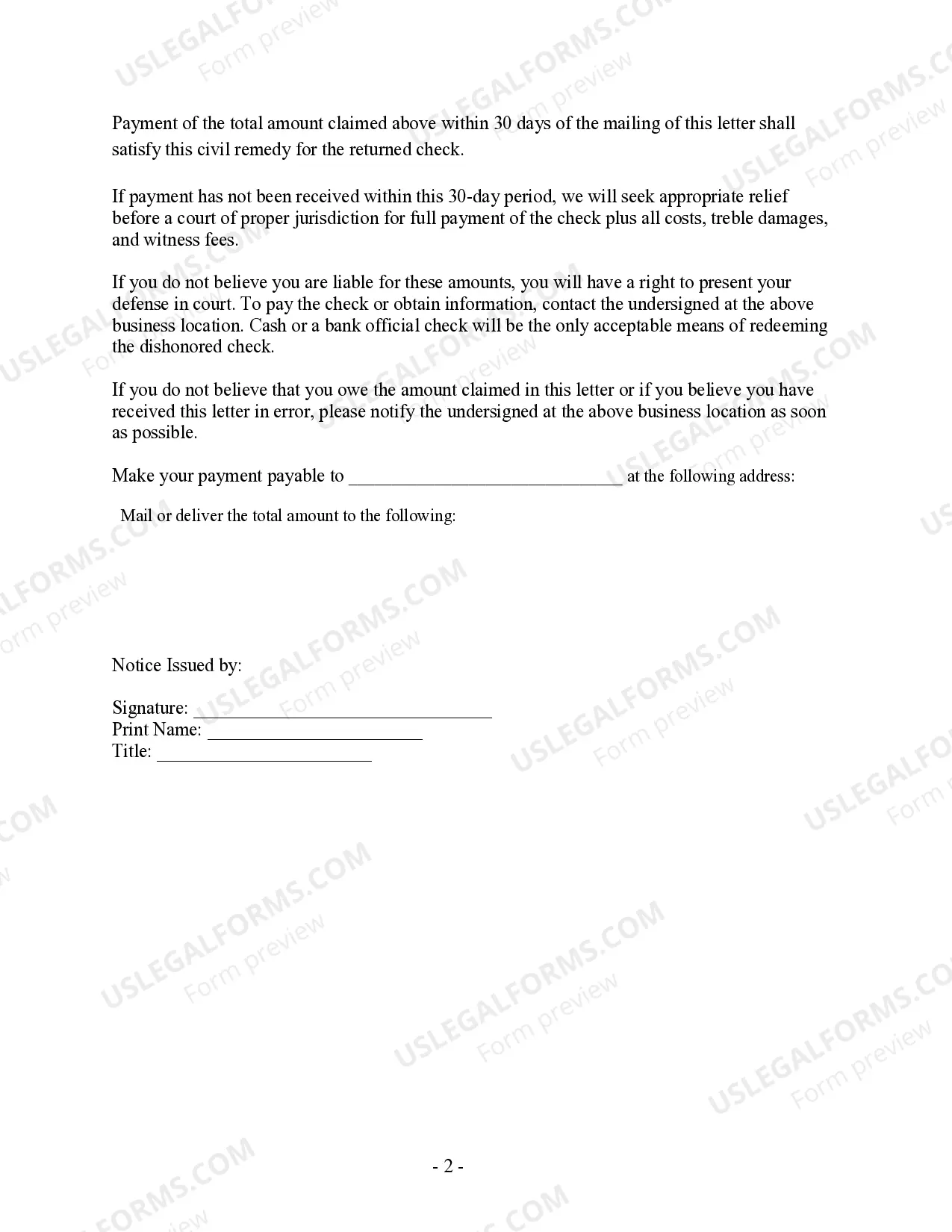

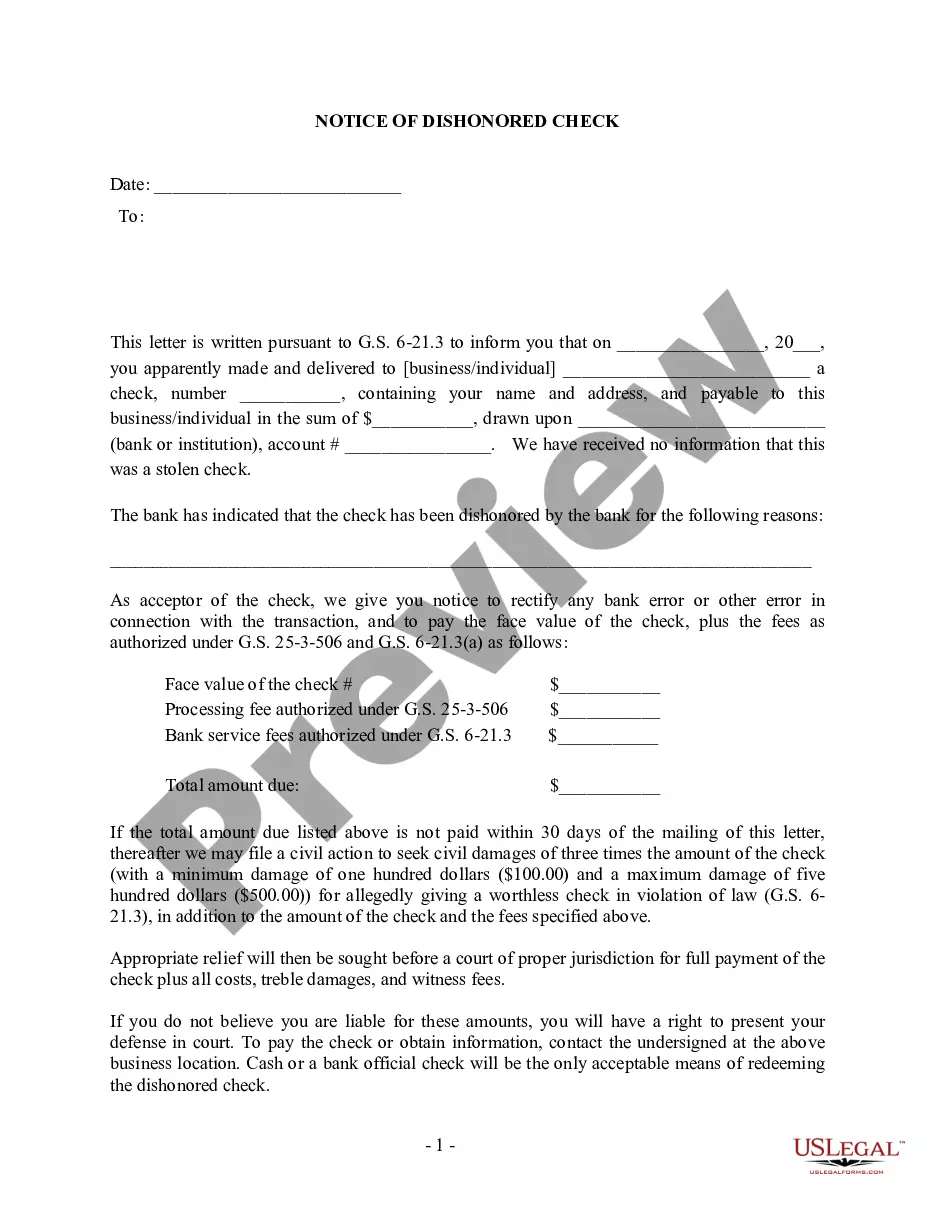

In Greensboro, North Carolina, if you have received a Notice of Dishonored Check Civilvi— - 2nd Notice, it typically means that a check you issued has been returned by the bank due to insufficient funds or other reasons. This notice is an important legal document that informs you of the dishonored check and the steps you need to take to rectify the situation. A bad check, also known as a bounced check, occurs when there are not enough funds in the issuer's account to cover the amount written on the check. This can lead to various consequences, including legal actions, penalties, and damage to your reputation as a reliable payer. The purpose of the Greensboro North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is to notify you that the initial attempt to resolve the issue has been unsuccessful. The second notice implies that you have not yet taken the required actions to resolve the situation, which could lead to further legal ramifications. If you find yourself in this situation, it is crucial to respond promptly and appropriately to protect your rights and avoid further consequences. Ignoring or delaying a response can worsen the situation and potentially lead to additional legal and financial penalties. When dealing with a bad check or bounced check notice, there are a few necessary steps you should consider taking: 1. Contact the Payee: Reach out to the person or business that received the bad check and explain the situation. Apologize for the inconvenience caused and express your commitment to resolving the issue promptly. 2. Make Payment: Offer to settle the debt immediately by providing an alternative form of payment, such as cash, money order, or a certified check. Ensure that you cover the initial amount owed as well as any additional fees or penalties. 3. Communicate with Your Bank: Contact your bank to discuss the situation and determine why the check was dishonored. They might be able to provide valuable insights into the issue and guide you on how to prevent similar occurrences in the future. 4. Keep Detailed Records: Preserve all the records related to the bounced check, including copies of the check, receipts of any payments made, and written communication with the payee or involved parties. These records will be vital in case further legal actions are necessary. It is important to note that failing to resolve a bad check issue can have serious consequences, including but not limited to civil lawsuits, additional fees or penalties, damage to your credit score, and even potential criminal charges in some cases. By addressing the Greensboro North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice promptly and taking the necessary steps to resolve the issue, you can demonstrate integrity, potentially reduce any penalties, and prevent further legal repercussions.

