In Charlotte, North Carolina, a reaffirmation agreement is a legal contract that allows a debtor to keep their secured property, such as a car or a house, in exchange for continuing to make payments on the associated loan even after the debtor files for bankruptcy. By entering into this agreement, the debtor essentially agrees to repay the debt owed, as if the bankruptcy filing had not occurred. Reaffirmation agreements are typically entered into voluntarily by the debtor, with the intention of retaining their property. There are several types of reaffirmation agreements that may be encountered in Charlotte, North Carolina. One common type is the mortgage reaffirmation agreement, which is used to retain ownership of a home or property secured by a mortgage loan. Another type is the vehicle reaffirmation agreement, which allows a debtor to keep their automobile by continuing to make loan payments. These agreements are subject to specific rules and procedures outlined in the bankruptcy code. In Charlotte, North Carolina, reaffirmation agreements must be filed with the bankruptcy court and approved by a judge to be legally binding. The agreement should include detailed information about the debtor, the secured property, and the terms of the reaffirmed debt, including interest rates, payment amounts, and the duration of the agreement. It is essential for debtors in Charlotte, North Carolina, to carefully consider whether entering into a reaffirmation agreement is in their best interest. While these agreements can help in retaining possession of important assets, such as a home or vehicle, debtors should weigh the potential consequences of continuing to be liable for the debt after bankruptcy. Seeking guidance from an experienced bankruptcy attorney is advised to understand the legal implications and potential risks associated with reaffirmation agreements.

