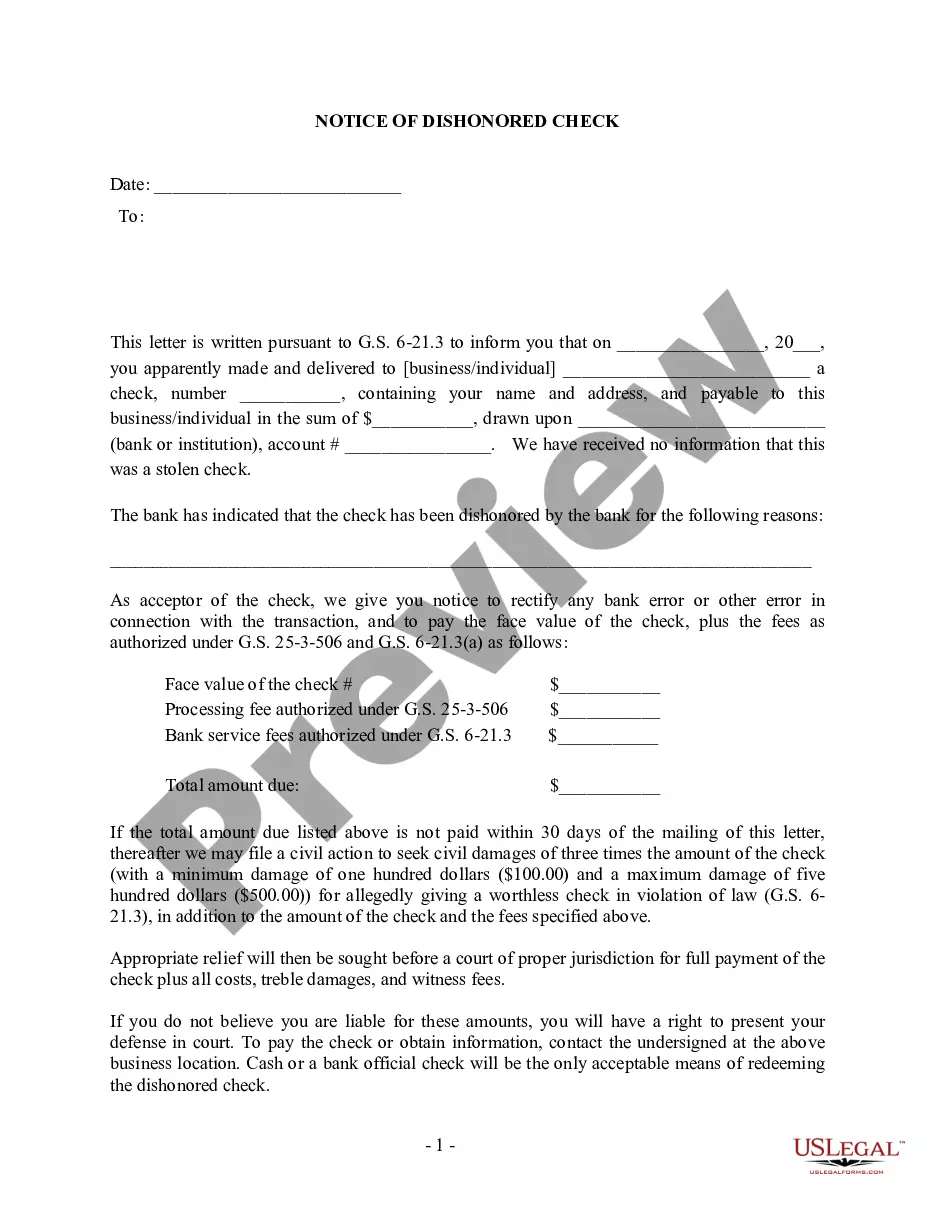

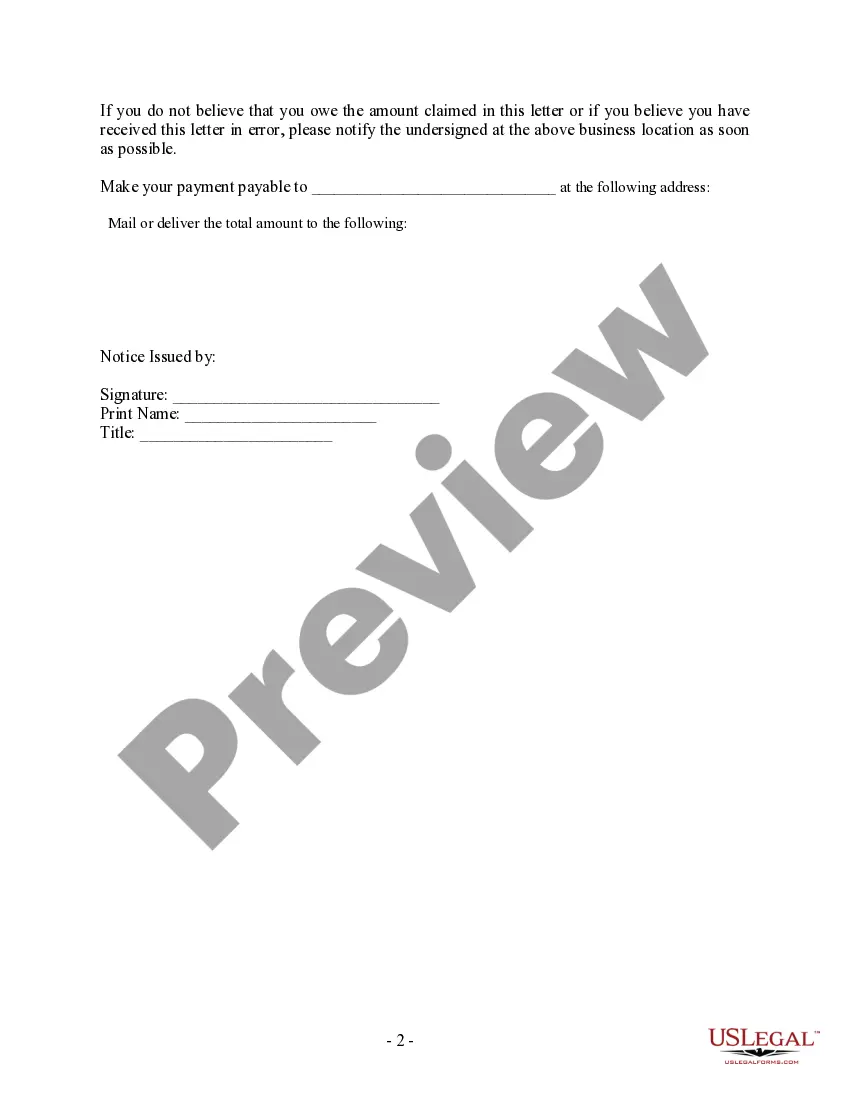

Title: Understanding Mecklenburg North Carolina Notice of Dishonored Check Civilvi— - 1st Notice Introduction: A Mecklenburg North Carolina Notice of Dishonored Check Civilvi— - 1st Notice is an official document issued to inform individuals or businesses about a dishonored or bounced check. This notice is a legal step taken by the recipient of the bad check to reclaim the funds owed to them. In this article, we will delve into the details of such notices, exploring the implications, procedures, and potential consequences associated with dishonored checks. 1. What is a Dishonored Check? A dishonored check, also known as a bad check or a bounced check, is a check that a bank refuses to honor and return unpaid due to insufficient funds in the issuer's account, a closed account, or other reasons specified by the bank. 2. Mecklenburg North Carolina Notice of Dishonored Check Civilvi— - 1st Notice: This specific type of notice is the initial step taken by the payee or recipient when a check they receive is dishonored. It aims to notify the check issuer about the dishonored check and provides them with an opportunity to rectify the situation. The first notice typically includes the following: a. Key Information: — Payee's name and contact details— - Check issuer's name and contact details. — Check date and amount— - Bank details where the check was deposited. b. Notice of Dishonored Check: — A concise explanation of why the check was dishonored. — The consequences of issuing a dishonored check, emphasizing the legal implications. c. Request for Payment: — Clear instructions on how the issuer can make prompt payment for the check amount. — The deadline by which the payment is expected to be fulfilled. d. Legal Actions: — The mention of potential legal actions that may be taken if the payment is not received by the given deadline. — The inclusion of civil penalties, including statutory damages, attorney fees, and court costs. 3. Types of Mecklenburg North Carolina Notice of Dishonored Check Civilvi— - 1st Notice: Based on the nature of dishonored checks and the involved parties, there might be various types of these notices. Some examples may include: a. Personal Check: This type of notice is used when an individual's personal check is dishonored and the payee seeks resolution or payment. b. Business Check: When a business issues a check that bounces, the payee utilizes this notice to bring attention to the matter and demand payment. c. Payroll Check: If an employer's check is returned unpaid, the employee or recipient can issue a notice to rectify the situation and receive their rightful