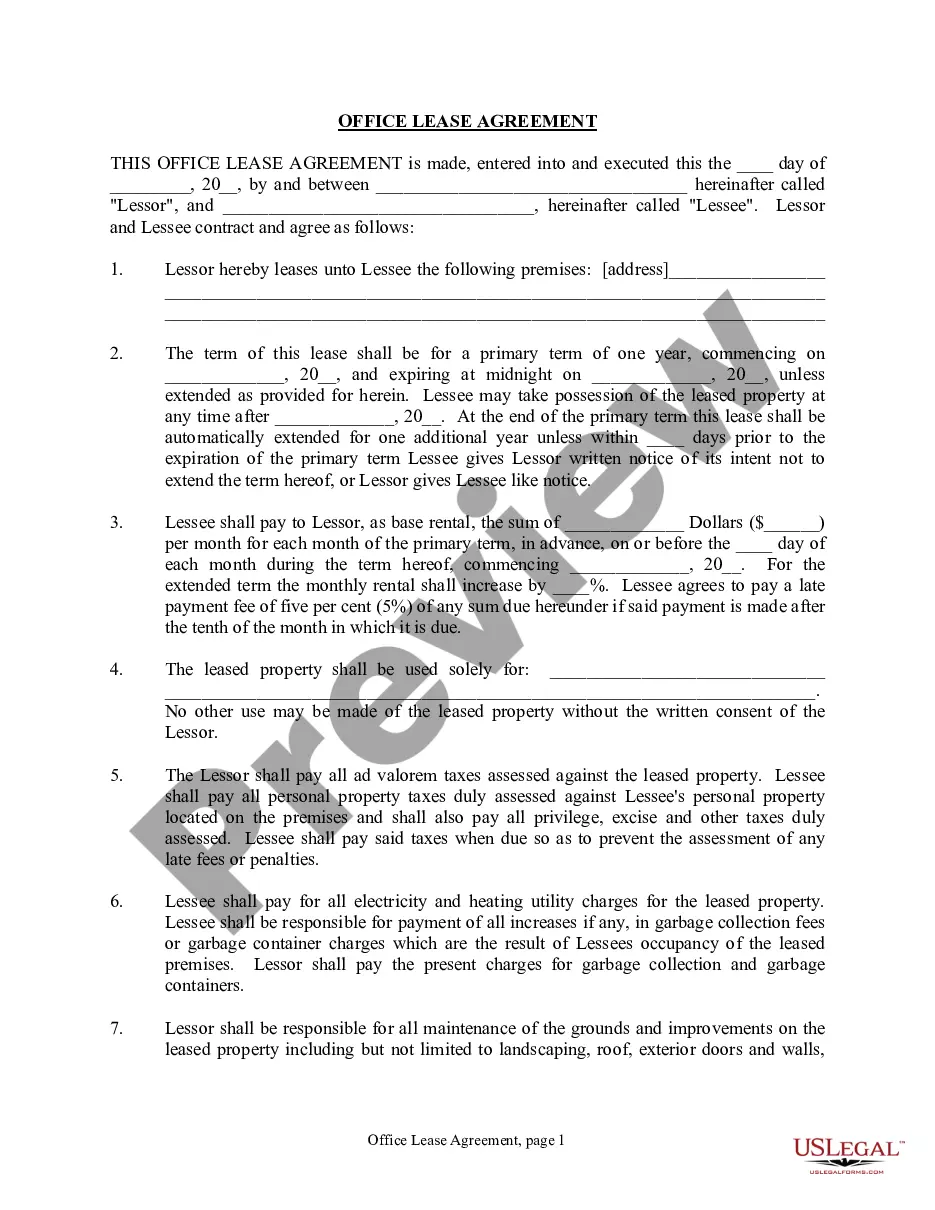

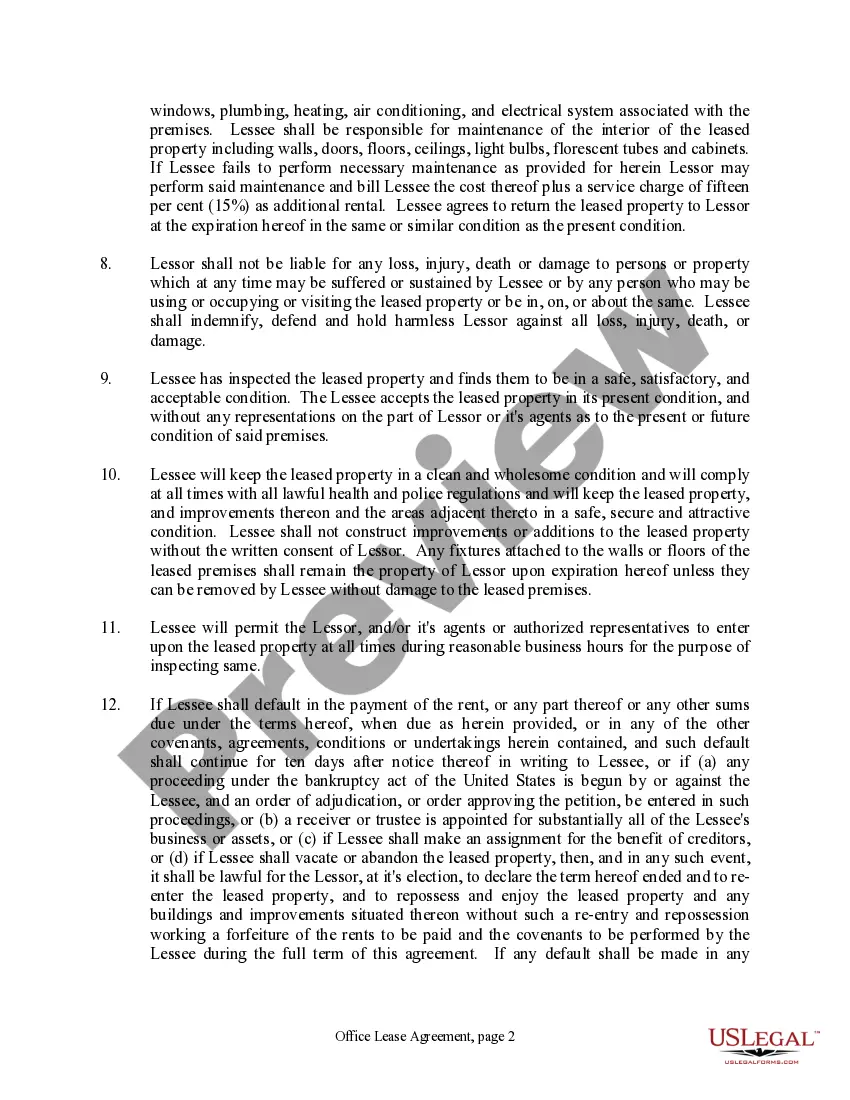

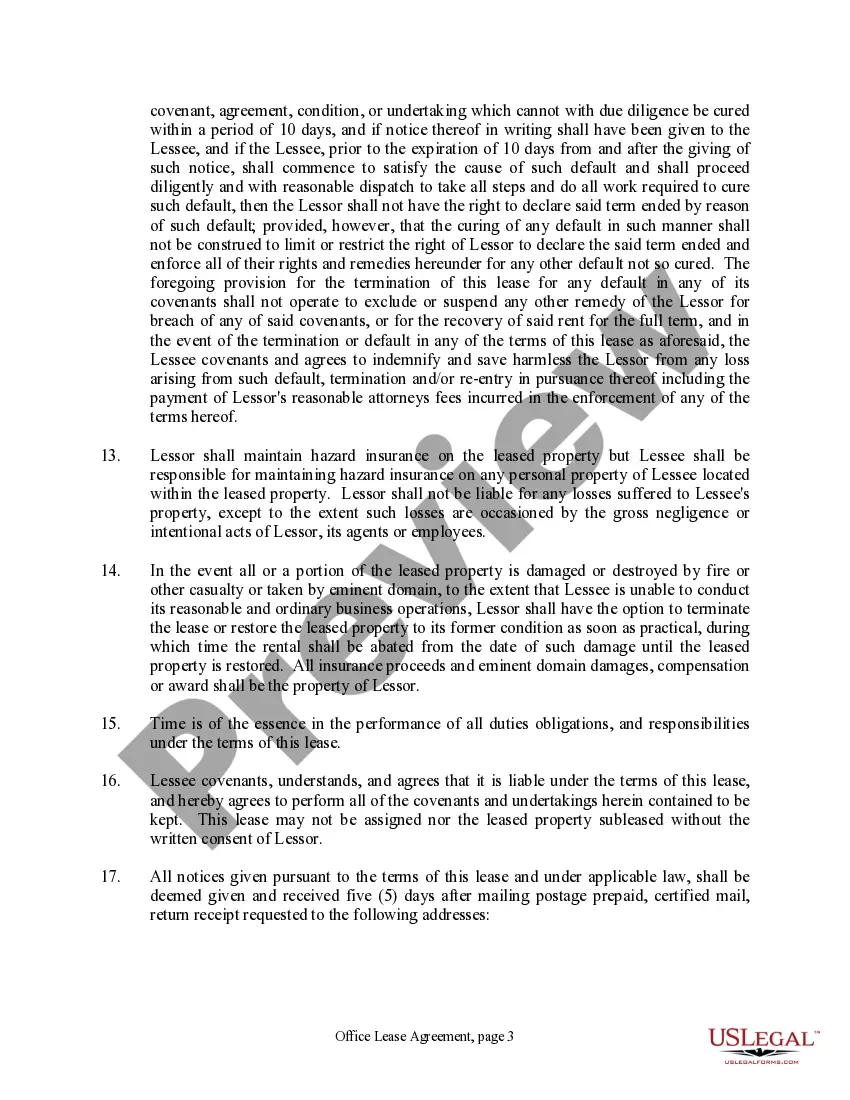

The Mecklenburg North Carolina Office Lease Agreement is a legally binding contract that outlines the terms and conditions between a landlord and a tenant for the rental of an office space located in Mecklenburg County, North Carolina. This agreement serves as a comprehensive document that covers various aspects of the lease, including the lease duration, rental payment details, rights and responsibilities of both parties, and any specific rules and regulations related to the use of the office space. The Mecklenburg North Carolina Office Lease Agreement provides clarity and protection for both landlords and tenants, ensuring that everyone involved understands their obligations and rights. This agreement helps avoid any potential disputes or misunderstandings that may arise over time. There are different types of Mecklenburg North Carolina Office Lease Agreements, including: 1. Gross Lease Agreement: This type of lease agreement typically involves a fixed rent amount that includes all expenses such as insurance, taxes, maintenance costs, and utilities. With a gross lease, the tenant does not have to pay for any additional expenses separately. 2. Net Lease Agreement: In a net lease agreement, the tenant is responsible for paying a base rent along with some or all of the operating expenses. These operating expenses may include property taxes, insurance, and maintenance fees. There are variations of net leases such as single net lease, double net lease, and triple net lease, depending on the extent of expenses the tenant is liable for. 3. Percentage Lease Agreement: A percentage lease agreement is commonly used in retail or commercial spaces. In addition to a base rent, the tenant is also required to pay a percentage of their gross sales as rent. This type of lease agreement is often structured so that the percentage rent increases as the tenant's revenue increases. 