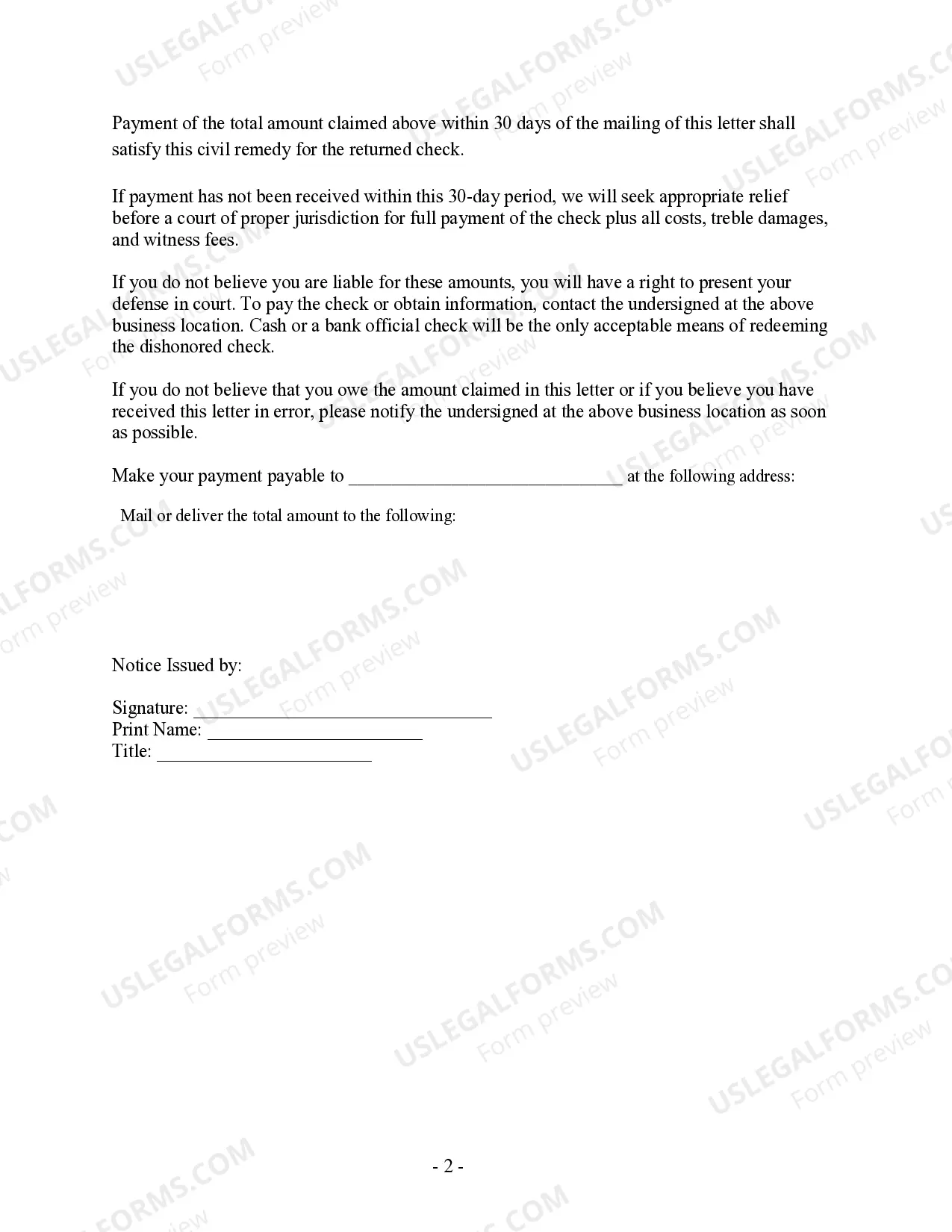

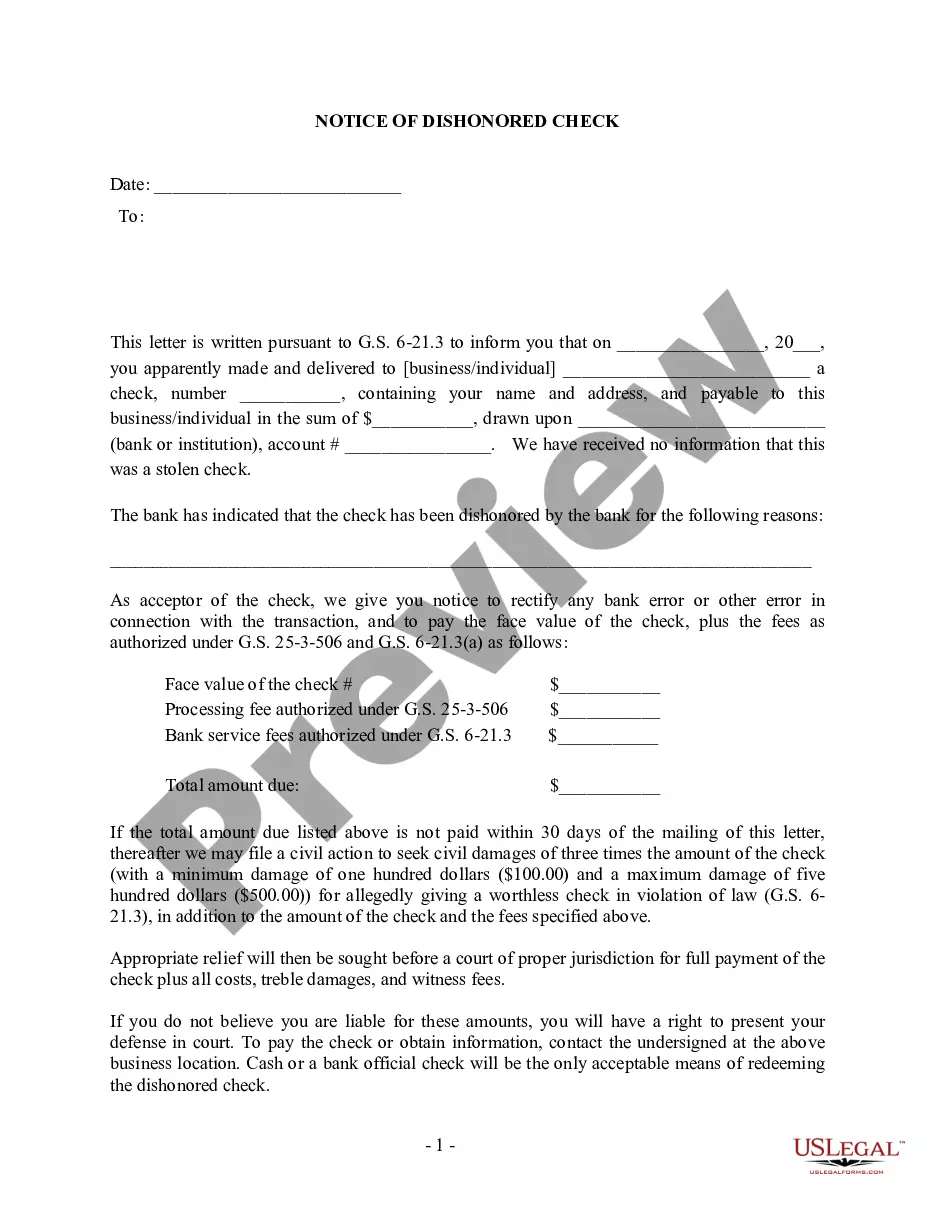

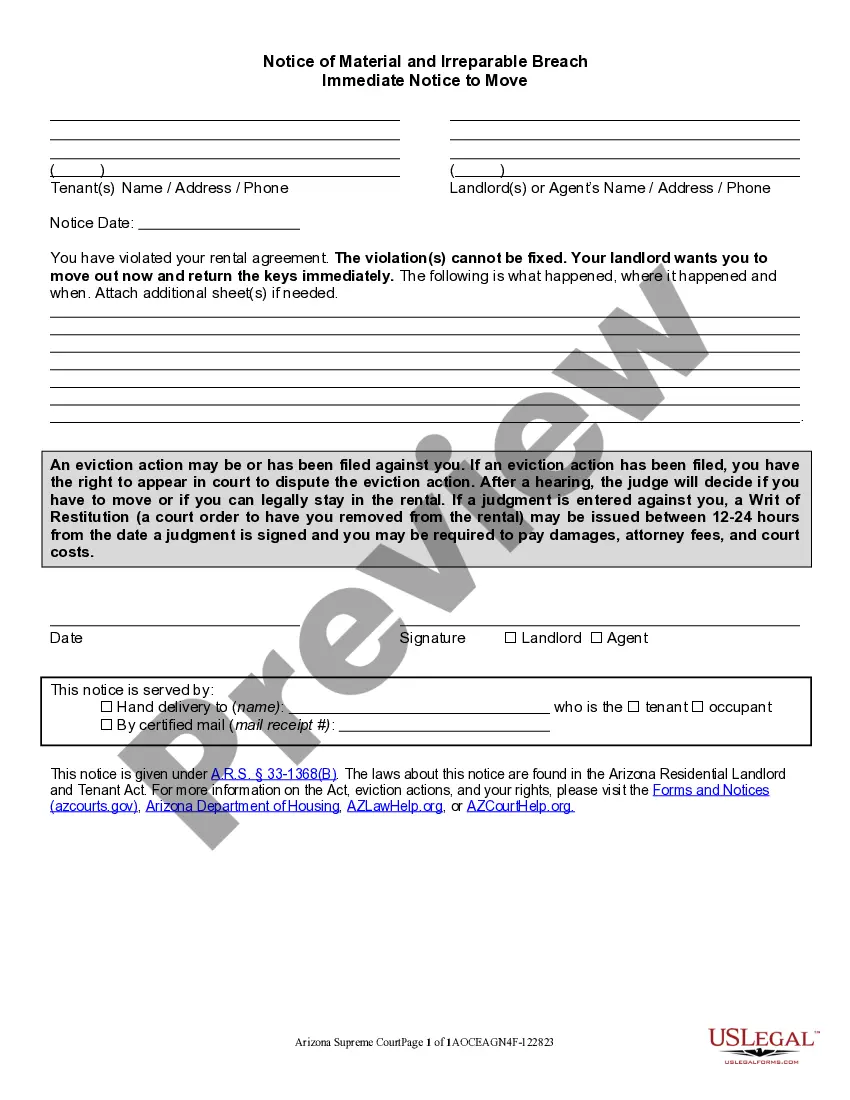

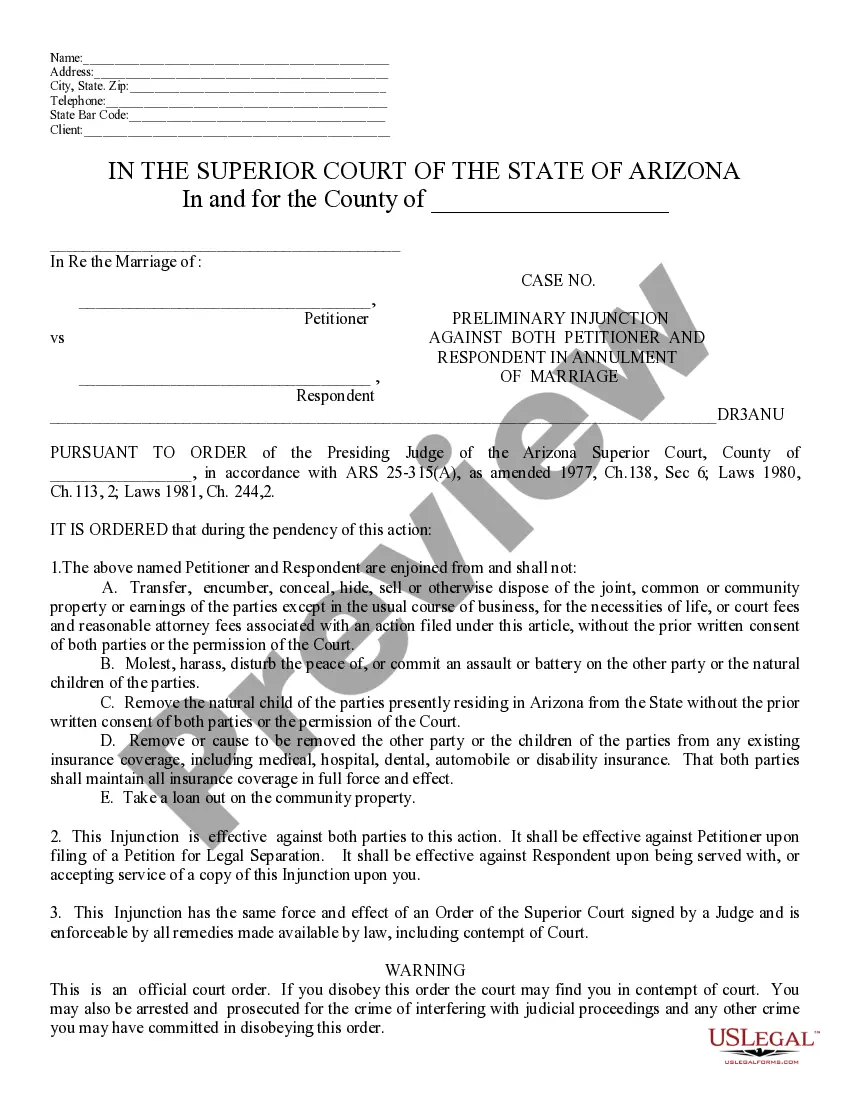

Title: Understanding the Winston-Salemem North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice Introduction: The Winston-Salem North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is an essential legal instrument used when a check has been returned due to insufficient funds in the account or other reasons. This article will provide a detailed description of this notice, explain its significance, and explore the different types of dishonored checks. Keywords: bad check, bounced check. 