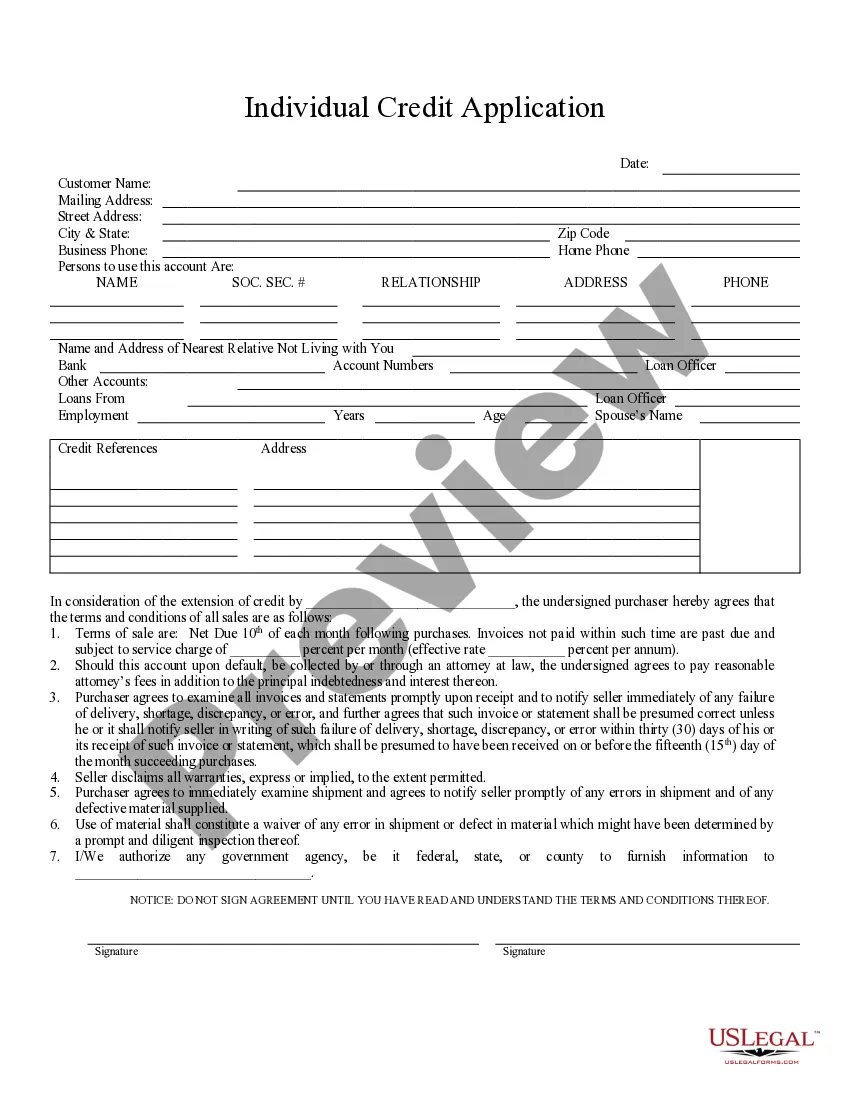

Fayetteville, North Carolina Individual Credit Application serves as a crucial document for individuals seeking credit in the city of Fayetteville, North Carolina. It enables financial institutions and lenders to evaluate the creditworthiness and financial stability of an individual before extending any credit facilities. This thorough application process allows lenders to assess the individual's credit history, income, employment information, and other relevant factors. The Fayetteville, North Carolina Individual Credit Application is designed to provide a comprehensive overview of an individual's financial standing, ensuring that lenders can make informed decisions regarding extending loans or credit lines. By analyzing key aspects such as the individual's employment history, monthly income, existing debts, and monthly expenses, lenders can assess the individual's ability to manage credit responsibly. Some essential information required in the Fayetteville, North Carolina Individual Credit Application include personal details such as the applicant's full name, residential address, contact information, and social security number. This information allows lenders to verify the applicant's identity and conduct necessary background checks. Additionally, the application may require employment information, including the applicant's current employer, job position, length of employment, and monthly income. By evaluating the stability of the applicant's job and income, lenders can determine the individual's ability to repay the loan or credit amount. The Fayetteville, North Carolina Individual Credit Application will also request details about the applicant's existing debts, such as mortgages, auto loans, credit card debt, and any other outstanding financial obligations. This information offers an insight into the individual's current financial obligations and helps lenders assess the applicant's debt-to-income ratio. Furthermore, the credit application may ask for information about the applicant's banking relationships and personal references. Lenders often use these references to validate the applicant's character, reliability, and past financial behavior. Different types of Fayetteville, North Carolina Individual Credit Application may include variations based on the type of credit being sought. For example, there might be separate applications for personal loans, auto loans, credit cards, or mortgage loans. These specific applications would tailor the information requirements based on the nature of the credit being requested, ensuring that the lenders collect the most relevant information to make accurate credit decisions. In summary, the Fayetteville, North Carolina Individual Credit Application is a critical tool for both individuals and lenders. It streamlines the credit evaluation process by gathering relevant personal, financial, and employment information required to determine the applicant's creditworthiness. Whether for personal loans, mortgage loans, auto loans, or credit cards, these applications help lenders evaluate risk and make informed decisions while extending credit to individuals in Fayetteville, North Carolina.

Fayetteville North Carolina Individual Credit Application

Description

How to fill out Fayetteville North Carolina Individual Credit Application?

We always want to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal solutions that, usually, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Fayetteville North Carolina Individual Credit Application or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Fayetteville North Carolina Individual Credit Application complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Fayetteville North Carolina Individual Credit Application would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!