- US Legal Forms

- Localized Forms

- North Carolina

- Greensboro

-

North Carolina Marital Domestic Separation and Property Settlement...

Greensboro North Carolina Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately

Description

Related forms

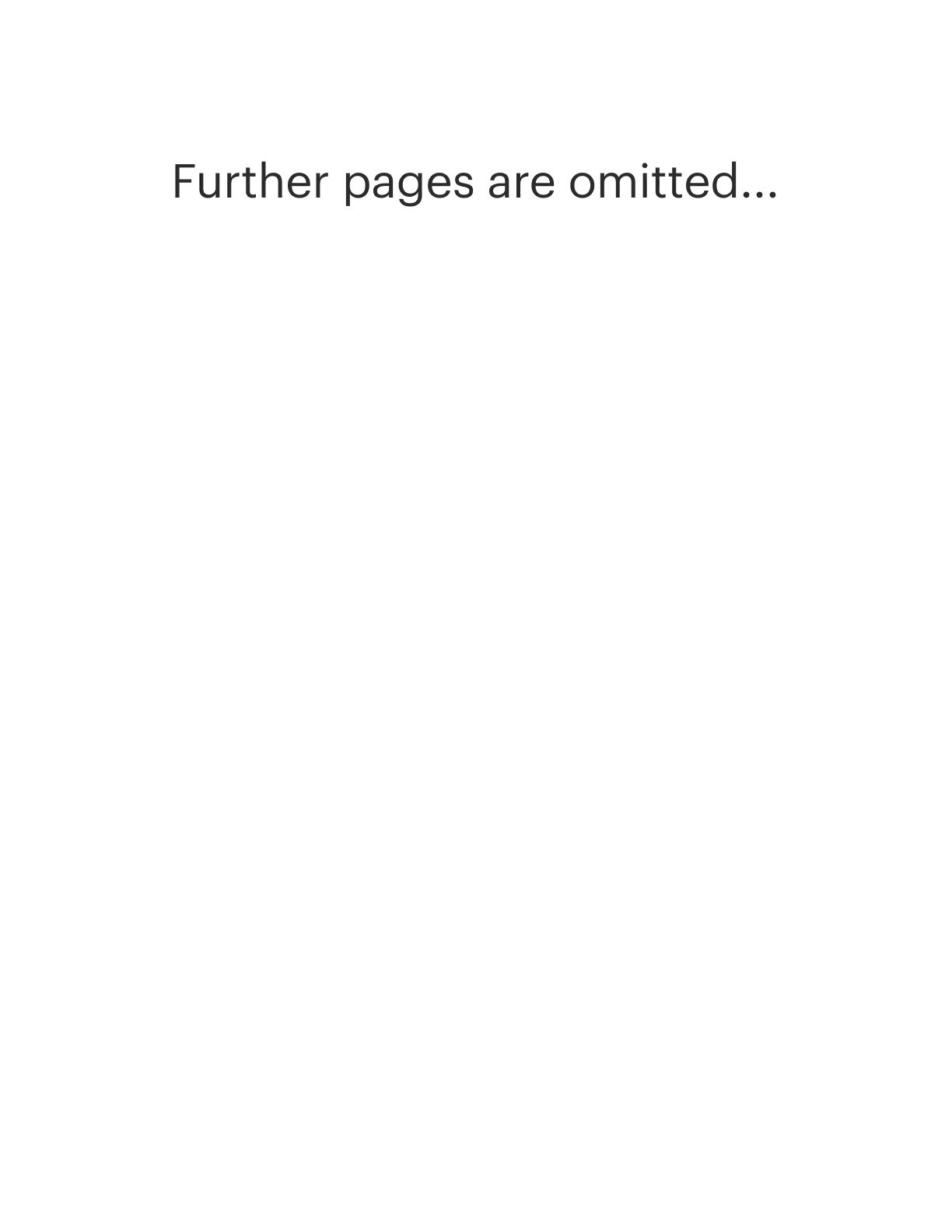

View Burbank Order to Set Aside Attachment, to Substitute Undertaking, Etc.

