Title: Wilmington North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice - Keywords: Bad Check, Bounced Check Introduction: In this article, we will provide a comprehensive overview of the Wilmington North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice, with a primary focus on keywords such as bad check and bounced check. We will delve into the importance of this notice, its legal implications, various types of dishonored checks, and steps to take when dealing with such situations. So, let's dive in! 1. Understanding the Notice of Dishonored Check: — Definition: The Notice of Dishonored Check is a legal document issued by the relevant authorities in Wilmington, North Carolina, to inform a party that their check has been deemed invalid due to insufficient funds. — Purpose: The notice serves as a means of alerting the check issuer about the bounced or bad check, enabling them to resolve the issue and avoid any further legal consequences. — Legal implications: Failure to resolve the issue within the specified time frame may result in legal actions being taken against the check issuer, potentially leading to penalties, fines, or even criminal charges. 2. Types of Dishonored Checks: — Insufficient funds: This is the most common type of dishonored check where the issuer's bank account lacks the necessary funds to cover the check amount. — Stale-dated check: When a check is presented to the bank after a specified period (usually within six months), it may be considered expired or stale-dated, rendering it invalid. — Post-dated check: A post-dated check is one that is dated for a future date. If the check is presented to the bank before the specified date, it will be dishonored. — Closed account: If the issuer's bank account has been closed or is no longer active, any checks drawn on that account will be dishonored. — Irregular signature: In certain cases, if the signature on the check does not match the specimen signature registered with the bank, it may be considered a dishonored check. 3. Steps to Take When Dealing with a Dishonored Check: — 1st Notice: Upon receiving the 1st Notice of Dishonored Check, the issuer should immediately contact the payee to determine the cause and resolve the issue amicably. Timely communication is essential to avoid further legal actions. — 2nd Notice: When a 2nd Notice of Dishonored Check is received, it signifies that the issuer has not responded to the first notice, prompting the payee to escalate the matter further. This notice serves as a final warning before further consequences are pursued. — Resolving the issue: To address a dishonored check, the issuer should ensure sufficient funds are available in their account and make immediate arrangements to pay the originally intended amount, along with any additional fees imposed by the payee or the law. — Seeking legal advice: If unable to settle the matter independently, the issuer should consider seeking legal advice to assess the potential consequences and determine the best course of action. Conclusion: The Wilmington North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice holds significant importance in communicating the dishonor of a check due to insufficient funds or other reasons mentioned above. It is crucial for both the check issuer and the payee to understand this legal process and take appropriate actions to rectify the situation promptly. By addressing dishonored checks expeditiously, individuals can mitigate risks, maintain financial credibility, and uphold the integrity of their financial transactions.

Wilmington North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check

Description

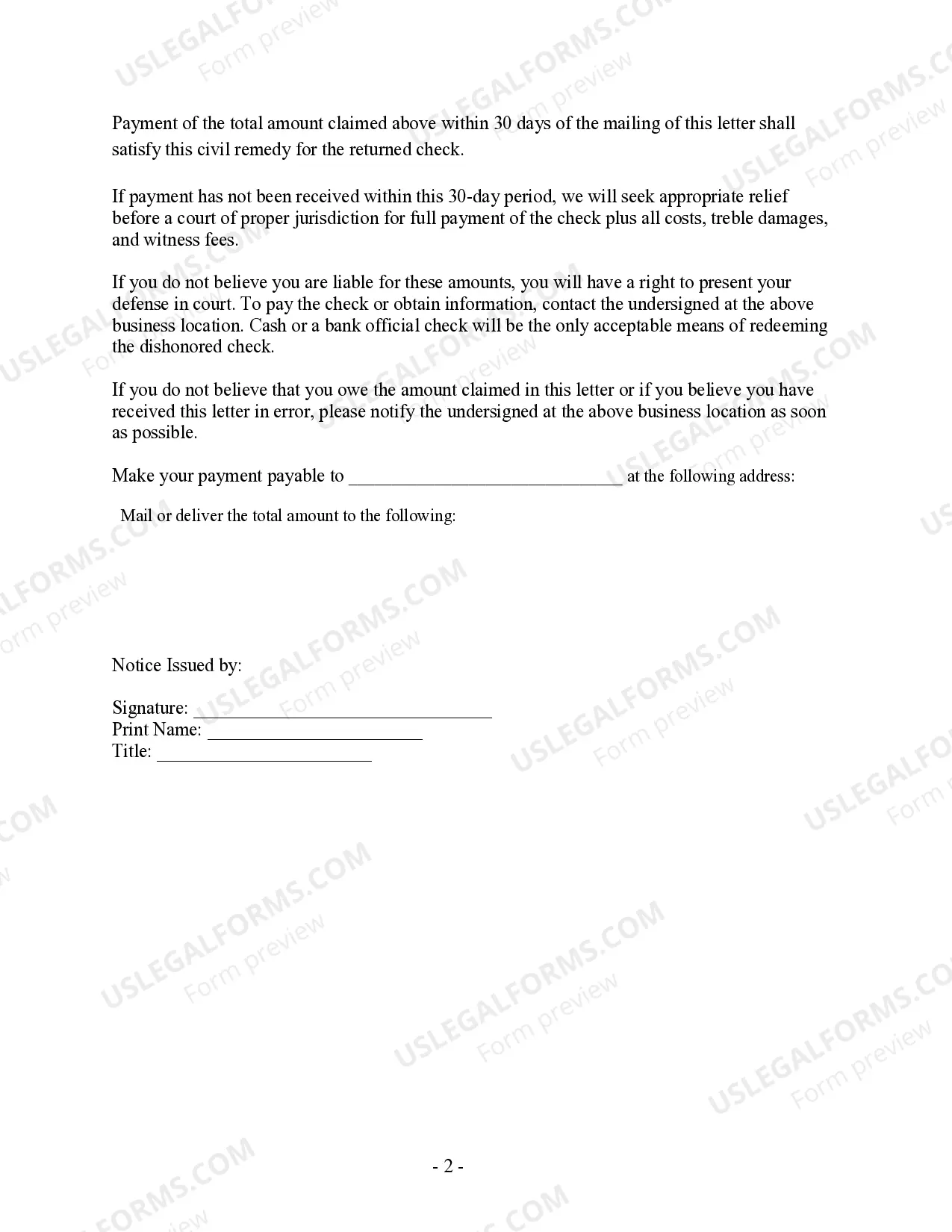

How to fill out Wilmington North Carolina Notice Of Dishonored Check - Civil - 2nd Notice - Keywords: Bad Check, Bounced Check?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for attorney solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to an attorney. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Wilmington North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Wilmington North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Wilmington North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check is proper for you, you can pick the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!