The Mecklenburg North Carolina Chapter 13 Plan refers to a specific type of bankruptcy filing and the corresponding repayment plan available to residents of Mecklenburg County in North Carolina. Designed for individuals with a regular income, Chapter 13 bankruptcy allows debtors to reorganize their debts under court supervision while still maintaining control of their assets. Under the Mecklenburg North Carolina Chapter 13 Plan, debtors propose a repayment scheme to the bankruptcy court, which must be approved by both the court and the creditors involved. This plan typically spans over a period of three to five years, during which debtors commit to making regular payments to a bankruptcy trustee. The focus of the Chapter 13 plan is to provide debtors with an opportunity to catch up on missed payments and discharge a portion of their debts, while still retaining their assets and working towards financial stability. The plan commonly includes restructuring secured debts such as mortgages and car loans, allowing debtors to catch up on past-due payments and avoid foreclosure or repossession. In addition to secured debts, the Chapter 13 plan also covers unsecured debts, including credit card debts, medical bills, and personal loans. The plan may propose to pay a percentage of the total outstanding unsecured debts based on the debtor's disposable income. At the end of the repayment period, any remaining unpaid balances on eligible debts may be discharged. It is worth noting that not all Chapter 13 plans are the same, as they are customized to each individual's financial circumstances and debt obligations. However, some common variations of the Mecklenburg North Carolina Chapter 13 Plan include: 1. Percentage Plan: This plan outlines a repayment proposal that involves paying a certain percentage of unsecured debts based on the debtor's disposable income. The percentage usually varies depending on factors such as income, expenses, and the amount of debt owed. 2. Priority Debt Plan: Designed for debtors with significant priority debts, such as tax liabilities or child support obligations, this type of plan focuses on ensuring these debts are repaid in full throughout the repayment period. The remaining unsecured debts may be discharged or paid partially, depending on the debtor's disposable income. 3. Cram down Plan: In cases where the value of secured debts exceeds the actual value of the collateral, debtors may propose an Arm down plan. This plan allows debtors to reduce the outstanding principal balance of certain secured debts to match the current value of the collateral while paying a portion of the remaining debt through the Chapter 13 plan. In conclusion, the Mecklenburg North Carolina Chapter 13 Plan provides a valuable opportunity for individuals in financial distress to reorganize their debts, catch up on missed payments, and protect their assets. With various types of plans tailored to individual circumstances, debtors can work towards resolving their debts and achieving a fresh financial start.

Mecklenburg North Carolina Chapter 13 Plan

Description

How to fill out Mecklenburg North Carolina Chapter 13 Plan?

