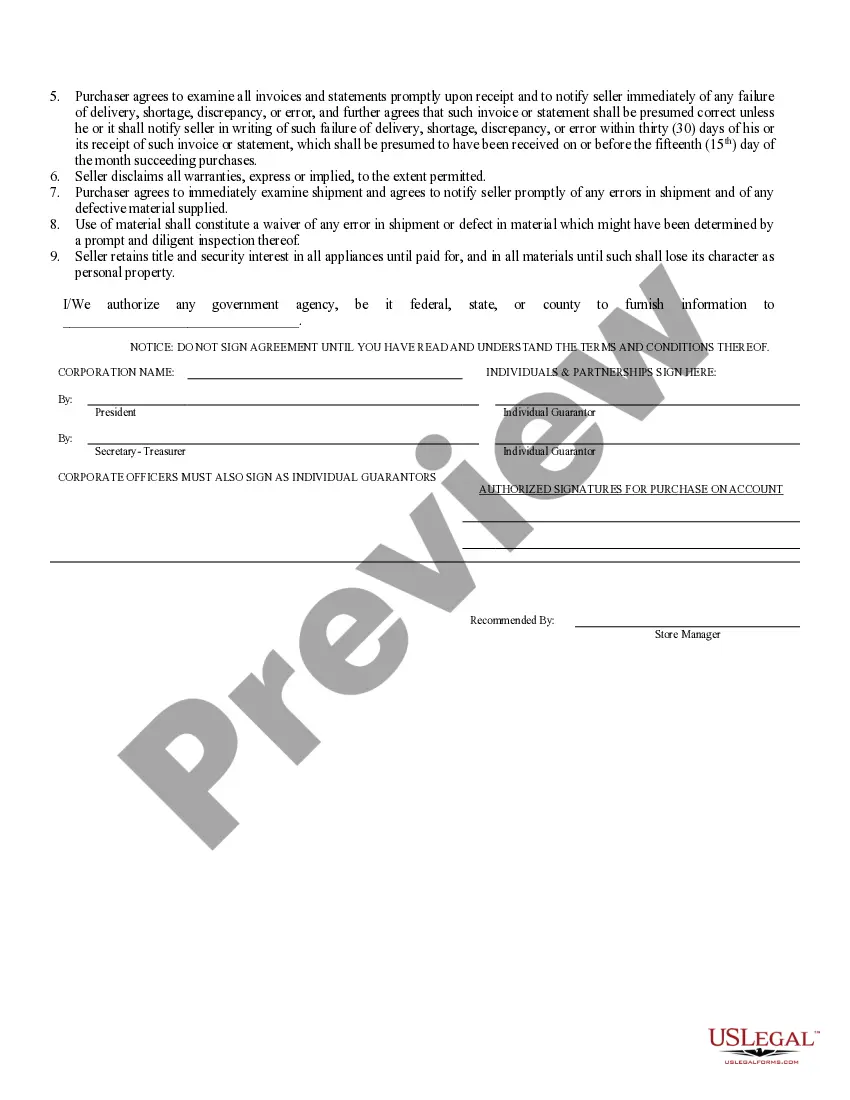

The Winston-Salem, North Carolina Business Credit Application is a comprehensive and essential document that local businesses and entrepreneurs utilize to establish credit accounts with various financial institutions and lenders. This application serves as a means for businesses to access credit facilities, loans, lines of credit, and other financial services necessary for their growth and development. The Winston-Salem Business Credit Application requires businesses to provide detailed information about their company and financial history, including but not limited to, the business's legal name, physical address, contact information, ownership structure, industry type, and number of years in operation. Moreover, it often mandates the applicant to disclose financial statements, tax returns, and financial projections to assess the creditworthiness and repayment capacity of the business. Key areas covered in the Winston-Salem Business Credit Application include: 1. Business Profile: This section elucidates the basic information about the business, its structure, legal status, industry classification, and any subsidiary or affiliated companies. 2. Owner/Principal Details: Here, applicants are required to furnish personal and professional information about the business owner(s) and principal(s), including their names, contact details, social security numbers, and percentage of ownership. 3. Financial Information: This section deals with the financial history and status of the business. It generally requires businesses to provide income statements, balance sheets, cash flow statements, and tax returns for a specific period. Additionally, projected financial data may also be requested to assess the future financial stability of the business. 4. Trade References: Businesses must include a list of trade references, including suppliers, vendors, and other businesses they have conducted transactions with. This allows financial institutions to assess the payment history and creditworthiness of the applicant. 5. Banking Information: Applicants are required to disclose the details of their business banking relationships, including the name of the banks, account numbers, and any outstanding loans or lines of credit. Different types of Winston-Salem North Carolina Business Credit Applications may exist, varying based on the financial institution or lender that provides them. Each lender may have its own customized version of the credit application, but they generally serve the same purpose. These variations might include particular sections or questions tailored to the lender's unique requirements or industry-specific needs. By completing and submitting the Winston-Salem Business Credit Application accurately and comprehensively, businesses enhance their chances of securing credit facilities, loans, and other financial resources necessary to fuel growth, expand operations, and achieve their long-term goals. Therefore, it is crucial for business owners to understand and meticulously provide all the requested information, ensuring transparency and professionalism throughout the application process.