Charlotte North Carolina Reaffirmation Agreement

Description

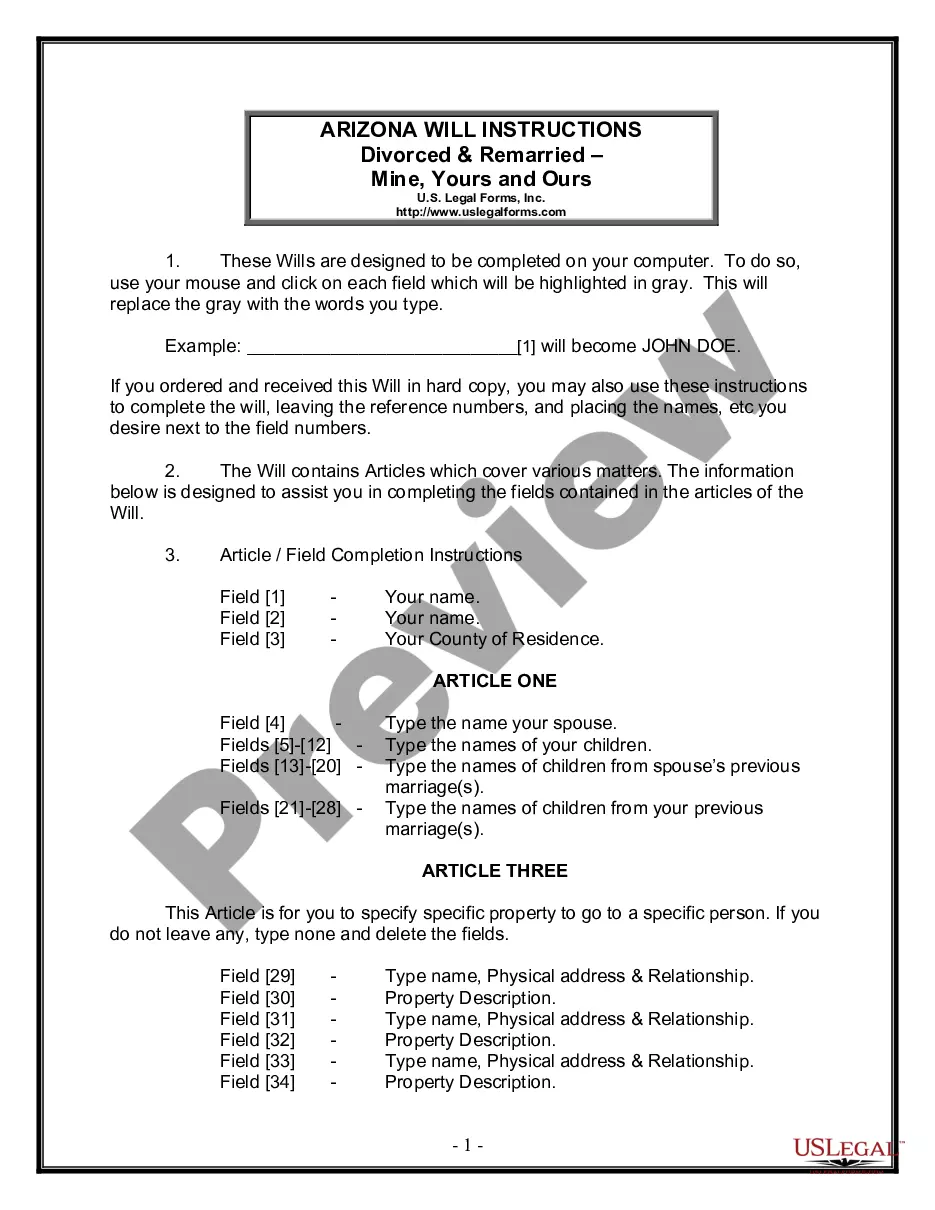

How to fill out Charlotte North Carolina Reaffirmation Agreement?

Are you in search of a reliable and affordable legal forms provider to purchase the Charlotte North Carolina Reaffirmation Agreement? US Legal Forms is your ideal option.

Whether you need a simple contract to establish guidelines for living together with your partner or a collection of paperwork to proceed with your divorce in court, we have you covered.

Our site offers over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not one-size-fits-all and are tailored to meet the specific requirements of individual states and regions.

To download the document, you need to Log Into your account, locate the desired form, and click the Download button adjacent to it. Please keep in mind that you can download your previously purchased form templates at any time from the My documents section.

Now you can set up your account. Then select the subscription plan and move on to payment. Once the payment is processed, download the Charlotte North Carolina Reaffirmation Agreement in any available file format.

You can revisit the website whenever you need and redownload the document at no extra cost. Finding current legal documents has never been more straightforward. Try US Legal Forms today, and stop wasting your precious time navigating legal paperwork online once and for all.

- Is it your first time visiting our platform? No problem.

- You can set up an account in just a few minutes, but first, ensure that you do the following.

- Confirm if the Charlotte North Carolina Reaffirmation Agreement aligns with the rules of your state and locality.

- Review the form’s description (if available) to understand who can use the document and for what purpose.

- Restart the search if the form does not meet your particular situation.

Form popularity

FAQ

If you want to file a reaffirmation agreement, you need to do so within 60 days of the first date of the meeting of creditors. Once you submit it, it must be accepted by the creditor.

A reaffirmation agreement removes a specific debt from your bankruptcy discharge and legally obligates you to make payments based on the terms of the agreement.

When you reaffirm a car loan in bankruptcy, you sign an agreement with the lender that you will continue to pay for the car as if you had not filed bankruptcy in exchange for keeping it. To reaffirm a car loan, you must be able to show the court that the vehicle is necessary and that the payment is reasonable.

If the Court denies the reaffirmation agreement, you are in technical default again. This is part of the trade?off between Chapters 7 and 13. In exchange for a quick, efficient, inexpensive discharge of your debts, you give up control over the actions of creditors.

Reaffirmation Provides Certainty Against Repossession If you don't sign a reaffirmation agreement, the lender can repossess your car after your case closes and the automatic stay lifts. Some car lenders are known to repossess the car immediately, even if you are current on payments.

Reaffirmation is voluntary You don't have to reaffirm. In fact, the form that you file with your bankruptcy papers allows you to elect to surrender the car. Surrender may be the best thing if the car is simply too expensive or isn't reliable. You can choose to keep the car and continue paying without reaffirming.