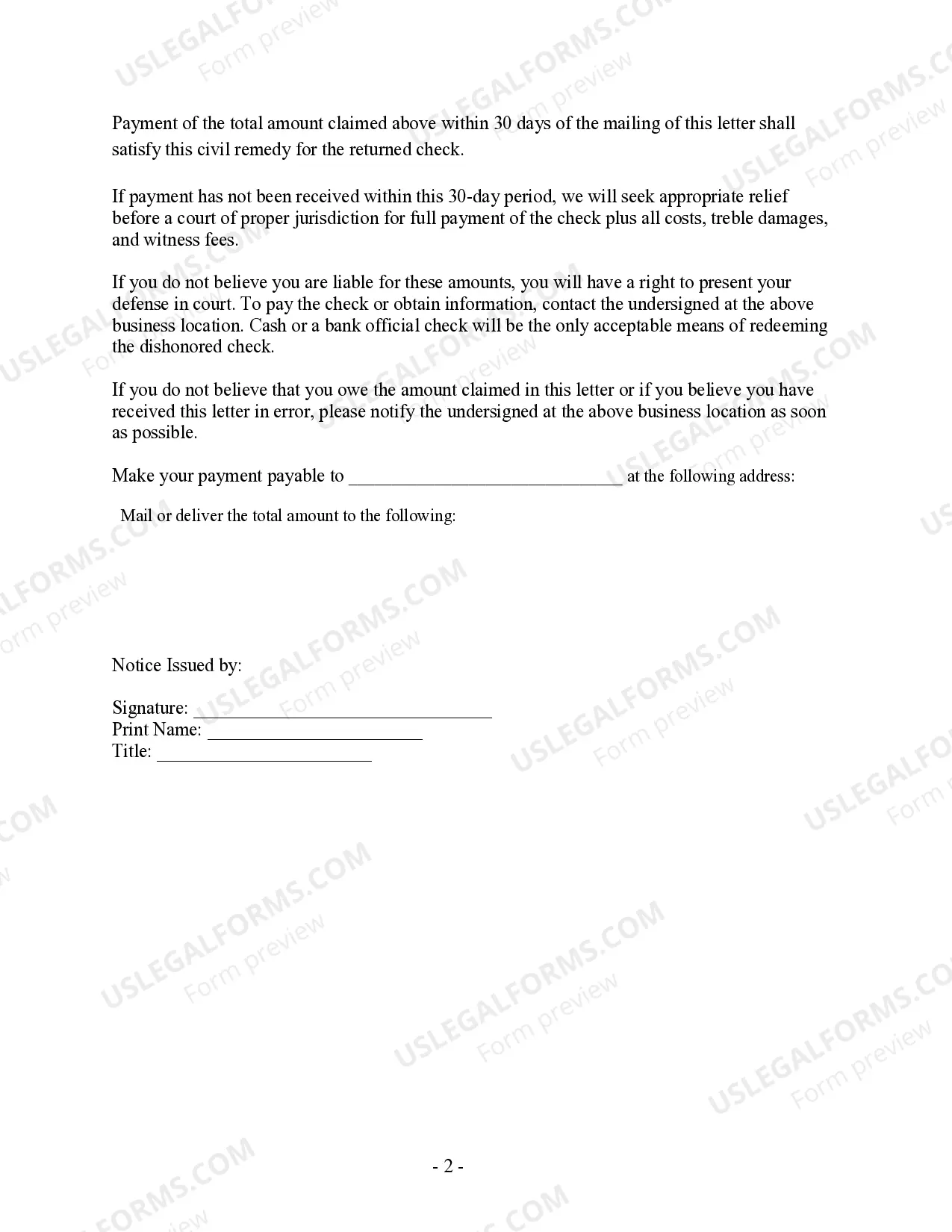

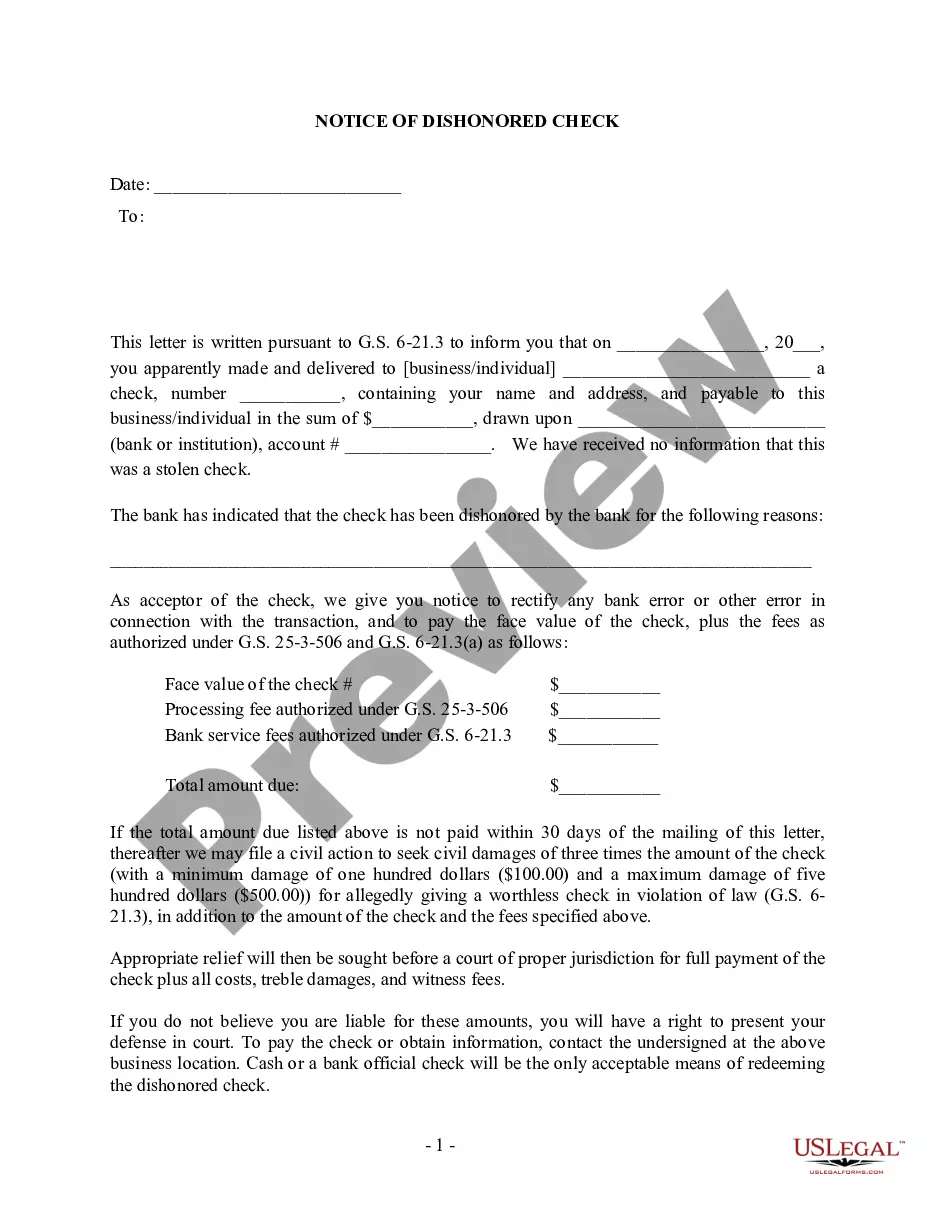

High Point North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice - Keywords: bad check, bounced check A High Point North Carolina Notice of Dishonored Check, also known as a Civil — 2nd Notice, is a legal notification sent by a merchant or business to inform the recipient that their check has been dishonored, or "bounced," by their banking institution due to insufficient funds or other reasons. This document serves as a formal warning that immediate action needs to be taken to resolve the situation. When a bad check is issued, it can cause significant inconvenience and financial loss to the merchant or business. The purpose of this notice is to emphasize the seriousness of the matter and urge the recipient to rectify the situation promptly. The notice typically includes relevant keywords such as bad check and bounced check, which highlight the nature of the issue. Different types of High Point North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice may include: 1. Bad check notice: This type of notice is specifically used for informing the recipient that their check has been returned unpaid to the merchant or business, indicating that it is considered a "bad" or non-negotiable check. 2. Bounced check notice: Similar to the bad check notice, a bounced check notice is sent when the recipient's check has been dishonored by their bank, bouncing back due to insufficient funds or other reasons. In both cases, the notice serves as a legal warning to the recipient that appropriate action needs to be taken to address the dishonored check. It may include relevant details such as the check's amount, date, recipient's account details, and a request for immediate payment to avoid further legal consequences. Receiving a High Point North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is a serious matter that should not be ignored. Failure to respond or resolve the dishonored check may result in legal actions, including civil lawsuits or being reported to credit bureaus, which can have a negative impact on the recipient's credit score and overall financial reputation. To address a dishonored check notice, recipients are advised to contact the issuing merchant or business promptly to discuss payment options and resolve the matter amicably. Promptly addressing the issue demonstrates responsibility and may help avoid further legal complications.

