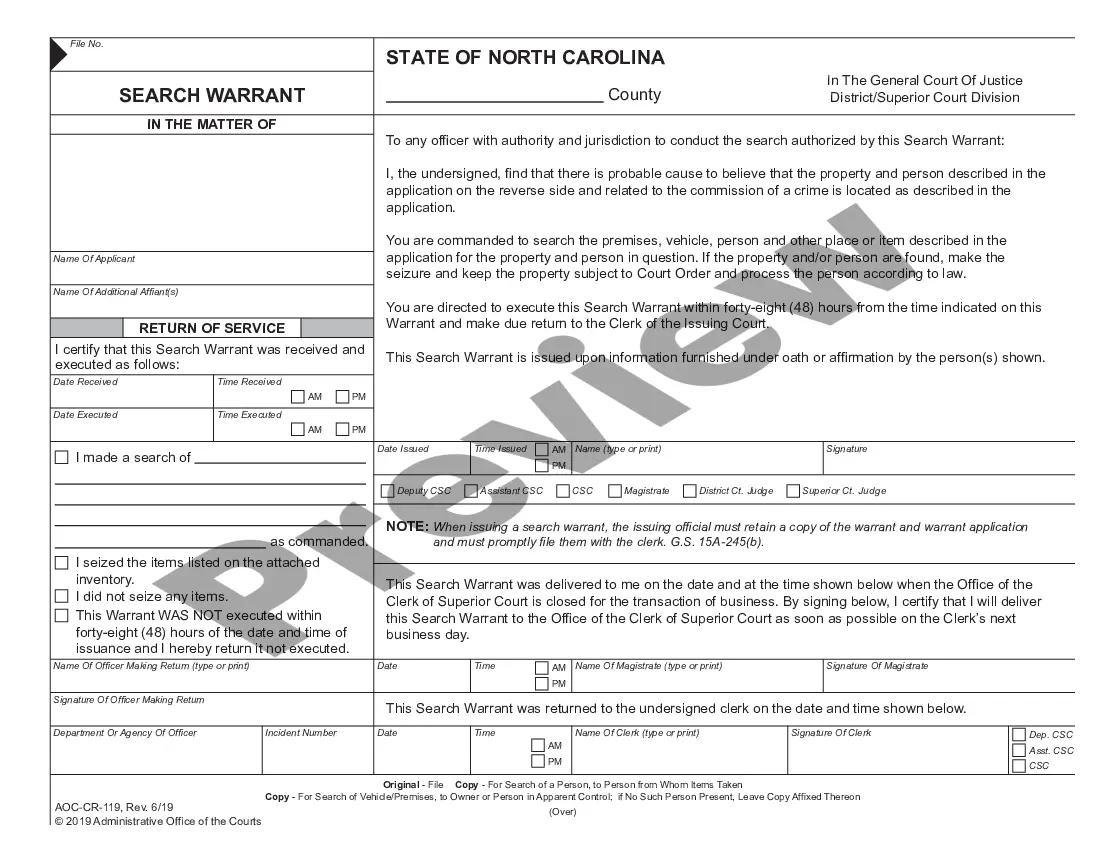

Deficiency Judgment: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

A deficiency judgment is a legal term used in High Point, North Carolina, and other states, to refer to the difference between the outstanding mortgage amount and the fair market value of a property when it is sold in a foreclosure or short sale. It is an important consideration for borrowers, lenders, and investors involved in real estate transactions. In High Point, North Carolina, when a homeowner defaults on their mortgage and the property is foreclosed upon or sold through short sale, the lender may not always recover the full loan amount. The deficiency judgment is the legal mechanism that allows the lender to pursue the remaining balance owed by the borrower. This is particularly relevant if the proceeds from the foreclosure or short sale do not cover the outstanding debt. It is essential to understand that there are different types of deficiency judgments in High Point, North Carolina, depending on the circumstances of the foreclosure or short sale. Here are a few notable distinctions: 1. Judicial Deficiency Judgment: In cases where the foreclosure goes through the court system, the lender may pursue a judicial deficiency judgment if the foreclosure sale doesn't cover the full mortgage balance. This type of deficiency judgment is obtained through a court order, and the lender can attempt to collect the remaining debt from the borrower. 2. Non-Judicial Deficiency Judgment: If the foreclosure process occurs without court involvement, as is often the case in North Carolina, the lender has the option to pursue a non-judicial deficiency judgment. However, it is important to note that in High Point, North Carolina, lenders have limited rights to pursue a deficiency judgment following a non-judicial foreclosure. 3. Voluntary Deficiency Judgment: Sometimes, a borrower and lender may negotiate a voluntary deficiency judgment as part of a short sale agreement. In this scenario, the borrower agrees to repay the difference between the outstanding mortgage balance and the short sale price, typically through a structured payment plan. It is crucial for homeowners facing foreclosure or contemplating a short sale in High Point, North Carolina, to consult with a knowledgeable attorney who can provide guidance and clarify the specific rules and regulations relevant to their situation. Being well-informed about deficiency judgments and the available options can help borrowers make informed decisions and navigate these potentially challenging circumstances.