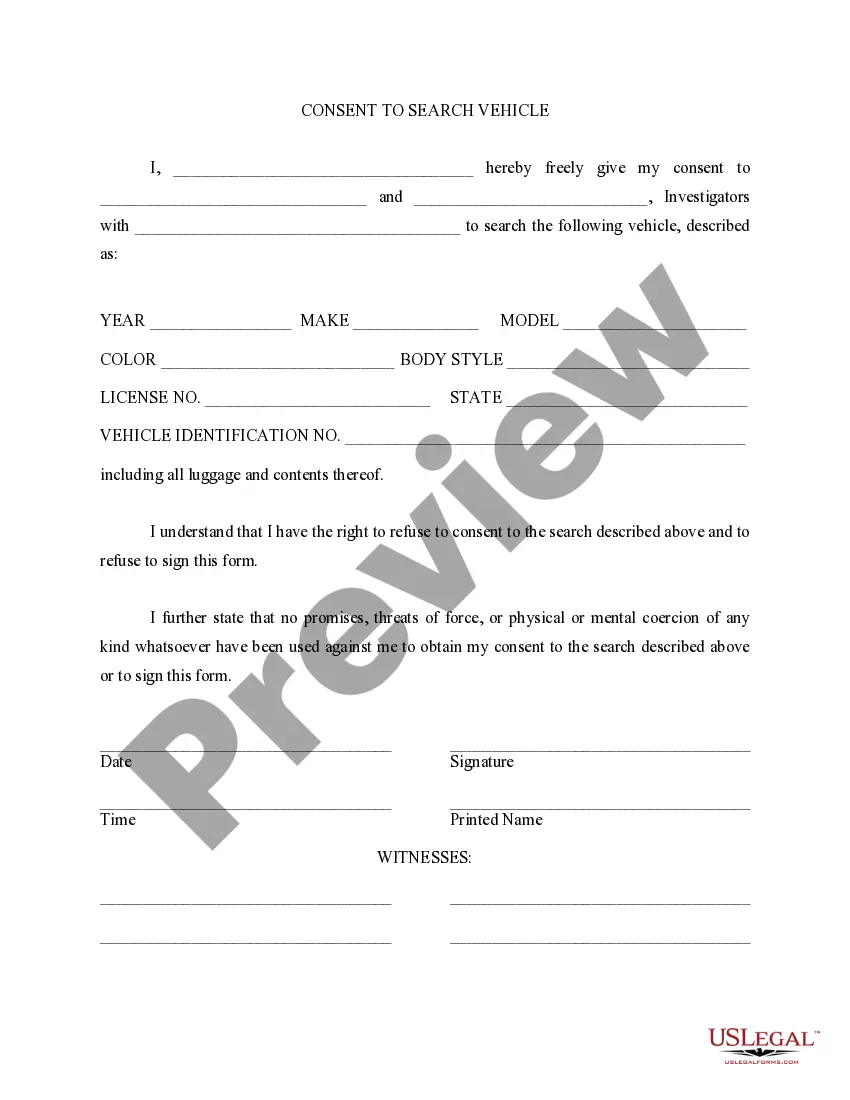

Are you looking for a reliable and inexpensive legal forms supplier to get the Mecklenburg North Carolina Chapter 13 Plan? US Legal Forms is your go-to solution.

Whether you require a simple agreement to set rules for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and area.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Mecklenburg North Carolina Chapter 13 Plan conforms to the regulations of your state and local area.

- Read the form’s description (if available) to find out who and what the form is good for.

- Start the search over in case the template isn’t good for your specific situation.

Now you can register your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Mecklenburg North Carolina Chapter 13 Plan in any available file format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal paperwork online once and for all.

Form popularity

FAQ

CHAPTER 13 BANKRUPTCY If you have a month where you receive an unexpected lump sum or windfall, you must pay the lump sum in to the bankruptcy as well. Just like in Chapter 7 Bankruptcy, however, you get to keep whatever you win after the creditors are paid off.

The debtor may be allowed to retain the increase in income unless the increase is significant and there are no offsetting increases in expenses. The Bankruptcy Code requires that the debtor contribute his or her projected disposable income toward the plan payments for the first three years (36 months) of the plan.

If you want, any case can be 60 months, which is the maximum length allowed in Chapter 13. To qualify for a 36-month plan, the amount of gross income received in the 6 calendar months prior to filing your case must be below the median income for your household size and geographic area.

Generally speaking, the funds you have in your bank accounts are safe when you file for Chapter 13 bankruptcy. Debtors filing for Chapter 13 bankruptcy ordinarily do not have to worry about what will happen to their checking or savings accounts.

Chapter 13 allows you to keep all of your assets, even if you have $1 million in cash in the bank. In return, the court asks you to pay at least some of your debt back over the next three or five years.

The Chapter 13 plan base is the amount that the debtor must pay during the duration of the plan in order to receive a discharge and complete a bankruptcy case.

The scheduled amount is what the debtor says is owed to creditor. The actual amount to be paid to the creditor is determined by the claim filed by the creditor.

Once you deduct your expenses from your income, you're left with your disposable income. Your disposable income gets applied to your debts according to priorities. To calculate your Chapter 13 monthly payment amount, you compare your disposable income to your debts.

Yes, it's highly likely that your appointed trustee will check both your personal bank accounts and any business-related bank accounts which you may have under your name.

Your monthly net income (gross pay less employment taxes, income taxes, health insurance plan deductions, etc) is the starting point.