Mecklenburg North Carolina Financial Affidavit

Description

How to fill out North Carolina Financial Affidavit?

If you’ve previously utilized our service, Log In to your account and retrieve the Mecklenburg North Carolina Financial Affidavit on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to revisit it. Utilize the US Legal Forms service to effortlessly locate and store any template for your personal or professional requirements!

- Confirm you’ve located the correct document. Review the description and utilize the Preview feature, if available, to verify if it fulfills your needs. If it doesn’t fit, use the Search tab above to discover the suitable one.

- Purchase the template. Click the Buy Now button and choose between a monthly or yearly subscription plan.

- Create an account and process your payment. Enter your credit card information or select the PayPal option to finalize the purchase.

- Obtain your Mecklenburg North Carolina Financial Affidavit. Choose the file format for your document and save it to your device.

- Complete your form. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

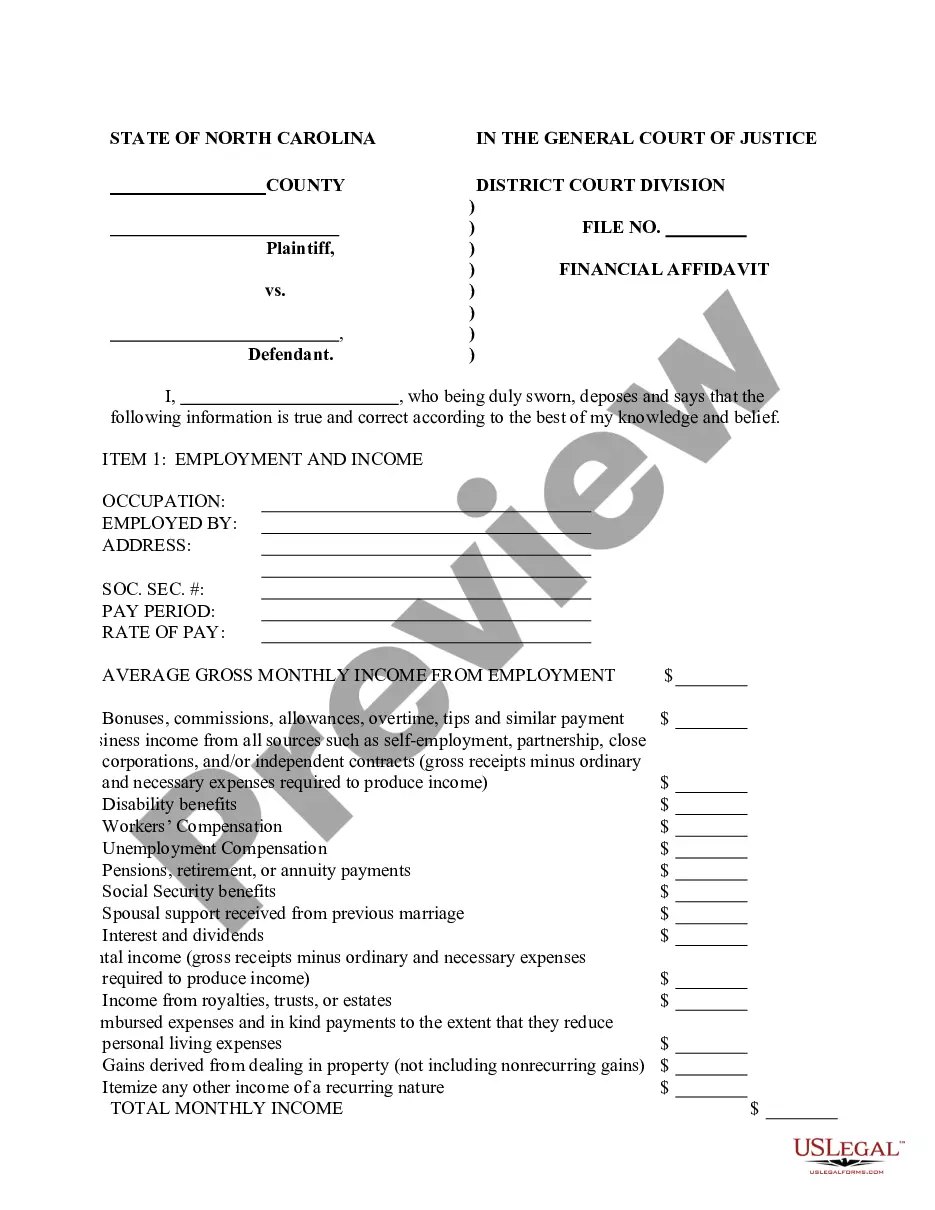

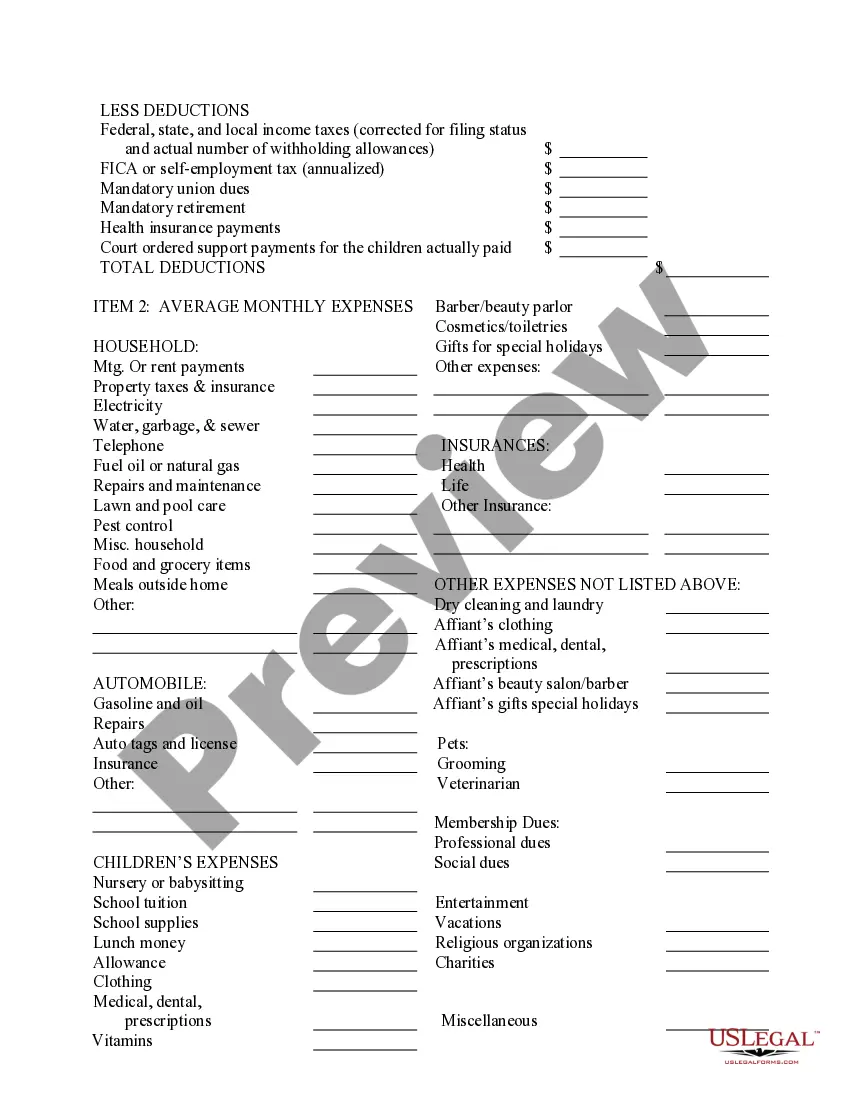

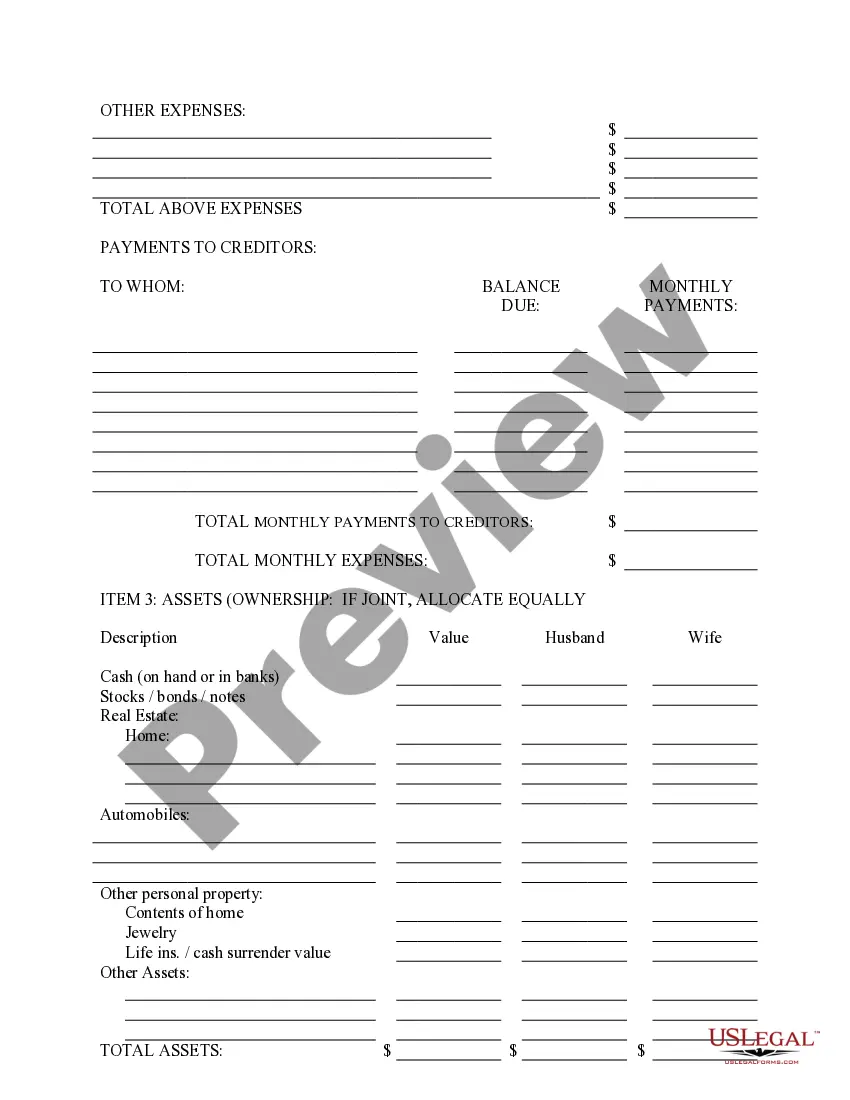

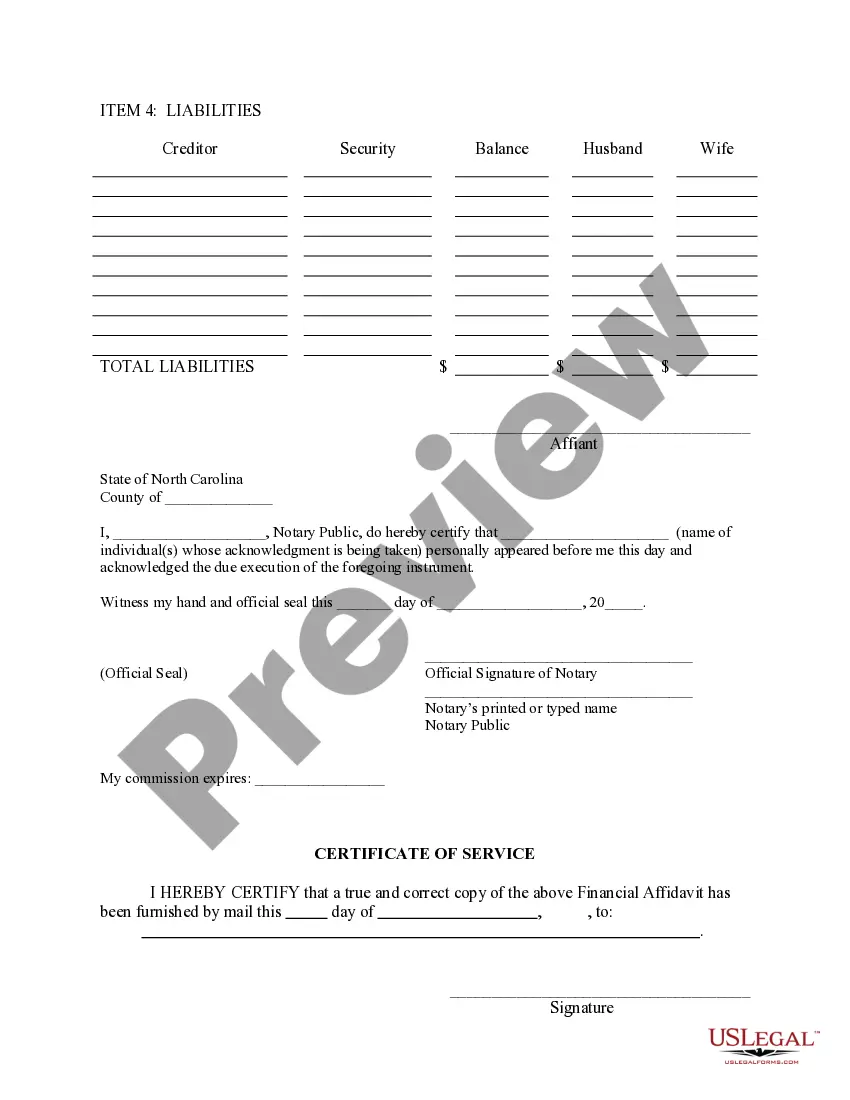