wages. Conclusion: The Mecklenburg North Carolina Notice of Dishonored Check Civilvi— - 1st Notice serves as a crucial initial step to address issues arising from bounced or bad checks. Understanding the content and implications of this notice is vital for both the payee and the check issuer. Prompt attention, resolution, and payment can help mitigate legal consequences and maintain positive financial relationships.

Mecklenburg North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check

Description

How to fill out Mecklenburg North Carolina Notice Of Dishonored Check - Civil - 1st Notice - Keywords: Bad Check, Bounced Check?

If you are searching for a valid form template, it’s difficult to find a more convenient service than the US Legal Forms website – probably the most comprehensive online libraries. Here you can find a huge number of document samples for business and personal purposes by categories and states, or key phrases. Using our advanced search option, finding the newest Mecklenburg North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check is as elementary as 1-2-3. Additionally, the relevance of each and every document is verified by a group of professional lawyers that regularly review the templates on our platform and update them according to the newest state and county demands.

If you already know about our system and have an account, all you should do to get the Mecklenburg North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check is to log in to your profile and click the Download option.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have opened the form you require. Look at its explanation and use the Preview option (if available) to see its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to discover the appropriate file.

- Confirm your choice. Select the Buy now option. After that, pick your preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Indicate the file format and download it on your device.

- Make modifications. Fill out, revise, print, and sign the received Mecklenburg North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check.

Every form you add to your profile does not have an expiration date and is yours permanently. You can easily access them using the My Forms menu, so if you want to receive an extra version for editing or creating a hard copy, you may come back and export it once again whenever you want.

Take advantage of the US Legal Forms professional library to get access to the Mecklenburg North Carolina Notice of Dishonored Check - Civil - 1st Notice - Keywords: bad check, bounced check you were seeking and a huge number of other professional and state-specific samples on one website!