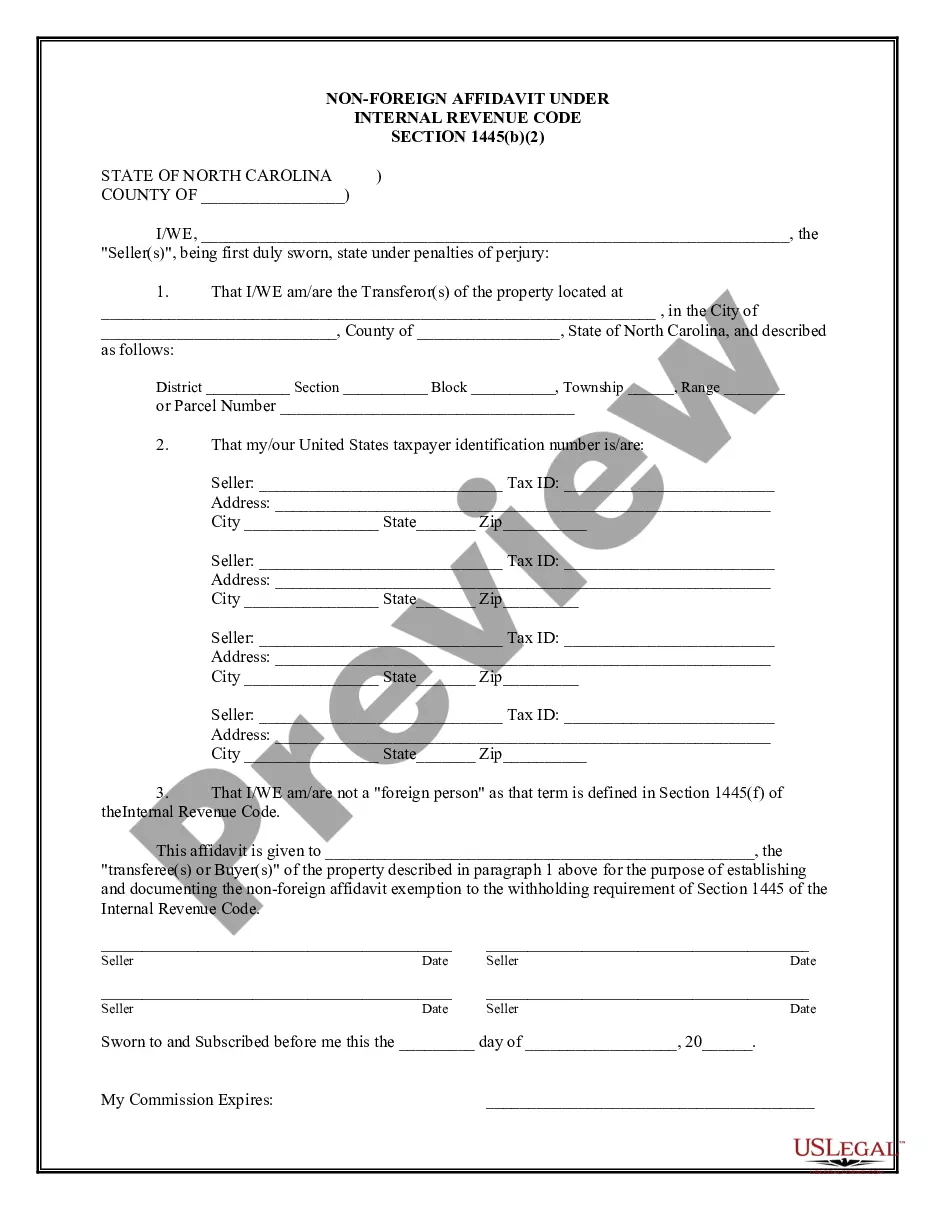

The Mecklenburg North Carolina Non-Foreign Affidavit Under IRC 1445 is a legal document that pertains to the sale or transfer of real estate properties by non-foreign individuals or entities. This affidavit is required by the Internal Revenue Code (IRC) Section 1445, which focuses on withholding tax obligations for foreign sellers. When a non-foreign individual or entity sells real estate property in the United States, the buyer is required to withhold a certain portion of the purchase price as a tax payment to the Internal Revenue Service (IRS). However, if the seller can provide a valid Non-Foreign Affidavit Under IRC 1445, they can avoid or reduce this withholding requirement. The Mecklenburg North Carolina Non-Foreign Affidavit Under IRC 1445 serves as a declaration by the seller stating their non-foreign status. It confirms that the seller is a U.S. citizen, a U.S. resident alien, a domestic corporation, or other eligible entities. By signing this affidavit, the seller legally acknowledges that they are exempt or partially exempt from the withholding tax requirement under IRC Section 1445. Different types of the Mecklenburg North Carolina Non-Foreign Affidavit Under IRC 1445 may include variations based on the specific circumstances of the seller. For example: 1. Individual Seller Affidavit: This type of affidavit is utilized when an individual (U.S. citizen or resident alien) is selling the real estate property. It confirms their non-foreign status and exemption from withholding tax under IRC Section 1445. 2. Corporate Seller Affidavit: This affidavit is applicable when a domestic corporation is the seller. It verifies that the corporation is incorporated under the laws of the United States and is therefore exempt from withholding tax requirements. 3. Partnership/LLC Seller Affidavit: If the seller is a partnership or limited liability company (LLC), this affidavit confirms that the entity is a domestic partnership or LLC and meets the non-foreign criteria outlined by IRC Section 1445. It is essential to accurately complete and submit the Mecklenburg North Carolina Non-Foreign Affidavit Under IRC 1445 to comply with the IRS regulations and avoid unnecessary withholding tax burdens. However, it is recommended to consult a qualified attorney or tax professional to ensure the proper execution of this document and to satisfy all legal obligations related to the sale or transfer of real estate properties.

Mecklenburg North Carolina Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Mecklenburg North Carolina Non-Foreign Affidavit Under IRC 1445?

We always want to reduce or prevent legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney solutions that, usually, are very costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Mecklenburg North Carolina Non-Foreign Affidavit Under IRC 1445 or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Mecklenburg North Carolina Non-Foreign Affidavit Under IRC 1445 adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Mecklenburg North Carolina Non-Foreign Affidavit Under IRC 1445 is suitable for your case, you can choose the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!