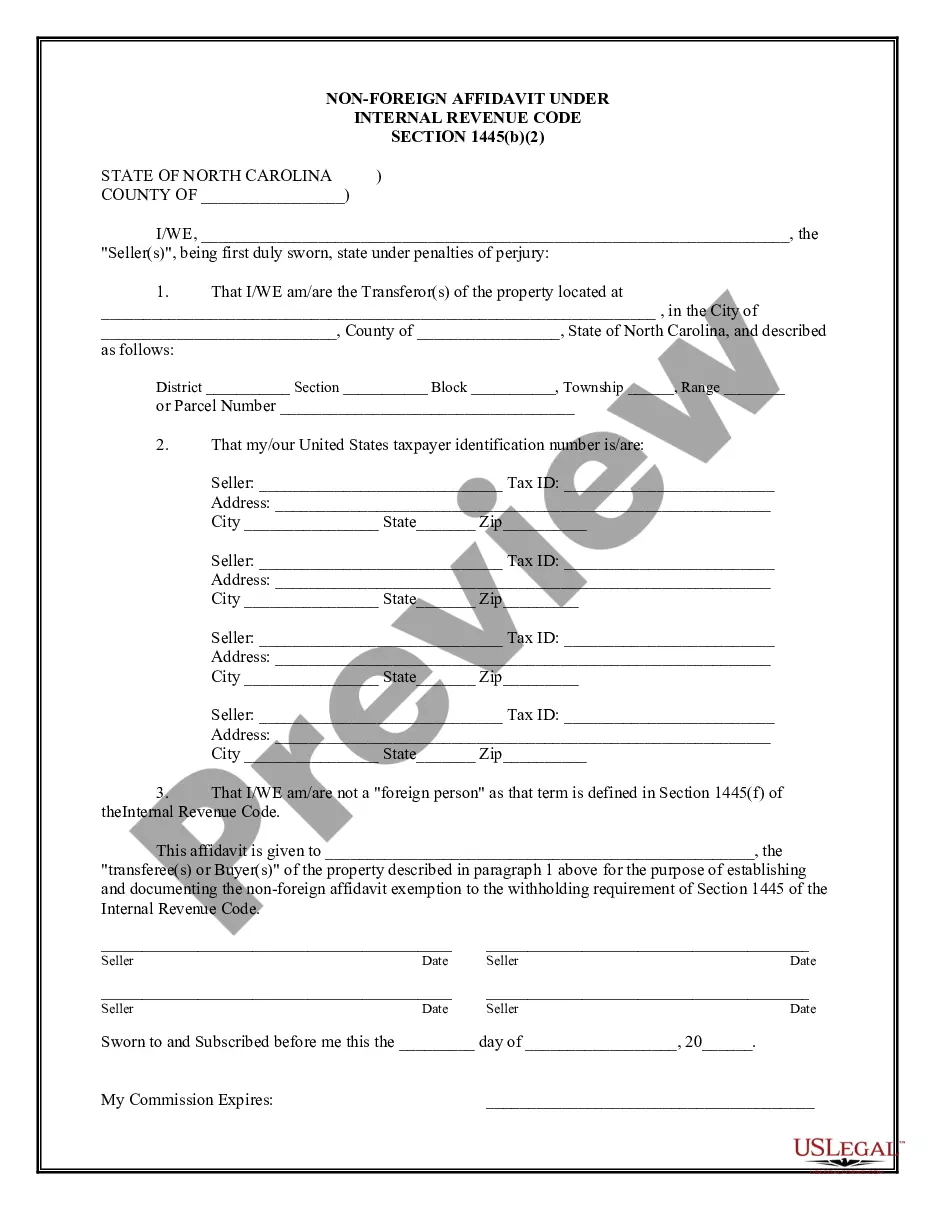

A non-foreign affidavit under IRC 1445 is a legal document that affirms the non-foreign status of a seller in a real estate transaction subject to withholding tax. In the context of Wake, North Carolina, this affidavit is submitted to the appropriate authorities to establish that the seller is not a foreign person and, therefore, exempt from certain tax withholding requirements. The Wake, North Carolina Non-Foreign Affidavit Under IRC 1445 is filed in accordance with the Internal Revenue Code (IRC) section 1445, which deals with the withholding of tax on dispositions of the United States real property interests. This affidavit is crucial for both buyers and sellers involved in real estate transactions to ensure compliance with tax regulations. Key information required in the Wake, North Carolina Non-Foreign Affidavit Under IRC 1445 typically includes the seller's name, contact details, and social security number or taxpayer identification number. The affidavit also includes a declaration stating that the seller is not a foreign person within the meaning of IRC section 7701(b) and provides the necessary supporting documentation to substantiate this claim. It's important to note that there may not be different types of Wake, North Carolina Non-Foreign Affidavit Under IRC 1445 as it primarily serves the purpose of confirming a seller's non-foreign status to comply with tax withholding obligations. However, variations of this affidavit may exist in other jurisdictions or specific circumstances, such as when dealing with partnerships or trusts involving foreign beneficiaries or partners. In summary, the Wake, North Carolina Non-Foreign Affidavit Under IRC 1445 is a vital document in real estate transactions involving non-foreign sellers. It verifies the seller's status, ensuring compliance with tax withholding requirements as outlined in the Internal Revenue Code. Sellers must complete this affidavit accurately and provide the necessary supporting documents to avoid potential penalties related to tax withholding.

Wake North Carolina Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Wake North Carolina Non-Foreign Affidavit Under IRC 1445?

Make use of the US Legal Forms and obtain instant access to any form you want. Our helpful platform with thousands of document templates makes it simple to find and obtain virtually any document sample you require. You are able to export, complete, and certify the Wake North Carolina Non-Foreign Affidavit Under IRC 1445 in a matter of minutes instead of surfing the Net for hours searching for a proper template.

Using our library is an excellent strategy to improve the safety of your record filing. Our professional legal professionals regularly check all the documents to make certain that the forms are relevant for a particular state and compliant with new laws and regulations.

How do you get the Wake North Carolina Non-Foreign Affidavit Under IRC 1445? If you have a subscription, just log in to the account. The Download option will appear on all the documents you look at. Furthermore, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions below:

- Open the page with the template you need. Make certain that it is the template you were hoping to find: check its title and description, and take take advantage of the Preview option if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and select the pricing plan you prefer. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the document. Indicate the format to get the Wake North Carolina Non-Foreign Affidavit Under IRC 1445 and edit and complete, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy form libraries on the internet. Our company is always ready to assist you in any legal procedure, even if it is just downloading the Wake North Carolina Non-Foreign Affidavit Under IRC 1445.

Feel free to take advantage of our service and make your document experience as straightforward as possible!