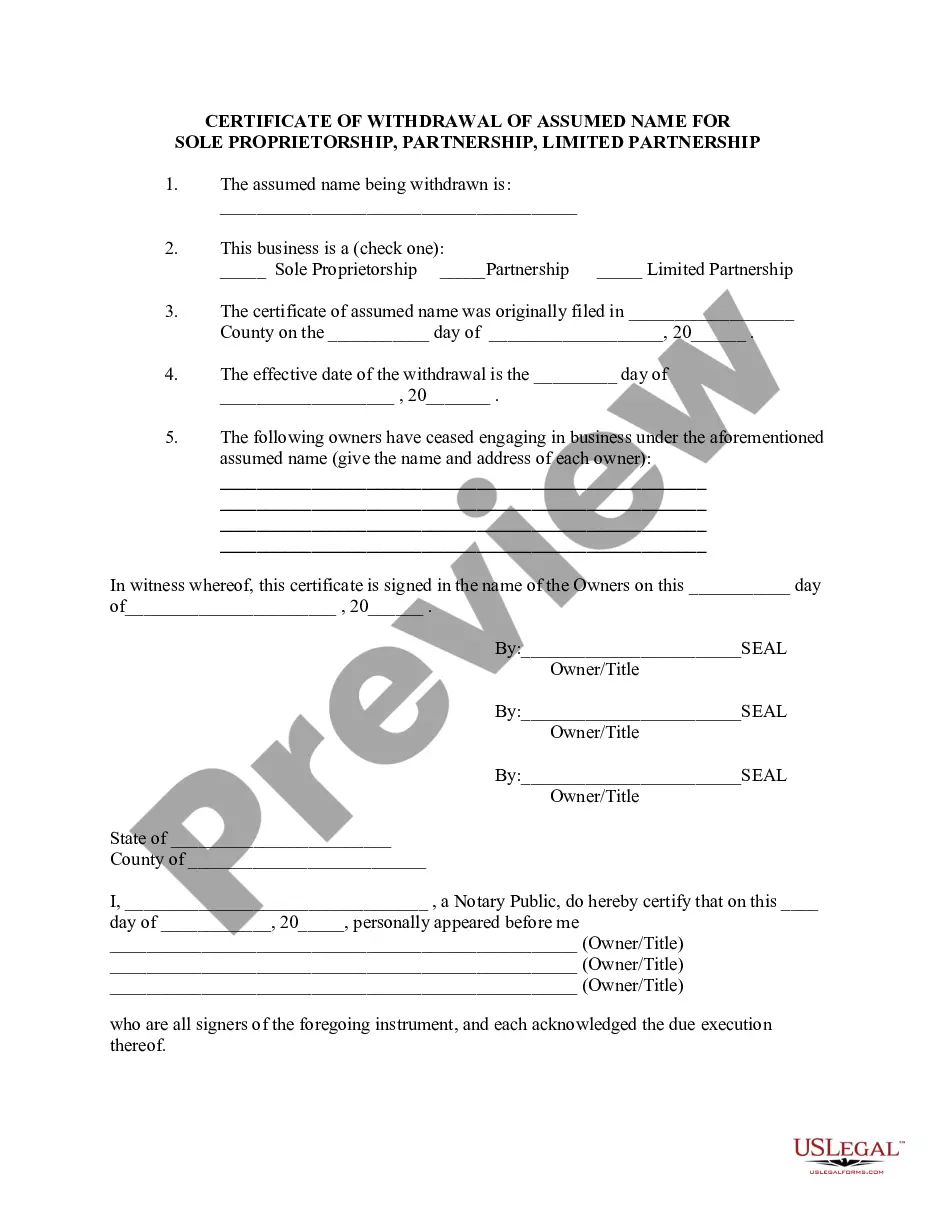

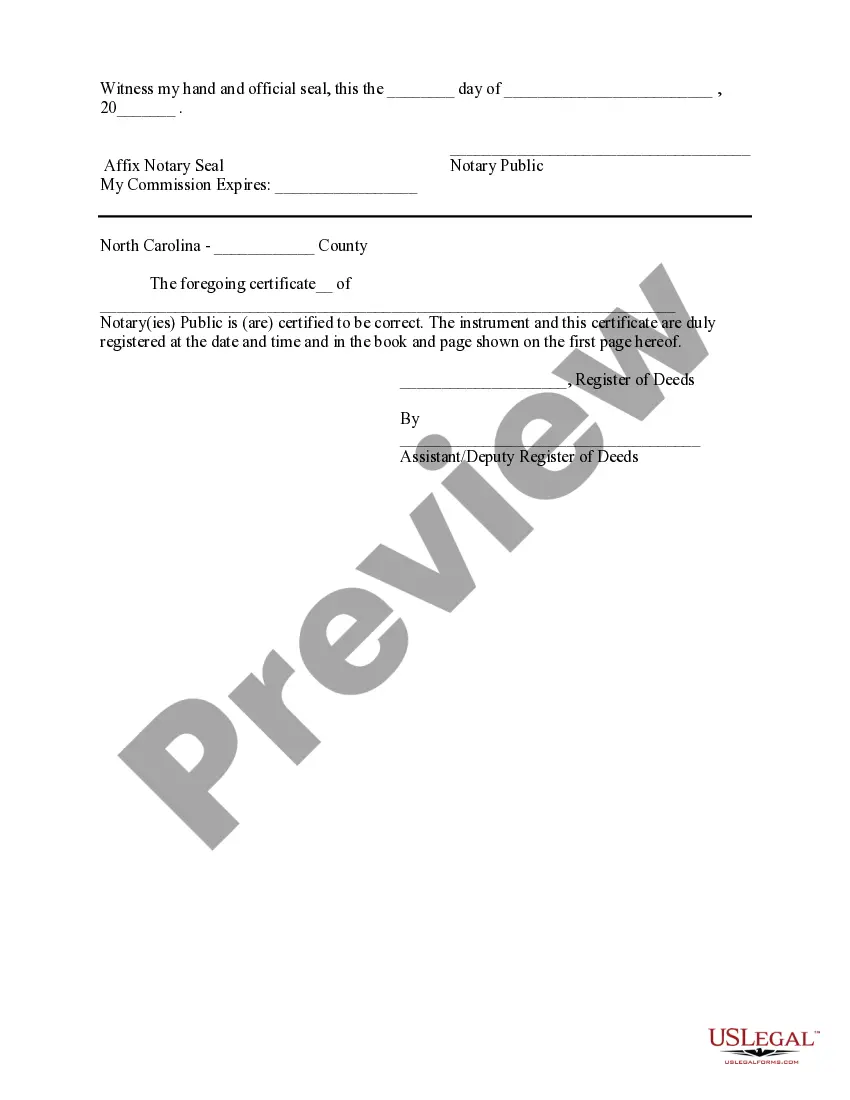

High Point, North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship, or Limited Partnership In High Point, North Carolina, businesses operating under assumed names, also known as "doing business as" (DBA), may need to file a withdrawal when they are no longer using the assumed name for their partnership, sole proprietorship, or limited partnership. This formal process ensures that the public is informed about changes in business identity and protects the rights of consumers and other stakeholders. There are several types of withdrawals for assumed names in High Point, depending on the type of business entity. These include withdrawal of assumed name for partnership, withdrawal of assumed name for sole proprietorship, and withdrawal of assumed name for limited partnership. 1. Withdrawal of Assumed Name for Partnership: Partnerships in High Point, North Carolina, may file a withdrawal of assumed name when they are no longer operating under the assumed name initially registered with the local county clerk office. This withdrawal is necessary to discontinue the use of the assumed name and revert to the legal business name of the partnership. It is important to promptly complete this withdrawal to ensure compliance with local regulations and prevent any potential legal complications. 2. Withdrawal of Assumed Name for Sole Proprietorship: Sole proprietors who have registered an assumed name for their business in High Point must file a withdrawal when they cease using that name. Whether the sole proprietor decides to operate under their legal name or choose a different assumed name, withdrawing the previous assumed name is crucial to maintain accurate record-keeping and transparency with customers and authorities. 3. Withdrawal of Assumed Name for Limited Partnership: Limited partnerships operating in High Point, North Carolina, must file a withdrawal of assumed name if they no longer wish to use the name under which they initially registered their business. This withdrawal ensures that any changes in the business identity are officially recorded, providing clarity and legal protection for all stakeholders involved in the limited partnership. To initiate the withdrawal process, the business owner or authorized representative should complete the necessary forms provided by the local county clerk's office or other relevant government agencies. These forms typically require basic information about the business, including the current assumed name, legal business name, and