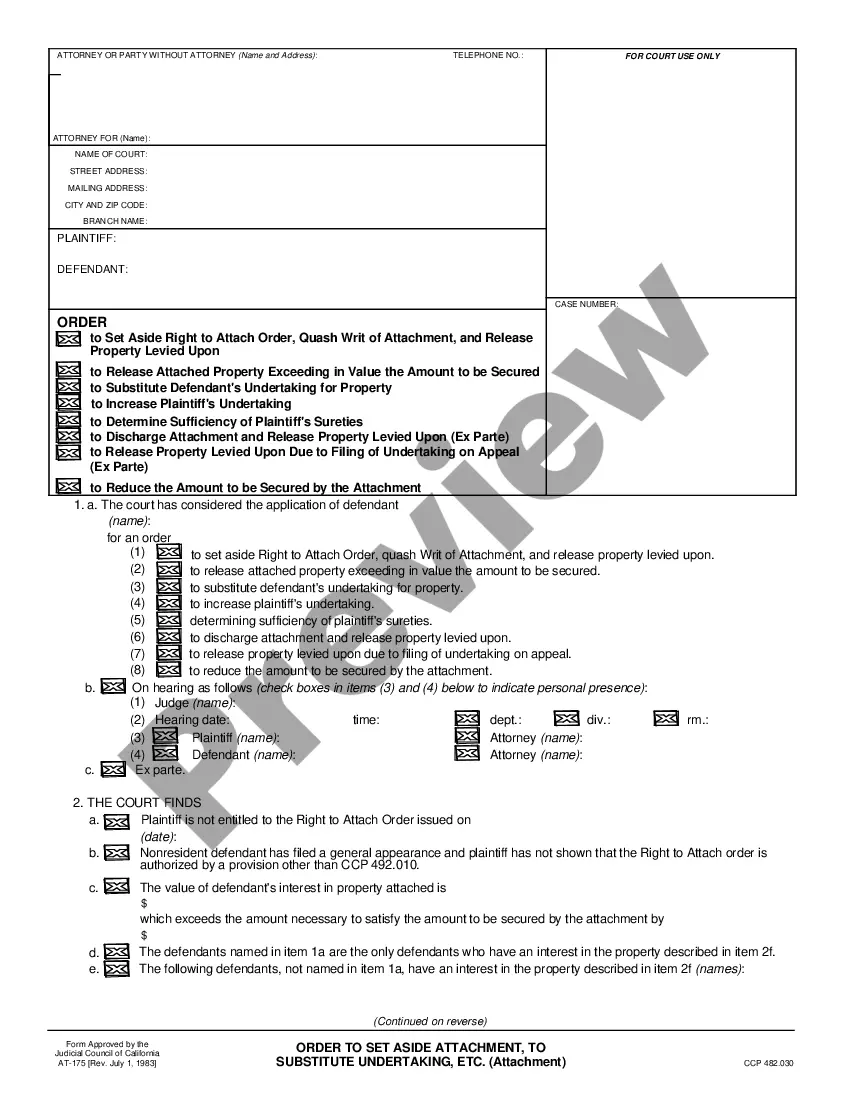

View Burbank Notice of Lien - same as EJ-185

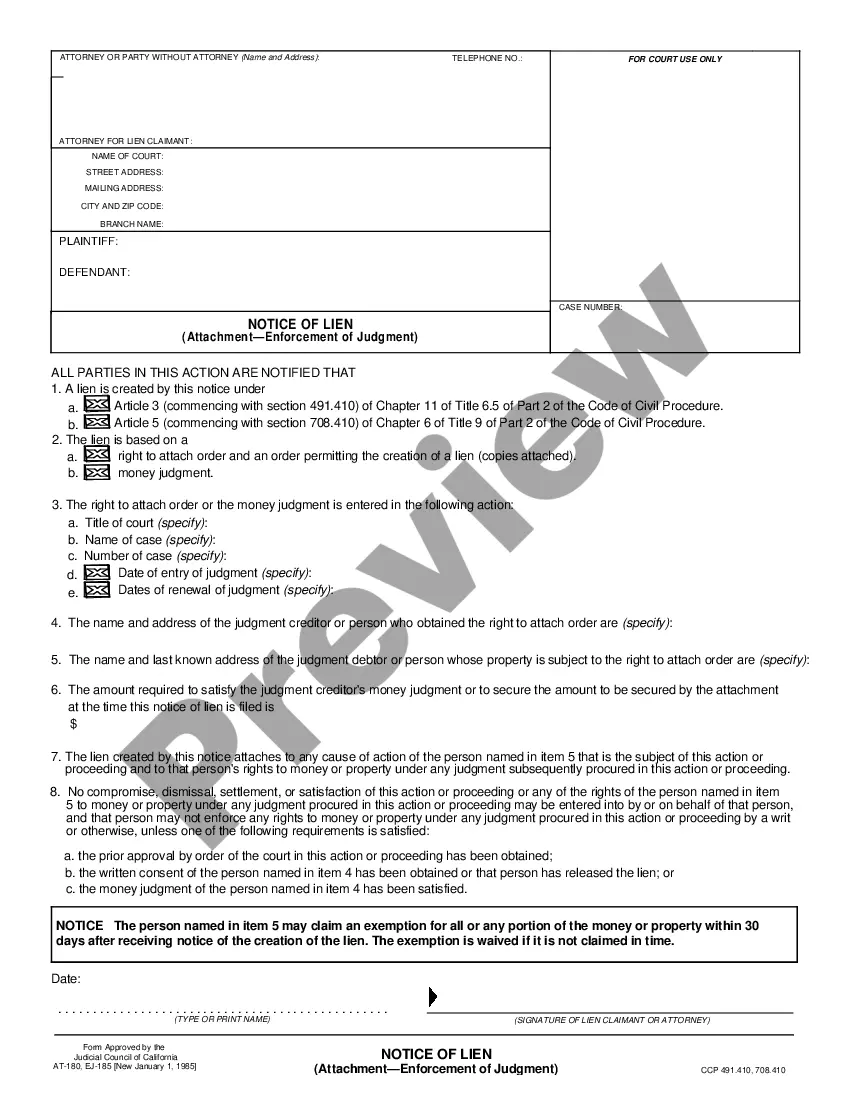

View Burbank Audit Referral Form for Workers' Compensation

View Burbank California Northern District Bankruptcy Guide and Forms Package for Chapters 7 or 13

View Burbank California Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13

Related legal definitions

How to fill out Greensboro North Carolina Marital Domestic Separation And Property Settlement Agreement No Children Parties May Have Joint Property Or Debts Effective Immediately?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Greensboro North Carolina Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Greensboro North Carolina Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Greensboro North Carolina Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form Rating

Form popularity

FAQ

Separate property can become marital property. For example, if it is used to benefit both spouses, it may then be considered a gift to the marriage. It is important to note that North Carolina does not grant common law marriages.

Privacy?Unlike court documents, a separation agreement is not a public record and the general public does not have access to the terms of your agreement without your consent. Time?A court trial can be a long, involved and time-consuming process.

A separation agreement must be entered into freely, fairly and voluntarily. If it can be proven that there were physical, verbal or psychological threats during the negotiating and signing of the terms, the agreement may be thrown out by the Courts.

A separation agreement is not valid in North Carolina unless both parties have signed and their signatures are notarized. For it to be valid, the agreement must be signed at or after the parties' separation. No one can compel a spouse to sign a separation agreement.

It is a legally-binding contract and both partners must adhere to the conditions within it. However, a separation agreement may be invalidated if it can be proven that it was not created fairly. Typically, this occurs if one partner knowingly tricks or threatens the other in order to gain an unfair advantage.

The separation agreement can be considered null and void if it is found that the party failed to disclose any important information about the assets. The court can also give stay orders on the separation agreement if it is found that the agreement is being enforced on one of the parties.

In the state of North Carolina, a couple must be legally separated for one year and a day before they can file for divorce.

A separation agreement is not valid in North Carolina unless both parties have signed and their signatures are notarized. For it to be valid, the agreement must be signed at or after the parties' separation. No one can compel a spouse to sign a separation agreement.

This can be due to changing circumstances as the divorce approaches; or alternatively, one or both parties may not be following the terms of the negotiated agreement to the letter. In such situations, the separation agreement can be amended in one of several ways.

Coercion, fraud, undue influence or lack of knowledge will void the terms of a separation agreement. A separation agreement is not proof of the parties' separation. It is not required for a divorce in North Carolina, and it doesn't make a divorce in North Carolina easier or more difficult to obtain.

Separate property can become marital property. For example, if it is used to benefit both spouses, it may then be considered a gift to the marriage. It is important to note that North Carolina does not grant common law marriages.

Privacy?Unlike court documents, a separation agreement is not a public record and the general public does not have access to the terms of your agreement without your consent. Time?A court trial can be a long, involved and time-consuming process.

A separation agreement must be entered into freely, fairly and voluntarily. If it can be proven that there were physical, verbal or psychological threats during the negotiating and signing of the terms, the agreement may be thrown out by the Courts.

A separation agreement is not valid in North Carolina unless both parties have signed and their signatures are notarized. For it to be valid, the agreement must be signed at or after the parties' separation. No one can compel a spouse to sign a separation agreement.

It is a legally-binding contract and both partners must adhere to the conditions within it. However, a separation agreement may be invalidated if it can be proven that it was not created fairly. Typically, this occurs if one partner knowingly tricks or threatens the other in order to gain an unfair advantage.

The separation agreement can be considered null and void if it is found that the party failed to disclose any important information about the assets. The court can also give stay orders on the separation agreement if it is found that the agreement is being enforced on one of the parties.

In the state of North Carolina, a couple must be legally separated for one year and a day before they can file for divorce.

A separation agreement is not valid in North Carolina unless both parties have signed and their signatures are notarized. For it to be valid, the agreement must be signed at or after the parties' separation. No one can compel a spouse to sign a separation agreement.

This can be due to changing circumstances as the divorce approaches; or alternatively, one or both parties may not be following the terms of the negotiated agreement to the letter. In such situations, the separation agreement can be amended in one of several ways.

Coercion, fraud, undue influence or lack of knowledge will void the terms of a separation agreement. A separation agreement is not proof of the parties' separation. It is not required for a divorce in North Carolina, and it doesn't make a divorce in North Carolina easier or more difficult to obtain.

Separate property can become marital property. For example, if it is used to benefit both spouses, it may then be considered a gift to the marriage. It is important to note that North Carolina does not grant common law marriages.

Privacy?Unlike court documents, a separation agreement is not a public record and the general public does not have access to the terms of your agreement without your consent. Time?A court trial can be a long, involved and time-consuming process.

A separation agreement must be entered into freely, fairly and voluntarily. If it can be proven that there were physical, verbal or psychological threats during the negotiating and signing of the terms, the agreement may be thrown out by the Courts.

A separation agreement is not valid in North Carolina unless both parties have signed and their signatures are notarized. For it to be valid, the agreement must be signed at or after the parties' separation. No one can compel a spouse to sign a separation agreement.

It is a legally-binding contract and both partners must adhere to the conditions within it. However, a separation agreement may be invalidated if it can be proven that it was not created fairly. Typically, this occurs if one partner knowingly tricks or threatens the other in order to gain an unfair advantage.

The separation agreement can be considered null and void if it is found that the party failed to disclose any important information about the assets. The court can also give stay orders on the separation agreement if it is found that the agreement is being enforced on one of the parties.

In the state of North Carolina, a couple must be legally separated for one year and a day before they can file for divorce.

A separation agreement is not valid in North Carolina unless both parties have signed and their signatures are notarized. For it to be valid, the agreement must be signed at or after the parties' separation. No one can compel a spouse to sign a separation agreement.

This can be due to changing circumstances as the divorce approaches; or alternatively, one or both parties may not be following the terms of the negotiated agreement to the letter. In such situations, the separation agreement can be amended in one of several ways.

Coercion, fraud, undue influence or lack of knowledge will void the terms of a separation agreement. A separation agreement is not proof of the parties' separation. It is not required for a divorce in North Carolina, and it doesn't make a divorce in North Carolina easier or more difficult to obtain.

Greensboro North Carolina Marital Domestic Separation and Property Settlement Agreement no Children parties may have Joint Property or Debts Effective Immediately Related Searches

