Charlotte North Carolina Owner's or Seller's Affidavit of No Liens

Category:

State:

North Carolina

City:

Charlotte

Control #:

NC-CLOSE8

Format:

Word;

Rich Text

Instant download

Description

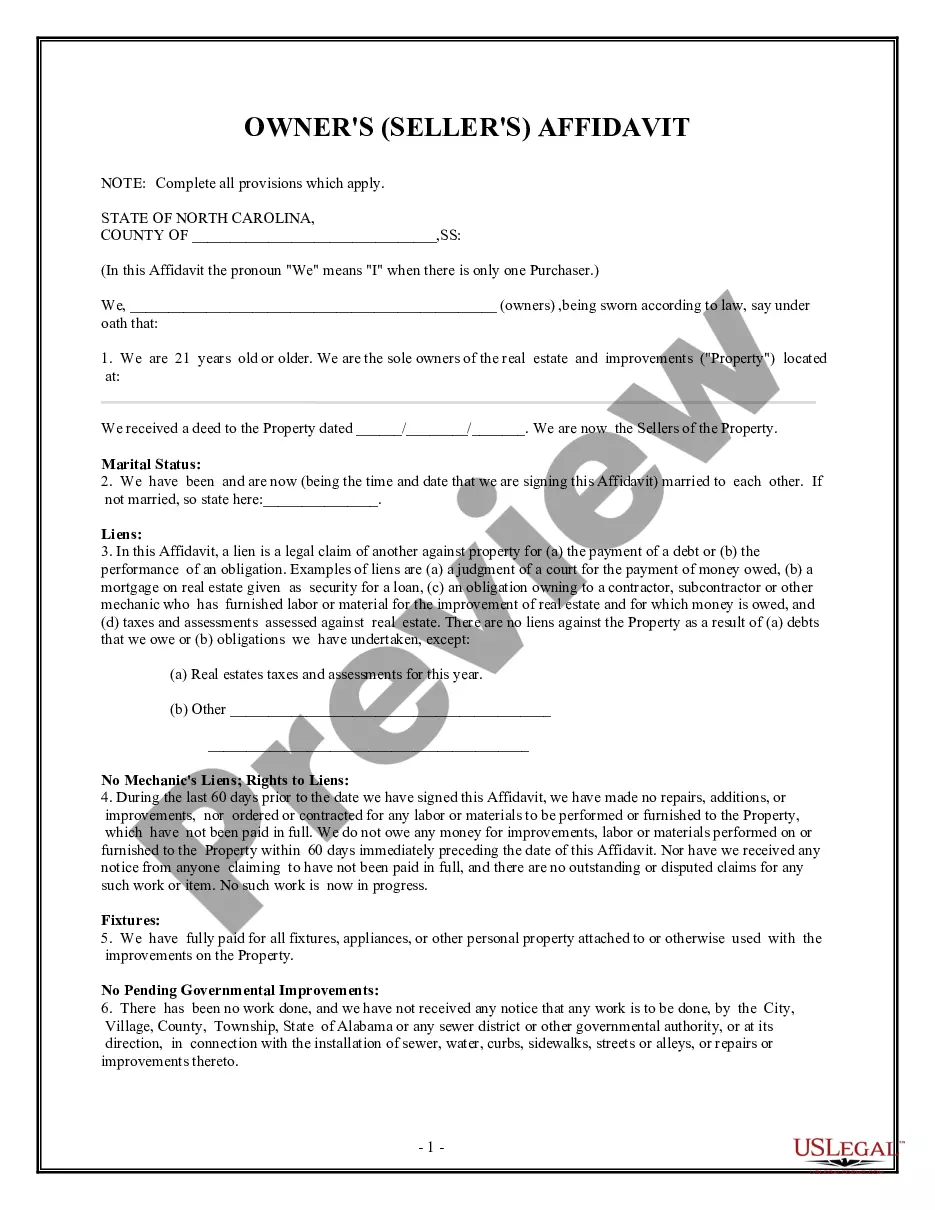

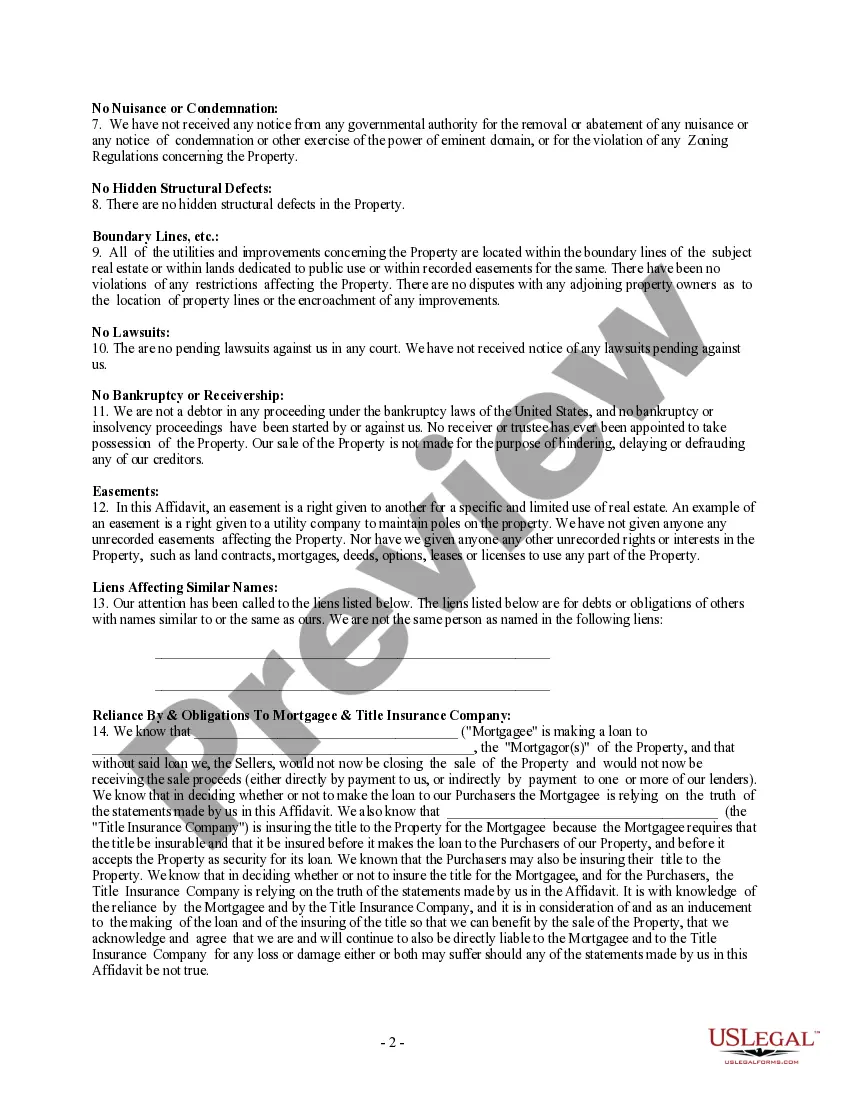

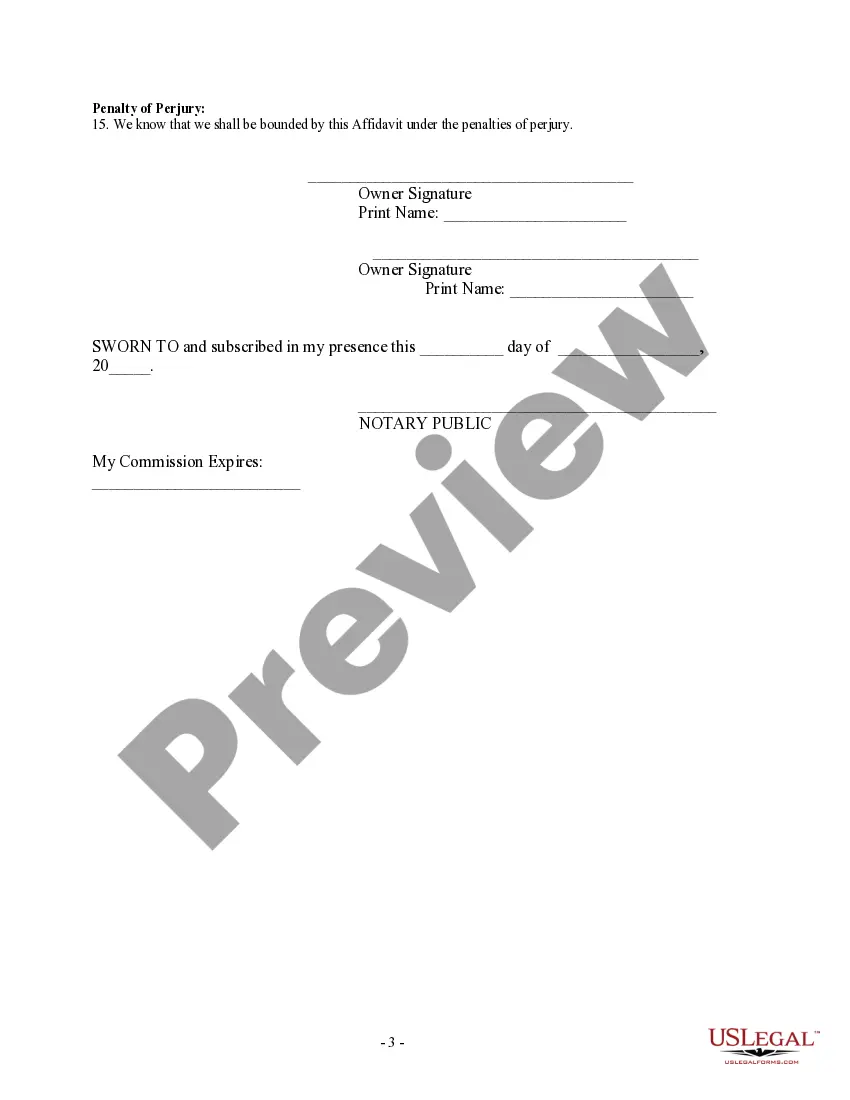

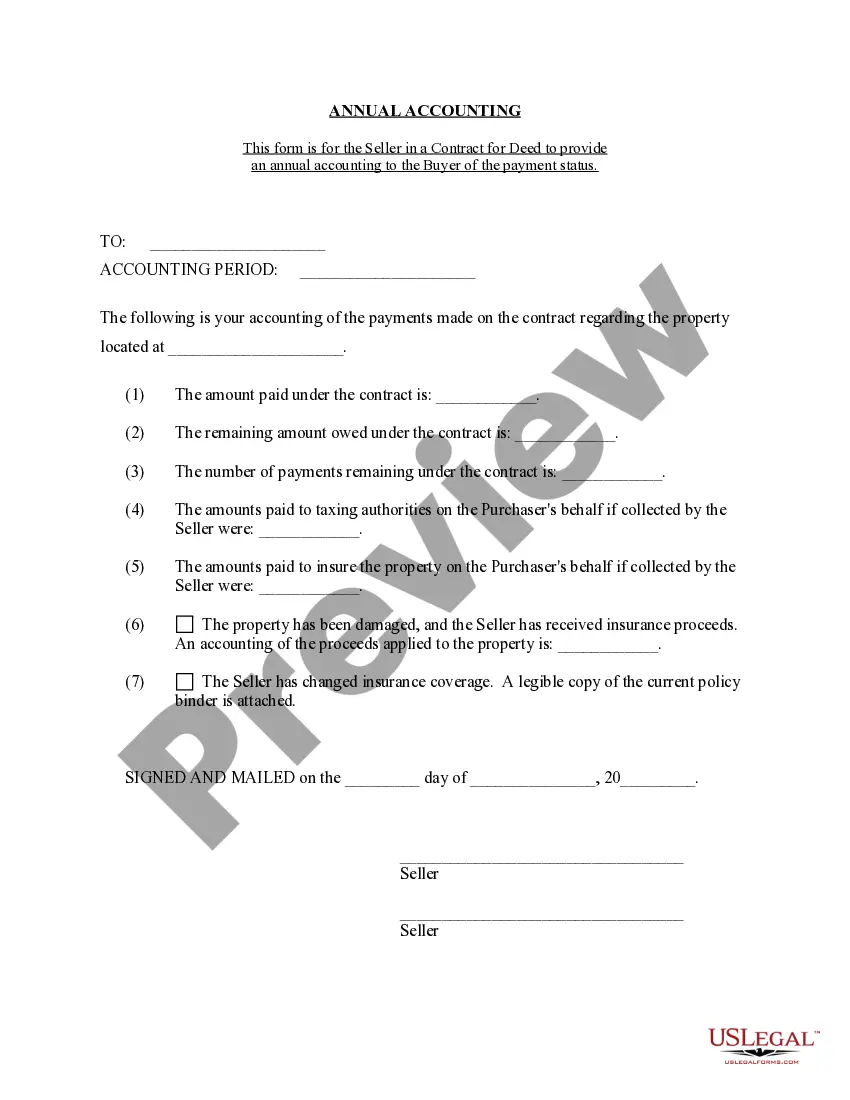

This Owner/Seller Affidavit is for seller(s) to sign at the time of closing certifying that, among other assurances, there are no liens on the property being sold, that they are the owners of the property, that there are no mechanic liens on the property and other certifications. This form must be signed and notarized.

Free preview

How to fill out North Carolina Owner's Or Seller's Affidavit Of No Liens?

If you have previously utilized our service, Log In to your account and download the Charlotte North Carolina Owner's or Seller's Affidavit of No Liens to your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it based on your payment plan.

If this is your initial engagement with our service, adhere to these straightforward steps to acquire your document.

You have uninterrupted access to all documents you have purchased: they can be found in your profile under the My documents menu whenever you need to access them again. Leverage the US Legal Forms service to swiftly locate and save any template for your personal or professional needs!

- Ensure you’ve identified a relevant document. Review the description and make use of the Preview feature, if available, to determine if it satisfies your needs. If it does not, use the Search tab above to find the appropriate one.

- Acquire the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Charlotte North Carolina Owner's or Seller's Affidavit of No Liens. Select the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.