the reason for the withdrawal. Filing fees may apply, and it is essential to meet any specific requirements outlined by the county or state. Once the High Point, North Carolina withdrawal of assumed name for partnership, sole proprietorship, or limited partnership is filed and approved, businesses can lawfully discontinue the use of the assumed name and operate solely under their legal business name. It is recommended to keep copies of all documentation related to the withdrawal for future reference and compliance purposes. In summary, the withdrawal of assumed name for partnership, sole proprietorship, or limited partnership in High Point, North Carolina, is a formal process that allows businesses to discontinue the usage of an assumed name and revert to their legal business name. Promptly completing this withdrawal is crucial to ensure compliance with local regulations and maintain transparency with customers, partners, and authorities.

High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership

Description

How to fill out High Point North Carolina Withdrawal Of Assumed Name For Partnership, Sole Proprietorship Or Limited Partnership?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney solutions that, usually, are very expensive. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as easy if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership would work for you, you can pick the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Changing the name of your existing business involves submitting the appropriate forms to the North Carolina Secretary of State and possibly your local Register of Deeds. Be sure to check if your new name complies with state regulations. Utilizing uslegalforms can help simplify the High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership process, ensuring everything is completed correctly.

To change your business name with the NC Secretary of State, you must complete and submit a Certificate of Amendment. This form requires details about your existing business and the new name you wish to adopt. Of course, if you are also managing an assumed name change, the High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership must be executed to update your records.

To establish an LLC in Greensboro, NC, you need to file Articles of Organization with the North Carolina Secretary of State. This process includes selecting a name, appointing a registered agent, and paying the appropriate fees. Once your LLC is formed, you may also need to consider the High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership if applicable.

