Charlotte North Carolina Closing Statement

Description

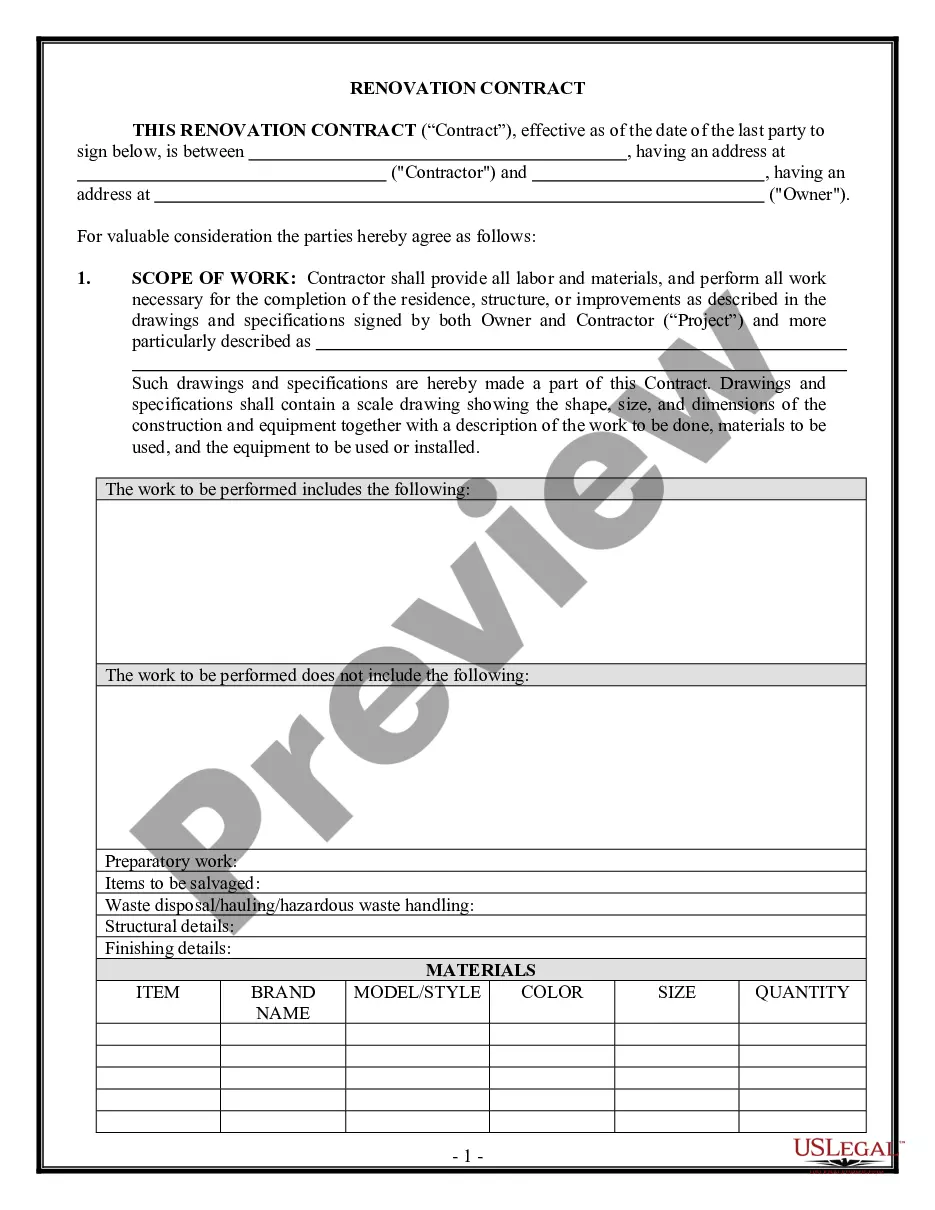

How to fill out North Carolina Closing Statement?

Regardless of social or occupational standing, completing law-related documents is a regrettable requirement in today’s business landscape.

Frequently, it’s nearly impossible for individuals without legal education to draft such documents from scratch, primarily due to the complex terminology and legal subtleties they encompass.

This is where US Legal Forms steps in to assist.

However, if you are unfamiliar with our library, make sure to follow these guidelines before downloading the Charlotte North Carolina Closing Statement.

Check that the form you have found is appropriate for your area, as the laws of one state or locality do not apply to another. Preview the document and review a brief summary (if available) of situations for which the document can be utilized. If the one you chose doesn’t meet your requirements, you can start over and search for the correct form. Click Buy now and choose the subscription plan that fits you best. Create an account {using your Log In details or set one up from the ground up. Select your payment method and proceed to download the Charlotte North Carolina Closing Statement right after the transaction is completed. You’re all set! Now you can print the document or complete it online. Should you encounter any issues retrieving your purchased forms, you can conveniently access them in the My documents section. No matter what issue you’re aiming to resolve, US Legal Forms has got you covered. Give it a shot now and witness the difference.

- Our platform offers an extensive library with over 85,000 ready-to-use state-specific forms applicable to nearly any legal scenario.

- US Legal Forms is also an excellent resource for associates or legal advisors looking to conserve time by using our DIY papers.

- Whether you need the Charlotte North Carolina Closing Statement or any other documentation that will be accepted in your state or locality, US Legal Forms has everything you need at your fingertips.

- Here’s how to obtain the Charlotte North Carolina Closing Statement within minutes using our dependable platform.

- If you are already a current customer, you can proceed to Log In to your account to acquire the necessary form.

Form popularity

FAQ

The buyer provides their agent with funds to pay for the closing and signs all necessary paperwork. The buyer's attorney records the new deed at the courthouse. The escrow agent will use the escrow funds to pay off any remaining mortgage and other closing costs. The remaining funds are then sent to the seller.

These documents present a comprehensive itemized listing of the funds and credits exchanged in the transaction, along with the parties by whom and to whom the money and credits are to be paid. Closing agents prepare and write up closing statements or settlement sheets.

Is an attorney required for closing in North Carolina? Specifically, in the state of North Carolina, it is mandated by law that the closing process of a real estate transaction is overseen by a licensed North Carolina attorney as it is a practice of law.

Parties. The purchaser and seller are ultimately responsible for the accuracy of the settlement statement. The purchaser and seller are the only two parties intimately involved in every part of the transaction. The seller is aware of liens attached to the property and the amount of any taxes or assessments owed.

In North Carolina, closings are usually handled by attorneys who specialize in real estate. In many other states, closings are handled by title or escrow companies; and in those states, the title search might be farmed out to lawyers or real estate paralegals.

The closing agent reviews the new lender's instructions/requirements, reviews instructions from other parties to the transaction, reviews legal and loan documents, assembles charges, and prepares closing statements and schedules the closing. Escrow/settlement agent oversees closing of the transaction.

Step 4: The sellers prepare disclosures. North Carolina law requires sellers to prepare a residential property disclosure for the buyer.

Is an attorney required for closing in North Carolina? Specifically, in the state of North Carolina, it is mandated by law that the closing process of a real estate transaction is overseen by a licensed North Carolina attorney as it is a practice of law.