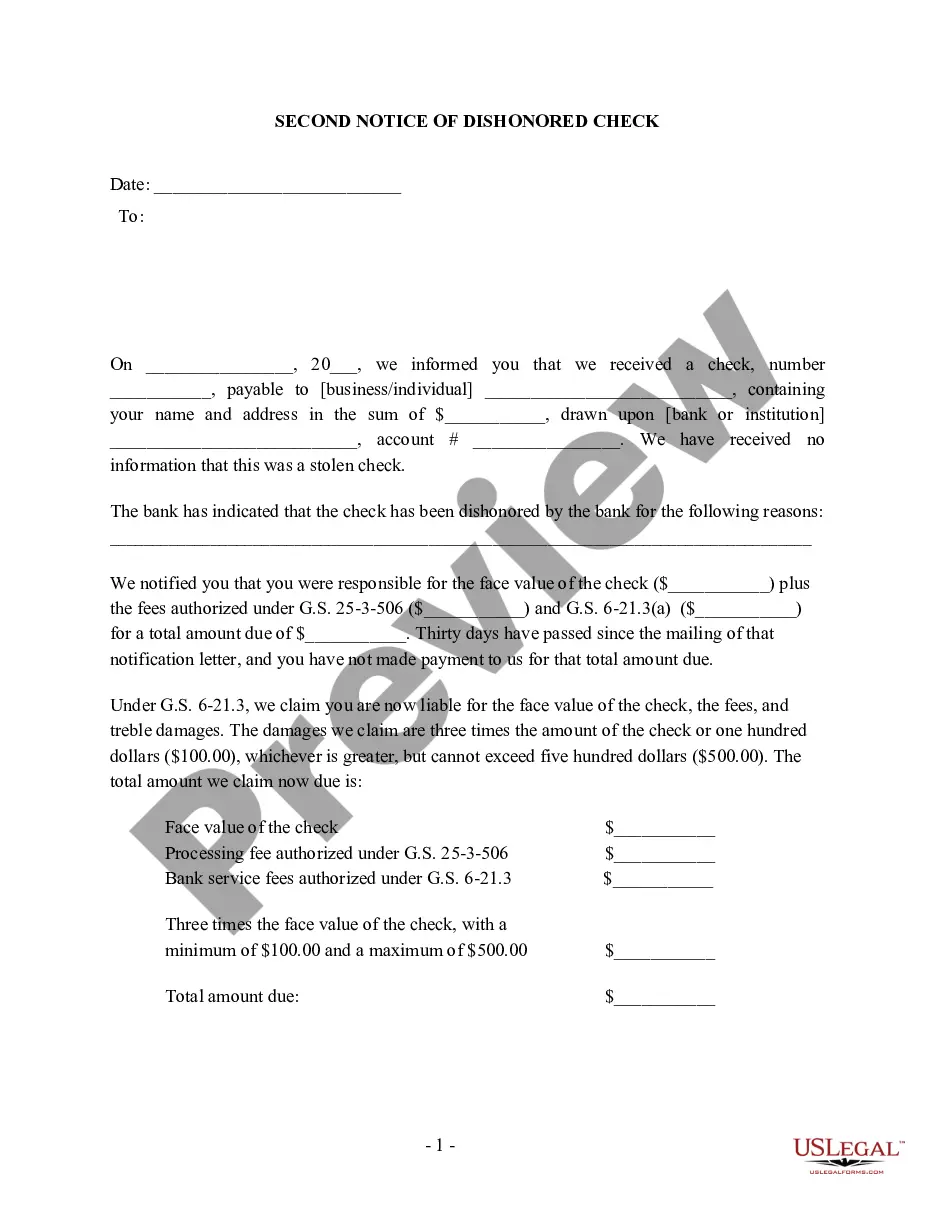

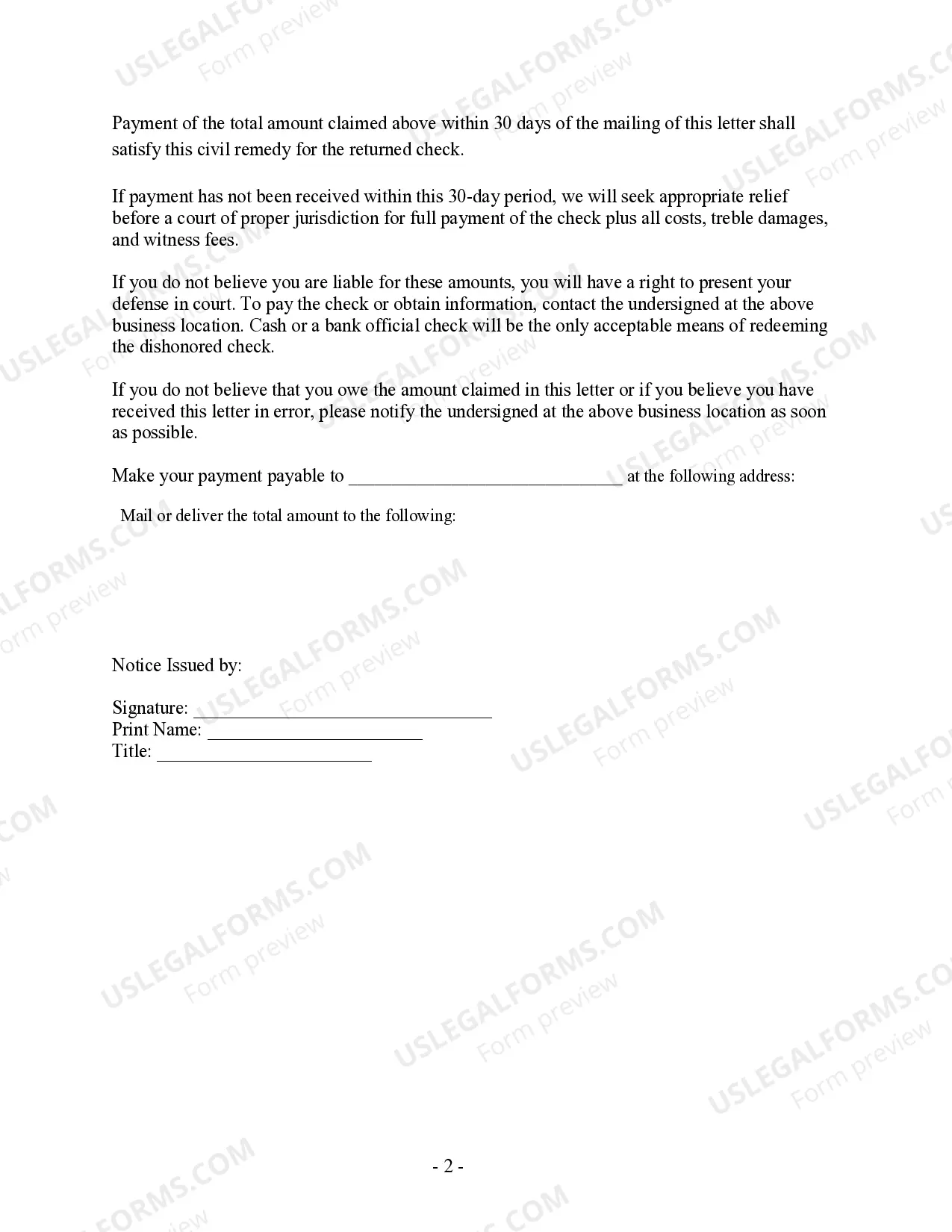

The Charlotte North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is a legally binding document that notifies a recipient about a bounced or bad check that has been issued by them. This notice is issued by the payee, usually a business or individual, to the payer or the individual who issued the check. The purpose of this notice is to inform the payer about the dishonored check and the consequences associated with it. It is important to note that there may be slight variations in the terminology used depending on the specific circumstances or the issuing authority, but the core content and intent remain consistent. The keywords associated with this notice are bad check and bounced check. A bad check refers to a check that is not honored by the bank due to insufficient funds, closed account, or any other reason that renders the check invalid for payment. A bounced check is another term commonly used to describe a bad check. It refers to a situation where the check is returned unpaid by the bank. In this 2nd notice, it indicates that this is the second communication sent to the payer regarding the dishonored check. The prior notice may have been in the form of an initial warning or a first notice informing the payer about the issue and requesting immediate resolution. The notice typically contains the following key components: 1. Heading: The notice will likely have a prominent heading stating "Notice of Dishonored Check Civilvi— - 2nd Notice." 2. Recipient Information: The name, contact details, and address of the payer are mentioned. This helps in ensuring the notice reaches the intended recipient. 3. Description of the Check: It specifies the details of the dishonored check, including the check number, date of issuance, and the amount involved. This information helps in identifying the specific transaction associated with the bounced check. 4. Payment Demand: The notice will provide a clear and concise demand for payment. It might include the original check amount, any associated bank charges or fees, and a specific due date for the payment. The payer may also be advised to make the payment in certified funds to avoid any further complications. 5. Consequences of Non-payment: The notice will outline the consequences if the payment is not made by the specified due date. This may include potential legal action, collection proceedings, damage to credit rating, or other penalties permitted under the applicable laws. 6. Contact Information: The notice will provide contact details of the payee or their representative to address any queries or concerns regarding the dishonored check. Throughout the notice, the terms bad check and bounced check may be used interchangeably to emphasize the issue at hand. It is essential for the payer to take this notice seriously and address the check's dishonor promptly to avoid further legal or financial consequences. Adhering to the demands mentioned and communicating with the payee can help resolve the matter efficiently.

Charlotte Notice

Description

How to fill out Charlotte North Carolina Notice Of Dishonored Check - Civil - 2nd Notice - Keywords: Bad Check, Bounced Check?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney solutions that, usually, are extremely costly. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to an attorney. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Charlotte North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Charlotte North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Charlotte North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!