In North Carolina, you file your assumed name certificate at the Register of Deeds office in the county where your business operates. This essential step ensures legal recognition of your business name. If you’re planning to undergo the High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership, make sure to complete this filing accurately.

To change your name legally in North Carolina, you usually need to file a petition in the court of your county. You may also need to publish your intent to change your name in a local newspaper. If you require assistance with your business name change, consider using uslegalforms for a streamlined process involving the High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership.

To change the name of your business in North Carolina, you need to file a Certificate of Amendment with the North Carolina Secretary of State. This involves filling out the required forms and paying the necessary fees. It’s important to also complete the High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership during this process to update your assumed name.

Yes, you can change your business name without needing to obtain a new Employer Identification Number (EIN). However, this only applies if you are not changing your business structure. If you are going through the High Point North Carolina Withdrawal of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership, make sure to notify the IRS of the name change to ensure accurate records.

Withdrawing from an LLC in North Carolina typically requires submitting a notice of withdrawal to the other members and possibly filing formal paperwork with the state. Ensure you follow the operating agreement guidelines for a smooth transition. Understanding the Withdrawal of Assumed Name for Partnership helps clarify your departure and protect your interests.

The process for dissolving a partnership generally includes notifying all partners, settling accounts, and filing necessary legal documents. Each partner's rights and obligations must be addressed during this transition, ensuring a smooth process. Utilizing the Withdrawal of Assumed Name for Partnership, Sole Proprietorship, or Limited Partnership can provide clarity and closure.

Removing a partner from an LLC in North Carolina requires following the procedures stated in your LLC's operating agreement. If you cannot reach a mutual agreement, a formal vote may be necessary. Implementing a Withdrawal of Assumed Name for Partnership can also safeguard remaining partners from potential liabilities.