Winston–Salem North Carolina Business Credit Application

Description

How to fill out Winston–Salem North Carolina Business Credit Application?

Do you require a reliable and affordable legal forms provider to obtain the Winston–Salem North Carolina Business Credit Application? US Legal Forms is your premier choice.

Whether you seek a simple contract to establish guidelines for living with your partner or a bundle of documents to facilitate your separation or divorce through the court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and commercial use. All templates we provide are not one-size-fits-all and are tailored to the specifics of individual states and counties.

To acquire the document, you must Log Into your account, locate the required form, and click the Download button adjacent to it. Please remember that you can access your previously acquired document templates at any time in the My documents section.

Is this your first visit to our platform? No problem. You can create an account in just a few minutes, but before proceeding, make sure to do the following.

Now you can register your account. Next, choose the subscription plan and move forward to payment. Once the payment is finalized, download the Winston–Salem North Carolina Business Credit Application in any available format. You can revisit the website at any time and re-download the document at no additional cost.

Finding current legal documents has never been simpler. Give US Legal Forms a try today, and say goodbye to spending countless hours researching legal papers online forever.

- Verify if the Winston–Salem North Carolina Business Credit Application aligns with the regulations of your state and locale.

- Examine the form's description (if available) to determine who and what the document is suitable for.

- Begin your search anew if the form does not match your particular situation.

Form popularity

FAQ

In North Carolina, the need for a business license depends on the type of business you are starting. Some professions, such as contractors or barbers, require specific licenses, while others may not need one. It’s crucial to research your industry regulations to determine your licensing requirements. If you plan to apply for a Winston–Salem North Carolina Business Credit Application, ensure you have all necessary documents and compliance in place to expedite the process.

Yes, you can run a business from home in North Carolina, including Winston–Salem, as long as you comply with zoning laws. Many entrepreneurs find success operating from their residences without the need for a commercial space. However, you should understand any restrictions specific to your neighborhood or homeowners' association. Furthermore, applying for a Winston–Salem North Carolina Business Credit Application can help you secure funding to support your home-based venture.

Some businesses do not require a license to operate in Winston–Salem, North Carolina. For instance, sole proprietorships, freelance services, and online businesses often escape licensing requirements. However, if your business engages in specific regulated activities, like selling alcohol or providing health services, you will need a license. Always check local regulations to ensure compliance, especially before applying for your Winston–Salem North Carolina Business Credit Application.

To apply for an LLC in North Carolina, you must file the Articles of Organization with the Secretary of State. You'll need to choose a unique name for your LLC and appoint a registered agent. Additionally, having an LLC can strengthen your application for a Winston–Salem North Carolina Business Credit Application, helping you secure financing for your operations.

Operating a business in North Carolina without the necessary licenses can lead to penalties and legal issues. While some business types may not need a license, it's vital to research your specific industry and location in Winston-Salem. Ensuring you meet licensing requirements will benefit your business, especially when preparing for a Winston–Salem North Carolina Business Credit Application.

While North Carolina does not have a general business license that every business must obtain, specific industries and local jurisdictions impose licensing requirements. In Winston-Salem, ensure you meet all the specific guidelines to operate legally. This is particularly important if you are considering a Winston–Salem North Carolina Business Credit Application.

North Carolina does not issue a state-wide business license, but many local governments require licenses for specific businesses. Therefore, if you're starting a business in Winston-Salem, it's crucial to check local laws to know the requirements. A valid business license may increase your chances when applying for a Winston–Salem North Carolina Business Credit Application.

Yes, many businesses in Forsyth County, NC, require a business license. The type of license you need can depend on the nature of your business and its location within Winston-Salem. Proper licensing helps you operate legally while applying for financial services like the Winston–Salem North Carolina Business Credit Application.

In North Carolina, business licenses typically do not require annual renewal, but specific requirements may vary depending on the city or county. For Winston-Salem, you should check local regulations to ensure compliance. Keeping your business license current is essential, especially when applying for a Winston–Salem North Carolina Business Credit Application, as it helps establish your business's legitimacy.

For a new business, the first step is to fill out a Winston–Salem North Carolina Business Credit Application. Choose cards designed for startups, as these usually have more lenient criteria. Ensure you compile the necessary documentation, like your Employer Identification Number (EIN) and financial projections. Establishing a strong business plan can help lenders view your application favorably.

Interesting Questions

More info

We have a team that is ready to meet your individual and business needs! You may also wish to contact the Customer Service Department of the Piedmont Credit Union via phone at 919.765.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.