-

what happens to property owned before marriage in nc

-

spouse won't sign separation agreement nc

-

separation agreement nc template

-

n.c. equitable distribution statute of limitations

-

nc divorce laws regarding 401k

-

nc divorce laws 2021

-

is north carolina a community property state after death

-

is nc a community property state

-

what is considered marital property in north carolina

-

what is a spouse entitled to in a divorce in nc

Interesting Questions

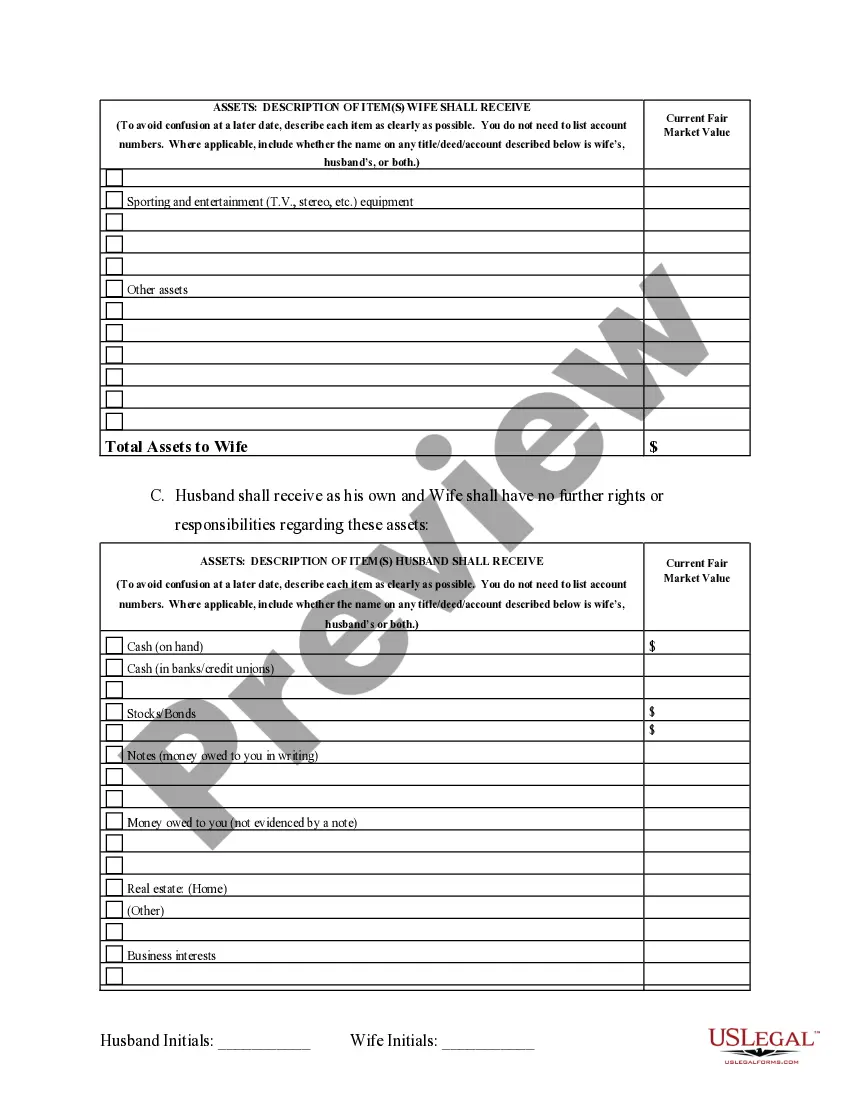

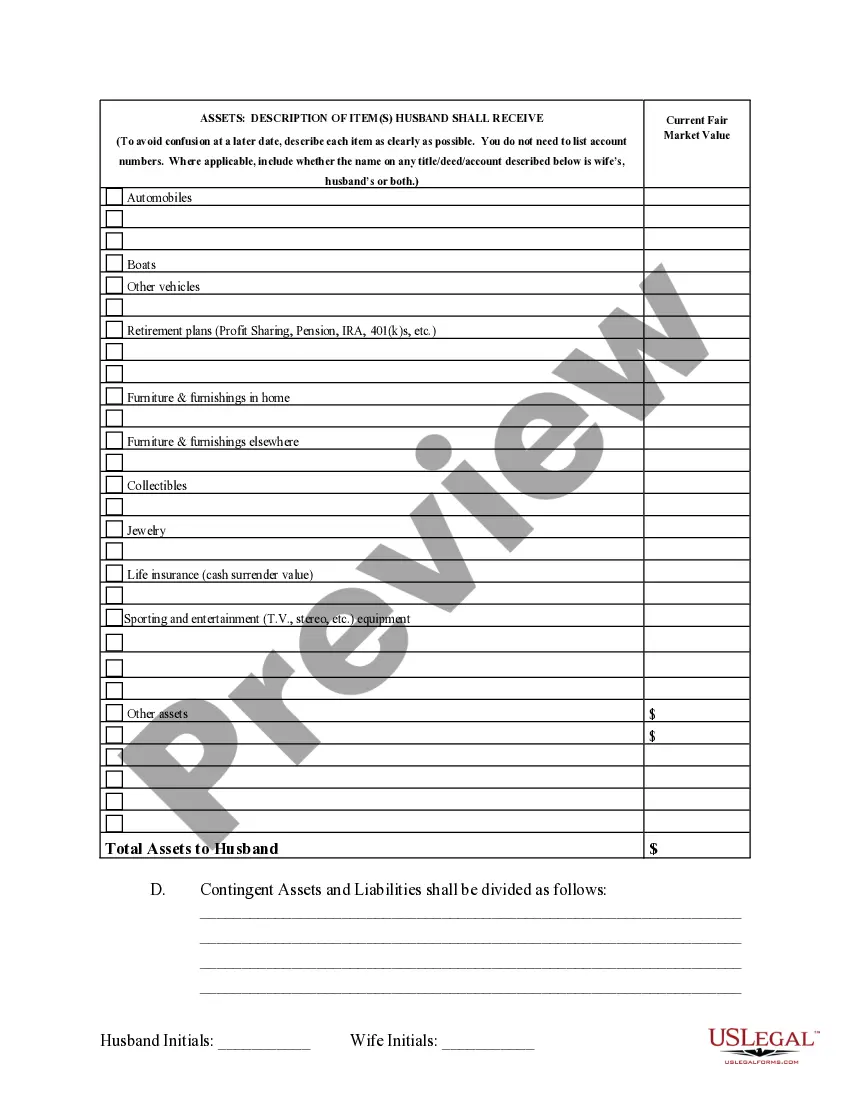

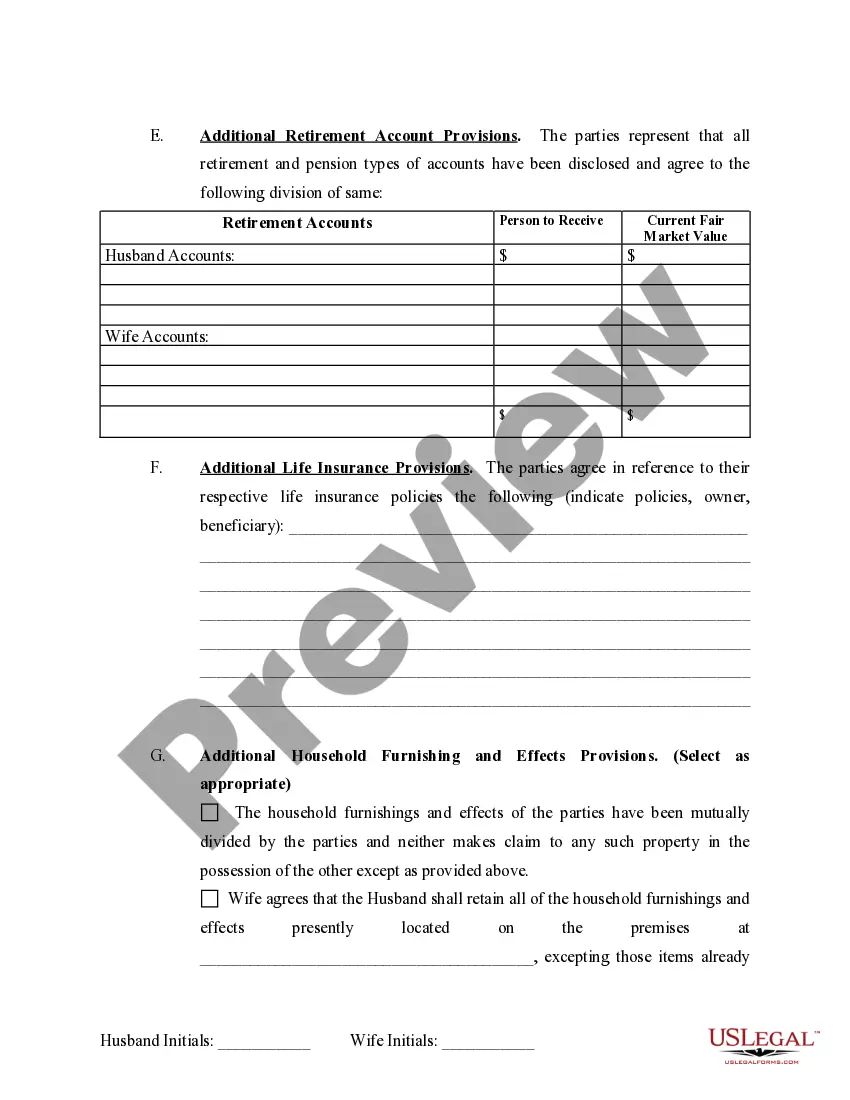

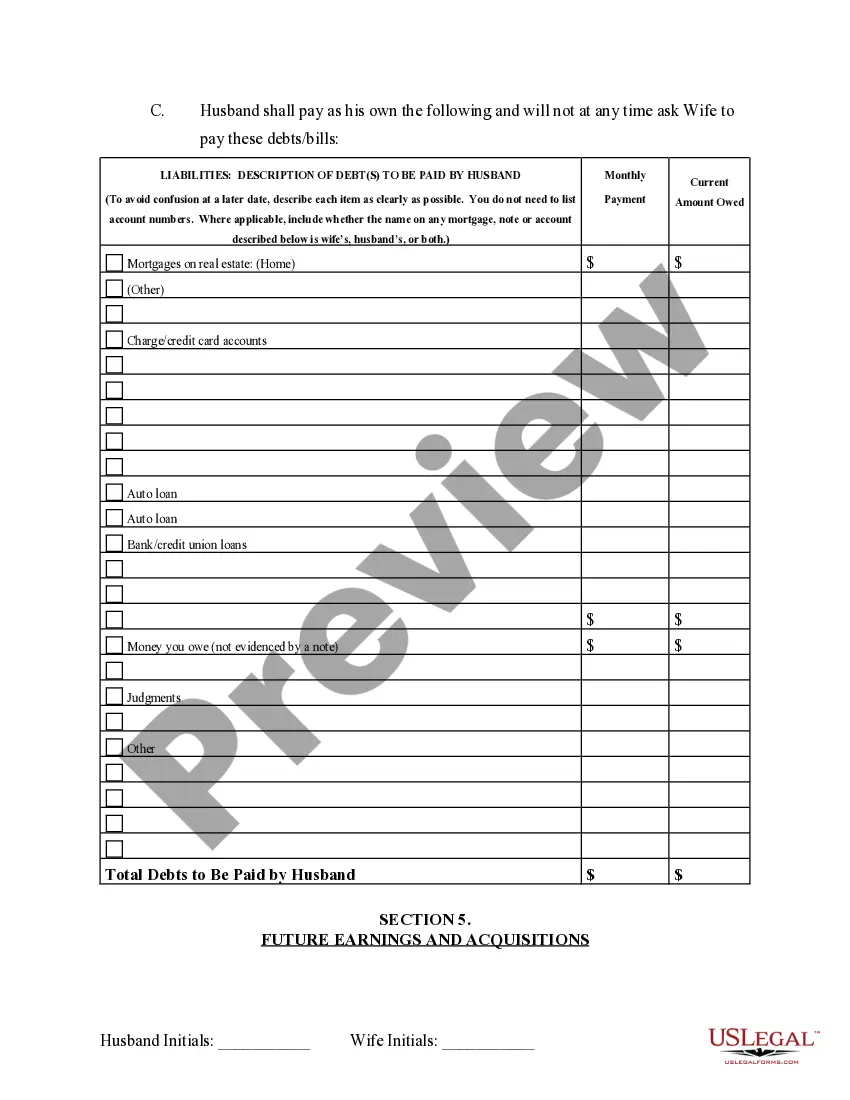

A Marital Domestic Separation and Property Settlement Agreement is a legal document that outlines the division of assets, debts, and other matters between married couples who are separating and getting divorced.

If you have joint property with your spouse, the Marital Domestic Separation and Property Settlement Agreement will specify how that property will be divided between both parties.

