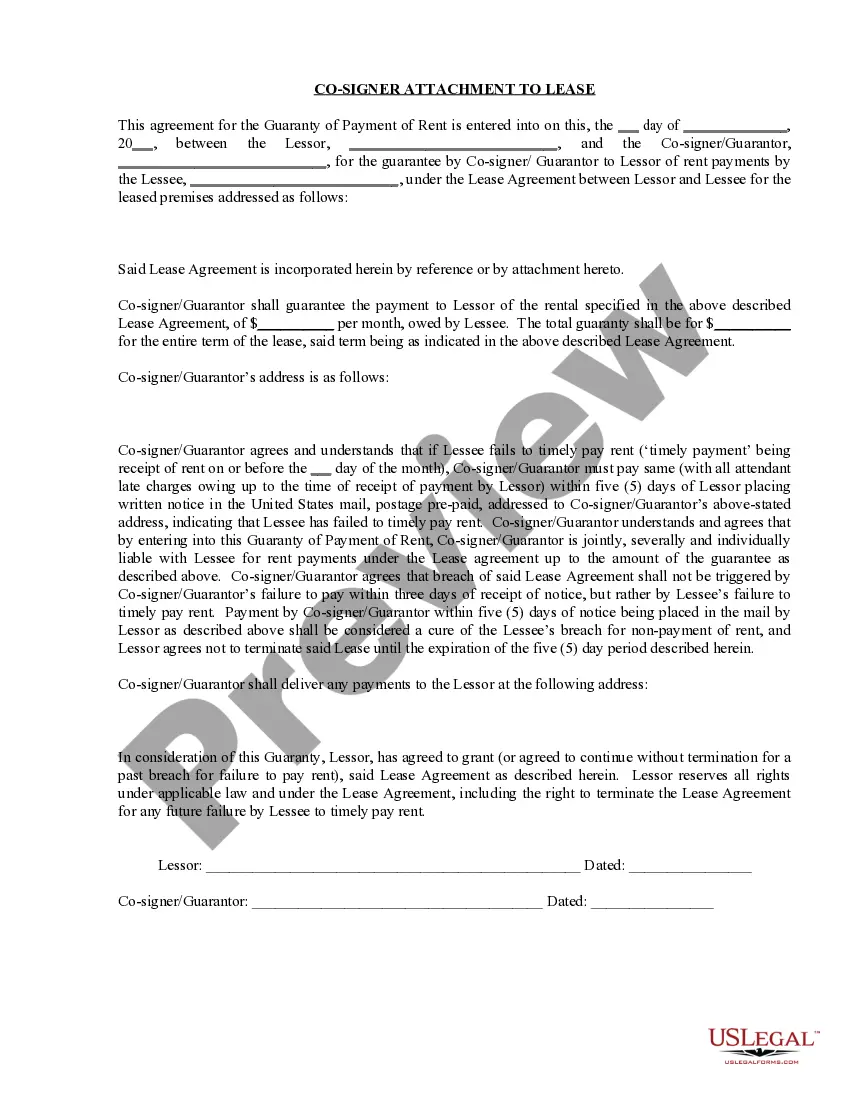

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). The Charlotte North Carolina Guaranty Attachment to Lease for Guarantor or Cosigner is a legal document that outlines the terms and conditions under which an individual (the guarantor or cosigner) agrees to act as a financial backup for another party (the tenant) in a lease agreement. This document provides additional security for the landlord or property owner in case the tenant fails to meet their obligations or defaults on the lease. The guaranty attachment clearly defines the role and responsibilities of the guarantor or cosigner, ensuring that they understand the potential risks and liabilities involved. Some key elements covered in this attachment include: 1. Identification: It includes the legal names and contact information of both the tenant and the guarantor or cosigner. 2. Lease details: The attachment references the original lease agreement to which it is attached, outlining the property details, lease term, rent amount, payment schedule, and any other relevant lease provisions. 3. Guarantee obligations: This section outlines the extent of the guarantor or cosigner's financial responsibility. It states that the guarantor will assume liability for the tenant's obligations (such as payment of rent, fees, and damages) if the tenant fails to fulfill their responsibilities. 4. Financial information: The guarantor or cosigner may be required to provide their financial information, including income details, assets, liabilities, and credit history. This helps the landlord assess their ability to financially support the tenant in case of default. 5. Consent for background checks: The attachment may include a clause allowing the landlord to conduct background checks on the guarantor or cosigner, including credit checks and character references. 6. Termination: This section specifies the circumstances under which the guarantor or cosigner's obligations may be terminated, such as the tenant fulfilling their lease obligations or a mutual agreement between the parties involved. Different types of Charlotte North Carolina Guaranty Attachment to Lease for Guarantor or Cosigner may exist, based on specific variations or preferences of landlords or tenants. Some examples may include a limited guaranty attachment, which limits the guarantor's liability to a certain amount or a specific time period. Another variation could be a conditional guaranty attachment, wherein the guarantor's obligation is contingent upon certain conditions being met. It is imperative for both the guarantor or cosigner and the tenant to carefully review and understand the terms of the guaranty attachment before signing. Seeking legal advice is also advisable to ensure all parties are aware of their rights and obligations.

The Charlotte North Carolina Guaranty Attachment to Lease for Guarantor or Cosigner is a legal document that outlines the terms and conditions under which an individual (the guarantor or cosigner) agrees to act as a financial backup for another party (the tenant) in a lease agreement. This document provides additional security for the landlord or property owner in case the tenant fails to meet their obligations or defaults on the lease. The guaranty attachment clearly defines the role and responsibilities of the guarantor or cosigner, ensuring that they understand the potential risks and liabilities involved. Some key elements covered in this attachment include: 1. Identification: It includes the legal names and contact information of both the tenant and the guarantor or cosigner. 2. Lease details: The attachment references the original lease agreement to which it is attached, outlining the property details, lease term, rent amount, payment schedule, and any other relevant lease provisions. 3. Guarantee obligations: This section outlines the extent of the guarantor or cosigner's financial responsibility. It states that the guarantor will assume liability for the tenant's obligations (such as payment of rent, fees, and damages) if the tenant fails to fulfill their responsibilities. 4. Financial information: The guarantor or cosigner may be required to provide their financial information, including income details, assets, liabilities, and credit history. This helps the landlord assess their ability to financially support the tenant in case of default. 5. Consent for background checks: The attachment may include a clause allowing the landlord to conduct background checks on the guarantor or cosigner, including credit checks and character references. 6. Termination: This section specifies the circumstances under which the guarantor or cosigner's obligations may be terminated, such as the tenant fulfilling their lease obligations or a mutual agreement between the parties involved. Different types of Charlotte North Carolina Guaranty Attachment to Lease for Guarantor or Cosigner may exist, based on specific variations or preferences of landlords or tenants. Some examples may include a limited guaranty attachment, which limits the guarantor's liability to a certain amount or a specific time period. Another variation could be a conditional guaranty attachment, wherein the guarantor's obligation is contingent upon certain conditions being met. It is imperative for both the guarantor or cosigner and the tenant to carefully review and understand the terms of the guaranty attachment before signing. Seeking legal advice is also advisable to ensure all parties are aware of their rights and obligations.