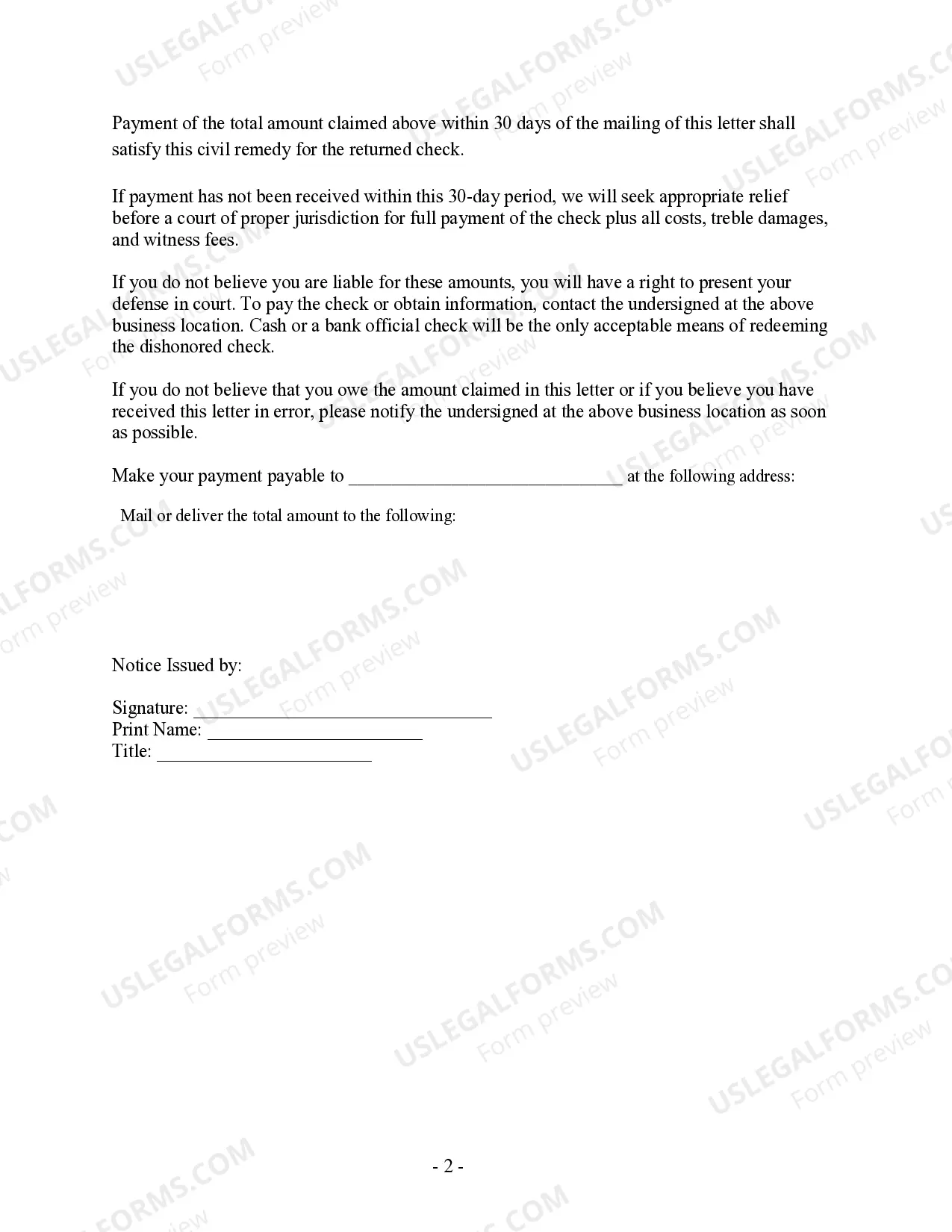

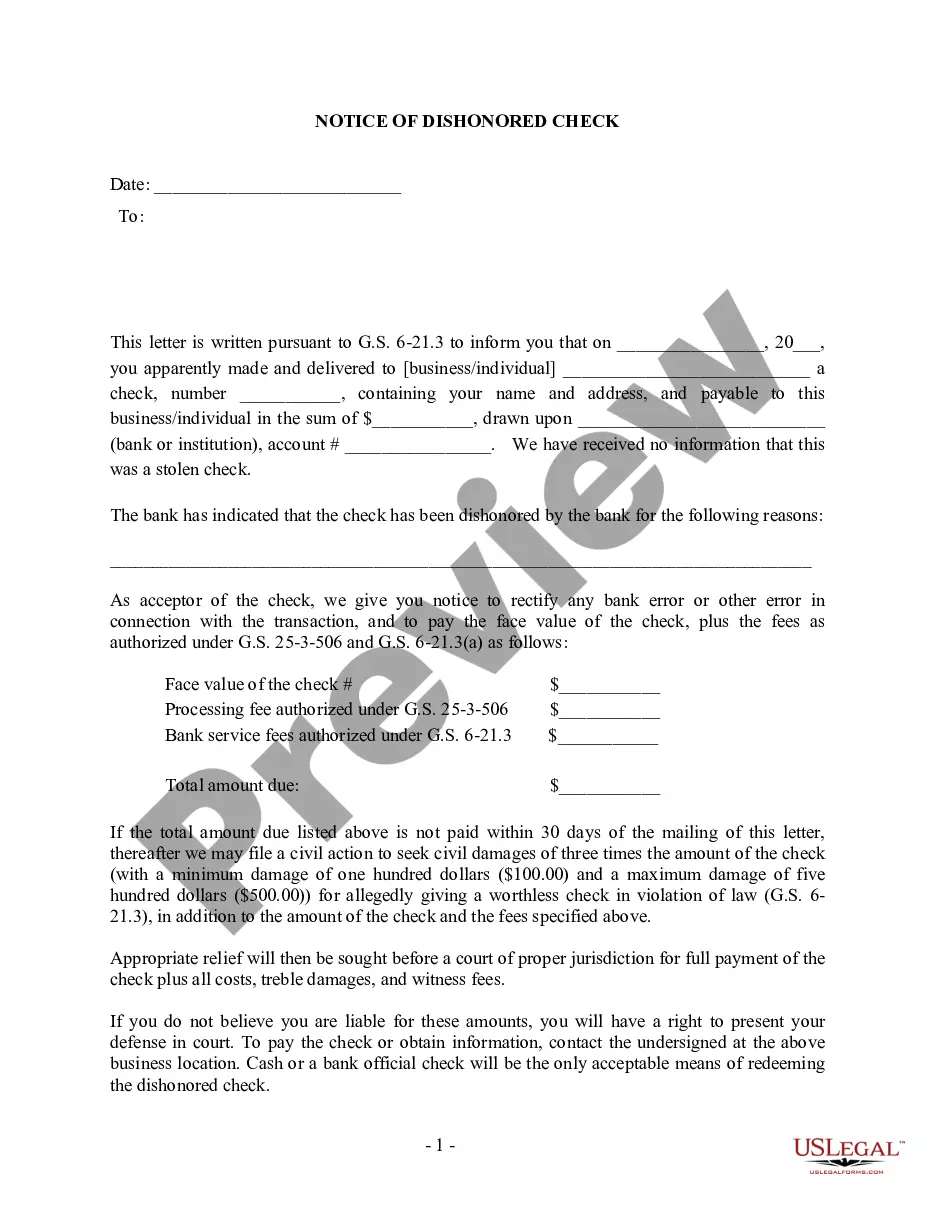

The Mecklenburg North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is an important legal document that serves as a notification to individuals or businesses that their check payment has been dishonored or bounced by the bank. This notice is typically sent by the payee or their attorney to inform the issuer of the bad check about the consequences and steps they need to take to rectify the situation. A bad check, also known as a bounced check, refers to a check that cannot be honored due to insufficient funds in the issuer's account or other reasons. It is essential to address these situations promptly to avoid further complications and legal repercussions. The Mecklenburg North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is a follow-up notice typically sent after the initial notice has been ignored or not appropriately resolved. This second notice emphasizes the seriousness of the matter and urges the check issuer to take immediate action to rectify the situation. By utilizing relevant keywords such as "bad check" and "bounced check," the content of this notice should clearly convey the following key points: 1. Identification: Begin the notice by providing the necessary details to identify the check transaction, such as the check number, date, and amount. This information helps both parties to recognize the specific incident in question. 2. Explanation: Clearly explain in simple terms that their check has been dishonored or bounced due to insufficient funds or any other valid reason. Use concise language to avoid confusion while maintaining clarity. 3. Legal Consequences: Highlight the legal implications of issuing a bad check, making it evident that these actions are taken seriously in the state of North Carolina. Mention that civil penalties, including fines and legal fees, may apply if the situation is not resolved promptly. 