Greensboro North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check

Description

How to fill out North Carolina Notice Of Dishonored Check - Civil - 2nd Notice - Keywords: Bad Check, Bounced Check?

We consistently aim to minimize or evade legal challenges when managing intricate legal or financial matters.

To achieve this, we enlist attorney services that, generally speaking, are exceedingly expensive.

Nonetheless, not all legal issues are similarly complicated.

The majority can be handled independently.

Take advantage of US Legal Forms whenever you need to locate and download the Greensboro North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check or any other document conveniently and securely.

- US Legal Forms is an online directory of current DIY legal documents encompassing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our library enables you to manage your affairs independently without the necessity of hiring legal counsel.

- We provide access to legal document templates that may not always be readily accessible.

- Our templates are specific to states and regions, which greatly streamlines the search process.

Form popularity

FAQ

In North Carolina, writing a bad check can be classified as a felony, particularly if the amount exceeds a specific threshold. If the issuer has a history of writing bounced checks, the consequences can escalate. It's crucial for both parties involved to understand the potential legal implications and seek resolution before things reach that level. Solutions like the Greensboro North Carolina Notice of Dishonored Check - Civil - 2nd Notice can aid in keeping matters civil and resolved effectively.

If you deposit a bad check, your bank will initially credit your account, but this could change once they process the check. When the check bounces, your bank will reverse the deposit, and you may incur fees for insufficient funds. It's essential to act quickly in these situations to mitigate losses, and using a Greensboro North Carolina Notice of Dishonored Check - Civil - 2nd Notice can help in recovering the owed amount.

A check may be returned or dishonored for several reasons, with insufficient funds being the most common. Other reasons include a closed account, a signature discrepancy, or a stop payment order by the writer. If you've received such a check, it's important to keep records and consider following up with the writer. Utilizing a Greensboro North Carolina Notice of Dishonored Check - Civil - 2nd Notice could be beneficial in resolving the issue efficiently.

If someone writes you a bad check, you may find yourself dealing with financial loss and potential complications. You should first contact the check writer to give them a chance to resolve the issue. If they fail to respond or make payment, you might consider sending a Greensboro North Carolina Notice of Dishonored Check - Civil - 2nd Notice. This notice serves as a formal warning and a step towards potentially escalating the matter legally.

In Greensboro, North Carolina, the person who writes a bounced check is typically held responsible. This means that if you receive a bad check, the writer could face legal consequences. They may incur fees from their bank and could also be reported to authorities depending on the situation. It's important to act promptly to address the issue before it escalates.

The case for a bounced check typically involves proving that the check was written intentionally without sufficient funds. In Greensboro, North Carolina, individuals can face civil penalties if they fail to address a dishonored check. It's important to gather all necessary documentation and evidence to support your claim. Utilizing platforms like US Legal Forms can provide you with necessary forms and guidance to effectively file your case.

The statute of limitations for pursuing a bad check in Greensboro, North Carolina, is three years. After this time frame, you may be unable to seek compensation through legal channels. It's important to act swiftly if you receive a bad check, as timely action increases the chances of recovery. US Legal Forms offers resources to assist you in understanding and acting on these legal timelines.

You generally have up to five years to present a bounced check for payment in Greensboro, North Carolina. However, it's best to act promptly to ensure collection efforts are effective. Prompt action can prevent additional complications and preserve your rights under the law. Consider using platforms like US Legal Forms for guidance on processing these checks correctly.

In Greensboro, North Carolina, the statute of limitations on a bad check is typically three years. This means that you have a three-year window from the date the check bounced to take legal action. If you wait beyond this period, you may lose your right to pursue the matter in court. It's essential to quickly address any issues with dishonored checks to ensure your legal options remain open.

The effect of a dishonored check extends beyond the immediate financial implications. It can complicate relationships between individuals or businesses, as trust may be broken. Legal repercussions, including the need for a Greensboro North Carolina Notice of Dishonored Check - Civil - 2nd Notice, may follow, ensuring proper formalities are observed.