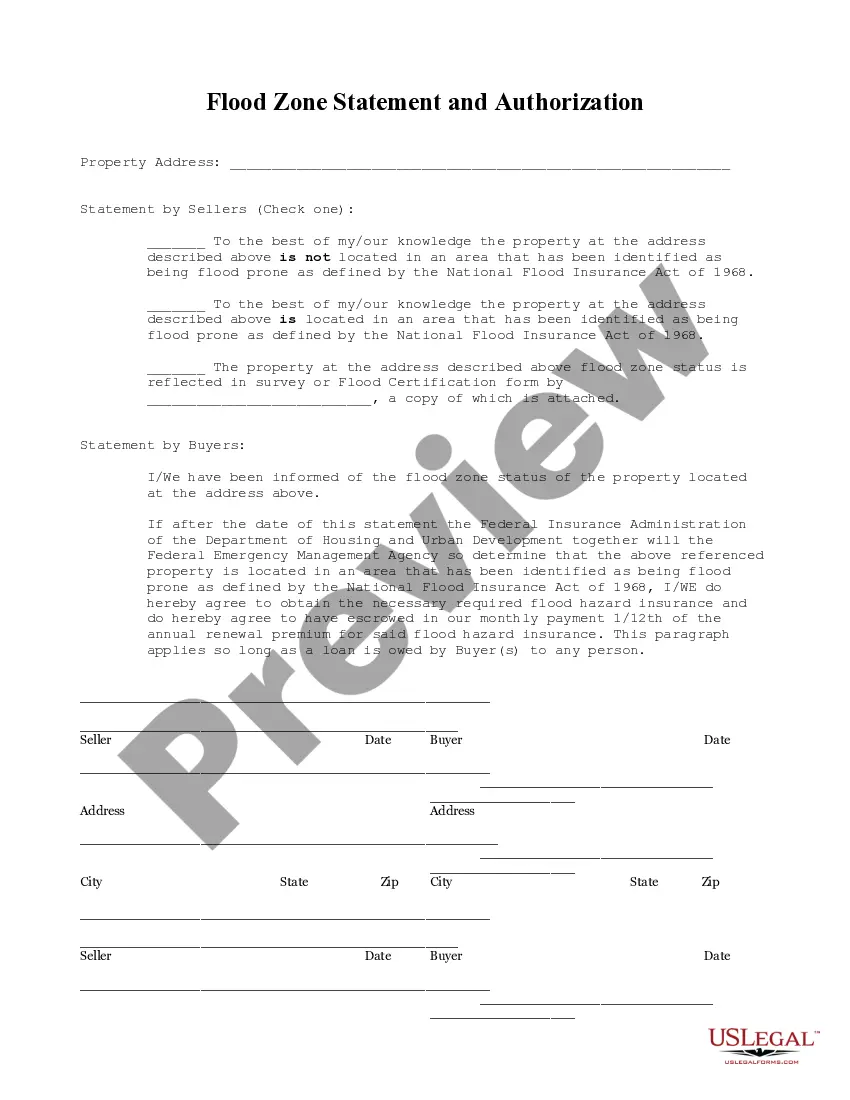

The Wake North Carolina Flood Zone Statement and Authorization is an essential document that serves to assess the flood risk associated with a property or land located in Wake County, North Carolina. It provides detailed information about the flood zone classification, floodplains, and potential risks for flooding, enabling property owners, insurance providers, and prospective buyers to make informed decisions regarding flood insurance and land use. The Wake North Carolina Flood Zone Statement and Authorization assists in determining the flood risk rating of a property, providing crucial data for floodplain management, insurance coverage, and community planning. This document is commonly required by various entities, including lending institutions, insurance companies, or government agencies, to ensure compliance with FEMA (Federal Emergency Management Agency) regulations and local building codes. When completing the Wake North Carolina Flood Zone Statement and Authorization, certain keywords and information need to be included: 1. Property Information: Full address, property identification numbers, lot size, and legal description to precisely identify the property being assessed. 2. FEMA Flood Zone Classification: The document includes the FEMA flood zone classification for the property, such as Zone A, AE, X, or V, based on the latest Flood Insurance Rate Map (FIRM). Each zone represents a different level of flood risk, ranging from high-risk areas (A, AE, V) to low to moderate-risk areas (X). 3. Floodplain Determination: The statement outlines whether the property falls within a designated Special Flood Hazard Area (FHA) or a floodplain. This includes information on Base Flood Elevation (BFE), floodplain boundaries, and other critical factors affecting the flood risk level. 4. Community Number: The Community Number provided in the statement is a FEMA identification number for Wake County that confirms its participation in the National Flood Insurance Program (FIP). 5. Flood Insurance Requirements: The document specifies whether flood insurance is mandatory based on the flood zone classification and other relevant factors. It may also outline any specific requirements for obtaining flood insurance coverage or mitigating the flood risk. Different Types of Wake North Carolina Flood Zone Statement and Authorization: 1. Mortgage Flood Zone Statement: This version of the statement is commonly required by lending institutions when a buyer seeks mortgage financing for a property. It ensures that the property's flood risk is evaluated before finalizing the loan terms and serves as proof of flood insurance requirements. 2. Insurance Flood Zone Statement: When property owners or buyers want to obtain flood insurance, an Insurance Flood Zone Statement is necessary. This document helps insurance providers determine appropriate coverage and premiums based on the property's flood risk. 3. Zoning and Land Use Flood Zone Statement: This type of statement caters to land developers, construction firms, and government agencies involved in zoning regulations and land use planning. It provides critical information about flood risk to ensure safe and proper development practices in compliance with local building codes and regulations. In conclusion, the Wake North Carolina Flood Zone Statement and Authorization is a vital document that evaluates flood risk for properties in Wake County. Its content ensures accurate determinations of flood zone classifications, floodplain boundaries, and associated risk factors, enabling property owners and relevant stakeholders to make well-informed choices regarding insurance coverage, land use planning, and compliance with regulatory requirements.

Wake North Carolina Flood Zone Statement and Authorization

Description

How to fill out Wake North Carolina Flood Zone Statement And Authorization?

Take advantage of the US Legal Forms and get instant access to any form template you need. Our helpful platform with a large number of document templates simplifies the way to find and obtain virtually any document sample you need. It is possible to download, complete, and sign the Wake North Carolina Flood Zone Statement and Authorization in just a matter of minutes instead of surfing the Net for hours searching for the right template.

Using our catalog is a superb way to raise the safety of your record filing. Our professional attorneys on a regular basis check all the documents to make sure that the templates are appropriate for a particular region and compliant with new laws and regulations.

How can you obtain the Wake North Carolina Flood Zone Statement and Authorization? If you have a profile, just log in to the account. The Download option will appear on all the documents you look at. Moreover, you can get all the previously saved records in the My Forms menu.

If you don’t have a profile yet, stick to the instructions listed below:

- Find the template you need. Ensure that it is the form you were looking for: check its headline and description, and utilize the Preview function when it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan you prefer. Then, create an account and process your order with a credit card or PayPal.

- Export the document. Choose the format to get the Wake North Carolina Flood Zone Statement and Authorization and change and complete, or sign it according to your requirements.

US Legal Forms is among the most considerable and reliable template libraries on the internet. We are always happy to help you in virtually any legal case, even if it is just downloading the Wake North Carolina Flood Zone Statement and Authorization.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!