4. Payment Options: Provide the issuer with various payment options to remedy the situation. Include details about acceptable forms of payment, such as cashier's checks or money orders, and specify the deadline date by which the payment must be made to avoid further legal action. 5. Contact Information: Include the contact information of the payee or their attorney, such as name, address, phone number, and email. This allows the issuer to reach out directly with any questions or concerns regarding the notice. It's important to note that there may be different variations or templates of the Mecklenburg North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice, tailored to specific cases or legal requirements. However, by focusing on keywords like "bad check" and "bounced check," the content of such notices will address the essential components, emphasizing the need for quick resolution and the potential consequences of non-compliance.

Mecklenburg North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check

Description

How to fill out Mecklenburg North Carolina Notice Of Dishonored Check - Civil - 2nd Notice - Keywords: Bad Check, Bounced Check?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for attorney solutions that, usually, are very expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Mecklenburg North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Mecklenburg North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Mecklenburg North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check would work for you, you can choose the subscription plan and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

N. C. G. S. §14.107(d) states that writing a bad check ?is a Class I Felony if the amount of the check or draft is more than two thousand dollars ($2,000).? A Class I Felony in North Carolina can result in up to twelve (12) months of incarceration.

If a cheque is dishonoured for any reason, the bank on which it is drawn must promptly return the cheque to the depositor's (payee's) bank, which will ultimately return it to the depositor.

