A Detailed Description of High Point North Carolina Reaffirmation Agreement In High Point, North Carolina, a reaffirmation agreement is a legally binding contract that allows individuals who have filed for bankruptcy to continue making payments on specific debts. This agreement is typically used for secured debts, such as car loans or home mortgages, where the debtor wants to keep the property pledged as collateral. By entering into a reaffirmation agreement, the debtor agrees to be personally liable for the debt, even after the bankruptcy discharge. High Point North Carolina Reaffirmation Agreement ensures that the debtor retains possession of the secured property and can continue to make regular payments as agreed upon with the creditor. By reaffirming the debt, the individual acknowledges that they are still obligated to repay it, despite bankruptcy. This is especially important because, under the bankruptcy laws, the automatic stay provision prohibits creditors from taking any collection actions during the bankruptcy process. The High Point North Carolina Reaffirmation Agreement provides a legal framework for both the debtor and the creditor. It outlines the terms and conditions of the debt repayment, including the interest rate, payment schedule, and any other relevant details. The agreement also includes provisions to protect the debtor's rights, such as a right to cancel the reaffirmation agreement within a specified time frame after signing. While the High Point North Carolina Reaffirmation Agreement applies to various types of secured debts, there are a few common types of reaffirmation agreements that individuals may encounter: 1. Vehicle Reaffirmation Agreement: This type of reaffirmation agreement is specific to car loans. It allows the debtor to retain ownership and continue making payments on their vehicle, ensuring they can maintain reliable transportation. 2. Mortgage Reaffirmation Agreement: Homeowners facing bankruptcy may opt for a mortgage reaffirmation agreement to retain their property. This agreement enables them to continue making mortgage payments and prevent foreclosure. 3. Personal Property Reaffirmation Agreement: For individuals with secured loans on belongings such as furniture, appliances, or electronics, a personal property reaffirmation agreement ensures they can keep these items by continuing to make regular payments. By entering into a High Point North Carolina Reaffirmation Agreement, individuals can demonstrate their commitment to repay specific debts and preserve their ownership or possession of important assets. It is essential to consult with an attorney experienced in bankruptcy law to ensure legal compliance and protect one's rights during the reaffirmation process.

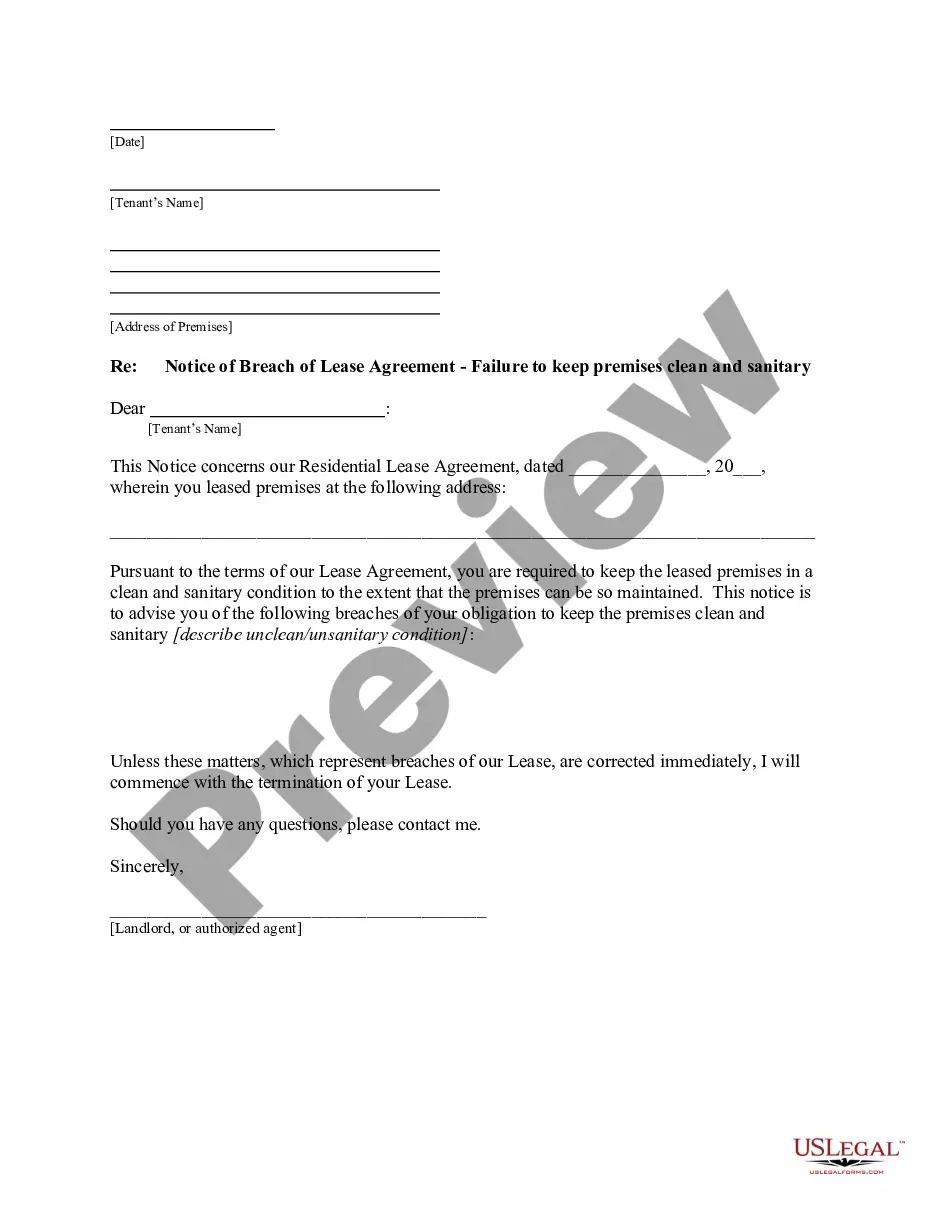

High Point North Carolina Reaffirmation Agreement

Description

How to fill out High Point North Carolina Reaffirmation Agreement?

Benefit from the US Legal Forms and get instant access to any form template you require. Our useful platform with a large number of document templates allows you to find and obtain almost any document sample you require. You can export, fill, and sign the High Point North Carolina Reaffirmation Agreement in just a matter of minutes instead of browsing the web for hours attempting to find the right template.

Utilizing our library is a great strategy to increase the safety of your form submissions. Our professional legal professionals regularly review all the documents to make certain that the forms are relevant for a particular state and compliant with new laws and polices.

How do you obtain the High Point North Carolina Reaffirmation Agreement? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you view. Moreover, you can find all the previously saved files in the My Forms menu.

If you don’t have an account yet, follow the instructions listed below:

- Open the page with the form you need. Ensure that it is the template you were seeking: verify its name and description, and use the Preview feature when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving procedure. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the document. Indicate the format to obtain the High Point North Carolina Reaffirmation Agreement and change and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy form libraries on the web. We are always happy to help you in any legal process, even if it is just downloading the High Point North Carolina Reaffirmation Agreement.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!