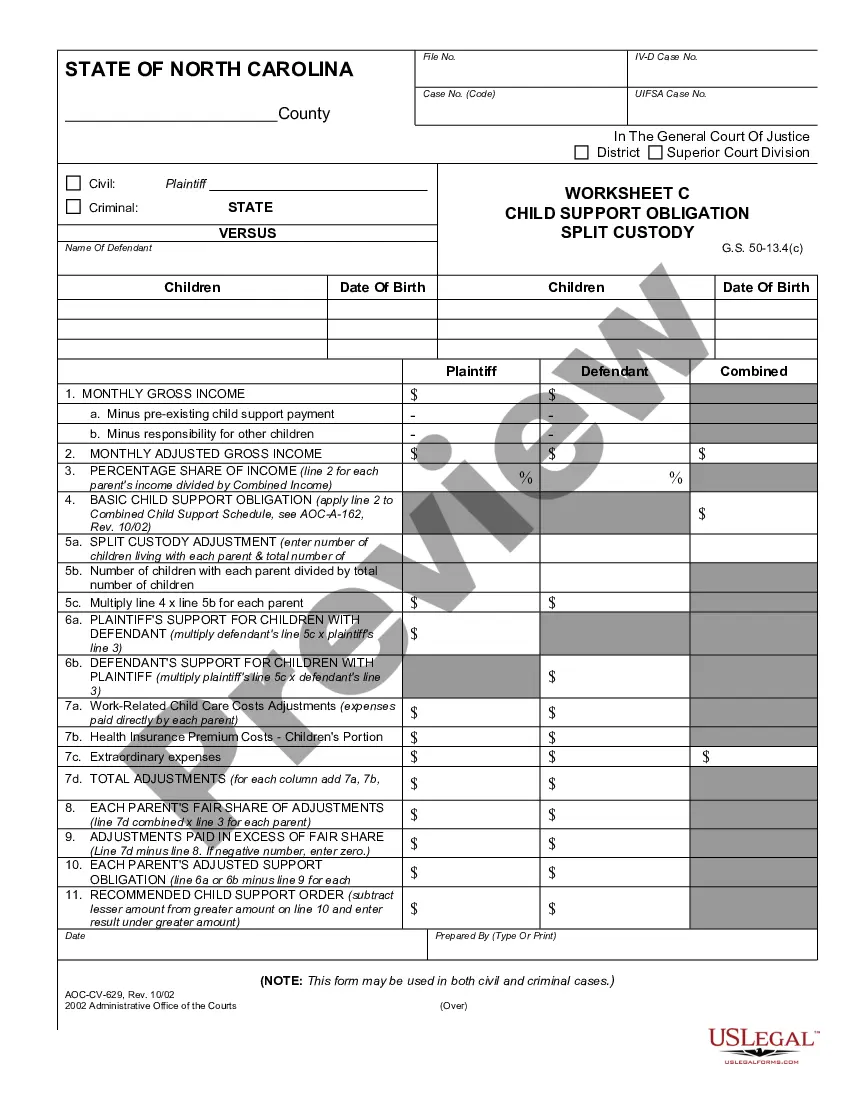

Child Support Worksheet C - Child Support Obligation, Split Custody: This is an official form from the North Carolina Administration of the Courts - AOC, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Charlotte North Carolina Child Support Worksheet C - Child Support Obligation Split Custody

Description

How to fill out North Carolina Child Support Worksheet C - Child Support Obligation Split Custody?

Do you require a dependable and budget-friendly provider of legal forms to purchase the Charlotte North Carolina Child Support Worksheet C - Child Support Obligation Split Custody? US Legal Forms is your best option.

Whether you need a straightforward arrangement to establish rules for cohabitating with your significant other or a collection of forms to facilitate your divorce proceedings in court, we have you covered. Our platform offers over 85,000 current legal document templates for individual and business purposes. All templates that we provide access to are not generic but tailored according to the specifications of particular states and counties.

To obtain the document, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please remember that you can retrieve your previously acquired document templates at any time from the My documents tab.

Are you unfamiliar with our site? No problem. You can create an account in just a few minutes, but prior to that, ensure to do the following.

