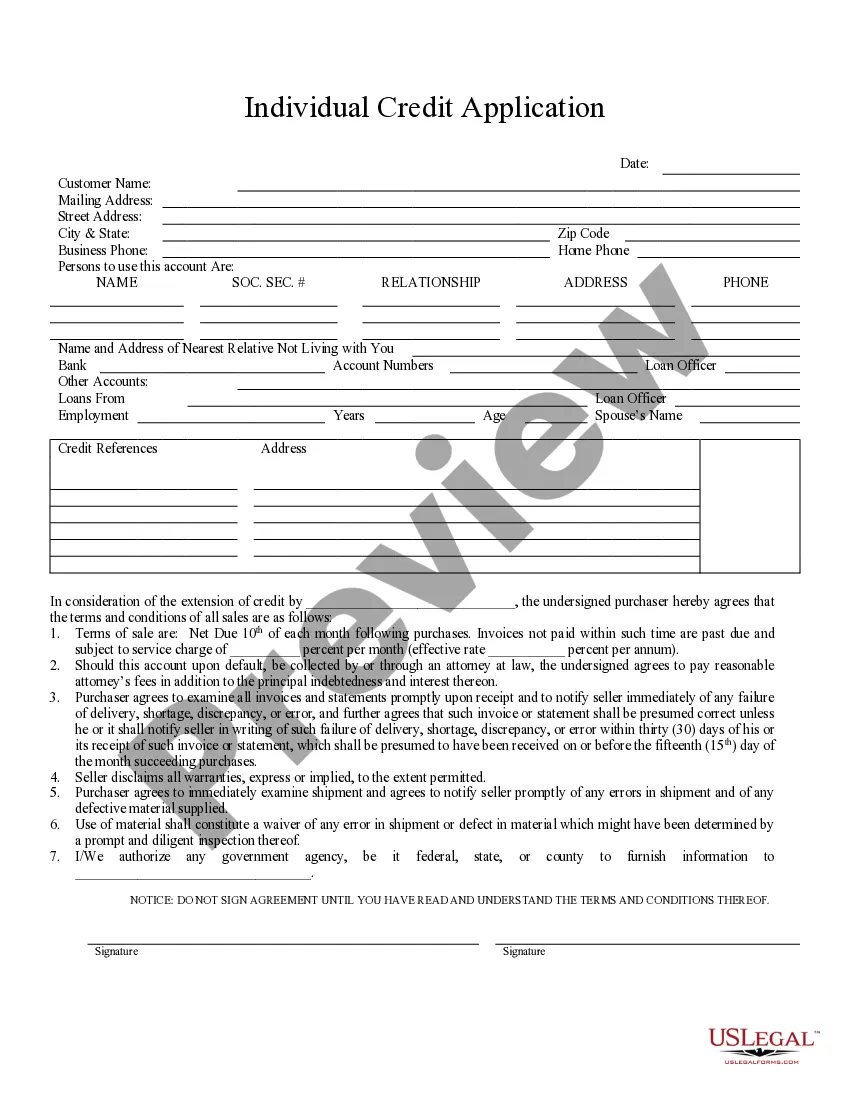

Wilmington, North Carolina Individual Credit Application: A Comprehensive Overview The Wilmington, North Carolina Individual Credit Application is an essential document used by individuals residing in Wilmington and its neighboring areas to apply for credit services offered by financial institutions, lenders, or even local businesses. This credit application serves as the first step towards acquiring loans, credit cards, mortgages, or other forms of financial assistance. Keywords: Wilmington, North Carolina, individual, credit application, loans, credit cards, mortgages, financial assistance. Types of Wilmington North Carolina Individual Credit Applications: 1. Personal Loans Credit Application: This type of credit application is specifically designed for individuals seeking personal loans to fulfill various financial requirements. Whether it's for debt consolidation, education expenses, medical bills, or home improvements, individuals can utilize this form to apply for personal loans from Wilmington-based lenders or banks. 2. Credit Card Application: Wilmington individuals looking for credit cards can make use of this specialized credit application to apply for credit cards offered by various financial institutions. The credit card application process involves disclosing personal information, income details, and credit history, allowing the credit card issuer to determine the individual's creditworthiness and eligibility for specific credit card options. 3. Mortgage Application: For individuals planning to purchase a property or refinance an existing mortgage in Wilmington, the mortgage application is crucial. This type of credit application requires applicants to provide detailed information about their financial status, employment, income, and other relevant documentation. Local lenders or banks consider this application when making decisions regarding mortgage approvals and interest rates. 4. Auto Loan Application: Wilmington residents interested in purchasing a vehicle can utilize the auto loan credit application. By providing essential details such as employment, income, and credit history, individuals can apply for auto loans offered by local lenders, credit unions, or car dealerships. This application helps financial institutions evaluate the applicant's creditworthiness and determine suitable loan terms. In summary, the Wilmington, North Carolina Individual Credit Application is a versatile tool catering to the diverse financial needs of individuals in the region. Whether one is seeking personal loans, credit cards, mortgages, or auto loans, using the appropriate credit application form helps streamline the process, allowing financial institutions to assess an individual's creditworthiness effectively.

Wilmington North Carolina Individual Credit Application

Description

How to fill out Wilmington North Carolina Individual Credit Application?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone without any legal background to draft such papers cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time using our DYI forms.

Whether you want the Wilmington North Carolina Individual Credit Application or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Wilmington North Carolina Individual Credit Application quickly employing our trusted platform. In case you are presently a subscriber, you can go on and log in to your account to get the needed form.

However, in case you are unfamiliar with our platform, make sure to follow these steps before downloading the Wilmington North Carolina Individual Credit Application:

- Ensure the template you have found is specific to your area since the rules of one state or area do not work for another state or area.

- Review the document and go through a quick description (if provided) of scenarios the document can be used for.

- In case the one you selected doesn’t meet your needs, you can start again and search for the suitable form.

- Click Buy now and choose the subscription option that suits you the best.

- with your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Wilmington North Carolina Individual Credit Application once the payment is completed.

You’re all set! Now you can go on and print the document or complete it online. In case you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.