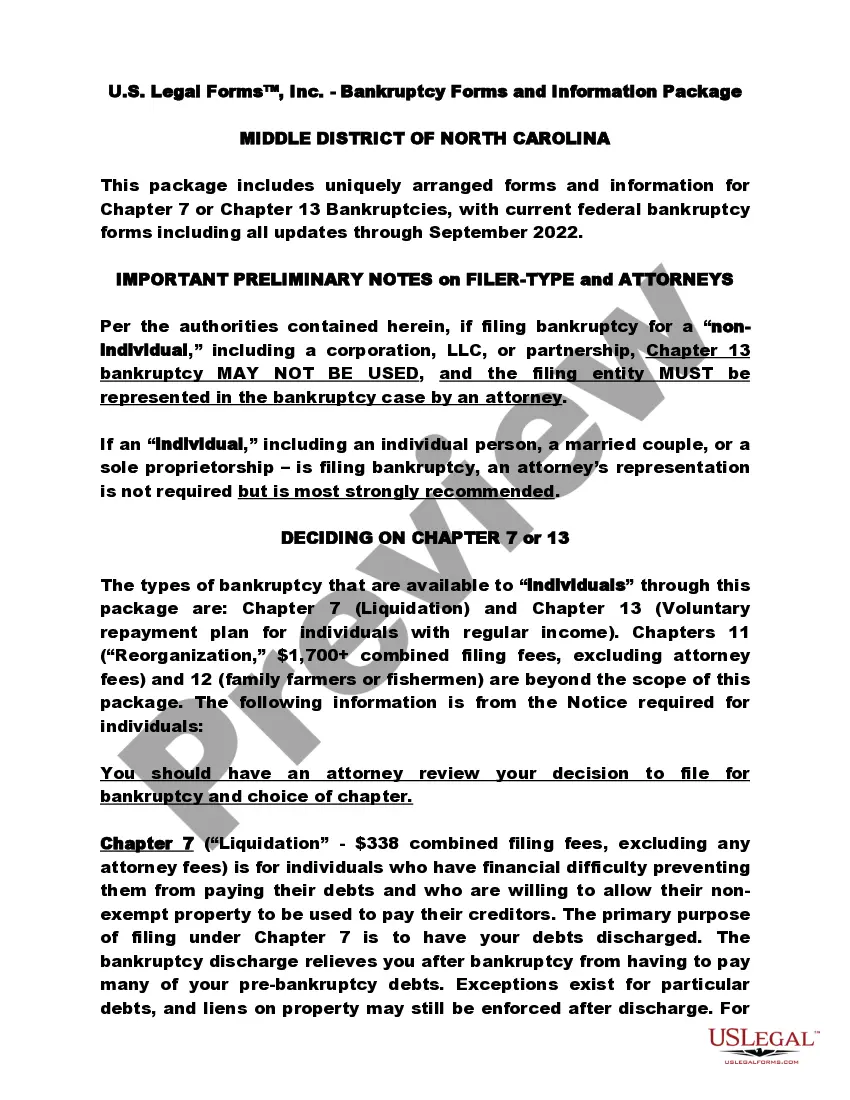

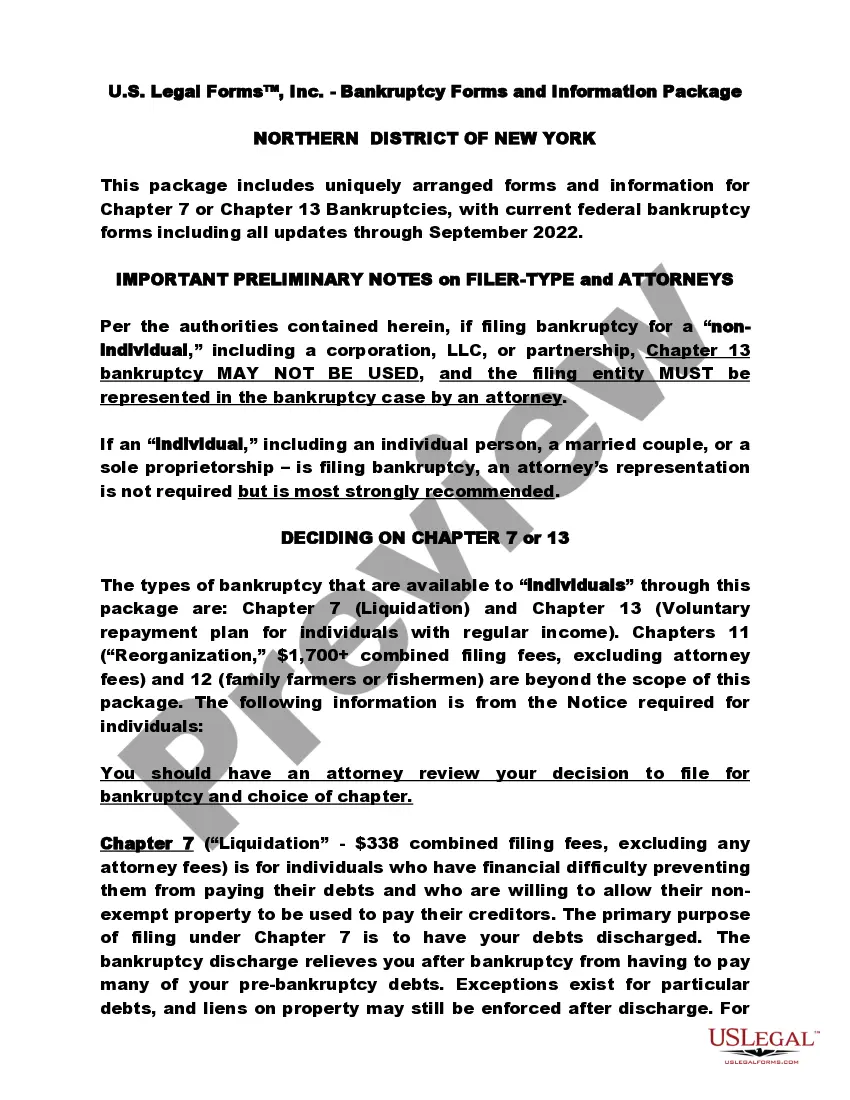

Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

The Winston-Salem North Carolina Western District Bankruptcy Guide and Forms Package for Chapters 7 or 13 is a comprehensive resource designed to assist individuals or businesses facing bankruptcy in the western district of North Carolina. This guide provides detailed information and step-by-step instructions on how to navigate the bankruptcy process under either Chapter 7 or Chapter 13. Chapter 7 bankruptcy is often referred to as "liquidation" bankruptcy and is available to individuals or businesses who are unable to repay their debts. This package includes all the necessary forms and documents required to file for Chapter 7 bankruptcy in the western district of North Carolina. It provides detailed guidance on eligibility requirements, asset exemptions, and the role of the bankruptcy trustee. On the other hand, Chapter 13 bankruptcy is known as "reorganization" bankruptcy and is an option for individuals or businesses who have a steady income but are struggling with overwhelming debts. This bankruptcy package also covers all the required forms and documents for filing Chapter 13 bankruptcy in the western district of North Carolina. It offers instructions on creating a repayment plan to pay off debts over a period of three to five years. The Winston-Salem North Carolina Western District Bankruptcy Guide and Forms Package highlights the importance of understanding the bankruptcy process, including the mandatory credit counseling and debtor education courses. It also provides useful information on important deadlines, attending meetings of creditors, and the discharge of debts. Whether one is considering Chapter 7 or Chapter 13 bankruptcy, this comprehensive package ensures that individuals or businesses have access to all the necessary forms and guidance to successfully navigate the bankruptcy process. By using this guide, individuals can better understand their rights and responsibilities, make