Now you can register your account. After that, select the subscription plan and proceed to payment. Once the payment is finalized, download the Charlotte North Carolina Child Support Worksheet C - Child Support Obligation Split Custody in any available format. You can revisit the website at any time and redownload the document free of charge.

Obtaining current legal forms has never been simpler. Try US Legal Forms now, and say goodbye to wasting your precious time trying to understand legal paperwork online forever.

- Check whether the Charlotte North Carolina Child Support Worksheet C - Child Support Obligation Split Custody meets the rules of your state and locality.

- Review the details of the form (if available) to understand for whom and what the document is designed.

- Restart the search if the template does not fit your particular situation.

Form popularity

FAQ

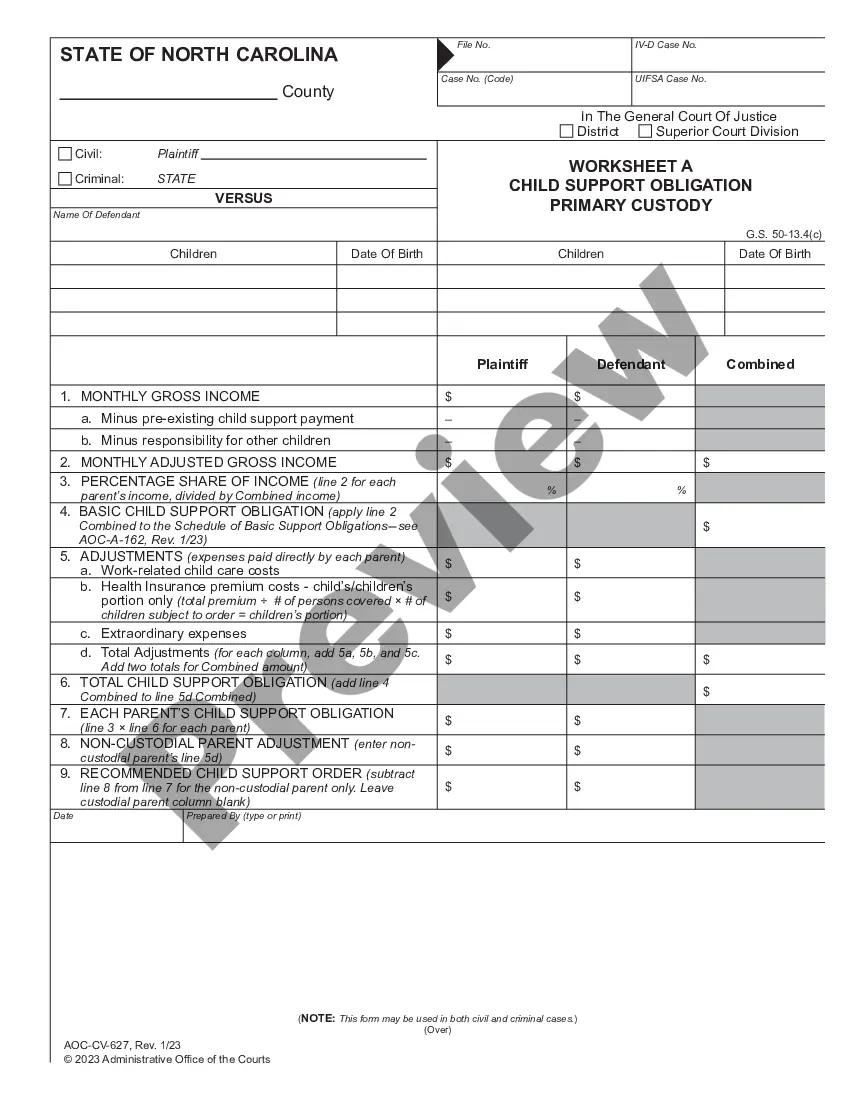

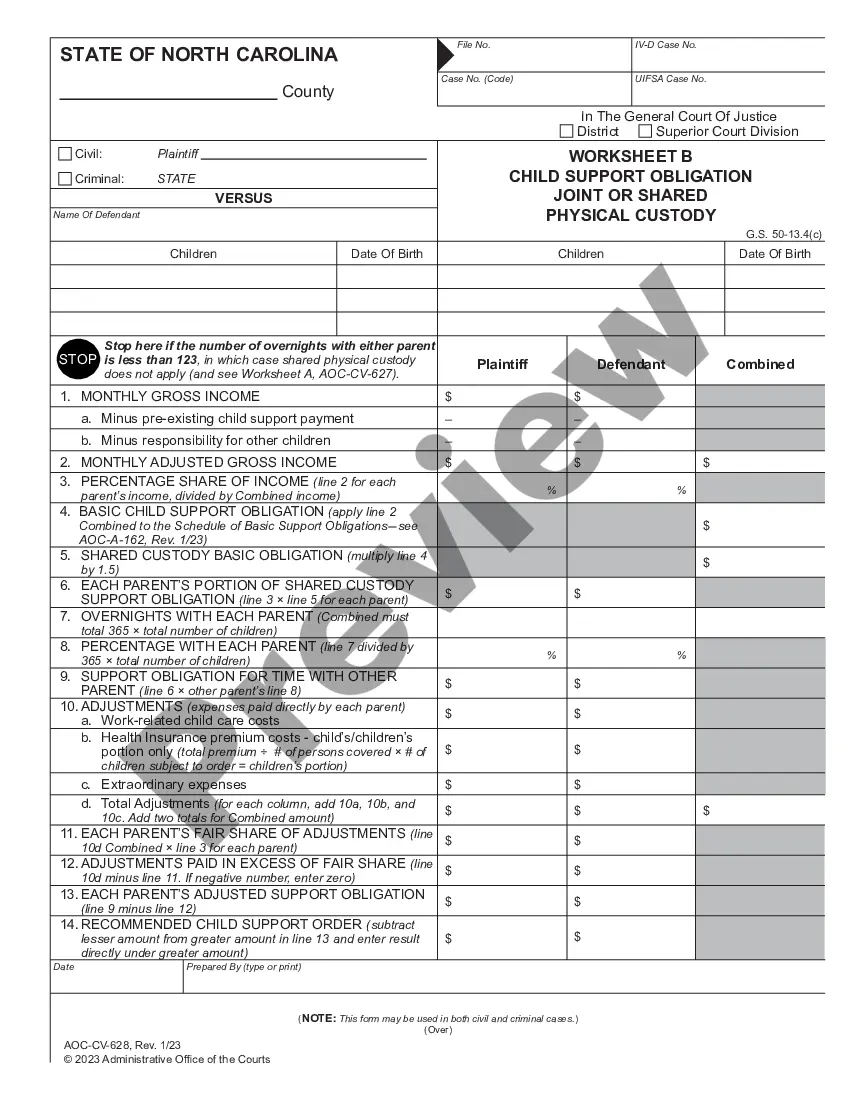

Child support is calculated based on the number of overnights the child or children spend with each parent. Worksheet A recognizes a situation in which one parent has primary custody (more than 243 days per year). Worksheet B is applicable to parents who share custody jointly.

Yes. Under North Carolina law, garnishment of a paycheck for child support may be ordered for up to forty percent (40%) of the net available pay.

If you and your ex-partner have children, you're both expected to continue to pay towards their costs after you separate. And often that means one parent will pay the other. You can agree this between you or, if you can't agree, ask the Child Maintenance Service to calculate the amount.

However, negotiating a joint custody agreement won't automatically reduce your child support amount to zero. The amount joint custodians will owe depends on the income of both parents, who pays certain expenses for the children, and the number of overnights the kids spend in each parent's home.

Even Parents With Joint Custody May Owe Child Support In North Carolina, all parents are responsible for supporting the reasonable needs of their children as long as they have parental rights.

If the parties initially set forth their child support obligations in an agreement, then generally, the parties can likewise change the support obligation by agreement, if both spouses consent and wish to do so. Any change made would of course need to be in writing, and signed by both parties.

Parents can be obligated to pay child support even if they have joint custody of their children.

Parents can be obligated to pay child support even if they have joint custody of their children.