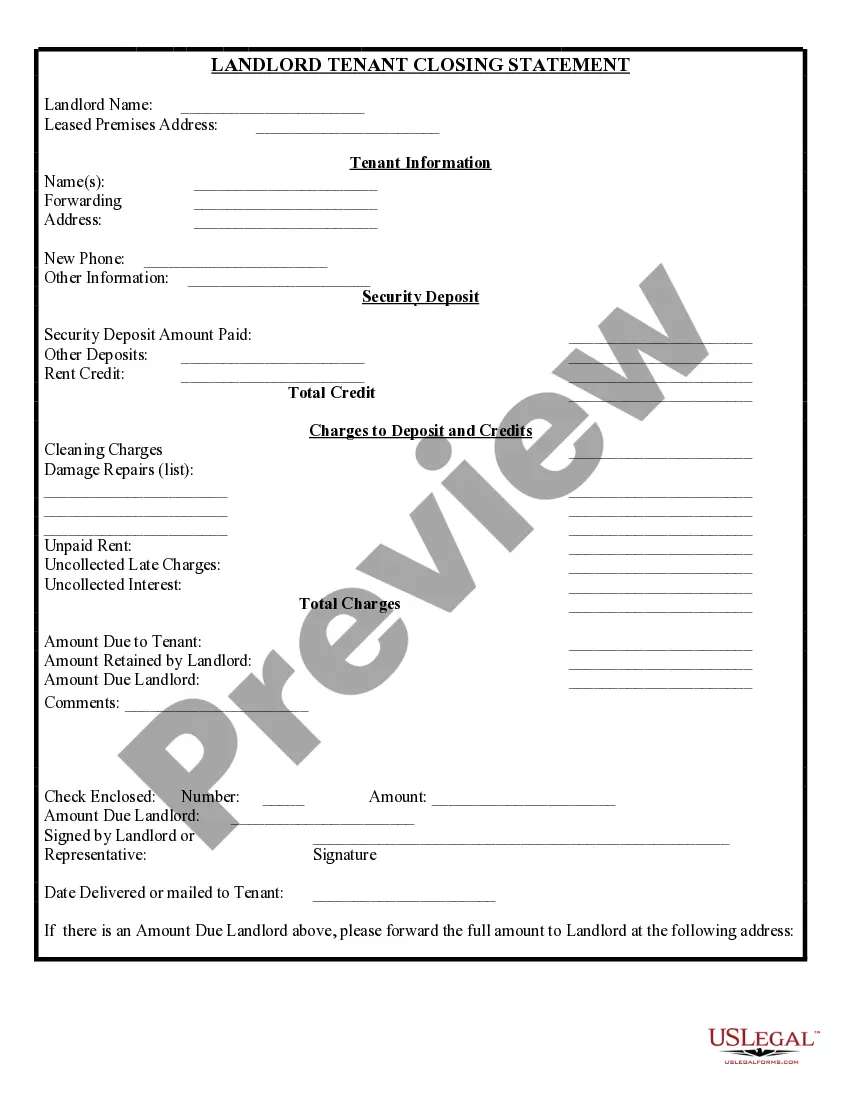

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. A High Point North Carolina Landlord Tenant Closing Statement to Reconcile Security Deposit is a document that outlines the final settlement of a security deposit between a landlord and tenant at the end of a tenancy. It serves as a legal record of the condition of the rental property and ensures proper distribution of the security deposit. Key elements typically included in a High Point North Carolina Landlord Tenant Closing Statement to Reconcile Security Deposit may consist of: 1. Property Details: The address and pertinent information of the rental property, such as the number of bedrooms, bathrooms, and any additional features or amenities. 2. Tenant Information: The full name(s) of the tenant(s), contact information, and the lease commencement and expiration dates. 3. Landlord Information: The full name(s) of the landlord(s), contact information, and any relevant identification numbers, such as the Tax ID or Social Security Number. 4. Security Deposit Details: The initial amount of the security deposit paid by the tenant at the beginning of the lease term and any interest accrued. 5. Deductions and Credits: A comprehensive list of deductions made from the security deposit, including damages beyond normal wear and tear, unpaid rent or fees, repairs, cleaning costs, or any other agreed-upon expenses. It should also include any credits or refunds due to the tenant, such as the return of the remaining security deposit balance. 6. Supporting Documentation: Any accompanying documents or receipts that justify the deductions made, like repair invoices, cleaning service bills, or written notifications to the tenant regarding deductions. 7. Dispute Resolution: A section outlining the process for resolving disputes, including any applicable time limits or requirements for providing written notice of disagreement within a specified period. There may not be different types of High Point North Carolina Landlord Tenant Closing Statements to Reconcile Security Deposit. However, variations can occur depending on the specific lease agreement, local regulations, or any predetermined conditions agreed upon by both parties. To ensure accuracy and compliance with local laws, landlords and tenants in High Point, North Carolina, are advised to consult with legal professionals or refer to official resources, such as the North Carolina General Statutes, specifically Chapter 42, Article 6, which covers landlord and tenant obligations concerning security deposits.

A High Point North Carolina Landlord Tenant Closing Statement to Reconcile Security Deposit is a document that outlines the final settlement of a security deposit between a landlord and tenant at the end of a tenancy. It serves as a legal record of the condition of the rental property and ensures proper distribution of the security deposit. Key elements typically included in a High Point North Carolina Landlord Tenant Closing Statement to Reconcile Security Deposit may consist of: 1. Property Details: The address and pertinent information of the rental property, such as the number of bedrooms, bathrooms, and any additional features or amenities. 2. Tenant Information: The full name(s) of the tenant(s), contact information, and the lease commencement and expiration dates. 3. Landlord Information: The full name(s) of the landlord(s), contact information, and any relevant identification numbers, such as the Tax ID or Social Security Number. 4. Security Deposit Details: The initial amount of the security deposit paid by the tenant at the beginning of the lease term and any interest accrued. 5. Deductions and Credits: A comprehensive list of deductions made from the security deposit, including damages beyond normal wear and tear, unpaid rent or fees, repairs, cleaning costs, or any other agreed-upon expenses. It should also include any credits or refunds due to the tenant, such as the return of the remaining security deposit balance. 6. Supporting Documentation: Any accompanying documents or receipts that justify the deductions made, like repair invoices, cleaning service bills, or written notifications to the tenant regarding deductions. 7. Dispute Resolution: A section outlining the process for resolving disputes, including any applicable time limits or requirements for providing written notice of disagreement within a specified period. There may not be different types of High Point North Carolina Landlord Tenant Closing Statements to Reconcile Security Deposit. However, variations can occur depending on the specific lease agreement, local regulations, or any predetermined conditions agreed upon by both parties. To ensure accuracy and compliance with local laws, landlords and tenants in High Point, North Carolina, are advised to consult with legal professionals or refer to official resources, such as the North Carolina General Statutes, specifically Chapter 42, Article 6, which covers landlord and tenant obligations concerning security deposits.