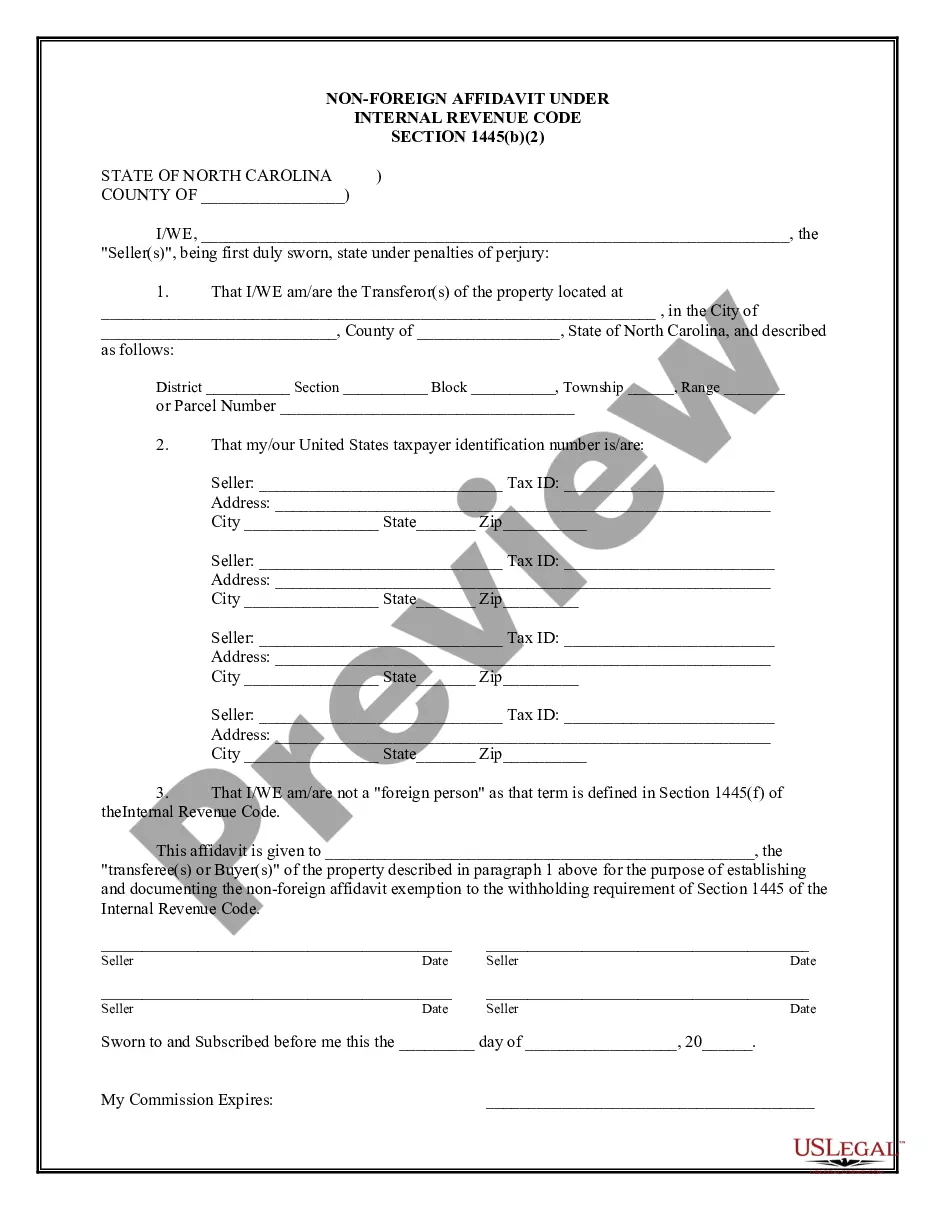

High Point, North Carolina Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Introduction: In the realm of real estate and property transactions, intricate legal processes often come into play. One such process involves the submission of a Non-Foreign Affidavit under IRC 1445. This affidavit serves as a crucial tool for verifying the tax status of non-foreign entities engaged in property transactions in High Point, North Carolina. In this detailed description, we will explore the purpose, significance, and different types of Non-Foreign Affidavit Under IRC 1445 applicable in High Point, North Carolina, along with the relevant keywords associated with this topic. What is a Non-Foreign Affidavit Under IRC 1445? A Non-Foreign Affidavit Under IRC 1445 is a legal document required by the Internal Revenue Code (IRC) section 1445. This affidavit serves as proof that the seller of a property in High Point, North Carolina is not a foreign entity, ensuring compliance with federal tax laws. Purpose and Significance: The purpose of this affidavit is to ensure that the buyer or transferee of a property complies with the mandatory withholding requirements imposed by the IRC. Non-foreign sellers who are exempt from these requirements need to provide this affidavit to confirm their status. The affidavit helps prevent tax evasion and ensures smooth property transactions, protecting both buyers and sellers. Types of High Point, North Carolina Non-Foreign Affidavit Under IRC 1445: 1. Certificate of non-foreign status for real property disposition (Form 8288-B): This form is typically used to certify the non-foreign status of the seller or transferor for withholding tax purposes during the sale or disposition of real property. It contains essential information about the property, buyer, seller, and the certification itself. 2. Notice of withholding of tax on dispositions by foreign persons of U.S. real property interests (Form 8288): While not a Non-Foreign Affidavit, it is closely related to the affidavit. This form is filed by the buyer or transferee to inform the IRS about the withholding of tax on dispositions by foreign persons. If a buyer is uncertain about the seller's status, they may file this form as a precautionary measure. 3. Statement of Citizenship, Residency, and Taxpayer Identification Number for State Property Transactions (Form N-FAT): In some cases, the state of North Carolina may require additional documentation to verify non-foreign status. This form helps verify the seller's citizenship, residency, and taxpayer identification number. Keywords: — High Point, NortCarolinain— - Non-Foreign Affidavit — IRC 1445 - Internal Revenue Cod— - Property transaction — Tax status - Selle— - Buyer - Withholding requirements — Tacompliancenc— - Tax evasion - Certificate of non-foreign status — Form 8288-— - Notice of withholding - Form 8288 — Statemencitizenshiphi— - Residency - Taxpayer identification number — State property transactions Conclusion: Understanding the intricacies and implications of a High Point, North Carolina Non-Foreign Affidavit Under IRC 1445 is crucial for both buyers and sellers involved in property transactions. By providing the necessary documentation and complying with federal tax laws, individuals can ensure the successful completion of property transfers while maintaining transparency and legal compliance.

High Point North Carolina Non-Foreign Affidavit Under IRC 1445

Description

How to fill out High Point North Carolina Non-Foreign Affidavit Under IRC 1445?

Are you looking for a reliable and affordable legal forms supplier to buy the High Point North Carolina Non-Foreign Affidavit Under IRC 1445? US Legal Forms is your go-to option.

Whether you need a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of separate state and area.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the High Point North Carolina Non-Foreign Affidavit Under IRC 1445 conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to learn who and what the document is good for.

- Restart the search in case the template isn’t good for your specific situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the High Point North Carolina Non-Foreign Affidavit Under IRC 1445 in any provided format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time learning about legal papers online for good.