Writing a bad check is a crime if the check writer knew that there were insufficient funds to cover the check and intended to defraud you. It is also a crime to forge a check or write a fake check.

N. C. G. S. §14.107(d) states that writing a bad check ?is a Class I Felony if the amount of the check or draft is more than two thousand dollars ($2,000).? A Class I Felony in North Carolina can result in up to twelve (12) months of incarceration.

1, effective December 1, 1999. (3) If the check or draft is drawn upon a nonexistent account, the person is guilty of a Class 1 misdemeanor.

People who write bad checks are normally charged fees by their banks and could be on the hook for any fees incurred by the payee. Knowingly writing a bad check may constitute a misdemeanor or felony, depending on the amount of the check and the state in which it was written.

(d) A violation of this section is a Class I felony if the amount of the check or draft is more than two thousand dollars ($2,000).

Dishonored checks are items deposited at a depository bank, but are returned to the State due to non-sufficient funds or other reasons preventing the bank from cashing the items.

Officially referred to as a ?worthless check,? North Carolina law defines a worthless check as a check that is written from an account that does not have sufficient funds to cover the amount of the check.

Interesting Questions

More info

So that our customers can get to know us and our products, we set up a number of standard procedures which should meet every requirement. In fact, at this time, over a thousand customers have been satisfied with our work, the reasons of which include: Quality of our work, and the results we achieve in an easy and timely way. Quality of the product, which we work hard on to bring as close to perfection as possible. Customer service, which is very responsive and personalized with the satisfaction of each customer, no matter their requirements.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.