4. Sublease Agreement: A sublease agreement allows the tenant, who is already leasing the office space, to sublet a portion of the space to another party. This agreement specifies the terms and conditions for the sublease, providing clarity on rent payments, duration, and any additional obligations or restrictions. It is essential for both landlords and tenants to carefully review and understand the terms and conditions outlined in the Mecklenburg North Carolina Office Lease Agreement before signing it. If needed, seeking legal advice is advisable to ensure compliance with local laws and regulations and protect the interests of both parties involved in the lease agreement.

Mecklenburg North Carolina Office Lease Agreement

State:

North Carolina

County:

Mecklenburg

Control #:

NC-802LT

Format:

Word;

Rich Text

Instant download

Description

This form is a contract to Lease office space from property owner to tenant. This contract will include lease terms that are compliant with state statutory law. Tenant must abide by terms of the lease and its conditions as agreed.

The Mecklenburg North Carolina Office Lease Agreement is a legally binding contract that outlines the terms and conditions between a landlord and a tenant for the rental of an office space located in Mecklenburg County, North Carolina. This agreement serves as a comprehensive document that covers various aspects of the lease, including the lease duration, rental payment details, rights and responsibilities of both parties, and any specific rules and regulations related to the use of the office space. The Mecklenburg North Carolina Office Lease Agreement provides clarity and protection for both landlords and tenants, ensuring that everyone involved understands their obligations and rights. This agreement helps avoid any potential disputes or misunderstandings that may arise over time. There are different types of Mecklenburg North Carolina Office Lease Agreements, including: 1. Gross Lease Agreement: This type of lease agreement typically involves a fixed rent amount that includes all expenses such as insurance, taxes, maintenance costs, and utilities. With a gross lease, the tenant does not have to pay for any additional expenses separately. 