Greensboro, North Carolina Individual Credit Application is a vital form used by individuals residing in Greensboro, North Carolina, to apply for credit from various financial institutions or lenders. This application form is specifically tailored to accommodate the needs and requirements of residents in Greensboro, ensuring a convenient and hassle-free credit application process. The Greensboro, North Carolina Individual Credit Application plays a crucial role in assessing an individual's creditworthiness and financial capability prior to the approval of credit. It contains comprehensive sections and fields that gather personal and financial information necessary for the lender to make an informed decision. Keywords: Greensboro, North Carolina, Individual Credit Application, credit, financial institutions, lenders, creditworthiness, personal information, financial information, decision. Different types of Greensboro, North Carolina Individual Credit Applications may include: 1. Personal Loan Credit Application: This type of credit application is designed for individuals seeking personal loans from banks or financial institutions in Greensboro, North Carolina. It typically requires detailed information about the borrower's employment, income, expenses, and other relevant financial details. 2. Mortgage Credit Application: Specifically targeted for individuals planning to purchase or refinance a property in Greensboro, North Carolina, this credit application delves into the applicant's financial history, employment details, loan amount requested, and property information. Lenders use this information to evaluate the borrower's eligibility for a mortgage loan. 3. Auto Loan Credit Application: Intended for individuals looking to purchase a vehicle in Greensboro, North Carolina, this type of credit application focuses on the borrower's employment status, income verification, vehicle details, loan amount requested, and credit history. Lenders use this information to assess the borrower's ability to repay the auto loan. 4. Credit Card Application: Greensboro residents can also complete a credit card application to obtain a credit card from banking institutions. This application typically requires personal information such as name, address, social security number, income details, and employment status. Lenders evaluate this information to determine the individual's credit card eligibility and credit limit. By collecting and analyzing the information provided in the Greensboro, North Carolina Individual Credit Application, financial institutions in Greensboro can make informed decisions regarding the creditworthiness and eligibility of individuals seeking credit.

Greensboro North Carolina Individual Credit Application

State:

North Carolina

City:

Greensboro

Control #:

NC-21-CR

Format:

Word;

Rich Text

Instant download

Description

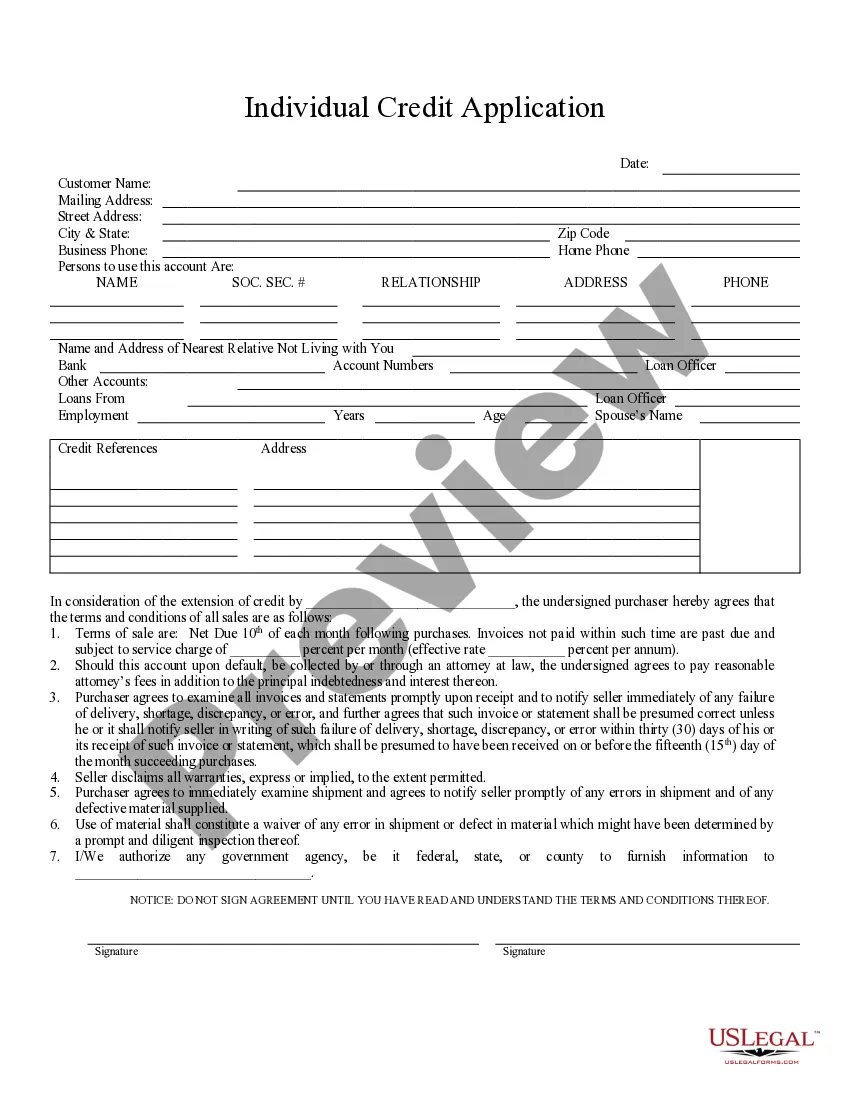

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Greensboro, North Carolina Individual Credit Application is a vital form used by individuals residing in Greensboro, North Carolina, to apply for credit from various financial institutions or lenders. This application form is specifically tailored to accommodate the needs and requirements of residents in Greensboro, ensuring a convenient and hassle-free credit application process. The Greensboro, North Carolina Individual Credit Application plays a crucial role in assessing an individual's creditworthiness and financial capability prior to the approval of credit. It contains comprehensive sections and fields that gather personal and financial information necessary for the lender to make an informed decision. Keywords: Greensboro, North Carolina, Individual Credit Application, credit, financial institutions, lenders, creditworthiness, personal information, financial information, decision. Different types of Greensboro, North Carolina Individual Credit Applications may include: 1. Personal Loan Credit Application: This type of credit application is designed for individuals seeking personal loans from banks or financial institutions in Greensboro, North Carolina. It typically requires detailed information about the borrower's employment, income, expenses, and other relevant financial details. 2. Mortgage Credit Application: Specifically targeted for individuals planning to purchase or refinance a property in Greensboro, North Carolina, this credit application delves into the applicant's financial history, employment details, loan amount requested, and property information. Lenders use this information to evaluate the borrower's eligibility for a mortgage loan. 3. Auto Loan Credit Application: Intended for individuals looking to purchase a vehicle in Greensboro, North Carolina, this type of credit application focuses on the borrower's employment status, income verification, vehicle details, loan amount requested, and credit history. Lenders use this information to assess the borrower's ability to repay the auto loan. 4. Credit Card Application: Greensboro residents can also complete a credit card application to obtain a credit card from banking institutions. This application typically requires personal information such as name, address, social security number, income details, and employment status. Lenders evaluate this information to determine the individual's credit card eligibility and credit limit. By collecting and analyzing the information provided in the Greensboro, North Carolina Individual Credit Application, financial institutions in Greensboro can make informed decisions regarding the creditworthiness and eligibility of individuals seeking credit.

How to fill out Greensboro North Carolina Individual Credit Application?

If you’ve already utilized our service before, log in to your account and save the Greensboro North Carolina Individual Credit Application on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Greensboro North Carolina Individual Credit Application. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!