The cosigner is also sometimes be called a guarantor. A guaranty is a contract under which one person (guarantor) agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Raleigh North Carolina Landlord Tenant Lease Co-Signer Agreement

Description

How to fill out North Carolina Landlord Tenant Lease Co-Signer Agreement?

If you are looking for a pertinent form, it’s infeasible to select a more suitable platform than the US Legal Forms site – likely the most extensive collections online.

Here you can obtain a vast array of form examples for business and personal use by categories and regions, or keywords.

With our sophisticated search feature, locating the latest Raleigh North Carolina Landlord Tenant Lease Co-Signer Agreement is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Select the file format and download it to your device.

- Moreover, the relevance of each document is validated by a team of experienced lawyers who regularly review the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Raleigh North Carolina Landlord Tenant Lease Co-Signer Agreement is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions provided below.

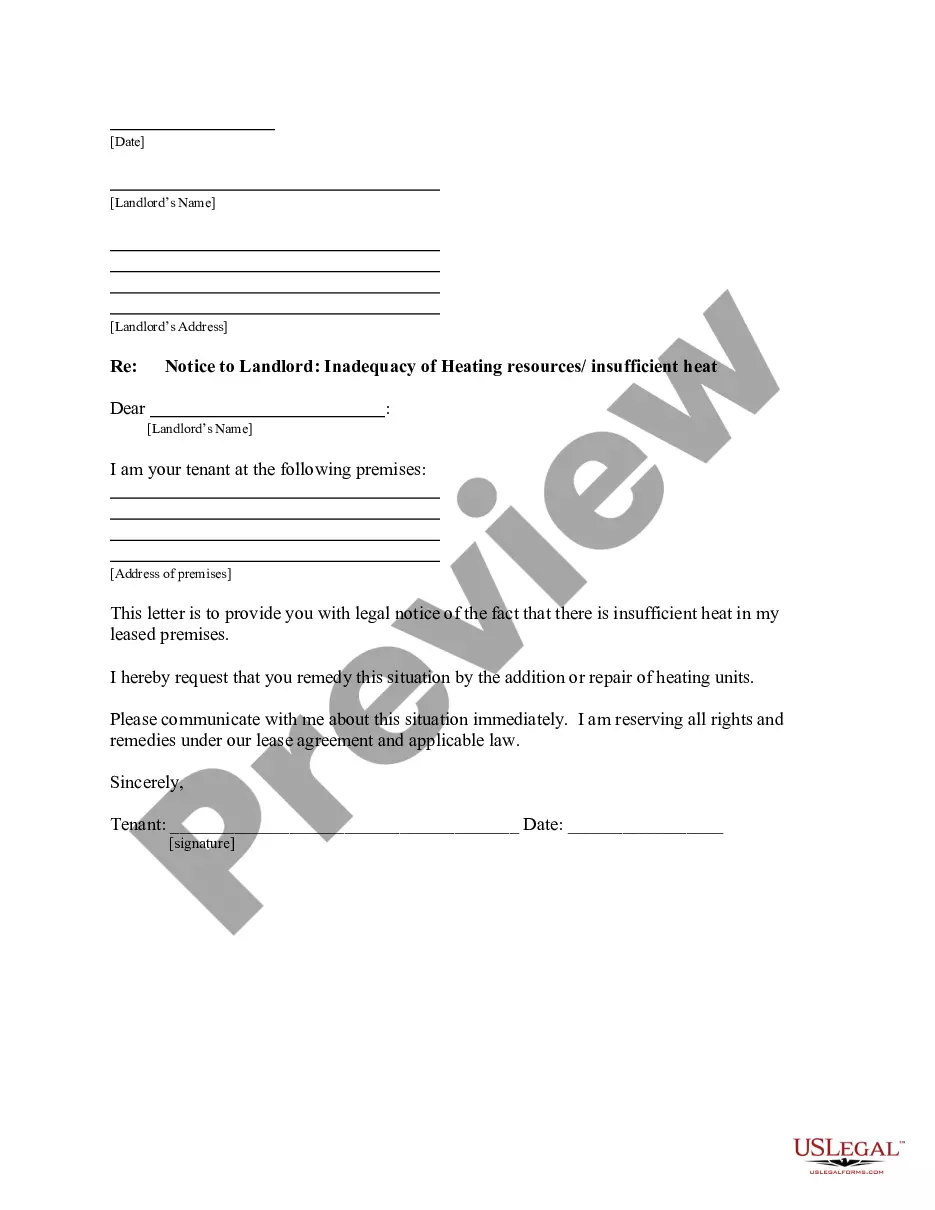

- Ensure you have located the form you need. Review its description and utilize the Preview option (if available) to inspect its content. If it doesn’t meet your requirements, use the Search field at the top of the page to find the right document.