2. Net Lease Agreement: In a net lease agreement, the tenant is responsible for paying a base rent along with some or all of the operating expenses. These operating expenses may include property taxes, insurance, and maintenance fees. There are variations of net leases such as single net lease, double net lease, and triple net lease, depending on the extent of expenses the tenant is liable for. 3. Percentage Lease Agreement: A percentage lease agreement is commonly used in retail or commercial spaces. In addition to a base rent, the tenant is also required to pay a percentage of their gross sales as rent. This type of lease agreement is often structured so that the percentage rent increases as the tenant's revenue increases. 4. Sublease Agreement: A sublease agreement allows the tenant, who is already leasing the office space, to sublet a portion of the space to another party. This agreement specifies the terms and conditions for the sublease, providing clarity on rent payments, duration, and any additional obligations or restrictions. It is essential for both landlords and tenants to carefully review and understand the terms and conditions outlined in the Mecklenburg North Carolina Office Lease Agreement before signing it. If needed, seeking legal advice is advisable to ensure compliance with local laws and regulations and protect the interests of both parties involved in the lease agreement.

Free preview

How to fill out Mecklenburg North Carolina Office Lease Agreement?

If you’ve already utilized our service before, log in to your account and download the Mecklenburg North Carolina Office Lease Agreement on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Mecklenburg North Carolina Office Lease Agreement. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!