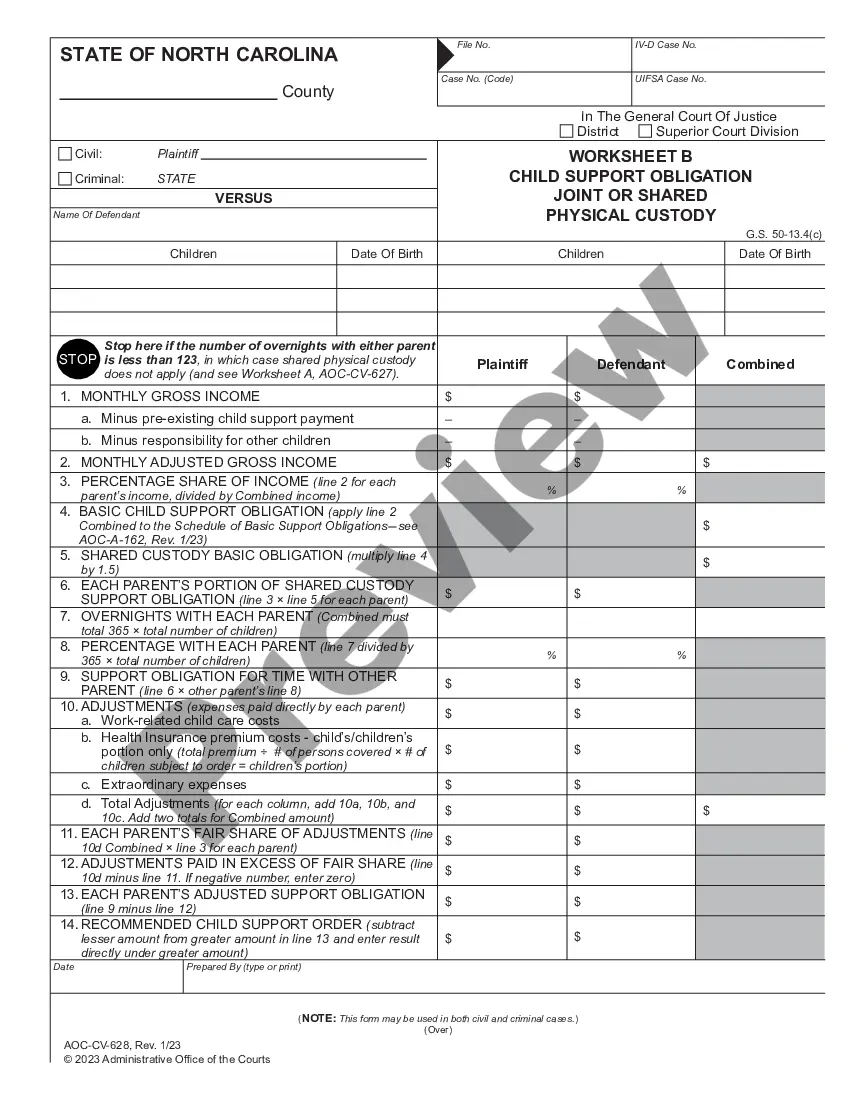

Child Support Worksheet C - Child Support Obligation, Split Custody: This is an official form from the North Carolina Administration of the Courts - AOC, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

High Point North Carolina Child Support Worksheet C — Child Support Obligation Split Custody is a legal document used in the state of North Carolina to determine child support obligations in cases where parents share custody of their children. In split custody arrangements, each parent has primary physical custody of one or more children. The purpose of this worksheet is to establish the financial responsibility of each parent towards the child support obligation. It considers various factors, including the income of both parents, the number of children involved, and the parenting time-share. Specifically, Child Support Worksheet C helps calculate the child support amount by considering the following key elements: 1. Income of each parent: This worksheet takes into account the individual gross monthly income of both parents, which includes wages, salaries, bonuses, commissions, and other sources of income. 2. Adjustments and Deductions: Certain adjustments and deductions are made to the gross income of each parent, including but not limited to, tax deductions, child support payments for children from prior relationships, and health insurance costs. These adjustments help determine the net income for child support calculations. 3. Number of children: The worksheet considers the number of children involved in the split custody arrangement. It accounts for shared children and non-shared children separately to determine the child support obligation accurately. 4. Parenting time credit: The amount of time each parent spends with the children is taken into consideration. Parenting time credits are given to the parent with less parenting time, which can reduce their child support obligation. 5. Additional expenses: Besides basic child support, the worksheet also considers various additional expenses related to childcare, like child care expenses, healthcare costs, and educational expenses. These additional expenses can be allocated between the parents based on their respective incomes. It is important to note that High Point North Carolina Child Support Worksheet C is used specifically for cases involving split custody. If the custody arrangement differs, there are other worksheets available, such as Worksheet A — Sole Custody and Worksheet — - Shared Custody, to determine child support obligations. Ensuring accurate and fair child support calculations is crucial to maintaining the well-being and financial security of children involved in split custody arrangements. High Point North Carolina Child Support Worksheet C serves as a valuable tool for both parents and the court system to establish the appropriate financial support necessary to meet the needs of the children.High Point North Carolina Child Support Worksheet C — Child Support Obligation Split Custody is a legal document used in the state of North Carolina to determine child support obligations in cases where parents share custody of their children. In split custody arrangements, each parent has primary physical custody of one or more children. The purpose of this worksheet is to establish the financial responsibility of each parent towards the child support obligation. It considers various factors, including the income of both parents, the number of children involved, and the parenting time-share. Specifically, Child Support Worksheet C helps calculate the child support amount by considering the following key elements: 1. Income of each parent: This worksheet takes into account the individual gross monthly income of both parents, which includes wages, salaries, bonuses, commissions, and other sources of income. 2. Adjustments and Deductions: Certain adjustments and deductions are made to the gross income of each parent, including but not limited to, tax deductions, child support payments for children from prior relationships, and health insurance costs. These adjustments help determine the net income for child support calculations. 3. Number of children: The worksheet considers the number of children involved in the split custody arrangement. It accounts for shared children and non-shared children separately to determine the child support obligation accurately. 4. Parenting time credit: The amount of time each parent spends with the children is taken into consideration. Parenting time credits are given to the parent with less parenting time, which can reduce their child support obligation. 5. Additional expenses: Besides basic child support, the worksheet also considers various additional expenses related to childcare, like child care expenses, healthcare costs, and educational expenses. These additional expenses can be allocated between the parents based on their respective incomes. It is important to note that High Point North Carolina Child Support Worksheet C is used specifically for cases involving split custody. If the custody arrangement differs, there are other worksheets available, such as Worksheet A — Sole Custody and Worksheet — - Shared Custody, to determine child support obligations. Ensuring accurate and fair child support calculations is crucial to maintaining the well-being and financial security of children involved in split custody arrangements. High Point North Carolina Child Support Worksheet C serves as a valuable tool for both parents and the court system to establish the appropriate financial support necessary to meet the needs of the children.