During a separation, it is important to address joint debts. The Marital Domestic Separation and Property Settlement Agreement will determine how these debts will be shared or paid off.

Yes, the Marital Domestic Separation and Property Settlement Agreement is effective immediately upon both parties signing the agreement.

'Effective immediately' means that the terms and provisions outlined in the agreement will start being enforced and put into action as soon as the agreement is signed.

If you and your spouse don't have children, the Marital Domestic Separation and Property Settlement Agreement will focus solely on the division of property and debts.

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

North Carolina

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Jersey

-

New Mexico

-

New York

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Dakota

-

Tennessee

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

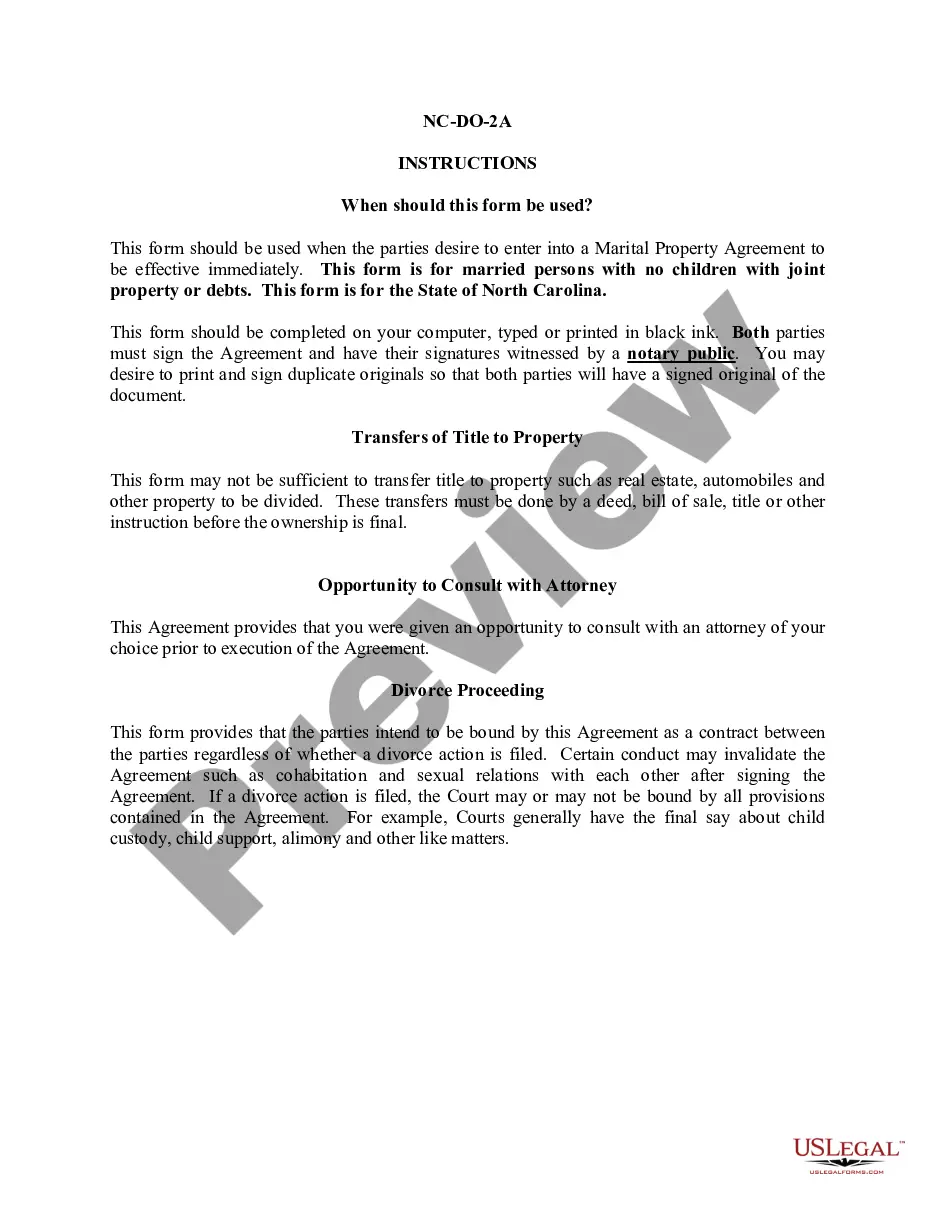

Note: This summary is not intended to be an all inclusive discussion of the law of separation agreements in North Carolina, but does include basic and other provisions.

General Summary:

