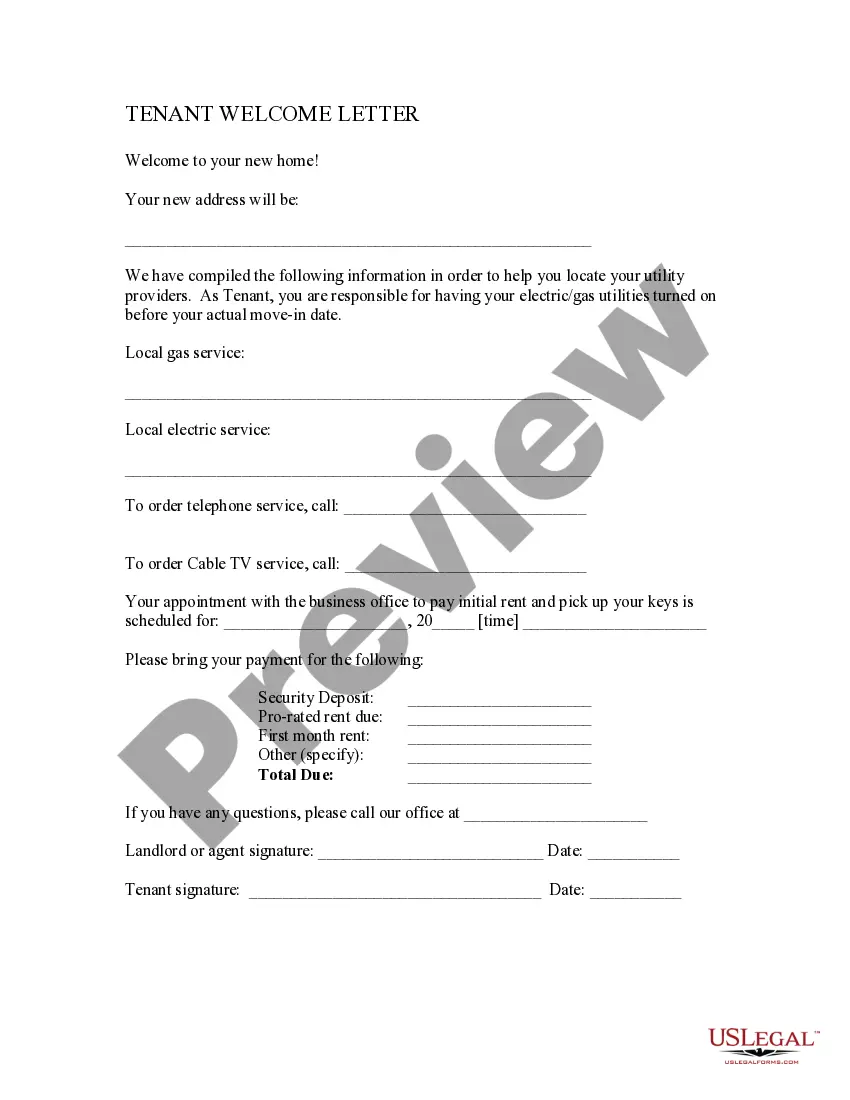

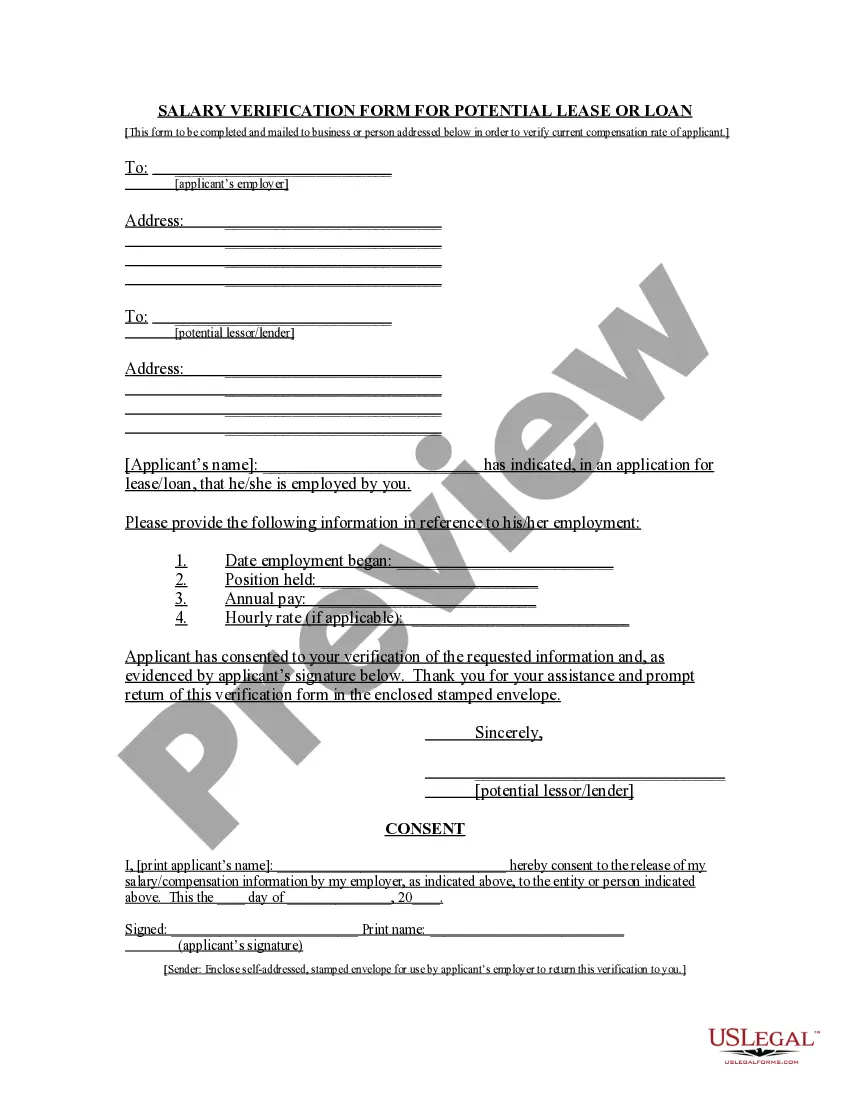

Fayetteville, North Carolina Salary Verification Form for Potential Lease is a significant document used to verify an individual's income during the rental application process. Landlords and property managers require tenants to submit this form to authenticate their ability to meet the financial obligations of renting a property. This form ensures a fair and transparent evaluation of potential tenants, helping landlords make informed decisions based on the applicant's financial stability. The Fayetteville, North Carolina Salary Verification Form for Potential Lease typically seeks detailed information about the applicant's income sources, employment details, and duration of employment. The form may include fields such as: 1. Applicant's Name: the full name of the person applying for the lease. 2. Address: the applicant's current residential address. 3. Employer Information: the name, address, and contact details of the applicant's employer. 4. Job Position: the title or position the applicant holds at their current job. 5. Employment Duration: the period of time the applicant has been working at their current job. 6. Total Monthly Income: the amount of income earned by the applicant per month. 7. Other Sources of Income: information about any additional income, such as investments, freelance work, or government assistance. 8. Pay Frequency: how often the applicant receives their paycheck (e.g., weekly, bi-weekly, monthly). 9. Supervisor Contact: the contact information of the applicant's immediate supervisor or HR representative for verification purposes. 10. Signature: the applicant's signature, acknowledging the accuracy and truthfulness of the provided information. Different types of Fayetteville, North Carolina Salary Verification Forms for Potential Lease may exist depending on the specific requirements of landlords or property management companies. These variations may include: 1. Basic Salary Verification Form: A standard form that covers the essential information about the applicant's income, employment, and contact details. 2. Comprehensive Income Verification Form: A more detailed form that requests additional information such as previous employment history, tax returns, and bank statements. 3. Self-Employed Income Verification Form: Specifically designed for self-employed individuals, this form includes sections to provide details about business income, client contracts, and profitability. 4. Two-Year Income Verification Form: Some landlords may require a form that entails income details over the past two years, including salary increases or stability checks. It is essential for potential tenants to fill out the Fayetteville, North Carolina Salary Verification Form accurately and honestly as landlords may cross-verify the information provided. This form acts as a crucial tool in ensuring both the tenant's ability to make rental payments and the landlord's peace of mind in choosing responsible and reliable renters.

Fayetteville North Carolina Salary Verification form for Potential Lease

Description

How to fill out Fayetteville North Carolina Salary Verification Form For Potential Lease?

We always strive to reduce or avoid legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal solutions that, usually, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to an attorney. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Fayetteville North Carolina Salary Verification form for Potential Lease or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Fayetteville North Carolina Salary Verification form for Potential Lease adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Fayetteville North Carolina Salary Verification form for Potential Lease would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!