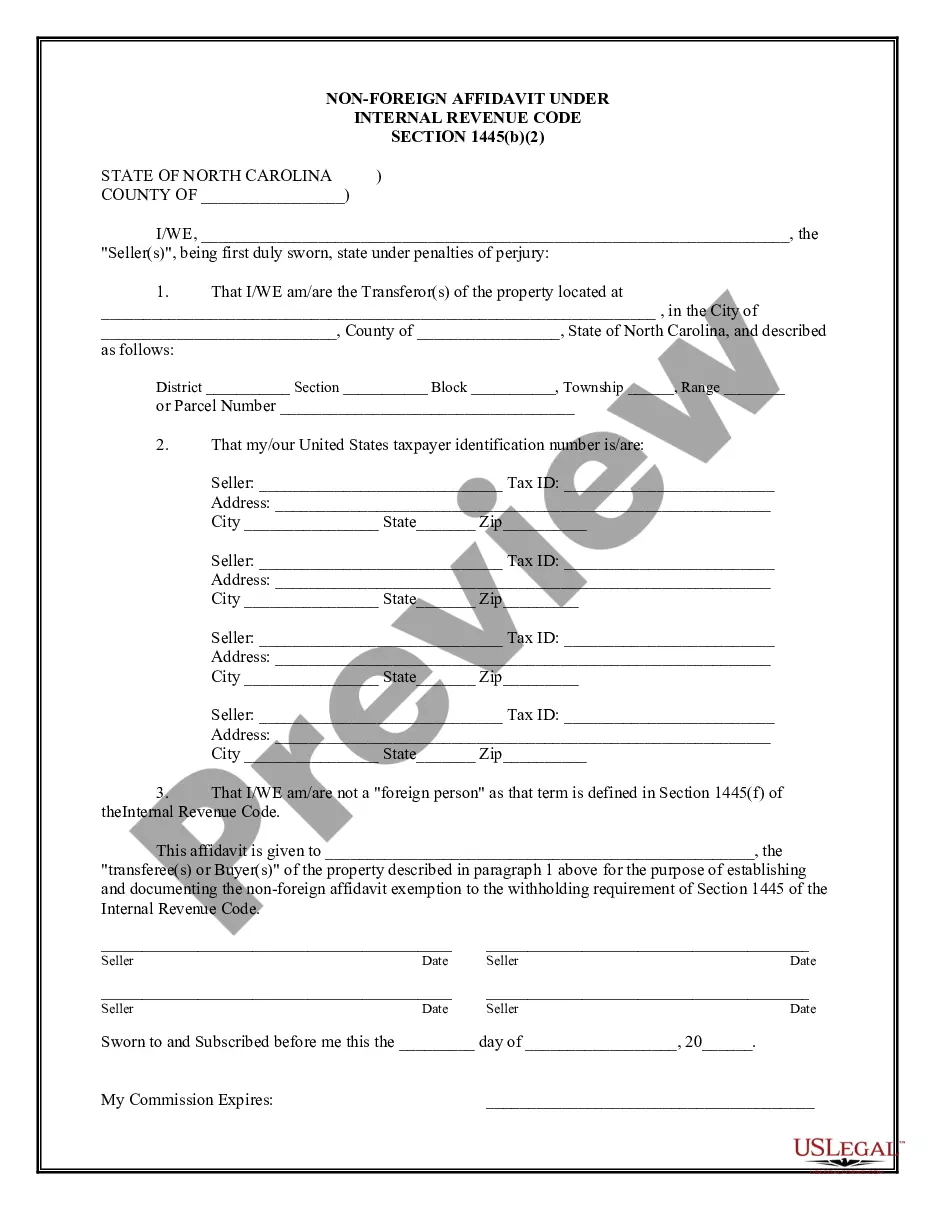

A Non-Foreign Affidavit Under IRC 1445 is a legal document that pertains to the sale of real property by a foreign individual in Fayetteville, North Carolina. It is required by the United States Internal Revenue Service (IRS) to ensure compliance with tax regulations. This affidavit serves as a declaration by the foreign seller that they are not subject to withholding tax under section 1445 of the Internal Revenue Code (IRC). Section 1445 mandates that buyers withhold a certain percentage of the sale price as tax when purchasing real property from a foreign individual. The purpose of the Fayetteville North Carolina Non-Foreign Affidavit Under IRC 1445 is to establish the eligibility of the seller for exemption from this withholding tax. By signing this document, the foreign seller declares that they meet the criteria for an exemption, which are determined by the IRS. It is important to note that Fayetteville, North Carolina, does not have different types of Non-Foreign Affidavit Under IRC 1445. However, it is essential to understand the specific requirements and guidelines outlined by the IRS for this affidavit. Keywords: — Fayetteville, NortCarolinain— - Non-Foreign Affidavit — IRC 1445 - Reapropertyrt— - Foreign seller — Internal ReveServicervic— - Withholding tax — Exemption - Tax regulation— - Legal document — Compliance - Declaratio— - Eligibility — Criteria

Fayetteville North Carolina Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Fayetteville North Carolina Non-Foreign Affidavit Under IRC 1445?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone with no law background to draft such papers from scratch, mainly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform provides a huge library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you need the Fayetteville North Carolina Non-Foreign Affidavit Under IRC 1445 or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Fayetteville North Carolina Non-Foreign Affidavit Under IRC 1445 in minutes using our reliable platform. If you are already an existing customer, you can go on and log in to your account to download the needed form.

Nevertheless, in case you are new to our platform, make sure to follow these steps before downloading the Fayetteville North Carolina Non-Foreign Affidavit Under IRC 1445:

- Ensure the form you have chosen is suitable for your location considering that the regulations of one state or area do not work for another state or area.

- Preview the document and go through a brief description (if available) of scenarios the paper can be used for.

- If the form you chosen doesn’t meet your needs, you can start over and look for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your login information or register for one from scratch.

- Select the payment method and proceed to download the Fayetteville North Carolina Non-Foreign Affidavit Under IRC 1445 once the payment is through.

You’re all set! Now you can go on and print out the document or fill it out online. Should you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.