Wilmington North Carolina Chapter 13 Plan — Understanding the Bankruptcy Solution The Wilmington North Carolina Chapter 13 Plan is a legal mechanism designed to help individuals and small businesses struggling with overwhelming debt regain control of their financial situation. Filed under Chapter 13 of the United States Bankruptcy Code, this debt reorganization plan allows debtors to create a repayment plan tailored to their specific circumstances, making it an attractive option for those seeking to resolve their financial woes. Chapter 13 bankruptcy is suitable for individuals and small businesses with a stable income and the ability to repay a portion of their debts over a three to five-year period. By opting for a Chapter 13 Plan, debtors can prevent foreclosure, halt collection efforts, and possibly reduce or eliminate certain types of debts. Key Features of Wilmington North Carolina Chapter 13 Plan: 1. Repayment Plan: The Chapter 13 Plan requires the debtor to propose a comprehensive repayment plan, detailing how they intend to repay their creditors. The plan is submitted to the bankruptcy court for approval. 2. Duration: The plan typically spans a period of three to five years, allowing the debtor ample time to repay their debts in manageable installments. 3. Debt Consolidation: Chapter 13 consolidates the debtor's debts into a single monthly payment, often significantly lower than the combined amount previously owed. 4. Home Preservation: One of the most significant advantages of Chapter 13 is its ability to halt foreclosure proceedings and allow debtors to catch up on missed mortgage payments over time, thus saving their homes. Different Types of Wilmington North Carolina Chapter 13 Plans: 1. Individual Debtors: These plans are primarily designed for individuals with regular income. They enable debtors to keep their property while repaying debts through a structured plan. 2. Small Business Debtors: Chapter 13 Plans are also available for small businesses seeking to reorganize their debts. This allows them to continue operations while repaying creditors over a predetermined period. 3. Wage Earner Plans: This type of Chapter 13 Plan is specifically tailored for individuals with a regular source of income from wages or salary. It allows them to repay their debts based on their disposable income. In summary, the Wilmington North Carolina Chapter 13 Plan offers individuals and small businesses a viable solution to regain control of their finances. By proposing a repayment plan that considers their income, the debtor can restructure their debts, potentially save their homes from foreclosure, and work towards a more secure financial future. Whether it is an individual debtor, small business debtor, or wage earner, Chapter 13 provides a flexible and powerful tool to overcome financial challenges and achieve long-term stability.

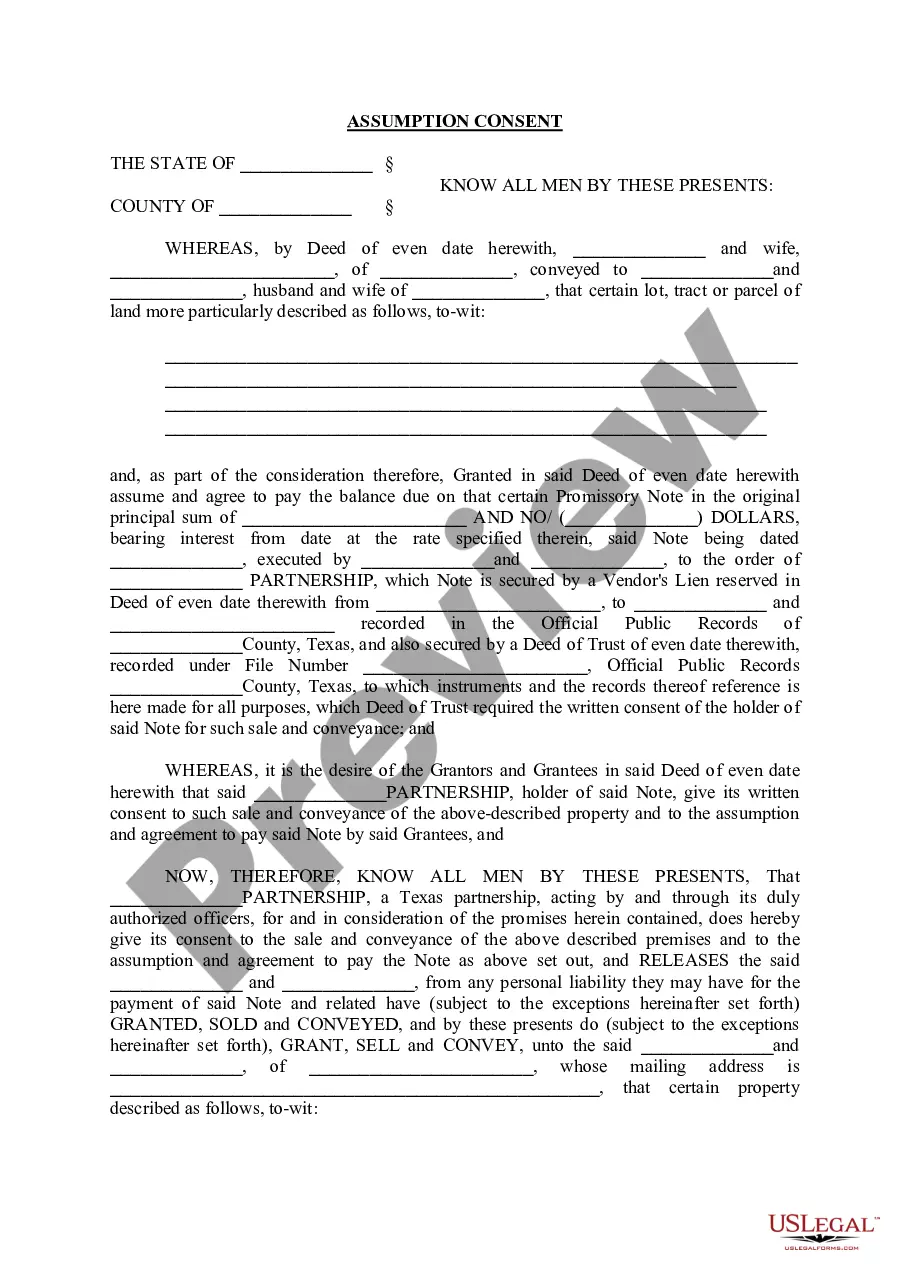

Wilmington North Carolina Chapter 13 Plan

Description

How to fill out Wilmington North Carolina Chapter 13 Plan?

Do you need a trustworthy and affordable legal forms supplier to buy the Wilmington North Carolina Chapter 13 Plan? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of specific state and county.

To download the document, you need to log in account, locate the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Wilmington North Carolina Chapter 13 Plan conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is intended for.

- Restart the search if the form isn’t suitable for your legal scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Wilmington North Carolina Chapter 13 Plan in any available file format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time learning about legal papers online for good.