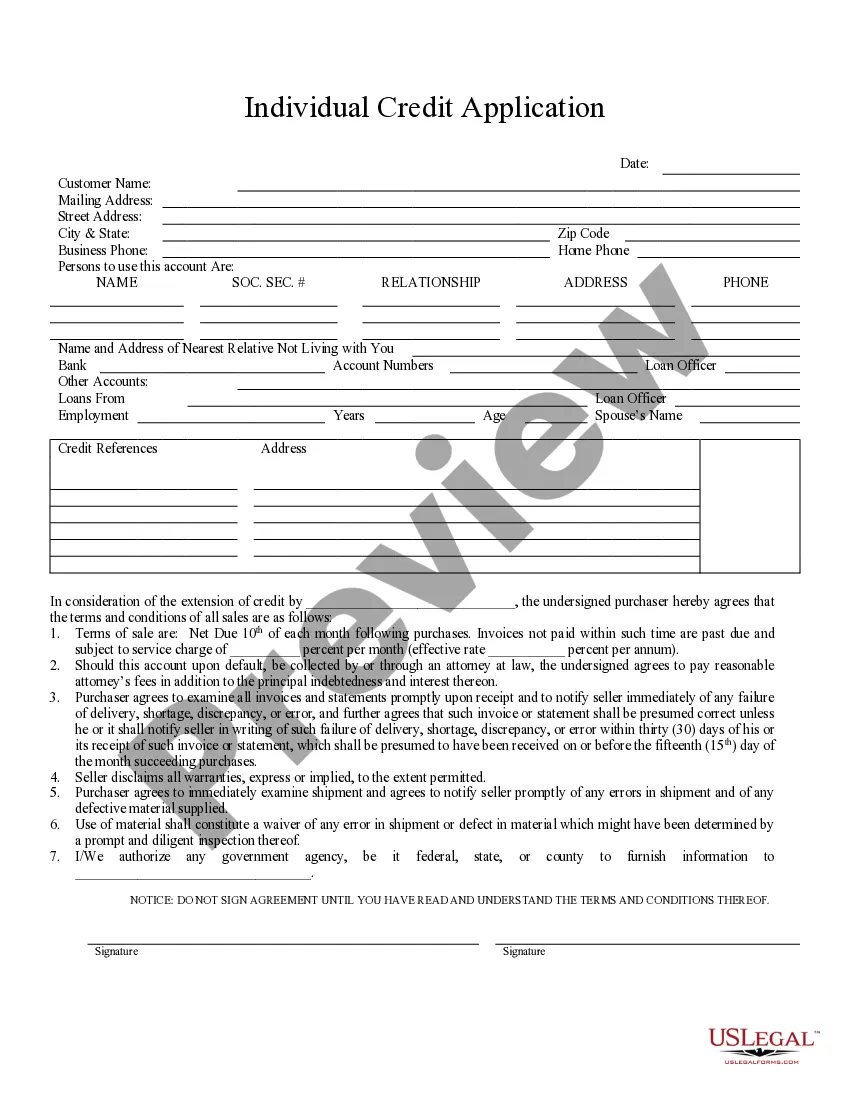

High Point North Carolina Individual Credit Application is a formal document used by individuals residing in High Point, North Carolina, to apply for credit from various financial institutions or lenders. It serves as a comprehensive record of an individual's personal and financial information, allowing lenders to assess their creditworthiness and determine the eligibility for credit products. The High Point North Carolina Individual Credit Application typically consists of multiple sections, including personal details, employment information, financial information, and references. These sections help lenders gather relevant information about the applicant to evaluate their ability to repay the credit. The application also includes a legally binding agreement, outlining the terms and conditions of the credit agreement, interest rates, and payment schedules. In High Point, North Carolina, there are several types of Individual Credit Applications available, tailored to different credit needs and institutions. Some common types include: 1. High Point Mortgage Credit Application: This type of application is specifically designed for individuals seeking mortgage loans to finance their home purchases or refinancing options. It focuses on gathering detailed financial information, such as income, assets, and debts, to determine the loan amount and interest rate. 2. High Point Auto Loan Credit Application: Geared towards individuals looking to finance a vehicle purchase, this credit application focuses on collecting information about the applicant's income, employment details, and desired loan amount. It helps lenders evaluate the individual's ability to afford the car loan and repay it over time. 3. High Point Personal Loan Credit Application: Aimed at individuals in need of unsecured loans for various purposes such as debt consolidation, home improvements, or unexpected expenses, this type of credit application focuses on the applicant's financial standing, credit history, and income. This information assists lenders in assessing the individual's creditworthiness and determining the loan's terms. 4. High Point Credit Card Application: For individuals looking to obtain a credit card, this type of application is used. It gathers personal and financial details, including income, employment, and credit history, to assess the applicant's eligibility, credit limit, and interest rate. By providing accurate and complete information on the High Point North Carolina Individual Credit Application, applicants increase their chances of obtaining credit from lenders or financial institutions in High Point, North Carolina. It is crucial to review and understand the application thoroughly to ensure compliance with the requirements and avoid any potential discrepancies that may affect the credit approval process.

High Point North Carolina Individual Credit Application

Description

How to fill out High Point North Carolina Individual Credit Application?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the High Point North Carolina Individual Credit Application? US Legal Forms is your go-to solution.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of particular state and area.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the High Point North Carolina Individual Credit Application conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the document is good for.

- Restart the search in case the form isn’t good for your legal scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is completed, download the High Point North Carolina Individual Credit Application in any available file format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online once and for all.