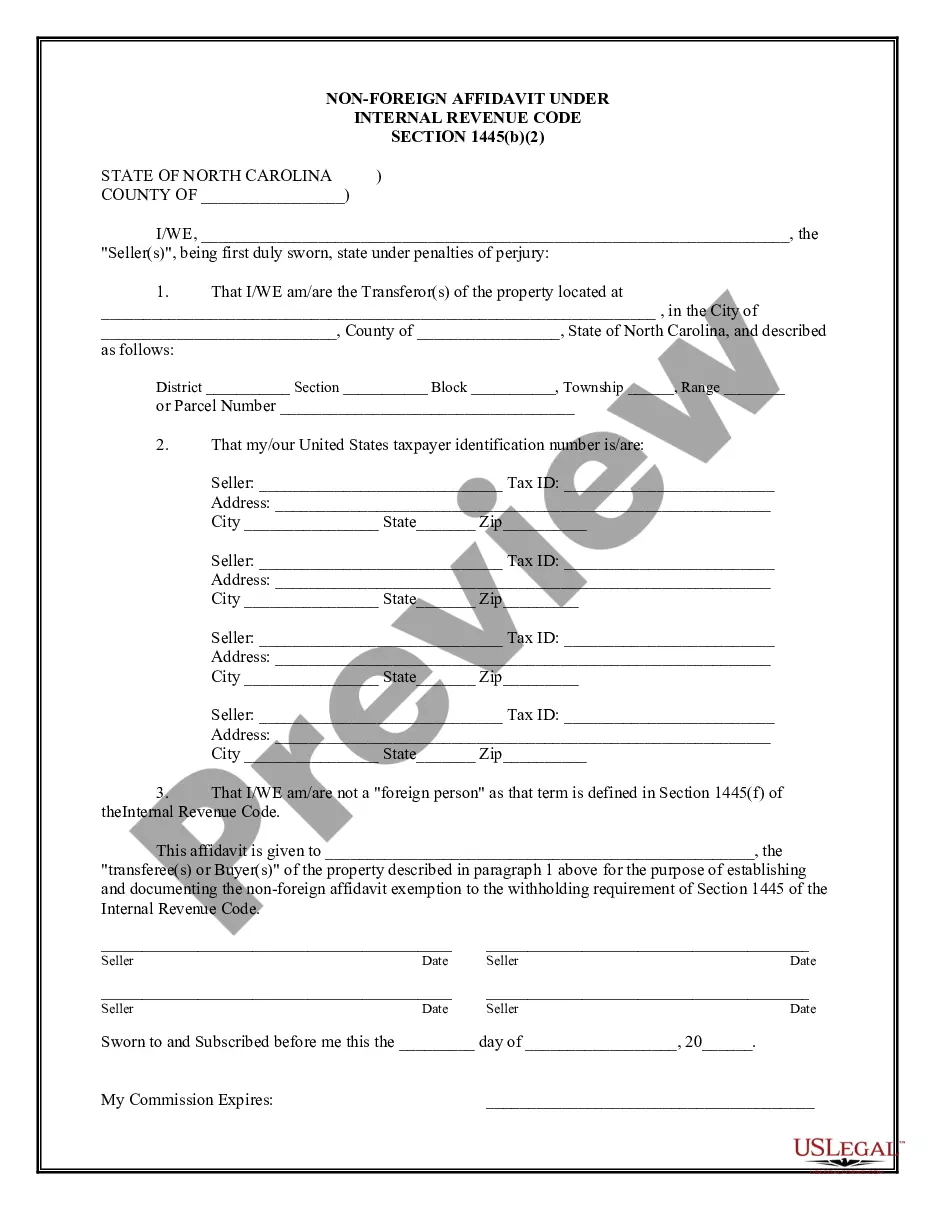

Raleigh, North Carolina Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Introduction: A Raleigh, North Carolina Non-Foreign Affidavit Under IRC 1445 is a legal document that certifies the non-foreign status of a seller in a real estate transaction subject to the Internal Revenue Code (IRC) 1445 withholding requirements. This affidavit is a crucial component of the real estate closing process in Raleigh, North Carolina, ensuring compliance with federal tax regulations. What is an Affidavit Under IRC 1445? An Affidavit Under IRC 1445 is a sworn statement intended to establish the non-foreign status of the seller in a real estate transaction. The IRC 1445, enacted by the U.S. Congress, requires a withholding tax on the disposition of U.S. real property interests by foreign persons to ensure the collection of appropriate tax amounts. Types of Raleigh Non-Foreign Affidavit Under IRC 1445: While there may not be different types of Raleigh Non-Foreign Affidavits Under IRC 1445, various versions may exist, primarily tailored to the specific requirements or updates in federal or local tax legislation. Therefore, it is essential to ensure you are using the most recent version of the form provided by the Internal Revenue Service (IRS) or other authorized sources. Purpose of the Raleigh Non-Foreign Affidavit Under IRC 1445: The primary purpose of the Raleigh Non-Foreign Affidavit Under IRC 1445 is to affirm that the seller is not a foreign person for tax withholding purposes. By submitting this affidavit, the seller certifies their U.S. residency or citizenship, ensuring compliance with IRS regulations. This form protects both the buyer and the intermediary parties involved in the real estate transaction from potential tax liabilities. Information Required: When completing the Raleigh Non-Foreign Affidavit Under IRC 1445, the following information may be necessary: 1. Seller's personal information: Full legal name, contact details, Social Security Number or Individual Taxpayer Identification Number (ITIN), and date of birth. 2. Seller's taxpayer status: The affidavit requires the seller to affirm their U.S. citizenship, status as a lawful permanent resident, or other exempt status under the IRC. 3. Property details: Provide accurate information about the property being sold, including its address, legal description, and purchase price. 4. Date of closing: Indicate the anticipated or actual closing date of the real estate transaction. 5. Certification: The seller must sign and date the document, acknowledging the penalties associated with providing false information. Conclusion: A Raleigh, North Carolina Non-Foreign Affidavit Under IRC 1445 acts as a crucial legal safeguard in real estate transactions. By verifying the seller's non-foreign status, this affidavit ensures compliance with tax regulations and protects all parties involved. It is essential to consult with a legal professional or utilize authorized IRS forms to complete this document accurately. Stay updated with any potential changes in tax laws to ensure adherence to the most current procedures.