- Confirm your choice. Click the Buy now button. Then, choose your desired pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

If you're going to ask someone to take the risk of cosigning a loan for you, respect them enough to tell them why you need a cosigner. If it's due to low credit, be honest about what caused your credit score to drop. If your score is due to mistakes you have made, be open about it.

When you cosign a lease, you are agreeing to become 100 percent responsible for that lease. In other words, if your friend decides to skip town in their brand-new car and simultaneously stop paying their $300/month car lease payments, it's on you to foot the bill.

Steps to take when accepting a cosigner. Do your research on the cosigner/guarantor. Are they a family member?Confirm you can contact the cosigner. With the Naborly application, your tenant can add a cosigner automatically and we'll reach out for you! Go through the contract with the cosigner.

When you cosign on a lease, you're making a legal promise to uphold the terms of the lease and to pay rent if the lessee does not. As a cosigner, your credit could be affected whether or not the person you're cosigning with pays their rent.

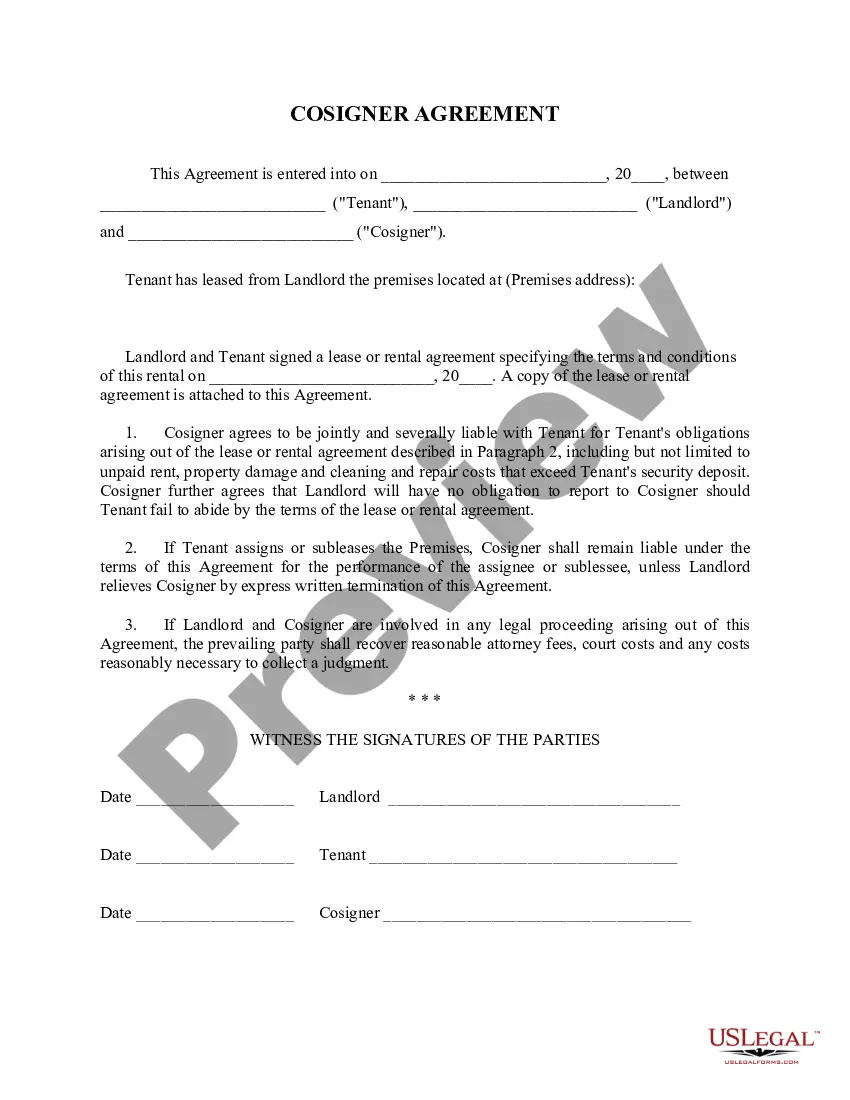

Your Co-Signer Agreement should include information like: who is the landlord; the name(s) of the tenant(s); when the original lease was signed; the rental property's location; the co-signer's name, driver's license and social security number; whether the co-signer will be responsible for any lease extensions or

How Cosigning Could Hurt Your Credit The landlord could report late payments. Some landlords report monthly rental payments to the credit bureaus, which means your payment history could take a hit if the lessee pays rent late.The debt could go to collections.An inquiry could appear on your report.

Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.

According to Nolo, a cosigner is a person designated to make the rental payments if the tenant does not pay. They sign their name to the lease agreement and are held fully responsible for rent if the tenant stops paying rent.

As a cosigner on a lease, you're not only helping someone out, you're taking on a ton of risk. For instance, if the lease holder doesn't make their payments on time, it will negatively affect your credit report and credit score.