Filling out a financial affidavit is important for several reasons. It provides the court with a clear picture of your financial situation, which is often necessary in divorce proceedings, child support cases, or other legal matters. By documenting your finances, you can help ensure fair decisions are made. Using a reliable resource like USLegalForms can make the process of completing your Mecklenburg North Carolina Financial Affidavit more efficient and accurate.

Making a simple affidavit involves a few key steps. First, identify the specific purpose of your affidavit, which should relate to your financial status or another relevant issue. Then, draft a statement that clearly lays out the facts, and be prepared to sign it in front of a notary if required. For those in Mecklenburg, North Carolina, resources like USLegalForms can assist in ensuring your affidavit meets all necessary criteria.

Creating a financial affidavit in Mecklenburg, North Carolina, is straightforward. Start by gathering all financial documents, including income statements, expenses, and asset details. Next, fill out the form, making sure to provide accurate and complete information. You can simplify this process by using platforms like USLegalForms, which offer templates specifically for the Mecklenburg North Carolina Financial Affidavit.

In Mecklenburg, North Carolina, a financial affidavit typically does not require notarization. However, local courts may have specific requirements, so it’s essential to verify the rules for your situation. Notarization can add an extra layer of credibility, but it’s not always necessary. If you are unsure, consider consulting legal guidance or using services that assist with Mecklenburg North Carolina Financial Affidavit preparation.

An affidavit of financial status is a legal declaration of an individual’s current financial situation. It includes details about income, expenses, assets, and liabilities, all of which are essential in legal contexts. In Mecklenburg, North Carolina, providing an accurate affidavit of financial status can influence legal decisions, making it vital to maintain honesty and clarity in your statements.

To fill out a financial affidavit, begin by clearly outlining all your financial information, including assets, liabilities, income, and expenses. Use accurate figures and ensure that each section is completed thoroughly. Resources like US Legal Forms can assist you in creating a comprehensive Mecklenburg North Carolina financial affidavit to meet your needs.

A sworn financial affidavit is a legal document where you affirm that the information provided about your finances is true. This affidavit holds significant weight in court, especially in Mecklenburg, North Carolina, where financial transparency is critical in various legal matters. It is essential to complete this affidavit with care to avoid any discrepancies.

To fill out an affidavit example, follow the structure outlined in the document. Begin with your personal details, then proceed to detail your financial information, such as income and expenses. By reviewing examples, you can better understand how to create a Mecklenburg North Carolina financial affidavit specific to your situation.

Filling out a financial affidavit properly involves ensuring that all financial information is complete and truthful. Start by gathering your financial records, and use them to fill in each section of the affidavit accurately. In Mecklenburg, North Carolina, this document is crucial for various legal proceedings, so take your time to verify your data.

To fill out an individual financial statement, begin by collecting all relevant financial documents. Clearly list your income, expenses, assets, and liabilities in the provided sections. Make sure to double-check your entries for accuracy, as your financial affidavit can impact legal processes in Mecklenburg, North Carolina.