Raleigh, North Carolina Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Introduction: A Raleigh, North Carolina Non-Foreign Affidavit Under IRC 1445 is a legal document that certifies the non-foreign status of a seller in a real estate transaction subject to the Internal Revenue Code (IRC) 1445 withholding requirements. This affidavit is a crucial component of the real estate closing process in Raleigh, North Carolina, ensuring compliance with federal tax regulations. What is an Affidavit Under IRC 1445? An Affidavit Under IRC 1445 is a sworn statement intended to establish the non-foreign status of the seller in a real estate transaction. The IRC 1445, enacted by the U.S. Congress, requires a withholding tax on the disposition of U.S. real property interests by foreign persons to ensure the collection of appropriate tax amounts. Types of Raleigh Non-Foreign Affidavit Under IRC 1445: While there may not be different types of Raleigh Non-Foreign Affidavits Under IRC 1445, various versions may exist, primarily tailored to the specific requirements or updates in federal or local tax legislation. Therefore, it is essential to ensure you are using the most recent version of the form provided by the Internal Revenue Service (IRS) or other authorized sources. Purpose of the Raleigh Non-Foreign Affidavit Under IRC 1445: The primary purpose of the Raleigh Non-Foreign Affidavit Under IRC 1445 is to affirm that the seller is not a foreign person for tax withholding purposes. By submitting this affidavit, the seller certifies their U.S. residency or citizenship, ensuring compliance with IRS regulations. This form protects both the buyer and the intermediary parties involved in the real estate transaction from potential tax liabilities. Information Required: When completing the Raleigh Non-Foreign Affidavit Under IRC 1445, the following information may be necessary: 1. Seller's personal information: Full legal name, contact details, Social Security Number or Individual Taxpayer Identification Number (ITIN), and date of birth. 2. Seller's taxpayer status: The affidavit requires the seller to affirm their U.S. citizenship, status as a lawful permanent resident, or other exempt status under the IRC. 3. Property details: Provide accurate information about the property being sold, including its address, legal description, and purchase price. 4. Date of closing: Indicate the anticipated or actual closing date of the real estate transaction. 5. Certification: The seller must sign and date the document, acknowledging the penalties associated with providing false information. Conclusion: A Raleigh, North Carolina Non-Foreign Affidavit Under IRC 1445 acts as a crucial legal safeguard in real estate transactions. By verifying the seller's non-foreign status, this affidavit ensures compliance with tax regulations and protects all parties involved. It is essential to consult with a legal professional or utilize authorized IRS forms to complete this document accurately. Stay updated with any potential changes in tax laws to ensure adherence to the most current procedures.