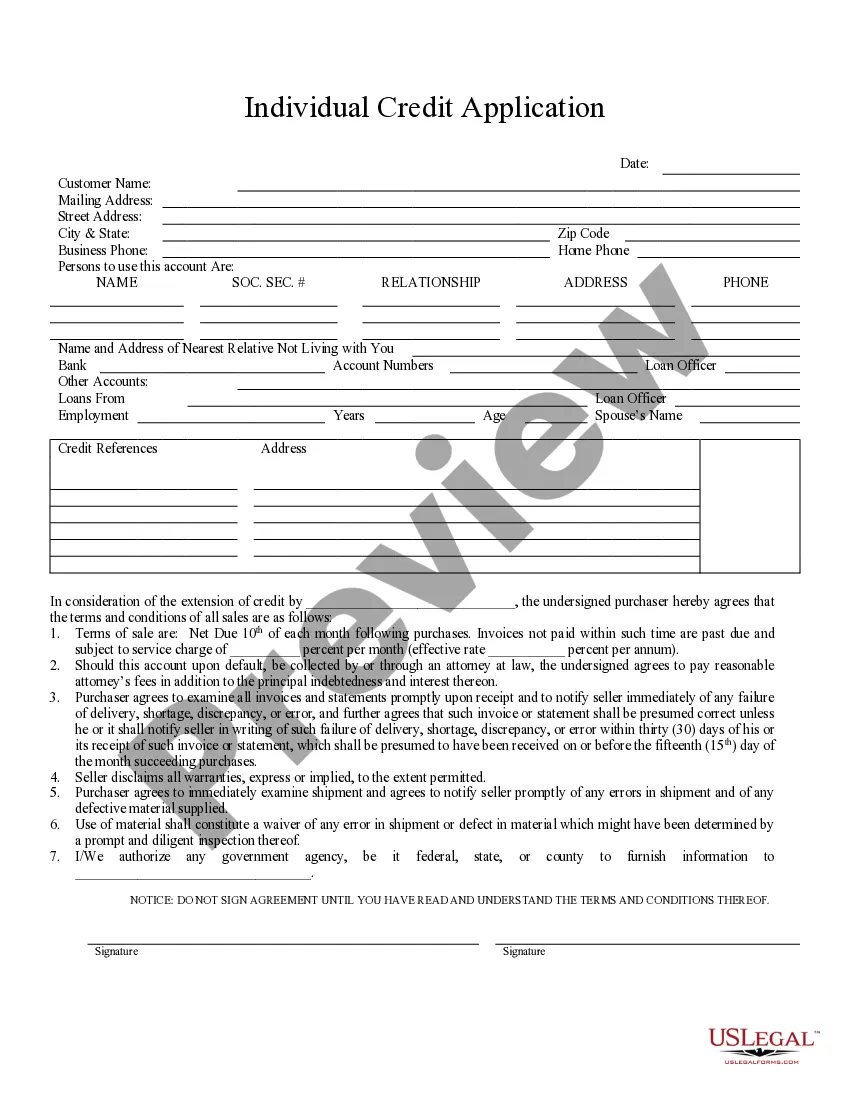

Wake North Carolina Individual Credit Application is a comprehensive and standardized form that individuals residing in Wake, North Carolina must complete when applying for credit. This application collects essential personal and financial information necessary for lenders and financial institutions to evaluate an individual's creditworthiness and make informed decisions on lending opportunities. The Wake North Carolina Individual Credit Application consists of various sections requesting specific details to assess an individual's creditworthiness. The application typically starts with personal information, including the applicant's full name, contact details such as address, phone number, and email address, date of birth, and social security number. As for the financial aspect, the application asks for employment information, which may include the applicant's current employer, job title, length of employment, and monthly income. It also asks for details regarding any other sources of income, such as investments or rental properties. In addition to personal and financial information, the credit application commonly requires the applicant to disclose their existing debts and liabilities. This typically includes outstanding loans, mortgages, credit card balances, and other financial obligations. Applicants may need to provide detailed information about their accounts, such as the account numbers, balances, and monthly repayment amounts. Furthermore, the Wake North Carolina Individual Credit Application may request information about the applicant's assets, such as real estate, vehicles, investments, and savings accounts. This helps evaluate an individual's net worth and overall financial stability. Different types of Wake North Carolina Individual Credit Applications may exist based on the specific purpose for which they are being used. For example, there may be credit applications tailored for car loans, home mortgages, personal loans, or credit cards. These specialized applications may include additional sections relevant to the specific type of credit being sought, such as specific information about the vehicle or property for collateral. Overall, the Wake North Carolina Individual Credit Application serves as a crucial tool for financial institutions and lenders to determine an individual's creditworthiness. By collecting comprehensive personal, financial, and employment-related information, the application helps lenders assess risk, make informed lending decisions, and offer suitable credit options to residents of Wake, North Carolina.

Wake North Carolina Individual Credit Application

Description

How to fill out Wake North Carolina Individual Credit Application?

Are you looking for a trustworthy and inexpensive legal forms provider to get the Wake North Carolina Individual Credit Application? US Legal Forms is your go-to option.

No matter if you require a basic arrangement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Wake North Carolina Individual Credit Application conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is intended for.

- Start the search over if the template isn’t good for your legal scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Wake North Carolina Individual Credit Application in any provided file format. You can get back to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time researching legal papers online for good.