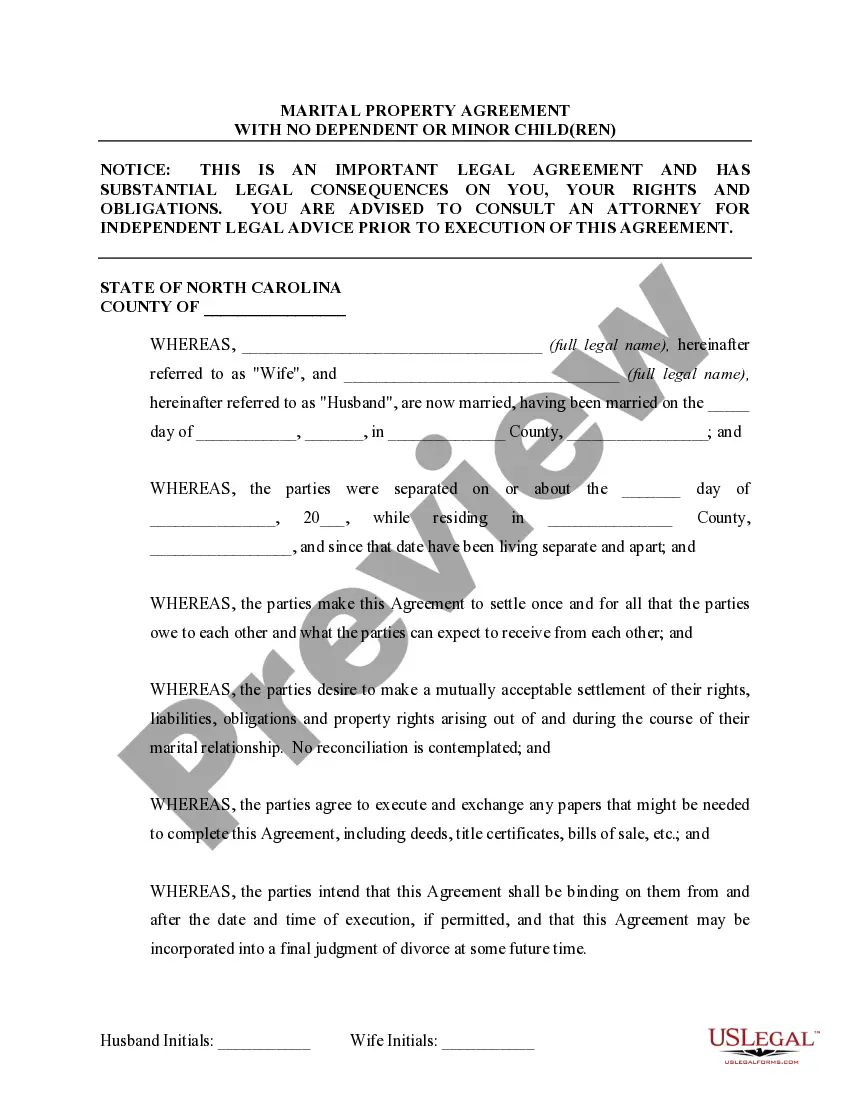

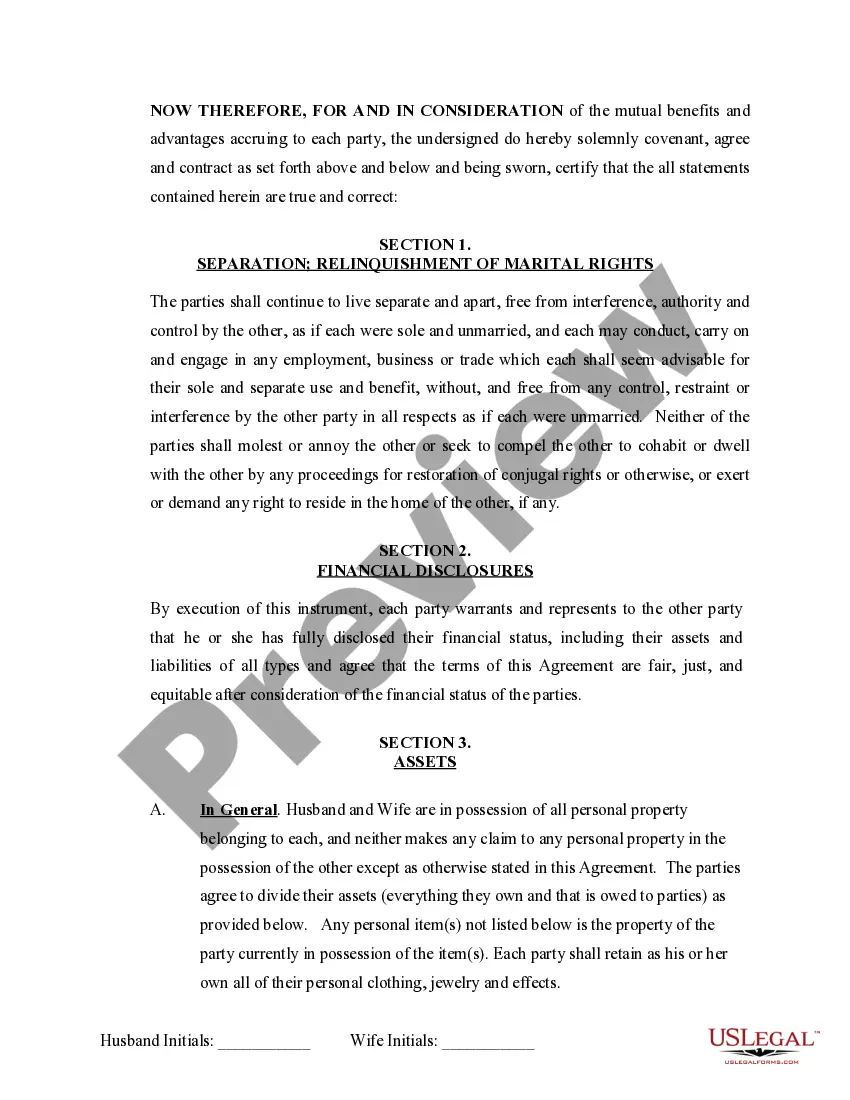

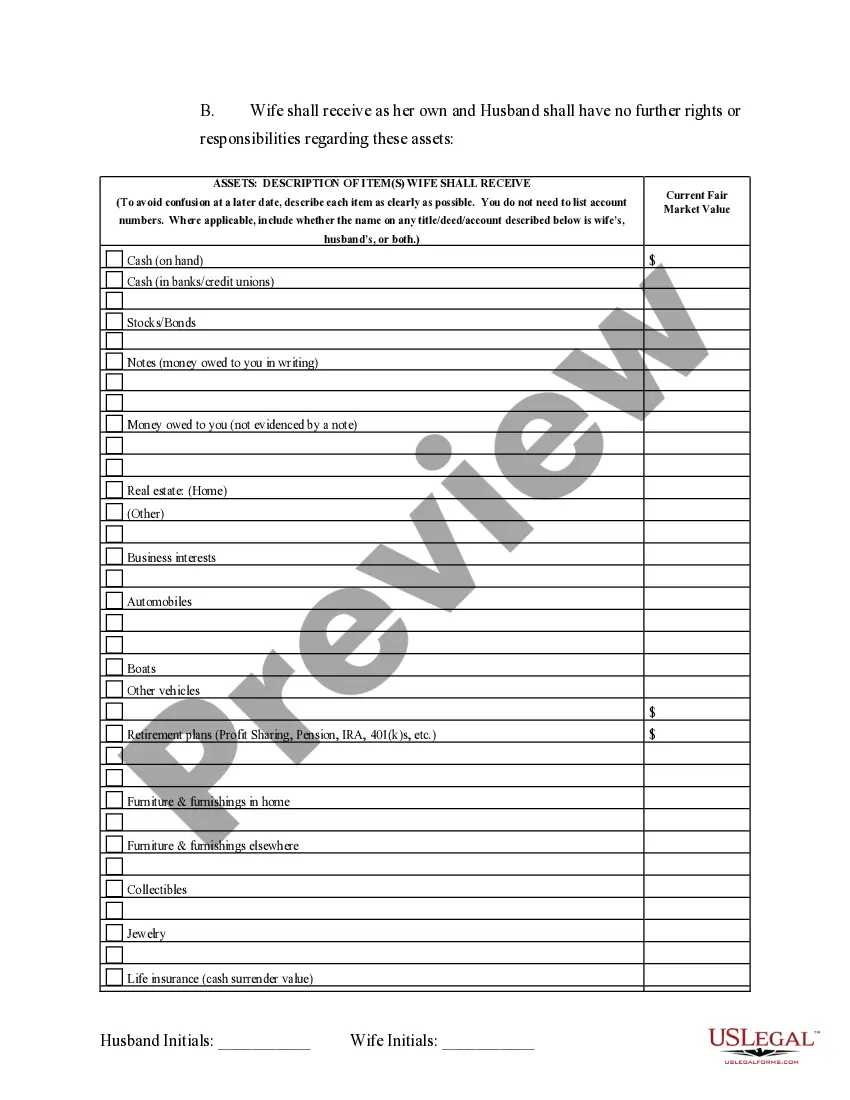

Any married couple is hereby authorized to execute a separation agreement not inconsistent with public policy which shall be legal, valid, and binding in all respects; provided, that the separation agreement must be in writing and acknowledged by both parties before a certifying officer, such as a notary public. When the Agreement is presented to the court for the court's approval, the agreement is treated not as a contract but rather as a court ordered judgment which may be modified and enforced through the contempt powers of the court, in the same manner as any other judgment in a domestic relations case.

Statutes:

North Carolina General Statutes

Chapter 50

Divorce and Alimony

Distribution by court of marital and divisible property upon divorce:

(a) Upon application of a party, the court shall

determine what is the marital property and divisible property and shall

provide for an equitable distribution of the marital property and divisible

property between the parties in accordance with the provisions of this

section.

(b) For purposes of this section:

(1) "Marital property" means all real and personal

property acquired by either spouse or both spouses during the course of

the marriage and before the date of the separation of the parties, and

presently owned, except property determined to be separate property or

divisible property in accordance with subdivision (2) or (4) of this subsection.

Marital property includes all vested and nonvested pension, retirement,

and other deferred compensation rights, and vested and nonvested military

pensions eligible under the federal Uniformed Services Former Spouses'

Protection Act. It is presumed that all property acquired after the date

of marriage and before the date of separation is marital property except

property which is separate property under subdivision (2) of this subsection.

