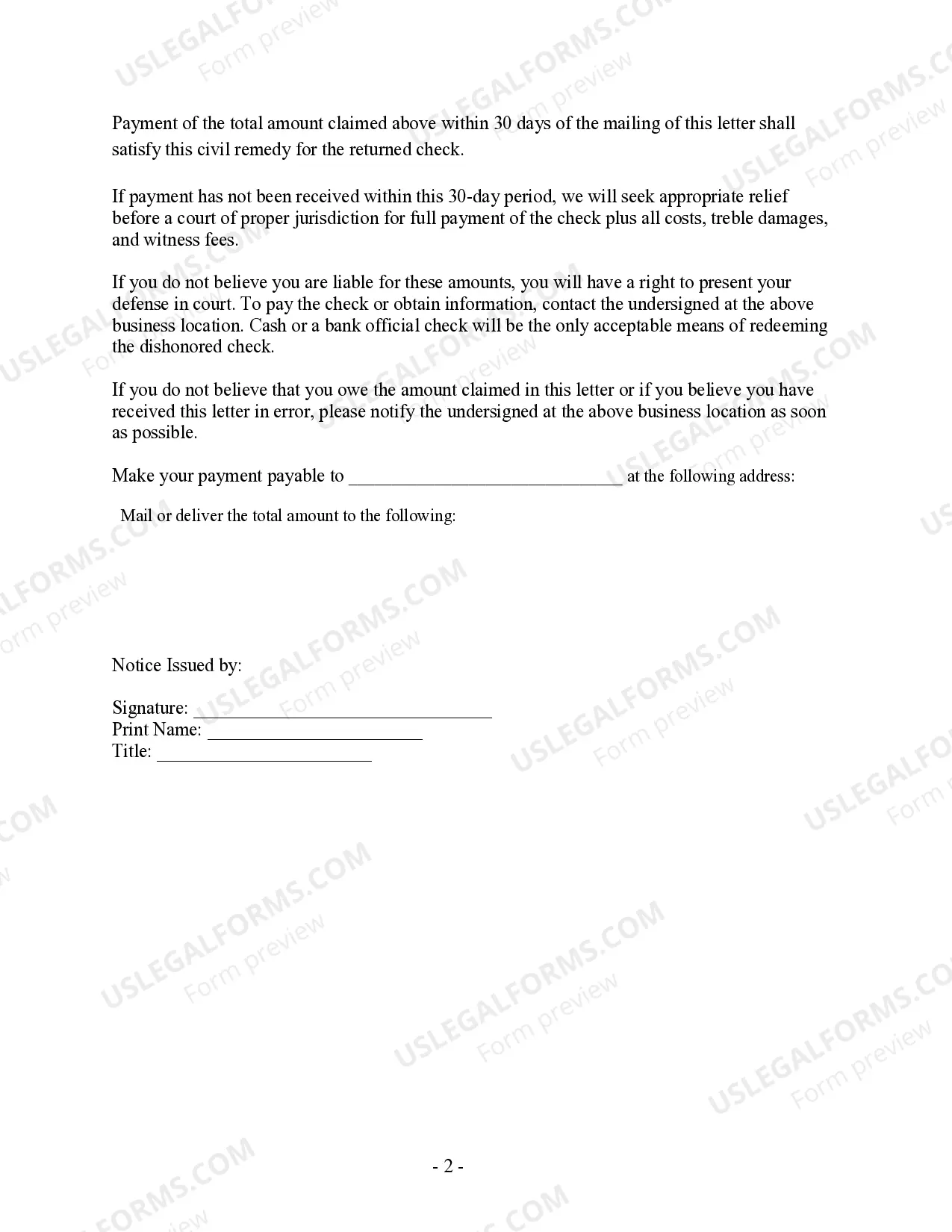

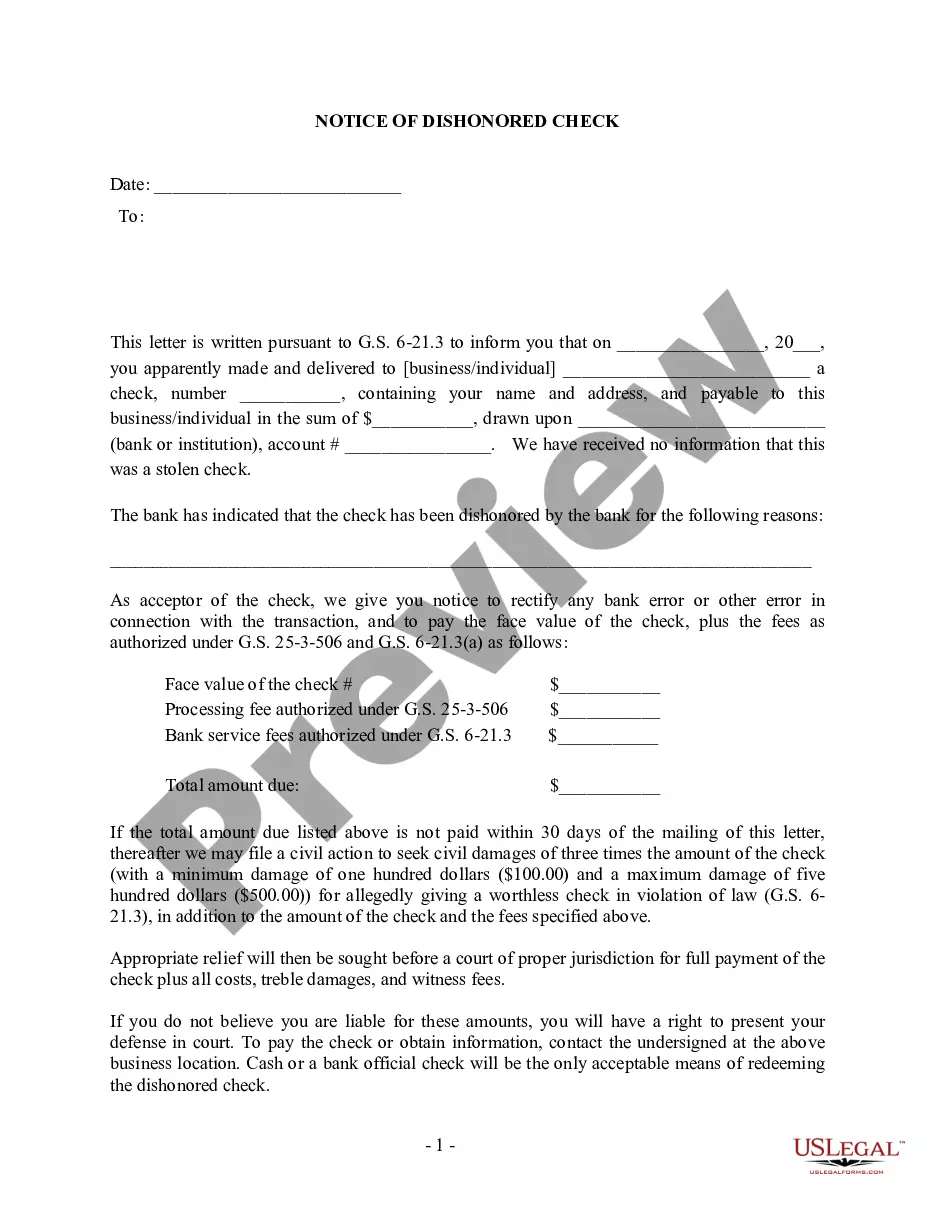

Cary North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice In the state of North Carolina, dishonored checks, also known as bad checks or bounced checks, can lead to legal consequences. When a check is returned due to insufficient funds or any other reason, the recipient has the right to initiate legal proceedings to recover the full amount owed. The Notice of Dishonored Check, also referred to as a Second Notice, is an important step in the civil process. This notice serves as a formal communication to the individual who issued the bad check, informing them about the dishonor and demanding payment to rectify the situation. Keywords: bad check, bounced check This second notice is sent after the initial attempt to rectify the situation through a First Notice has been unsuccessful. The Second Notice highlights the seriousness of the matter and emphasizes the legal repercussions that may follow if the payment is not made promptly. It is crucial to include relevant keywords such as "bad check" and "bounced check" in the notice to ensure that the recipient understands the severity of the situation and the legal implications associated with their actions. These keywords help convey the urgency and the necessity of resolving the matter in a swift and responsible manner. Different Types of Cary North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice: 1. Delinquency Notice: This type of notice is issued when the recipient fails to respond or resolve the issue within the specified timeframe after receiving the initial First Notice. It serves as an escalation of the matter, stressing the urgency for immediate attention and payment. 2. Legal Enforcement Notice: If the recipient still fails to address the dishonored check after receiving the Delinquency Notice, a Legal Enforcement Notice is sent as a final warning. This notice explicitly informs the individual about the imminent legal consequences if they do not make the necessary payment or take appropriate corrective measures. 3. Court Summons: In extreme cases where all attempts to resolve the matter outside the court have failed, the creditor may decide to file a lawsuit. The Court Summons is then served to the individual, officially initiating the legal process and requiring their appearance in court to address the dishonored check issue. 4. Judgment Notice: If the court rules in favor of the creditor and the individual are found responsible for the dishonored check, a Judgment Notice is issued. This notice outlines the amount owed, any additional fees or penalties, and the legal obligations the individual must fulfill to rectify the situation. In summary, the Cary North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is an important legal document that emphasizes the consequences of issuing a bad check. By using keywords such as "bad check" and "bounced check" throughout the notice, the recipient is made aware of the severity of the situation and the need for immediate action to resolve the matter amicably and avoid further legal repercussions.

