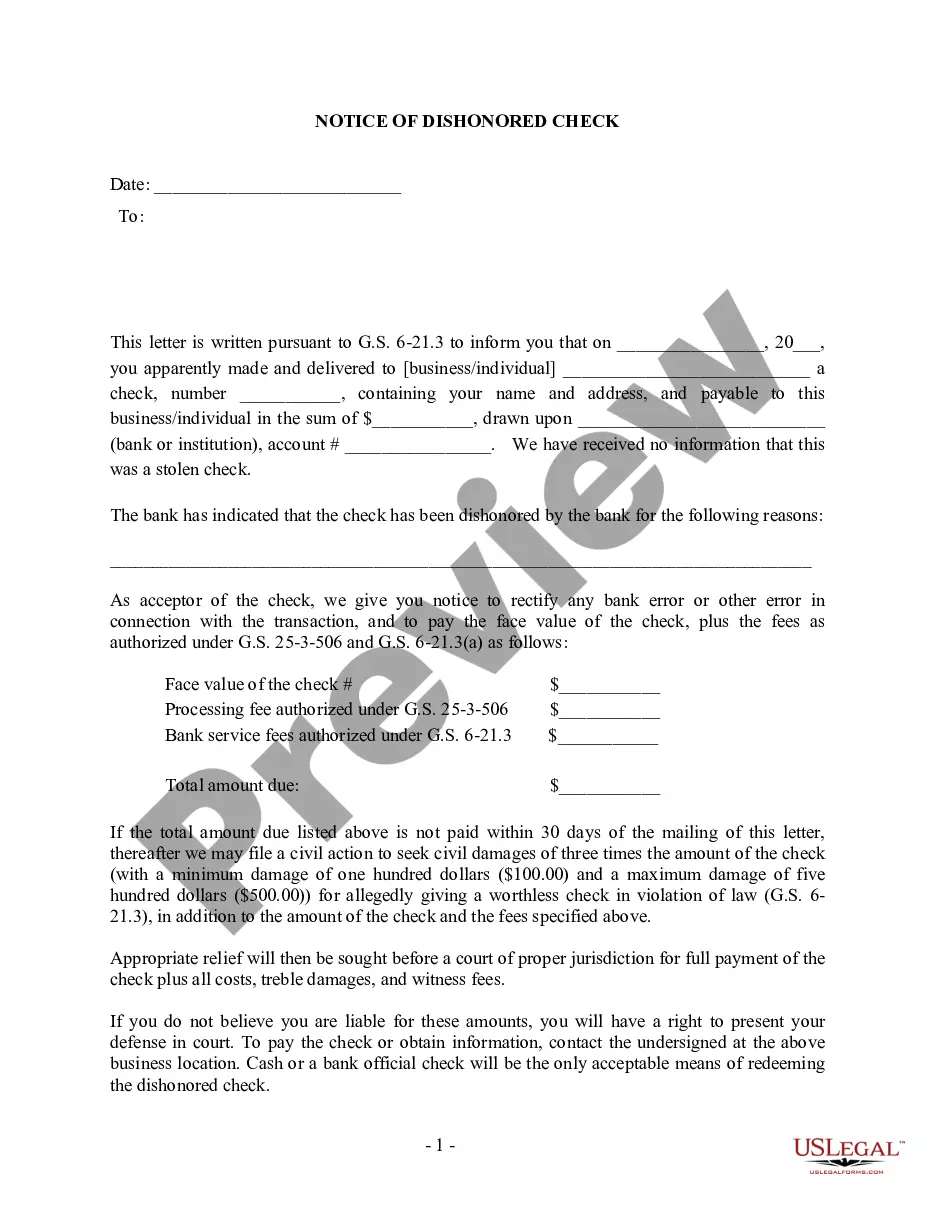

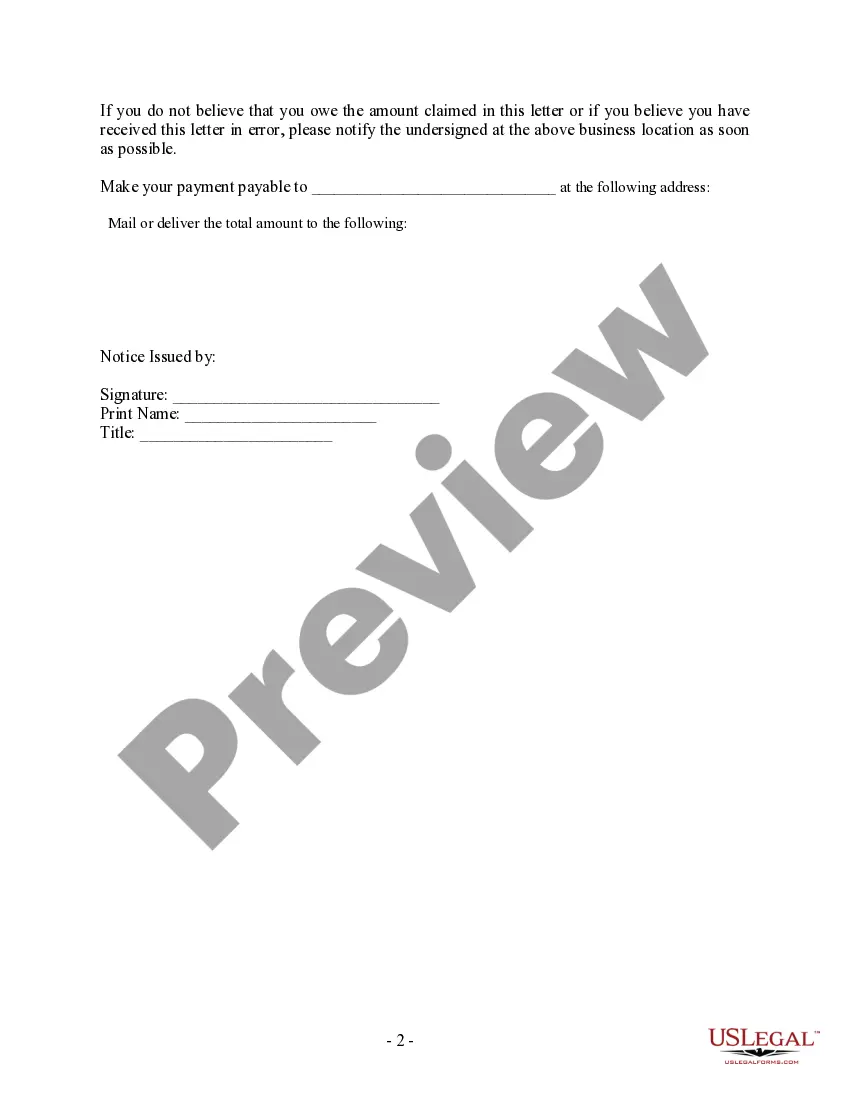

Title: Understanding the High Point North Carolina Notice of Dishonored Check Civilvi— - 1st Notice Introduction: In High Point, North Carolina, dealing with bounced or bad checks can lead to legal consequences. The High Point North Carolina Notice of Dishonored Check Civilvi— - 1st Notice is an important document in the process of addressing this issue. This article will provide a detailed description of what this notice entails and shed light on the keywords associated with it, such as bad check and bounced check. 1. Definition and Purpose of the Notice: The High Point North Carolina Notice of Dishonored Check Civilvi— - 1st Notice is a legal document issued to inform the recipient (check issuer) that a check they provided has bounced or been marked as a bad check. The notice serves as the initial step in the civil process, alerting the check issuer about the dishonored check and its legal implications. 2. Consequences of a Bounced or Bad Check: When a check bounces or is marked as a bad check, it indicates that the check issuer did not have sufficient funds in their account to cover the payment. This situation can lead to several consequences, including: — Legal Action: The recipient of the bad check has the right to pursue legal action against the check issuer, with the goal of recovering the owed amount. — Financial Penalties: The check issuer may be subject to financial penalties, including additional fees imposed by the recipient or monetary penalties imposed by the court. — Damage to Credit Score: The incident can negatively impact the check issuer's credit score, making it harder for them to obtain credit in the future. — Potential Criminal Charges: In some cases, intentionally writing bad checks can be considered a criminal offense. This depends on the circumstances and the intent behind the action. 