This presumption may be rebutted by the greater weight of the evidence.

(2) "Separate property" means all real and personal property

acquired by a spouse before marriage or acquired by a spouse by bequest,

devise, descent, or gift during the course of the marriage. However, property

acquired by gift from the other spouse during the course of the

marriage shall be considered separate property only if such an intention

is stated in the conveyance. Property acquired in exchange for separate

property shall remain separate property regardless of whether the title

is in the name of the husband or wife or both and shall not be considered

to be marital property unless a contrary intention is expressly stated

in the conveyance. The increase in value of separate property

and the income derived from separate property shall be considered separate

property. All professional licenses and business licenses which would terminate

on transfer shall be considered separate property.

(3) "Distributive award" means payments that are payable

either in a lump sum or over a period of time in fixed amounts, but shall

not include alimony payments or other similar payments for support and

maintenance which are treated as ordinary income to the recipient under

the Internal Revenue Code.

(4) "Divisible property" means all real and personal property

as set forth below:

a. All appreciation and diminution in value of marital property

and divisible property of the parties occurring after the date of separation

and prior to the date of distribution, except that appreciation or diminution

in value which is the result of postseparation actions or activities of

a spouse shall not be treated as divisible property.

b. All property, property rights, or any portion thereof

received after the date of separation but before the date of distribution

that was acquired as a result of the efforts of either spouse during the

marriage and before the date of separation, including, but not limited

to, commissions, bonuses, and contractual rights.

c. Passive income from marital property received after the

date of separation, including, but not limited to, interest

and dividends.

d. Increases in marital debt and financing charges and interest

related to marital debt.

(c) There shall be an equal division by using net value of marital

property and net value of divisible property unless the court determines

that an equal division is not equitable. If the court determines that an

equal division is not equitable, the court shall divide the marital property

and divisible property equitably. Factors the court shall consider under

this subsection are as follows:

(1) The income, property, and liabilities of each

party at the time the division of property is to become effective;

(2) Any obligation for support arising out of a prior marriage;

(3) The duration of the marriage and the age and physical

and mental health of both parties;

(4) The need of a parent with custody of a child or children

of the marriage to occupy or own the marital residence and to use or own

its household effects;

(5) The expectation of pension, retirement, or other deferred

compensation rights that are not marital property;

(6) Any equitable claim to, interest in, or direct or indirect

contribution made to the acquisition of such marital property by the party

not having title, including joint efforts or expenditures and contributions

and services, or lack thereof, as a spouse, parent, wage earner or homemaker;

(7) Any direct or indirect contribution made by one spouse

to help educate or develop the career potential of the other spouse;

(8) Any direct contribution to an increase in value of separate

property which occurs during the course of the marriage;

(9) The liquid or nonliquid character of all marital property

and divisible property;

(10) The difficulty of evaluating any component asset or

any interest in a business, corporation or profession, and the economic

desirability of retaining such asset or interest, intact and free from

any claim or interference by the other party;

(11) The tax consequences to each party;

(11a) Acts of either party to maintain, preserve, develop,

or expand; or to waste, neglect, devalue or convert the marital property

or divisible property, or both, during the period after separation of the

parties and before the time of distribution; and

(12) Any other factor which the court finds to be just

and proper.

(c1) Notwithstanding any other provision of law, a

second or subsequent spouse acquires no interest in the marital property

and divisible property of his or her spouse from a former marriage until

a final determination of equitable distribution is made in the marital

property and divisible property of the spouse's former marriage.

(d) Before, during or after marriage the parties may by written

agreement, duly executed and acknowledged in accordance with the provisions

of G.S. 52-10 and 52-10.1, or by a written agreement valid in the jurisdiction

where executed, provide for distribution of the marital property or divisible

property, or both, in a manner deemed by the parties to be equitable and

the agreement shall be binding on the parties.

(e) Subject to the presumption of subsection (c) of this

section that an equal division is equitable, it shall be presumed in every

action that an in-kind distribution of marital or divisible property is

equitable. This presumption may be rebutted by the greater weight of the

evidence, or by evidence that the property is a closely held business entity

or is otherwise not susceptible of division in-kind. In any action in which

the presumption is rebutted, the court in lieu of in-kind distribution

shall provide for a distributive award in order to achieve equity between

the parties. The court may provide for a distributive award to facilitate,

effectuate or supplement a distribution of marital or divisible property.

The court may provide that any distributive award payable over a period

of time be secured by a lien on specific property.

(f) The court shall provide for an equitable distribution

without regard to alimony for either party or support of the children of

both parties. After the determination of an equitable distribution, the

court, upon request of either party, shall consider whether an order for

alimony or child support should be modified or vacated pursuant to G.S.

50-16.9 or 50-13.7.

(g) If the court orders the transfer of real or personal

property or an interest therein, the court may also enter an order which

shall transfer title, as provided in G.S. 1A-1, Rule 70 and G.S. 1-228.

(h) If either party claims that any real property is marital

property or divisible property, that party may cause a notice of lis pendens

to be recorded pursuant to Article 11 of Chapter 1 of the General Statutes.

Any person whose conveyance or encumbrance is recorded or whose interest

is obtained by descent, prior to the filing of the lis pendens, shall take

the real property free of any claim resulting from the equitable distribution

proceeding. The court may cancel the notice of lis pendens upon substitution

of a bond with surety in an amount determined by the court to be sufficient

provided the court finds that the claim of the spouse against property

subject to the notice of lis pendens can be satisfied by money damages.

(i) Upon filing an action or motion in the cause requesting

an equitable distribution or alleging that an equitable distribution will

be requested when it is timely to do so, a party may seek injunctive relief

pursuant to G.S. 1A-1, Rule 65 and Chapter 1, Article 37, to prevent the

disappearance, waste or conversion of property alleged to be marital property,

divisible property, or separate property of the party seeking relief. The

court, in lieu of granting an injunction, may require a bond or other assurance

of sufficient amount to protect the interest of the other spouse in the

property. Upon application by the owner of separate property which was

removed from the marital home or possession of its owner by the other spouse,

the court may enter an order for reasonable counsel fees and costs of court

incurred to regain its possession, but such fees shall not exceed the fair

market value of the separate property at the time it was removed.

(i1) Unless good cause is shown that there should not be

an interim distribution, the court may, at any time after an action for

equitable distribution has been filed and prior to the final judgment of

equitable distribution, enter orders declaring what is separate property

and may also enter orders dividing part of the marital property, divisible property or debt, or marital debt

between the parties. The partial distribution may provide for a distributive

award and may also provide for a distribution of marital property, marital

debt, divisible property, or divisible debt. Any such orders entered shall

be taken into consideration at trial and proper credit given.

Hearings held pursuant to this subsection may be held at sessions

arranged by the chief district court judge pursuant to G.S. 7A-146 and,

if held at such sessions, shall not be subject to the reporting requirements

of G.S. 7A-198.

(j) In any order for the distribution of property made pursuant

to this section, the court shall make written findings of fact that support

the determination that the marital property and divisible property has

been equitably divided.

(k) The rights of the parties to an equitable distribution

of marital property and divisible property are a species of common ownership,

the rights of the respective parties vesting at the time of the parties'

separation. § 50-20.

Procedures in actions for equitable distribution of property; sanctions for purposeful and prejudicial delay:

(a) At any time after a husband and wife begin to

live separate and apart from each other, a claim for equitable distribution

may be filed, either as a separate civil action, or together with any other

action brought pursuant to Chapter 50 of the General Statutes, or as a

motion in the cause as provided by G.S. 50-11(e) or (f). Within 90 days

after service of a claim for equitable distribution, the party who first

asserts the claim shall prepare and serve upon the opposing party an equitable

distribution inventory affidavit listing all property claimed by the party

to be marital property and all property claimed by the party to be separate

property, and the estimated date-of-separation fair market value of each

item of marital and separate property. Within 30 days after service of

the inventory affidavit, the party upon whom service is made shall prepare

and serve an inventory affidavit upon the other party. The inventory affidavits

prepared and served pursuant to this subsection shall be subject to amendment

and shall not be binding at trial as to completeness or value. The court

may extend the time limits in this subsection for good cause shown. The

affidavits are subject to the requirements of G.S. 1A-1, Rule 11, and are

deemed to be in the nature of answers to interrogatories propounded to

the parties. Any party failing to supply the information required by this

subsection in the affidavit is subject to G.S. 1A-1, Rules 26, 33, and

37. During the pendency of the action for equitable distribution, discovery

may proceed, and the court shall enter temporary orders as appropriate

and necessary for the purpose of preventing the disappearance, waste, or

destruction of marital or separate property or to secure the possession

thereof.

Real or personal property located outside of North Carolina is subject

to equitable distribution in accordance with the provisions of G.S. 50-20,

and the court may include in its order appropriate provisions to ensure

compliance with the order of equitable distribution.

