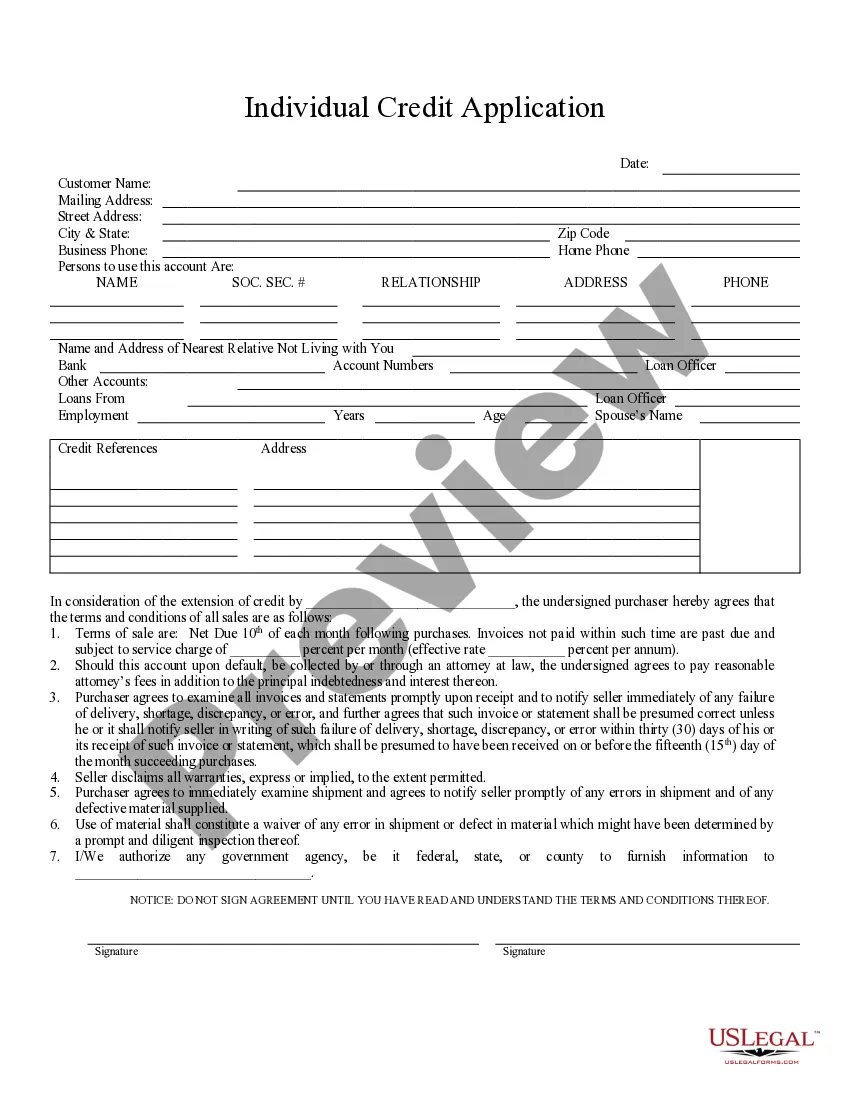

Raleigh, North Carolina Individual Credit Application is a form that individuals residing in Raleigh, North Carolina can fill out to apply for credit. This application is typically used when individuals are seeking financial assistance from banks, credit unions, or other lending institutions to fund personal expenses, such as buying a car, paying for education, or managing unexpected financial emergencies. The Raleigh, North Carolina Individual Credit Application gathers crucial information about the applicant's personal details, employment history, income, expenses, and existing financial obligations. This information helps lenders assess the applicant's creditworthiness and determine whether they qualify for the requested credit. Some types of Raleigh, North Carolina Individual Credit Application may include: 1. Mortgage Loan Application: This type of credit application specifically focuses on individuals seeking to finance the purchase of a home or refinance an existing mortgage in Raleigh, North Carolina. It collects information about the borrower's income, assets, liabilities, and property details, allowing lenders to evaluate the applicant's eligibility for a mortgage loan. 2. Auto Loan Application: This form is designed for individuals planning to purchase a vehicle in Raleigh, North Carolina. It requires applicants to provide information about their employment, income, residence history, and desired loan amount. Lenders use this information to assess the applicant's ability to repay the loan and determine the terms and conditions for the auto loan. 3. Personal Loan Application: This application concentrates on individuals seeking unsecured loans for various personal expenses in Raleigh, North Carolina. It typically requires information related to the applicant's employment, income, existing debts, and credit history. Lenders evaluate this information to assess the individual's creditworthiness and make decisions regarding the personal loan application. 4. Student Loan Application: Geared towards students pursuing higher education in Raleigh, North Carolina, this type of credit application allows students to seek financial aid to fund their educational expenses. It collects detailed information about the student's educational institution, program of study, cost of attendance, and financial need. This information helps lenders determine the student's eligibility for various federal or private student loan programs. Overall, Raleigh, North Carolina Individual Credit Applications play a crucial role in securing financial assistance for individuals in the area. By providing comprehensive and accurate information, applicants increase their chances of obtaining credit, such as mortgages, auto loans, personal loans, or student loans, tailored to their specific needs and financial situation.

Raleigh North Carolina Individual Credit Application

Description

How to fill out Raleigh North Carolina Individual Credit Application?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal services that, as a rule, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Raleigh North Carolina Individual Credit Application or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as easy if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Raleigh North Carolina Individual Credit Application complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Raleigh North Carolina Individual Credit Application is suitable for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!