3. The High Point North Carolina Notice of Dishonored Check Civilvi— - 1st Notice: This notice is typically sent to the check issuer via certified mail or personally delivered. It includes the following essential information: — Date and Reference Number: The notice is dated and assigned a unique reference number for record-keeping purposes. — Recipient Information: The recipient (person or entity) who received the dishonored check. — Check Issuer Information: The details of the person or entity who issued the bad check, including their name, address, and any additional contact information. — Check Details: The notice describes the check in question, mentioning the check number, date, and amount. — Legal Consequences: The notice outlines the potential legal consequences associated with writing a bad check and emphasizes the recipient's right to pursue legal action if necessary. — Amount Due and Deadline: The notice specifies the amount the check issuer owes and establishes a due date for payment or resolution. — Contact Information: Instructions on how the check issuer can contact the recipient to resolve the matter, either by payment or communication. Conclusion: Receiving a High Point North Carolina Notice of Dishonored Check Civilvi— - 1st Notice is a serious matter that demands immediate attention. Understanding the consequences of writing a bad check and the details included in the notice can help the check issuer address the issue promptly and avoid further legal complications. It is important to take the necessary steps to resolve the matter, either by paying the owed amount or contacting the recipient to negotiate a resolution.

High Point North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check

Description

How to fill out High Point North Carolina Notice Of Dishonored Check - Civil - 1st Notice - Keywords: Bad Check, Bounced Check?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the High Point North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the High Point North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the High Point North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!