(b) For purposes of equitable distribution, marital property

shall be valued as of the date of the separation of the parties, and evidence

of preseparation and postseparation occurrences or values is competent

as corroborative evidence of the value of marital property as of the date

of the separation of the parties. Divisible property and divisible debt

shall be valued as of the date of distribution.

(c) Nothing in G.S. 50-20 or this section shall restrict

or extend the right to trial by jury as provided by the Constitution of

North Carolina.

(d) Within 120 days after the filing of the initial pleading

or motion in the cause for equitable distribution, the party first serving

the pleading or application shall apply to the court to conduct a scheduling

and discovery conference. If that party fails to make application, then

the other party may do so. At the conference the court shall determine

a schedule of discovery as well as consider and rule upon any motions for

appointment of expert witnesses, or other applications, including applications

to determine the date of separation, and shall set a date for the disclosure

of expert witnesses and a date on or before which an initial pretrial conference

shall be held.

At the initial pretrial conference the court shall make inquiry

as to the status of the case and shall enter a date for the completion

of discovery, the completion of a mediated settlement conference, if applicable,

and the filing and service of motions, and shall determine a date on or

after which a final pretrial conference shall be held and a date on or

after which the case shall proceed to trial.

The final pretrial conference shall be conducted pursuant to the

Rules of Civil Procedure and the General Rules of Practice in the applicable

district or superior court, adopted pursuant to G.S. 7A-34. The court shall

rule upon any matters reasonably necessary to effect a fair and prompt

disposition of the case in the interests of justice.

(e) Upon motion of either party or upon the court's own initiative,

the court shall impose an appropriate sanction on a party when the court

finds that:

(1) The party has willfully obstructed or unreasonably

delayed, or has attempted to obstruct or unreasonably delay, discovery

proceedings, including failure to make discovery pursuant to G.S. 1A-1,

Rule 37, or has willfully obstructed or unreasonably delayed or attempted

to obstruct or unreasonably delay any pending equitable distribution proceeding,

and

(2) The willful obstruction or unreasonable delay of the

proceedings is or would be prejudicial to the interests of the opposing

party.

Delay consented to by the parties is not grounds for sanctions. The sanction may include an order to pay the other party the amount of the reasonable expenses and damages incurred because of the willful obstruction or unreasonable delay, including a reasonable attorneys' fee, and including appointment by the court, at the offending party's expense, of an accountant, appraiser, or other expert whose services the court finds are necessary to secure in order for the discovery or other equitable distribution proceeding to be timely conducted. § 50-21.

Chapter 52

Powers and Liabilities of Married Persons

Separation agreements:

Any married couple is hereby authorized to execute a separation agreement not inconsistent with public policy which shall be legal, valid, and binding in all respects; provided, that the separation agreement must be in writing and acknowledged by both parties before a certifying officer as defined in G.S. 52-10(b). Such certifying officer must not be a party to the contract. This section shall not apply to any judgment of the superior court or other State court of competent jurisdiction, which, by reason of its being consented to by a husband and wife, or their attorneys, may be construed to constitute a separation agreement between such husband and wife. § 52-10.1.

Case Law:

Whenever the parties bring their separation agreements before the court for the court's approval, the agreement will be treated not as a contract but rather as a court ordered judgment . . . modifiable, and enforceable by the contempt powers of the court, in the same manner as any other judgment in a domestic relations case. Walters v. Walters, 307 N.C. 381, 298 S.E.2d 338 (1983).

No separation agreement between the parents will serve to deprive the court of its inherent authority to protect the interests and provide for the welfare of infants. A husband and wife may bind themselves by a separation agreement or by a consent judgment but they cannot withdraw children of the marriage from the protective custody of the court. Walters v. Walters, 307 N.C. 381, 298 S.E.2d 338 (1983).

Note: This summary is not intended to be an all inclusive discussion of the law of separation agreements in North Carolina, but does include basic and other provisions.

General Summary:

Any married couple is hereby authorized to execute a separation agreement not inconsistent with public policy which shall be legal, valid, and binding in all respects; provided, that the separation agreement must be in writing and acknowledged by both parties before a certifying officer, such as a notary public. When the Agreement is presented to the court for the court's approval, the agreement is treated not as a contract but rather as a court ordered judgment which may be modified and enforced through the contempt powers of the court, in the same manner as any other judgment in a domestic relations case.

Statutes:

North Carolina General Statutes

Chapter 50

Divorce and Alimony

Distribution by court of marital and divisible property upon divorce:

(a) Upon application of a party, the court shall

determine what is the marital property and divisible property and shall

provide for an equitable distribution of the marital property and divisible

property between the parties in accordance with the provisions of this

section.

(b) For purposes of this section:

(1) "Marital property" means all real and personal

property acquired by either spouse or both spouses during the course of

the marriage and before the date of the separation of the parties, and

presently owned, except property determined to be separate property or

divisible property in accordance with subdivision (2) or (4) of this subsection.

Marital property includes all vested and nonvested pension, retirement,

and other deferred compensation rights, and vested and nonvested military

pensions eligible under the federal Uniformed Services Former Spouses'

Protection Act. It is presumed that all property acquired after the date

of marriage and before the date of separation is marital property except

property which is separate property under subdivision (2) of this subsection.

This presumption may be rebutted by the greater weight of the evidence.

(2) "Separate property" means all real and personal property

acquired by a spouse before marriage or acquired by a spouse by bequest,

devise, descent, or gift during the course of the marriage. However, property

acquired by gift from the other spouse during the course of the

marriage shall be considered separate property only if such an intention

is stated in the conveyance. Property acquired in exchange for separate

property shall remain separate property regardless of whether the title

is in the name of the husband or wife or both and shall not be considered

to be marital property unless a contrary intention is expressly stated

in the conveyance. The increase in value of separate property

and the income derived from separate property shall be considered separate

property. All professional licenses and business licenses which would terminate

on transfer shall be considered separate property.

(3) "Distributive award" means payments that are payable

either in a lump sum or over a period of time in fixed amounts, but shall

not include alimony payments or other similar payments for support and

maintenance which are treated as ordinary income to the recipient under

the Internal Revenue Code.

(4) "Divisible property" means all real and personal property

as set forth below:

a. All appreciation and diminution in value of marital property

and divisible property of the parties occurring after the date of separation

and prior to the date of distribution, except that appreciation or diminution

in value which is the result of postseparation actions or activities of

a spouse shall not be treated as divisible property.

b. All property, property rights, or any portion thereof

received after the date of separation but before the date of distribution

that was acquired as a result of the efforts of either spouse during the

marriage and before the date of separation, including, but not limited

to, commissions, bonuses, and contractual rights.

c. Passive income from marital property received after the

date of separation, including, but not limited to, interest

and dividends.

d. Increases in marital debt and financing charges and interest

related to marital debt.

(c) There shall be an equal division by using net value of marital

property and net value of divisible property unless the court determines

that an equal division is not equitable. If the court determines that an

equal division is not equitable, the court shall divide the marital property

and divisible property equitably. Factors the court shall consider under

this subsection are as follows:

(1) The income, property, and liabilities of each

party at the time the division of property is to become effective;

(2) Any obligation for support arising out of a prior marriage;

(3) The duration of the marriage and the age and physical

and mental health of both parties;

(4) The need of a parent with custody of a child or children

of the marriage to occupy or own the marital residence and to use or own

its household effects;

(5) The expectation of pension, retirement, or other deferred

compensation rights that are not marital property;

(6) Any equitable claim to, interest in, or direct or indirect

contribution made to the acquisition of such marital property by the party

not having title, including joint efforts or expenditures and contributions

and services, or lack thereof, as a spouse, parent, wage earner or homemaker;

(7) Any direct or indirect contribution made by one spouse

to help educate or develop the career potential of the other spouse;

(8) Any direct contribution to an increase in value of separate

property which occurs during the course of the marriage;

(9) The liquid or nonliquid character of all marital property

and divisible property;

(10) The difficulty of evaluating any component asset or

any interest in a business, corporation or profession, and the economic

desirability of retaining such asset or interest, intact and free from

any claim or interference by the other party;

(11) The tax consequences to each party;

(11a) Acts of either party to maintain, preserve, develop,

or expand; or to waste, neglect, devalue or convert the marital property

or divisible property, or both, during the period after separation of the

parties and before the time of distribution; and

(12) Any other factor which the court finds to be just

and proper.

(c1) Notwithstanding any other provision of law, a

second or subsequent spouse acquires no interest in the marital property

and divisible property of his or her spouse from a former marriage until

a final determination of equitable distribution is made in the marital

property and divisible property of the spouse's former marriage.

(d) Before, during or after marriage the parties may by written

agreement, duly executed and acknowledged in accordance with the provisions

of G.S. 52-10 and 52-10.1, or by a written agreement valid in the jurisdiction

where executed, provide for distribution of the marital property or divisible

property, or both, in a manner deemed by the parties to be equitable and

the agreement shall be binding on the parties.