1. What is a Notice of Dishonored Check? A Notice of Dishonored Check is a formal written notification issued to the check issuer to inform them that the check they have issued has been returned unpaid. This notice serves as an important legal document to draw the issuer's attention to their financial obligation and potential consequences. 2. Purpose of the Notice: The primary objective of the Winston-Salem North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is to notify the check issuer that their check has been dishonored or bounced. This notice is typically sent when the issuer fails to resolve the issue even after a previous notice was sent. 3. Legal Implications: When an individual writes a bad check, it can have serious legal consequences. The notice serves as a warning to the check issuer that if they do not resolve the issue promptly, they may face legal action, hefty fines, or even criminal charges in some cases. 4. Types of Dishonored Checks: a) Insufficient Funds: The most common reason for a check to be dishonored is insufficient funds. This occurs when the issuer writes a check without having enough money in their account to cover the transaction. b) Closed Account: If the check issuer closes their account before the recipient deposits the check, the check will be dishonored. c) Irregular Signature: If the signature on the check does not match the account holder's authorized signature, the bank may dishonor the check. d) Post-Dated Check: A post-dated check, which is a check with a future date, may be dishonored if it is deposited before the specified date. e) Stolen or Forgery: If a check is reported as stolen or forged, the bank may dishonor the check. Conclusion: The Winston-Salem North Carolina Notice of Dishonored Check Civilvi— - 2nd Notice is a legal document used to notify check issuers about dishonored checks. Understanding the significance of this notice and its implications is crucial for check issuers to take prompt action to resolve the issue. Avoiding writing bad checks and maintaining adequate funds in the account are essential to prevent such notices and potential legal consequences.

