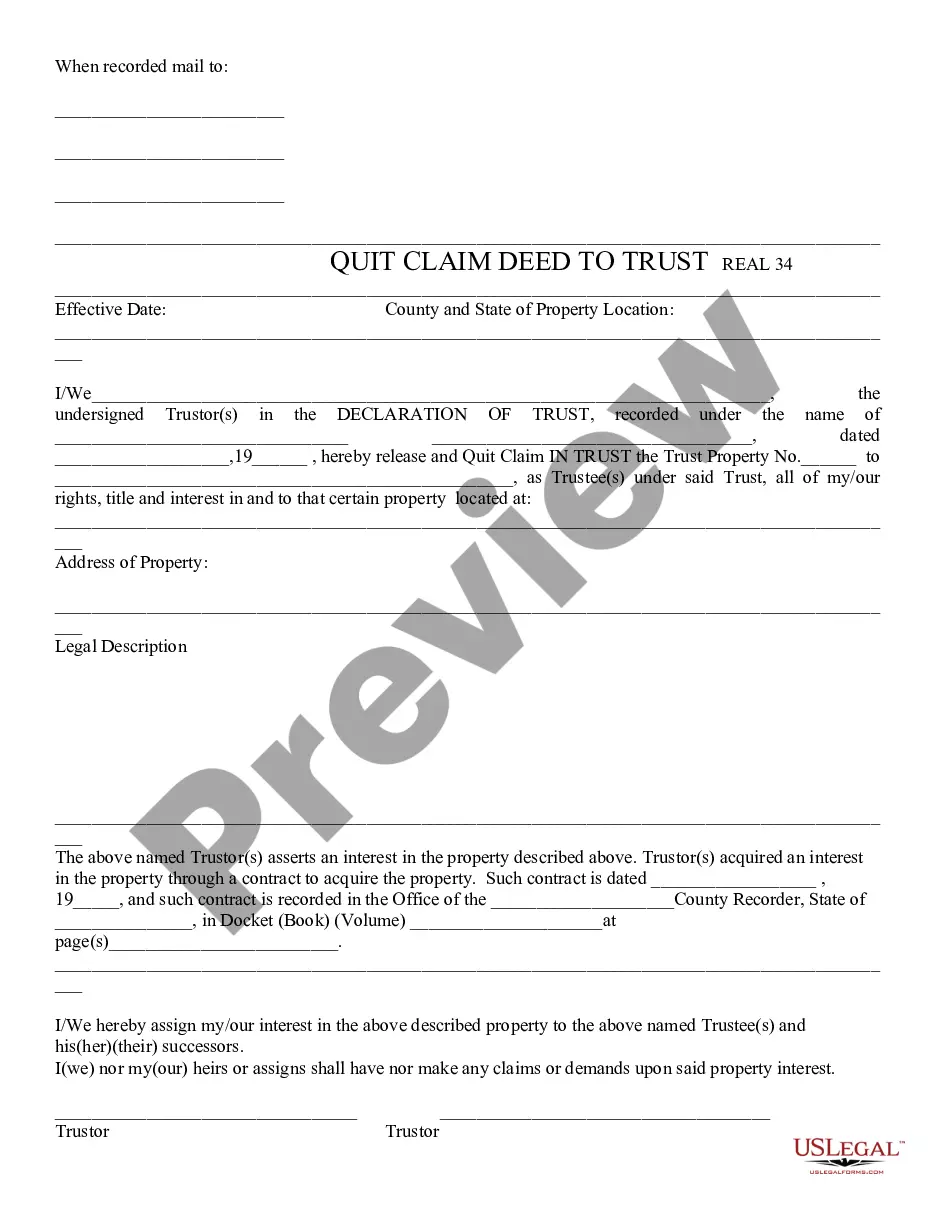

Winston-Salem, North Carolina Closing Statement is a legal document that marks the final step in a real estate transaction within the Winston-Salem area. It is a comprehensive document used to summarize and settle all financial obligations and legal aspects associated with the transfer of property ownership. This closing statement serves as an official record and ensures that both the buyer and seller have fulfilled their obligations. The Winston-Salem Closing Statement includes relevant information such as the property address, names of the involved parties, purchase price, loan details, and any prorated expenses. It outlines the financial transactions related to the purchase, including the payment of earnest money, down payment, and loan settlement costs. This statement also lists any outstanding expenses, such as property taxes, utility bills, or homeowner association fees, that need to be addressed before the transfer is complete. Different types of Winston-Salem North Carolina Closing Statements may include: 1. Residential Closing Statement: This is the most common type of closing statement, used for the sale or purchase of residential properties in Winston-Salem. 2. Commercial Closing Statement: This type of closing statement is used for the transfer of commercial properties, such as office spaces, retail buildings, or industrial lots, within Winston-Salem. 3. Refinance Closing Statement: When refinancing a property in Winston-Salem, a specific closing statement is generated to reflect the new loan terms and financial adjustments. 4. Short Sale Closing Statement: In cases where the property is sold for less than the outstanding loan balance, a short sale closing statement is prepared to outline the agreed-upon terms between the lender, seller, and buyer. 5. Foreclosure Closing Statement: When a foreclosed property is being sold, a foreclosure closing statement is created to document the sale price, expenses, repayments, and other related financial details. In conclusion, the Winston-Salem North Carolina Closing Statement is a crucial legal document that finalizes real estate transactions in the area. It ensures that all financial obligations are met by both parties involved, and serves as an official record of the property transfer. Whether it is a residential, commercial, refinance, short sale, or foreclosure closing, this statement plays a pivotal role in completing the transaction smoothly and ensuring all parties' rights and responsibilities are protected.

Winston–Salem North Carolina Closing Statement

Description

How to fill out Winston–Salem North Carolina Closing Statement?

Do you need a trustworthy and inexpensive legal forms provider to get the Winston–Salem North Carolina Closing Statement? US Legal Forms is your go-to choice.

Whether you need a simple agreement to set regulations for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed based on the requirements of particular state and county.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Winston–Salem North Carolina Closing Statement conforms to the laws of your state and local area.

- Go through the form’s description (if available) to find out who and what the document is intended for.

- Restart the search if the template isn’t suitable for your legal situation.

Now you can create your account. Then choose the subscription plan and proceed to payment. Once the payment is done, download the Winston–Salem North Carolina Closing Statement in any available file format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal papers online for good.