High Point North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check

Description

How to fill out North Carolina Notice Of Dishonored Check - Civil - 2nd Notice - Keywords: Bad Check, Bounced Check?

If you’ve previously utilized our service, Log In to your account and download the High Point North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: insufficient funds check, bounced check to your device by clicking the Download button. Ensure your subscription remains active. If it has lapsed, renew it as per your payment terms.

If this is your initial encounter with our service, follow these straightforward instructions to acquire your document.

You have indefinite access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to reuse it. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Confirm you’ve found an appropriate document. Review the description and use the Preview feature, if available, to verify if it fulfills your requirements. If it doesn't meet your expectations, utilize the Search tab above to locate the correct one.

- Buy the template. Press the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Employ your credit card information or the PayPal option to finalize the transaction.

- Retrieve your High Point North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: insufficient funds check, bounced check. Select the file format for your document and download it to your device.

- Fill out your form. Print it or utilize online professional editors to complete and sign it digitally.

Form popularity

FAQ

In North Carolina, a check is considered stale if it has not been cashed within six months from the date it was issued. Stale checks may not be honored by banks, which can complicate situations involving bounced checks. It is advisable to address stale checks promptly and consider utilizing resources such as the High Point North Carolina Notice of Dishonored Check - Civil - 2nd Notice to communicate effectively with the involved parties.

The statute for worthless checks in North Carolina is typically governed by N.C.G.S. § 6-21.3. This law outlines the penalties and procedures for dealing with checks that the bank refuses to honor. If you are facing a bounced check situation, serving a High Point North Carolina Notice of Dishonored Check - Civil - 2nd Notice can provide a formal method to recover the debt while reinforcing the seriousness of the matter.

In North Carolina, issuing a worthless check, often referred to as a bad check, can lead to serious legal consequences. The law dictates that if a check bounces due to insufficient funds, the issuer may face criminal charges or civil actions for recovery. Such cases may require a High Point North Carolina Notice of Dishonored Check - Civil - 2nd Notice to initiate processing and recovery through the legal system.

Yes, there is a statute of limitations on a worthless or bounced check in North Carolina. Typically, the time frame to bring a claim is three years from the date the check was issued. It is important to act promptly if you want to pursue collection of a bad check. Consider using the High Point North Carolina Notice of Dishonored Check - Civil - 2nd Notice to inform the payer and facilitate action.

Yes, you can face legal consequences for writing a check that bounces in North Carolina. The severity of the trouble depends on the check amount and your intent at the time of writing the check. Even if the amount is small, repeated offenses can lead to criminal charges. If you find yourself in this situation, it would be wise to consider using resources like USLegalForms to navigate the repercussions effectively.

A simple worthless check in North Carolina refers to a check that cannot be processed due to insufficient funds or because the account is closed. This type of check may not carry severe criminal penalties unless it involves intent to defraud. It is generally treated as a civil matter but can escalate if ignored. Handling issues effectively, such as understanding a High Point North Carolina Notice of Dishonored Check, can mitigate potential losses and legal troubles.

Writing a bad check in North Carolina can lead to serious consequences, including criminal charges and civil lawsuits. The bank may assess fees, and the payee can pursue legal action for the amount of the check plus damages. If the situation escalates, you could face trial, especially if it’s a repeated offense. It's vital to resolve any issues promptly to avoid receiving a High Point North Carolina Notice of Dishonored Check.

Penalties for a bounced check in North Carolina can range from civil lawsuits to criminal charges, depending on the check’s amount and circumstances. For small amounts, typically under $2,000, the penalty may be a fine or repayment with fees. However, in higher amounts, legal consequences escalate, which might involve felony charges. Always stay informed about your rights and options, especially if you receive a High Point North Carolina Notice of Dishonored Check.

Yes, receiving a bad check can put you in a tricky legal situation. If you negotiate the check, it can complicate matters, especially if the check bounces. It's best to address the issue with the writer and potentially involve legal advice if necessary. Understanding how to manage a High Point North Carolina Notice of Dishonored Check will protect you from potential pitfalls and liabilities.

A case for a bouncing check usually involves the payee pursuing legal action against the payer for the amount of the check plus any associated fees. If the payee attempts to collect and the payer fails to respond, the case may escalate to court. In North Carolina, the legal system has specific provisions regarding dishonored checks, making it crucial to respond promptly to any notices received. Utilizing resources like USLegalForms can simplify the process and ensure you handle everything correctly.