informed decisions, and work towards regaining financial stability.The Winston-Salem North Carolina Western District Bankruptcy Guide and Forms Package for Chapters 7 or 13 is a comprehensive resource designed to assist individuals or businesses facing bankruptcy in the western district of North Carolina. This guide provides detailed information and step-by-step instructions on how to navigate the bankruptcy process under either Chapter 7 or Chapter 13. Chapter 7 bankruptcy is often referred to as "liquidation" bankruptcy and is available to individuals or businesses who are unable to repay their debts. This package includes all the necessary forms and documents required to file for Chapter 7 bankruptcy in the western district of North Carolina. It provides detailed guidance on eligibility requirements, asset exemptions, and the role of the bankruptcy trustee. On the other hand, Chapter 13 bankruptcy is known as "reorganization" bankruptcy and is an option for individuals or businesses who have a steady income but are struggling with overwhelming debts. This bankruptcy package also covers all the required forms and documents for filing Chapter 13 bankruptcy in the western district of North Carolina. It offers instructions on creating a repayment plan to pay off debts over a period of three to five years. The Winston-Salem North Carolina Western District Bankruptcy Guide and Forms Package highlights the importance of understanding the bankruptcy process, including the mandatory credit counseling and debtor education courses. It also provides useful information on important deadlines, attending meetings of creditors, and the discharge of debts. Whether one is considering Chapter 7 or Chapter 13 bankruptcy, this comprehensive package ensures that individuals or businesses have access to all the necessary forms and guidance to successfully navigate the bankruptcy process. By using this guide, individuals can better understand their rights and responsibilities, make informed decisions, and work towards regaining financial stability.