Cary North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check

Description

How to fill out Cary North Carolina Notice Of Dishonored Check - Civil - 2nd Notice - Keywords: Bad Check, Bounced Check?

Utilize the US Legal Forms and gain immediate access to any document template you need.

Our helpful platform featuring thousands of document templates enables you to discover and obtain nearly any document sample you may require.

You can export, complete, and sign the Cary North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check in just minutes rather than spending hours online searching for the correct template.

Using our catalog is a great method to enhance the security of your document filing.

If you don’t have an account yet, follow the steps outlined below.

- Our skilled attorneys routinely review all documents to ensure that the forms are applicable for a specific state and adhere to updated laws and regulations.

- How can you obtain the Cary North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check.

- If you hold a subscription, simply Log In to your account.

- The Download button will appear on all the documents you examine.

- Additionally, you can access all previously saved records in the My documents menu.

Form popularity

FAQ

A dishonored check is a check that a bank does not process due to various reasons, often due to insufficient funds. When a check is returned, it is classified as a bad check or a bounced check, indicating that the funds were not available for withdrawal. This situation can lead to financial complications, so understanding your rights and options is essential. For effective management, consider using uslegalforms to draft a Cary North Carolina Notice of Dishonored Check - Civil - 2nd Notice.

Dishonour of a payment signifies that a financial institution, such as a bank, has refused to accept a check for cashing or deposit. This commonly arises when there are insufficient funds in the account linked to the check. Recognizing this situation as a bad check or a bounced check can help you act quickly and effectively in obtaining the owed funds. Leveraging a tailored notice of dishonored payment can streamline your communication with the issuer.

A notice of dishonour is a formal notification that a payment, typically a check, has been rejected. This document serves as evidence of the failed transaction and typically includes details such as the check number and the reason for dishonor. In a case involving a bounced check, this notice confirms the need for resolution. Utilize platforms like uslegalforms to create a professional notice for your records.

Dishonored payment refers to a situation where a check cannot be cashed or deposited because the bank refuses to process it. This refusal often happens due to insufficient funds in the payer's account, leading to the check being classified as a bad check or a bounced check. Knowing the meaning of dishonored payment helps you take appropriate actions, such as sending a Cary North Carolina Notice of Dishonored Check - Civil - 2nd Notice to the payer.

A notice of dishonored payment informs you that a check you received was not processed due to insufficient funds. This document is crucial for both the payee and the payer. When the check is marked as a bad check or a bounced check, it signals that the transaction cannot proceed. Understanding this notice is vital for managing your finances and ensuring clear communication.

Yes, you can write a demand letter without a lawyer. While professional legal assistance can be beneficial, many people choose to handle this process themselves. Be clear and concise in your letter, and use a formal tone to convey the seriousness of the situation regarding the bounced check. US Legal Forms provides essential resources and templates to help you create a powerful demand letter.

A bad check, often referred to as a bounced check, is one that cannot be processed due to insufficient funds or a closed account. In Cary, North Carolina, if a check is returned for these reasons, it is considered dishonored. This situation puts both the issuer and recipient in a challenging position. Understanding the implications of a bad check can help you take the right legal actions.

To write a strong demand payment letter, start by clearly stating the amount owed and the reason for the debt, such as a bounced check. Include specific details about the check, including the date, amount, and the name of the payer. Make sure to set a deadline for payment and mention the potential next steps if the payment is not received. US Legal Forms offers templates that can guide you in crafting an effective demand letter.

Yes, you can sue someone for writing you a bad check in Cary, North Carolina. If a bounced check causes you financial loss, you have the right to seek compensation. To pursue legal action, gather evidence such as the bounced check and any communications with the issuer. Utilizing resources like US Legal Forms can help you navigate the process of filing a lawsuit effectively.

Yes, in North Carolina, writing a check that bounces can be classified as a felony, especially if the check amount exceeds $2,000 or if it is a repeated action. Understanding the seriousness of this issue is crucial; you may receive a Cary North Carolina Notice of Dishonored Check - Civil - 2nd Notice, which outlines your legal responsibilities. Always consider legal resources or platforms like uslegalforms to navigate these situations successfully.