Winston–Salem North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check

Description

How to fill out Winston–Salem North Carolina Notice Of Dishonored Check - Civil - 2nd Notice - Keywords: Bad Check, Bounced Check?

Do you require a reliable and affordable provider of legal forms to obtain the Winston–Salem North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check? US Legal Forms is your best choice.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of documents to move forward with your separation or divorce in court, we have you covered. Our platform provides more than 85,000 current legal document templates for personal and business purposes. All the templates we offer are not generic and are tailored to the specific needs of individual states and counties.

To access the form, you must Log Into your account, locate the required template, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased document templates at any time from the My documents section.

Is this your first visit to our website? No problem. You can set up an account in just a few minutes, but before you start, ensure you do the following.

Now you can create your account. Then choose the subscription option and continue to the payment process. Once the payment is finalized, download the Winston–Salem North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check in any available format. You can come back to the website whenever you need and redownload the form without incurring any additional fees.

Accessing current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time studying legal documentation online once and for all.

- Verify that the Winston–Salem North Carolina Notice of Dishonored Check - Civil - 2nd Notice - Keywords: bad check, bounced check meets the regulations of your state and locality.

- Review the details of the form (if available) to understand who and what the form is applicable for.

- Restart your search if the template does not fit your legal situation.

Form popularity

FAQ

Writing a demand letter for a bad check involves stating the facts clearly. Start by mentioning the bounced check details, including the date, amount, and reason for its return. Then, specify a timeframe for payment and include potential consequences for non-compliance. Using US Legal Forms can streamline this process, ensuring your letter is professional and effective.

To collect on a bad check, first reach out to the issuer with a polite reminder about the bounced payment. If necessary, send a formal demand letter requesting payment or restitution. You may also consider involving a collections agency if the situation escalates. For guidance on drafting effective demand letters, US Legal Forms offers useful templates.

When informing someone that their check bounced, approach the conversation with sensitivity. Begin by verifying the situation and gently state that their payment was returned due to insufficient funds. It's essential to suggest a resolution, such as discussing alternative payment methods. A polite tone will maintain a positive relationship, despite the bad check incident.

To write a letter regarding insufficient funds, start by stating the details of the bounced check. Include the check number, date issued, and the amount. Clearly express that the check was returned due to insufficient funds, and request prompt payment for the amount due. Utilizing US Legal Forms can help you create a professional letter to address this situation effectively.

To write a bounced check letter, start with a clear statement identifying the check in question. Include details such as the check number, date, and amount. Next, explain the issue of the bad check and provide a request for payment—typically within a specific time frame. For your needs regarding the Winston–Salem North Carolina Notice of Dishonored Check - Civil - 2nd Notice, consider using uslegalforms for guidance and templates, ensuring proper legal wording and compliance.

Statute 14-74 in North Carolina outlines the legal framework surrounding the issuance of a worthless check. This statute states that writing a bad check with intent to defraud can result in criminal charges. Those facing issues related to a bounced check should familiarize themselves with this statute to navigate potential consequences effectively.

North Carolina law prohibits the issuance of bad checks, categorizing them as a form of theft if done knowingly. The law holds individuals accountable for checks written without sufficient funds or with closed accounts. Knowing these regulations is crucial for those residing in Winston-Salem when handling finances and checks.

In North Carolina, writing a bad check can result in penalties, including fines and legal action. The payee may file a complaint or seek restitution through the courts. You could also face criminal charges, particularly if it is deemed intentional, leading to additional legal implications in your case.

A dishonored check is commonly referred to as a bounced check because it 'bounces' back to the sender when it cannot be processed due to insufficient funds. This term illustrates the check's inability to reach the payee's account. Understanding this terminology is key for anyone dealing with bad checks in Winston-Salem, North Carolina.

If you accidentally write a bad check, it's vital to act quickly. You should contact the payee immediately to explain the situation and try to make amends. Additionally, resolving the matter before legal action is taken can help you avoid further complications regarding the Winston-Salem North Carolina Notice of Dishonored Check - Civil - 2nd Notice.