(e) Subject to the presumption of subsection (c) of this

section that an equal division is equitable, it shall be presumed in every

action that an in-kind distribution of marital or divisible property is

equitable. This presumption may be rebutted by the greater weight of the

evidence, or by evidence that the property is a closely held business entity

or is otherwise not susceptible of division in-kind. In any action in which

the presumption is rebutted, the court in lieu of in-kind distribution

shall provide for a distributive award in order to achieve equity between

the parties. The court may provide for a distributive award to facilitate,

effectuate or supplement a distribution of marital or divisible property.

The court may provide that any distributive award payable over a period

of time be secured by a lien on specific property.

(f) The court shall provide for an equitable distribution

without regard to alimony for either party or support of the children of

both parties. After the determination of an equitable distribution, the

court, upon request of either party, shall consider whether an order for

alimony or child support should be modified or vacated pursuant to G.S.

50-16.9 or 50-13.7.

(g) If the court orders the transfer of real or personal

property or an interest therein, the court may also enter an order which

shall transfer title, as provided in G.S. 1A-1, Rule 70 and G.S. 1-228.

(h) If either party claims that any real property is marital

property or divisible property, that party may cause a notice of lis pendens

to be recorded pursuant to Article 11 of Chapter 1 of the General Statutes.

Any person whose conveyance or encumbrance is recorded or whose interest

is obtained by descent, prior to the filing of the lis pendens, shall take

the real property free of any claim resulting from the equitable distribution

proceeding. The court may cancel the notice of lis pendens upon substitution

of a bond with surety in an amount determined by the court to be sufficient

provided the court finds that the claim of the spouse against property

subject to the notice of lis pendens can be satisfied by money damages.

(i) Upon filing an action or motion in the cause requesting

an equitable distribution or alleging that an equitable distribution will

be requested when it is timely to do so, a party may seek injunctive relief

pursuant to G.S. 1A-1, Rule 65 and Chapter 1, Article 37, to prevent the

disappearance, waste or conversion of property alleged to be marital property,

divisible property, or separate property of the party seeking relief. The

court, in lieu of granting an injunction, may require a bond or other assurance

of sufficient amount to protect the interest of the other spouse in the

property. Upon application by the owner of separate property which was

removed from the marital home or possession of its owner by the other spouse,

the court may enter an order for reasonable counsel fees and costs of court

incurred to regain its possession, but such fees shall not exceed the fair

market value of the separate property at the time it was removed.

(i1) Unless good cause is shown that there should not be

an interim distribution, the court may, at any time after an action for

equitable distribution has been filed and prior to the final judgment of

equitable distribution, enter orders declaring what is separate property

and may also enter orders dividing part of the marital property, divisible property or debt, or marital debt

between the parties. The partial distribution may provide for a distributive

award and may also provide for a distribution of marital property, marital

debt, divisible property, or divisible debt. Any such orders entered shall

be taken into consideration at trial and proper credit given.

Hearings held pursuant to this subsection may be held at sessions

arranged by the chief district court judge pursuant to G.S. 7A-146 and,

if held at such sessions, shall not be subject to the reporting requirements

of G.S. 7A-198.

(j) In any order for the distribution of property made pursuant

to this section, the court shall make written findings of fact that support

the determination that the marital property and divisible property has

been equitably divided.

(k) The rights of the parties to an equitable distribution

of marital property and divisible property are a species of common ownership,

the rights of the respective parties vesting at the time of the parties'

separation. § 50-20.

Procedures in actions for equitable distribution of property; sanctions for purposeful and prejudicial delay:

(a) At any time after a husband and wife begin to

live separate and apart from each other, a claim for equitable distribution

may be filed, either as a separate civil action, or together with any other

action brought pursuant to Chapter 50 of the General Statutes, or as a

motion in the cause as provided by G.S. 50-11(e) or (f). Within 90 days

after service of a claim for equitable distribution, the party who first

asserts the claim shall prepare and serve upon the opposing party an equitable

distribution inventory affidavit listing all property claimed by the party

to be marital property and all property claimed by the party to be separate

property, and the estimated date-of-separation fair market value of each

item of marital and separate property. Within 30 days after service of

the inventory affidavit, the party upon whom service is made shall prepare

and serve an inventory affidavit upon the other party. The inventory affidavits

prepared and served pursuant to this subsection shall be subject to amendment

and shall not be binding at trial as to completeness or value. The court

may extend the time limits in this subsection for good cause shown. The

affidavits are subject to the requirements of G.S. 1A-1, Rule 11, and are

deemed to be in the nature of answers to interrogatories propounded to

the parties. Any party failing to supply the information required by this

subsection in the affidavit is subject to G.S. 1A-1, Rules 26, 33, and

37. During the pendency of the action for equitable distribution, discovery

may proceed, and the court shall enter temporary orders as appropriate

and necessary for the purpose of preventing the disappearance, waste, or

destruction of marital or separate property or to secure the possession

thereof.

Real or personal property located outside of North Carolina is subject

to equitable distribution in accordance with the provisions of G.S. 50-20,

and the court may include in its order appropriate provisions to ensure

compliance with the order of equitable distribution.

(b) For purposes of equitable distribution, marital property

shall be valued as of the date of the separation of the parties, and evidence

of preseparation and postseparation occurrences or values is competent

as corroborative evidence of the value of marital property as of the date

of the separation of the parties. Divisible property and divisible debt

shall be valued as of the date of distribution.

(c) Nothing in G.S. 50-20 or this section shall restrict

or extend the right to trial by jury as provided by the Constitution of

North Carolina.

(d) Within 120 days after the filing of the initial pleading

or motion in the cause for equitable distribution, the party first serving

the pleading or application shall apply to the court to conduct a scheduling

and discovery conference. If that party fails to make application, then

the other party may do so. At the conference the court shall determine

a schedule of discovery as well as consider and rule upon any motions for

appointment of expert witnesses, or other applications, including applications

to determine the date of separation, and shall set a date for the disclosure

of expert witnesses and a date on or before which an initial pretrial conference

shall be held.

At the initial pretrial conference the court shall make inquiry

as to the status of the case and shall enter a date for the completion

of discovery, the completion of a mediated settlement conference, if applicable,

and the filing and service of motions, and shall determine a date on or

after which a final pretrial conference shall be held and a date on or

after which the case shall proceed to trial.

The final pretrial conference shall be conducted pursuant to the

Rules of Civil Procedure and the General Rules of Practice in the applicable

district or superior court, adopted pursuant to G.S. 7A-34. The court shall

rule upon any matters reasonably necessary to effect a fair and prompt

disposition of the case in the interests of justice.

(e) Upon motion of either party or upon the court's own initiative,

the court shall impose an appropriate sanction on a party when the court

finds that:

(1) The party has willfully obstructed or unreasonably

delayed, or has attempted to obstruct or unreasonably delay, discovery

proceedings, including failure to make discovery pursuant to G.S. 1A-1,

Rule 37, or has willfully obstructed or unreasonably delayed or attempted

to obstruct or unreasonably delay any pending equitable distribution proceeding,

and

(2) The willful obstruction or unreasonable delay of the

proceedings is or would be prejudicial to the interests of the opposing

party.

Delay consented to by the parties is not grounds for sanctions. The sanction may include an order to pay the other party the amount of the reasonable expenses and damages incurred because of the willful obstruction or unreasonable delay, including a reasonable attorneys' fee, and including appointment by the court, at the offending party's expense, of an accountant, appraiser, or other expert whose services the court finds are necessary to secure in order for the discovery or other equitable distribution proceeding to be timely conducted. § 50-21.

Chapter 52

Powers and Liabilities of Married Persons

Separation agreements:

Any married couple is hereby authorized to execute a separation agreement not inconsistent with public policy which shall be legal, valid, and binding in all respects; provided, that the separation agreement must be in writing and acknowledged by both parties before a certifying officer as defined in G.S. 52-10(b). Such certifying officer must not be a party to the contract. This section shall not apply to any judgment of the superior court or other State court of competent jurisdiction, which, by reason of its being consented to by a husband and wife, or their attorneys, may be construed to constitute a separation agreement between such husband and wife. § 52-10.1.

Case Law:

Whenever the parties bring their separation agreements before the court for the court's approval, the agreement will be treated not as a contract but rather as a court ordered judgment . . . modifiable, and enforceable by the contempt powers of the court, in the same manner as any other judgment in a domestic relations case. Walters v. Walters, 307 N.C. 381, 298 S.E.2d 338 (1983).

No separation agreement between the parents will serve to deprive the court of its inherent authority to protect the interests and provide for the welfare of infants. A husband and wife may bind themselves by a separation agreement or by a consent judgment but they cannot withdraw children of the marriage from the protective custody of the court. Walters v. Walters, 307 N.C. 381, 298 S.E.2d 338 (1983).