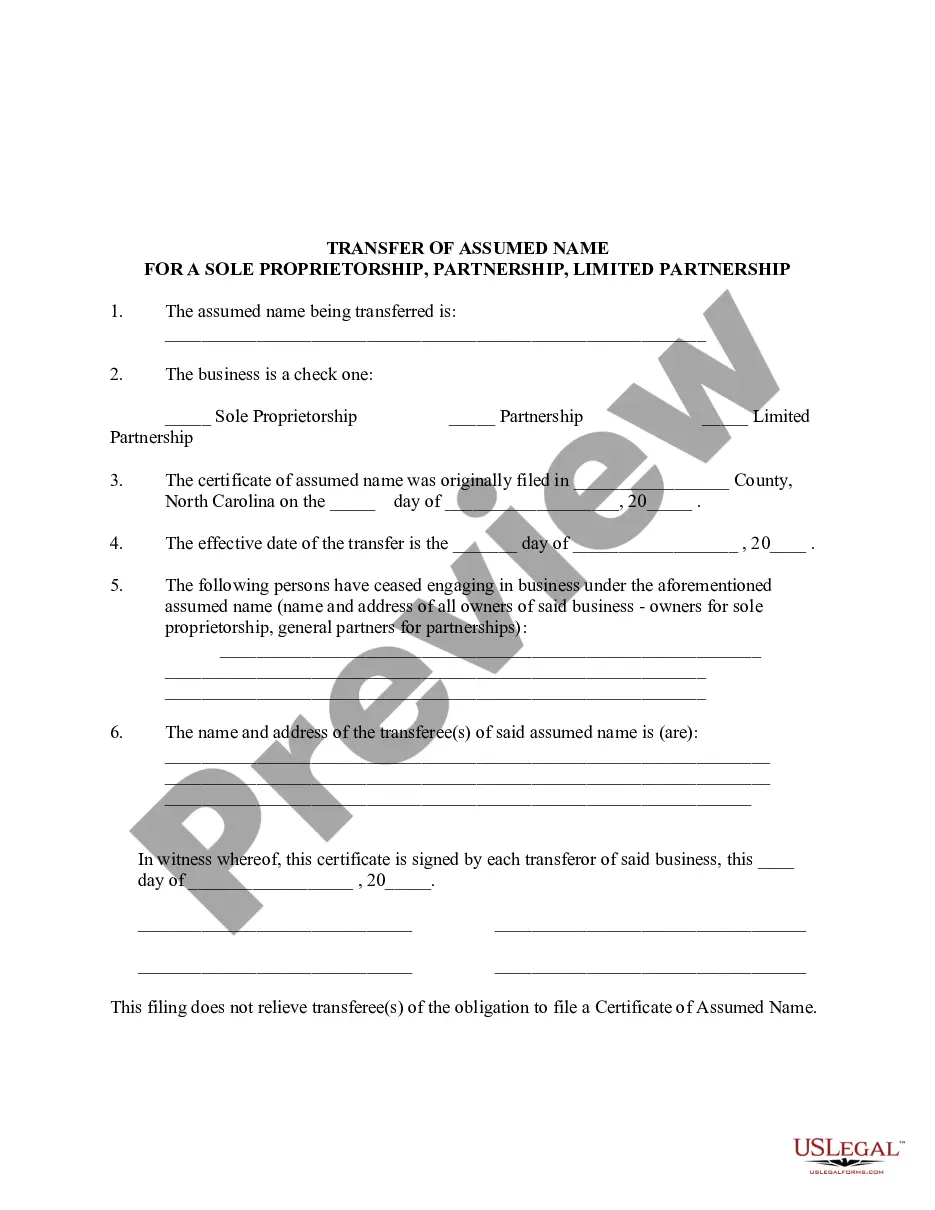

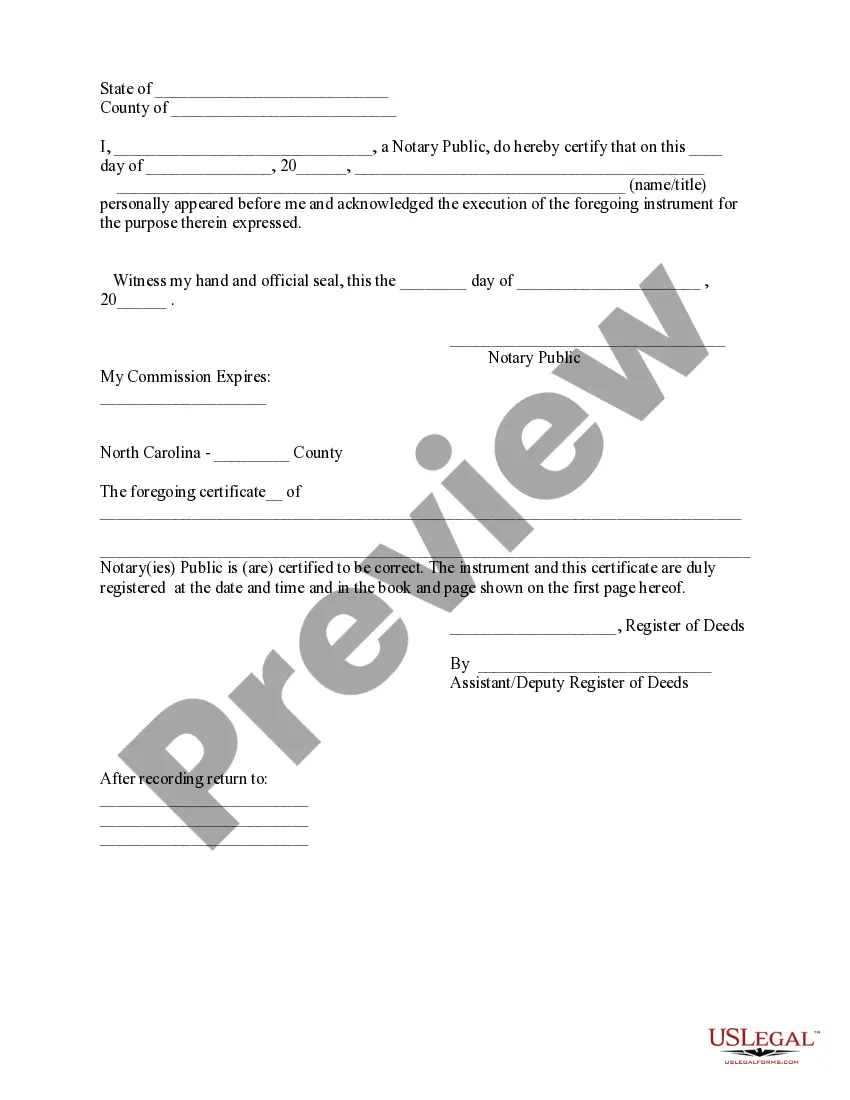

The Winston-Salem North Carolina Transfer of Assumed Name is a legal process that allows businesses operating as Partnership, Sole Proprietorship, or Limited Partnership to transfer the ownership or change the assumed name of their business. This process is essential for maintaining accurate records and ensuring transparency in business transactions. Keywords: Winston-Salem North Carolina, Transfer of Assumed Name, Partnership, Sole Proprietorship, Limited Partnership, business, ownership, legal process, change name, records, transparency, business transactions. There are different types of Transfer of Assumed Name for Partnership, Sole Proprietorship, or Limited Partnership in Winston-Salem North Carolina, namely: 1. Transfer of Assumed Name for Partnership: This type of transfer applies to businesses that operate as partnerships, where two or more individuals come together to carry out a business venture. When there is a change in partnership, or if one partner wishes to transfer their ownership or exit the partnership, the Transfer of Assumed Name process ensures that the new partner assumes the existing business name and all related legal responsibilities. 2. Transfer of Assumed Name for Sole Proprietorship: A sole proprietorship refers to a business owned and operated by a single individual. If the sole proprietor decides to sell or transfer the business to a new owner, the Transfer of Assumed Name process ensures a smooth transition. The new owner assumes the assumed name and takes over all the legal obligations associated with the business. 3. Transfer of Assumed Name for Limited Partnership: Limited partnerships involve two types of partners — general partners and limited partners. General partners have unlimited liability and are actively involved in managing the business, while limited partners have limited liability and are typically passive investors. If there is a change in the limited partnership structure or if a limited partner wants to transfer their ownership, the Transfer of Assumed Name process allows for a seamless transfer of the assumed name and the associated legal responsibilities. In all instances of Transfer of Assumed Name for Partnership, Sole Proprietorship, or Limited Partnership, it is crucial to adhere to the legal requirements set forth by the state of Winston-Salem North Carolina. This often involves submitting proper documentation, filing the necessary forms, paying fees, and updating any licenses or permits associated with the business. Adequate record keeping is also essential to ensure transparency and avoid any potential legal issues. Overall, the Transfer of Assumed Name process in Winston-Salem North Carolina provides a reliable framework for businesses to transfer ownership or change the assumed name in Partnership, Sole Proprietorship, or Limited Partnership scenarios. By following the required procedures and complying with legal obligations, businesses can ensure a smooth transition and maintain transparency in their operations.

Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership

Description

How to fill out Winston–Salem North Carolina Transfer Of Assumed Name For Partnership, Sole Proprietorship Or Limited Partnership?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our practical website featuring thousands of document templates enables you to locate and obtain nearly any document example you desire.

You can save, complete, and validate the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership in just a few minutes instead of spending hours online searching for a suitable template.

Employing our library is an excellent method to enhance the security of your record submissions.

- Our qualified lawyers routinely evaluate all the documents to ensure that the templates are applicable to specific regions and adhere to updated laws and regulations.

- How can you acquire the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership.

- If you hold a subscription, simply sign in to your account. The Download option will be activated for all the samples you access.

- Additionally, you can browse all the previously saved documents in the My documents section.

Form popularity

FAQ

Although you don't have to register a partnership in North Carolina, you must file for an assumed name if you choose to use one. This is essential for establishing your business identity and protecting your name in the marketplace. In the context of the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership, registration ensures that your business is recognized and can operate legally.

While North Carolina does not legally require a partnership agreement, having one is highly recommended. A partnership agreement clearly outlines each partner’s responsibilities, profit sharing, and dispute resolution processes. This ensures a smoother business operation, especially in situations involving the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership, where clarity is vital.

An assumed business name, often referred to as a 'doing business as' (DBA) name, is the name that your business uses other than its legal name. In North Carolina, businesses that want to operate under a different name must register this assumed name with the county register of deeds. This registration is essential when conducting the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership, as it helps in establishing your brand identity.

Any partnership that operates in North Carolina must file a partnership tax return. This includes general partnerships, limited partnerships, and limited liability partnerships. Even if your partnership does not owe taxes, it is required to report its income and expenses to maintain compliance, particularly when considering the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership.

In North Carolina, it is not mandatory to register a general partnership with the state. However, if you plan to operate under an assumed name, you must file for an assumed name certificate. This process is crucial for ensuring legal recognition and protecting your partnership's identity, especially when handling the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership.

A DBA in North Carolina for a sole proprietorship allows the owner to conduct business under a name that differs from their legal name. This is particularly beneficial in the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership context, as it enables the proprietor to market their services more effectively. Registering a DBA can enhance professionalism and help attract more customers.

While a DBA is not legally required for every business in North Carolina, it is recommended if you want to operate under a name that is different from your legal business name. Registering a DBA for the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership can help build a distinct brand identity and avoid potential legal issues. If you decide to use a DBA, you must register it with the appropriate authorities.

Yes, a sole proprietor in North Carolina may require a business license, depending on the type of business activities conducted. For example, certain professions necessitate specific permits or licenses, while others may not. Therefore, it's important to research local regulations pertaining to the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership to ensure compliance.

In the context of Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership, a DBA, or 'Doing Business As', refers to the name that a business uses to operate that is different from its legal name. This allows businesses to present a unique identity to customers. Sole proprietors and partnerships often use a DBA to differentiate their services and attract clients effectively.

In North Carolina, a sole proprietor does not need to register with the Secretary of State unless they are using an assumed name. If you choose to operate under a name that differs from your own, you must file for an assumed name certificate. This registration typically happens at the county level, but it is important for transparency. Understanding the Winston–Salem North Carolina Transfer of Assumed Name for Partnership, Sole Proprietorship or Limited Partnership can guide you through this essential step.